Find the Right Funds Before Your Competitors Do

The Shortcut to Your $300K+ Buy-Side Seat

You waste months chasing the wrong funds, emailing dead inboxes, and pitching PMs who were never going to say “yes.”

The buy-side doesn't post jobs. They hire quietly — through networks you’re not in yet. And every PM has an invisible filter for who they’ll even talk to.

By the time you figure it out, the role is gone… and so is your shot.

That’s why I built the U.S. Fund Primers — intelligence on 900+ hedge funds and long-onlys, mapped by region, strategy, sector, and founder background — so you know exactly who to approach, how they hire, and where you actually have a shot, without wasting months on dead ends.

For less than 0.1% of your first-year pay, you can skip months of trial and error—and get to a $300K+ buy-side seat faster.

Serious about breaking in? Get instant access 👇

What you will get instantly

Fund Primers by Region (# of U.S. funds)

Connecticut (77)

New Jersey (15)

NY Long-only’s (74)

NY HF - Tiger lineage (38)

NY HF - Biotech / healthcare (25)

NY HF - Activist (37)

NY HF - Market-neutral single-manager (36)

NY HF - Event-driven / Special Sit (39)

NY HF - Value, Growth, Style-agnostic (119)

Boston and U.S. Northeast (VT) (75)

California (134)

Chicago and U.S. Midwest (state of MN, WI, MI, OH, IA, MO, NE, KS) (68)

Florida and U.S. Southeast (AL, AK, GA, KY, NC, SC, TN) (78)

U.S. Mid-Atlantic (DE, MD, PA, VA) (27)

Texas (30)

U.S. West (CO, OR, UT, WA) and Puerto Rico (67)

Fund Primers by Sector Specialty (# of U.S. funds)

U.S. Biotech / healthcare (65) | U.S. TMT / Consumer (79) | U.S. Energy / Materials (29) | U.S. Financials (14) | More to come

Fund Primers by Investment Style (# of U.S. funds)

U.S. Activists (63) | U.S. Tiger lineage (79) | U.S. Market-neutral SM (84) | U.S. Long-only (275) | U.S. Multi-managers | U.S. Event-driven (70)

Fund Primers by Key Person Alma Mater (# of U.S. funds)

Columbia (88) | Cornell (24) | Dartmouth (21) | Harvard (143) | NYU (52) | UPenn / Wharton (108) | Princeton (38) | Stanford (52) | UVA (39) | Yale (49) | More to come

Hedge Fund Deep Dives (sneak peak via links below)

Abrams Capital | Baron Capital | Cantillon Capital Management | Coatue Management | Davidson Kempner Capital Management | Eminence Capital | Glenview Capital | King Street Capital | Lone Pine Capital | Maverick Capital (free) | ValueAct | Soroban Capital | Sands Capital Management | Third Point | Whale Rock | Baupost Group (free)

Mutual Fund Deep Dives (sneak peak via links below)

Industry Insight Series (sneak peak via links below)

2024 Sohn Conference Summary | How to Build Moats in a Hedge Fund Business? | Why Do Hedge Funds Fail? | What hedge funds don’t tell you | Coatue’s Wisdom on TMT Investing

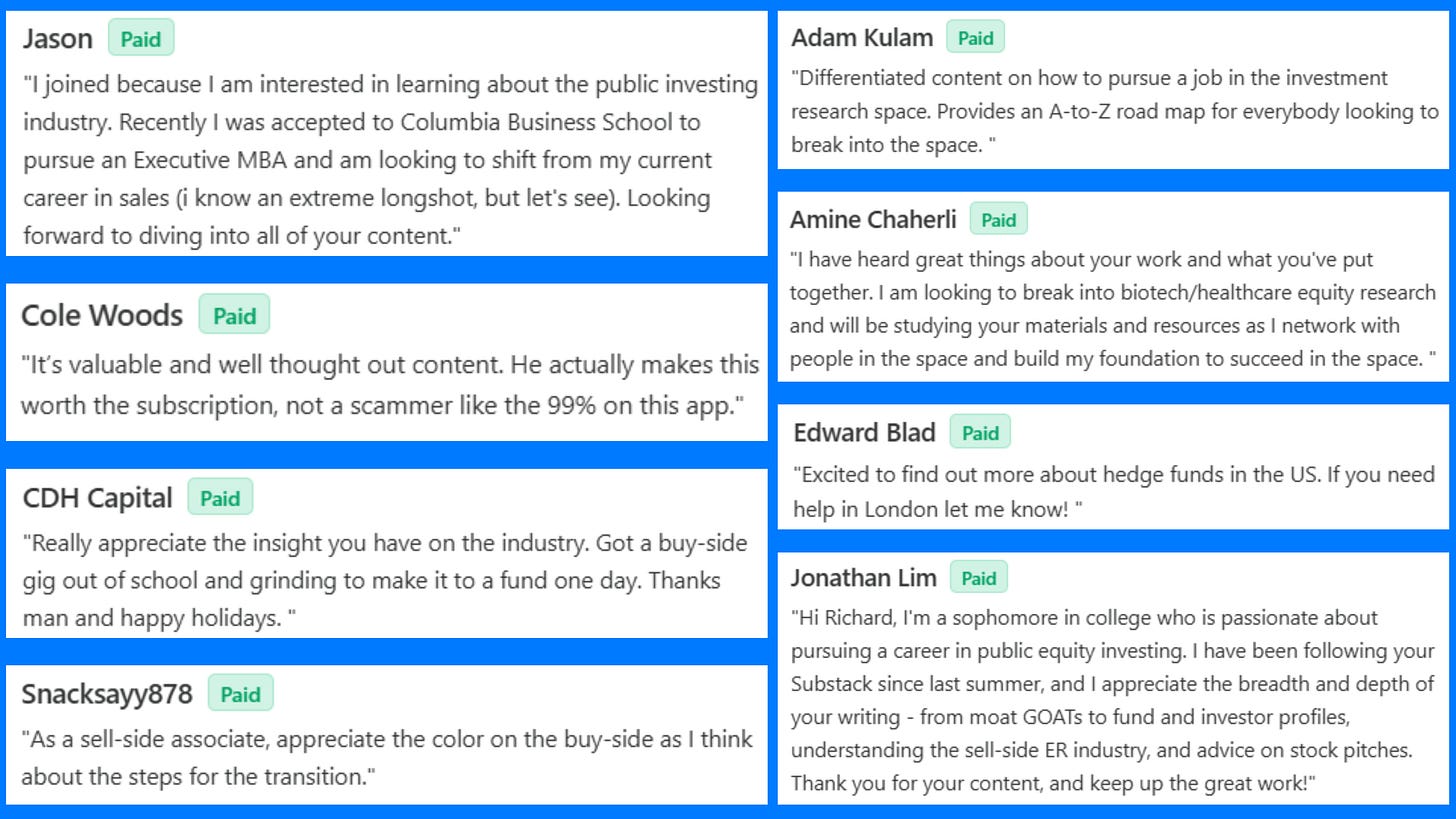

Here is what some of our readers are saying:

No content is paid for by the covered firms.

Thanks for sharing this detailed primer on breaking into buy-side roles! With so many funds and varying hiring practices, having a map like this sounds invaluable.

I’m curious—how often do you update the fund intel, and do you include insights on emerging sectors like ESG or AI-focused funds?

Would love to hear more about how this service keeps pace with the fast-changing market landscape!