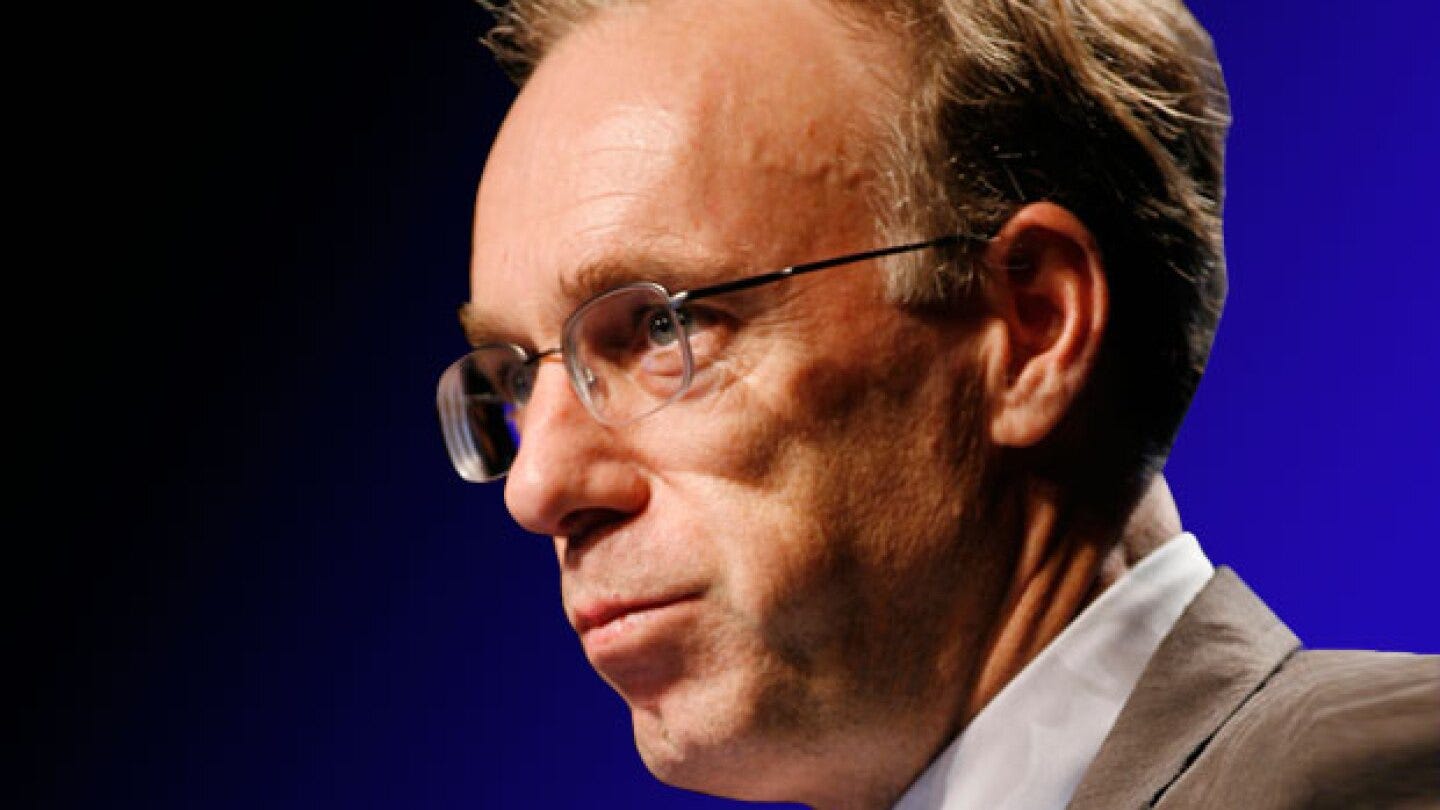

All Things Lone Pine Capital

with Stephen Mandel

In this article, we explore Stephen Mandel’s career: how he built Lone Pine Capital, what he means by “investing behind changes”, intel on the firm’s research process and research team and more.

Let’s dive in!

Intro

Stephen Mandel is the billionaire founder of Lone Pine Capital, a “Tiger Cub” hedge fund, as Mandel worked for the legendary Julian Robertson of Tiger Management.

Seth Klarman, the famed value investor and founder of Baupost, commented:

Steve Mandel is the best industry analyst I’ve ever met, who became the best long-short hedge-fund manager of his generation.

Fun fact: Mandel also was boss to Lee Ainslie during their time at Tiger Management, and he wholeheartedly endorsed Ainslie's promotion to Head of Technology at Tiger, a pivotal step that eventually led Ainslie to establish Maverick Capital in 1993.

Mandel's own journey to start a hedge fund happened in 1997 when he launched Lone Pine Capital, a name inspired by a resilient tree on the Dartmouth campus that had miraculously survived a lightning strike in 1887.

As of July 31, 2023, Lone Pine manages $15 billion of assets in its long/short (Cypress) and long-only products (Cascade). The firm has produced annualized returns of 15% since inception, outperforming global stock markets and many peers.

How Mandel got his start

Stephen Mandel earned his undergraduate degree from Dartmouth College and subsequently obtained an MBA from Harvard Business School in 1982, where he had the opportunity to rub shoulders with classmates who became influential figures in the business world.

Among his classmates were Seth Klarman, the renowned value investor behind the Baupost Group; Jamie Dimon, the CEO of JP Morgan; Steve Burke, the Chairman of NBCUniversal; and Jeff Immelt, the former CEO of General Electric, who, like Mandel, is also a Dartmouth alumnus.

Mandel began his career with Mars and Company, a consulting firm, from 1982 to 1984, where he developed an expertise in supermarkets. He then transitioned to Goldman Sachs, working under Joe Ellis in equity research, with a focus on the retail sector from 1984 to 1990.

Mandel was tasked to focus on food and drug retailing due to his background in supermarkets. Notably, Mandel took on the coverage of Walmart during a pivotal time when the retail giant was expanding into the food industry, a responsibility handed to him by his boss, Joe Ellis.

Mandel dedicated considerable effort to studying Walmart and greatly admired its founder, Sam Walton, particularly Walton's exceptional ability to connect with people and make them feel valued.

Mandel often highlights Walton's remarkable knowledge of Walmart associates, estimating that Walton knew the names of approximately 100,000 people within the company. He shares the inspiring example of attending Walmart's annual meeting, where he observed Walton engaging in meaningful one-on-one conversations with associates, using personal anecdotes related to each individual and their specific store.

More to come:

Building Lone Pine, the firm

Lone Pine’s investment process and profile of research team members

How public investing has changed during Mandel’s career

Mandel’s career advice for aspiring investors

** WE NO LONGER SELL VIA SUBSTACK, this is our legacy archive, available to legacy Substack paid members **: For the full archive and new paid content, please visit my website.