ValueAct Capital

Former Equity Research Analyst Turned Mega-Activist Investor

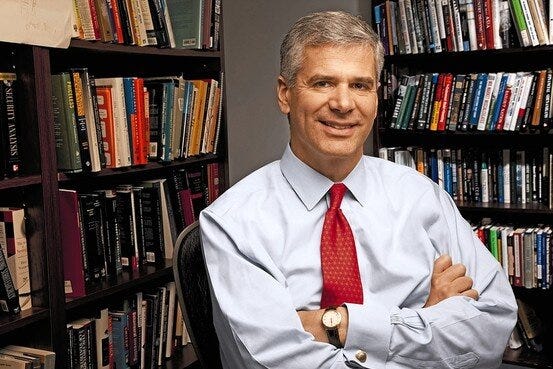

Mason Morfit is the CEO and Chief Investment Officer of ValueAct. He has held positions on the boards of an impressive 44 public companies. For a hedge fund manager who is typically secretive, Morfit has had a high-profile personal life thanks to his marriage with Jordana Brewster, renowned for her role in the “Fast and Furious” franchise.

Early Years

Morfit studied economics at Princeton University, a choice driven by his fascination with the mathematical modeling of human behaviors.

Just like Bill Gurley, Morfit is also “one of us”: He began his career at Credit Suisse First Boston (CSFB), where he covered managed care. He shared common ground with industry figures like Bill Gurley who was covering technology and shared a captivation for the insights of Mike Mauboussin.

Notably, Morfit's entry into CSFB coincided with the tech bubble era, a time when the investment bank, under the leadership of Frank Quattrone, held a pivotal role in the IPO landscape. While the tech sector boomed, Morfit's engagement in the healthcare services industry was characterized by consolidation, complex challenges, and regulation.

Big Break

Morfit got his big break when his friend’s association with Jeff Ubben (a privilege often associated with a Princeton pedigree) paved the way for a unique opportunity to join Ubben’s start-up fund, ValueAct. Morfit worked for Ubben for a couple of months for no pay where he quickly became engrossed in Ubben’s style of investing.

The allure lay in the departure from the mundane intricacies of Wall Street, such as incremental revenue trends and basis points of shifts in margins. Instead, Morfit found himself captivated by a new paradigm that offered a refreshing departure from the norm.

More to come:

History of Corporate Governance: pre-2002 vs. after

2 Types of Activism

ValueAct and its secret sauce

Case Studies: Microsoft, Morgan Stanley, Japan

** WE NO LONGER SELL VIA SUBSTACK, this is our legacy archive, available to legacy Substack paid members **: For the full archive and new paid content, please visit my website.