Moat GOATs: Copart (CPRT)

Why is vehicle salvaging a good business?

In this Moat GOAT piece, we will discuss Copart, an online marketplace business that sells salvage cars. If you missed my prior Moat GOAT article.

What problem does Copart solve?

When an accident or a natural disaster happens to your car, your insurance company will do one of two things:

pay for the cost of repairs

pay you the value of your car, take possession of it, and sell it for whatever it can

When a vehicle is damaged, it is towed to a storage facility for inspection by an insurance adjuster. The adjuster estimates the repair costs and the vehicle’s Pre-Accident Value (PAV). If the repair costs exceed the PAV minus the salvage value, the vehicle is classified as a total loss.

For example, if the PAV is $20,000, repair costs are $5,000, and the salvage value is estimated to be $17,000, the repair cost of $5,000 exceeds the PAV - $20,000, minus the estimated salvage value - $17,000, which is $3,000. The insurance company will classify the vehicle as a total loss. The insurance company will then assign the vehicle to Copart, pay the insured $20,000, and receive the vehicle's title. Otherwise, the insurance company will pay the repair cost if the value of the vehicle after the repair is still worth more than selling it in an auction.

And that’s where Copart comes in. Copart is a marketplace that helps sellers, such as insurance companies, sell salvage cars.

Operationally, when the seller assigns a car for salvage, Copart transports the vehicle to one of its nearest facilities. Copart will pay advance charges to obtain the vehicle’s release from the towing company, etc., and will later recover the advance charges from the sellers when the car sells (either through an explicit recovery fee or by deducting from the sale proceeds).

Copart doesn’t take inventory risk because the vehicles are on consignment. Copart simply earns a fee for the service of storing the vehicle and finding buyers for it.

Despite appearing like an industrial company, Copart benefits from the two-sided network effect enjoyed by internet-based companies (it does sell cars entirely online anyway.) In a two-sided network, the winner typically takes all, resulting in monstrous ROIC for Copart over multiple decades.

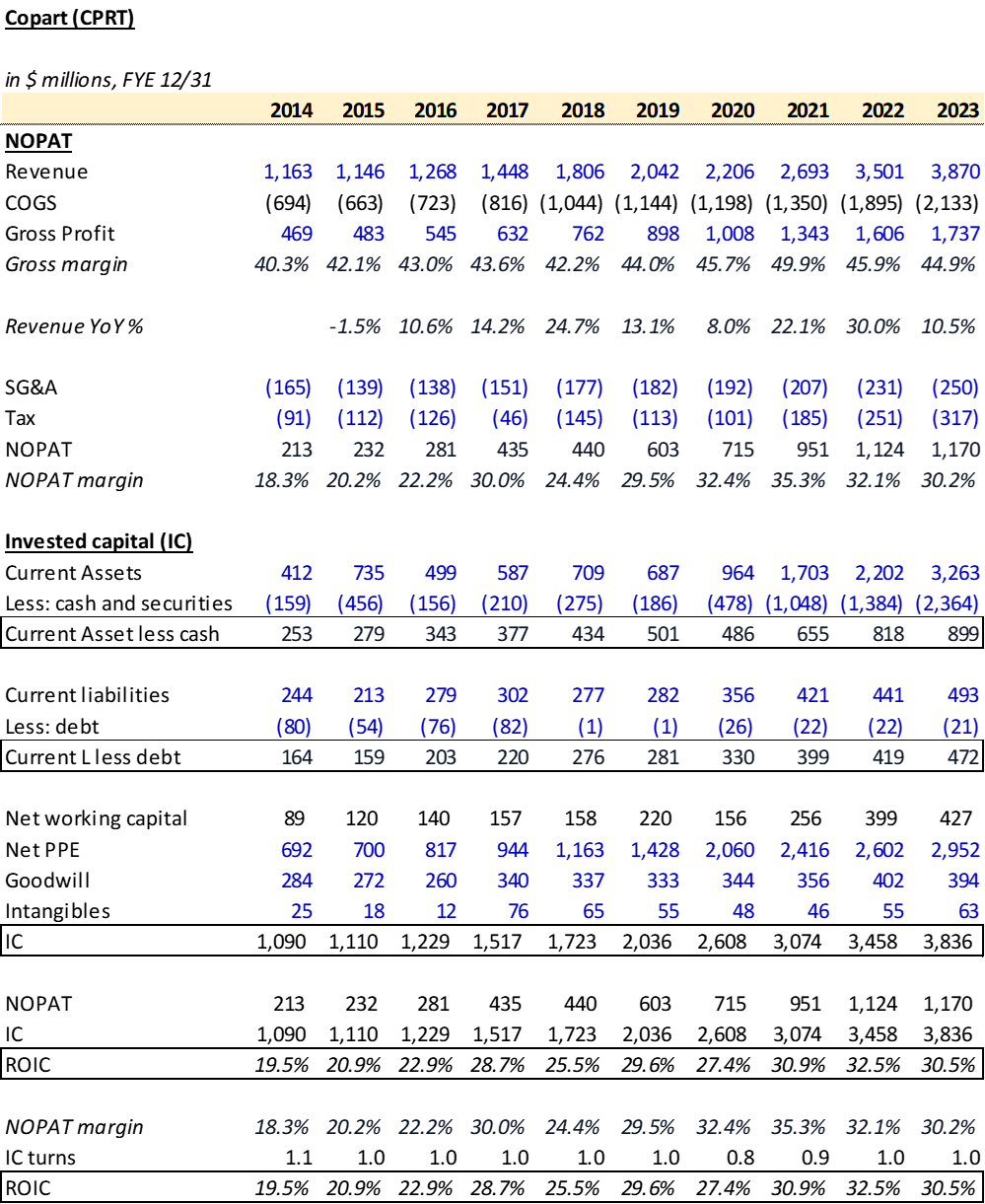

I was surprised by how much value Copart generates through its pricing power1, as I initially expected its ROIC2 to be driven more by capital investment turns. Due to the consignment model, the business requires minimal working capital, and, as anticipated, most of its capital investment is in land, reflected in Net PPE.

Industry structure

Copart sits between the sellers of cars, most of which are auto insurance companies, and the buyers (who the hell wants to buy totaled cars? As it turns out - many). The seller side is concentrated, with the top three players accounting for 45% of the auto premiums written.

The buyer side is more fragmented, consisting of smaller entities such as vehicle dismantlers, rebuilders, repair licensees, used vehicle dealers, exporters, and the general public. These buyers have different motives for purchasing the cars. Some want to sell the valuable parts and scrap the rest, while others buy and repair the vehicles to drivable standards in their countries, which are typically lower than in the U.S. As a side note, this might be an environmentally friendly move because driving a repaired car is less carbon-intensive than manufacturing a brand-new one.

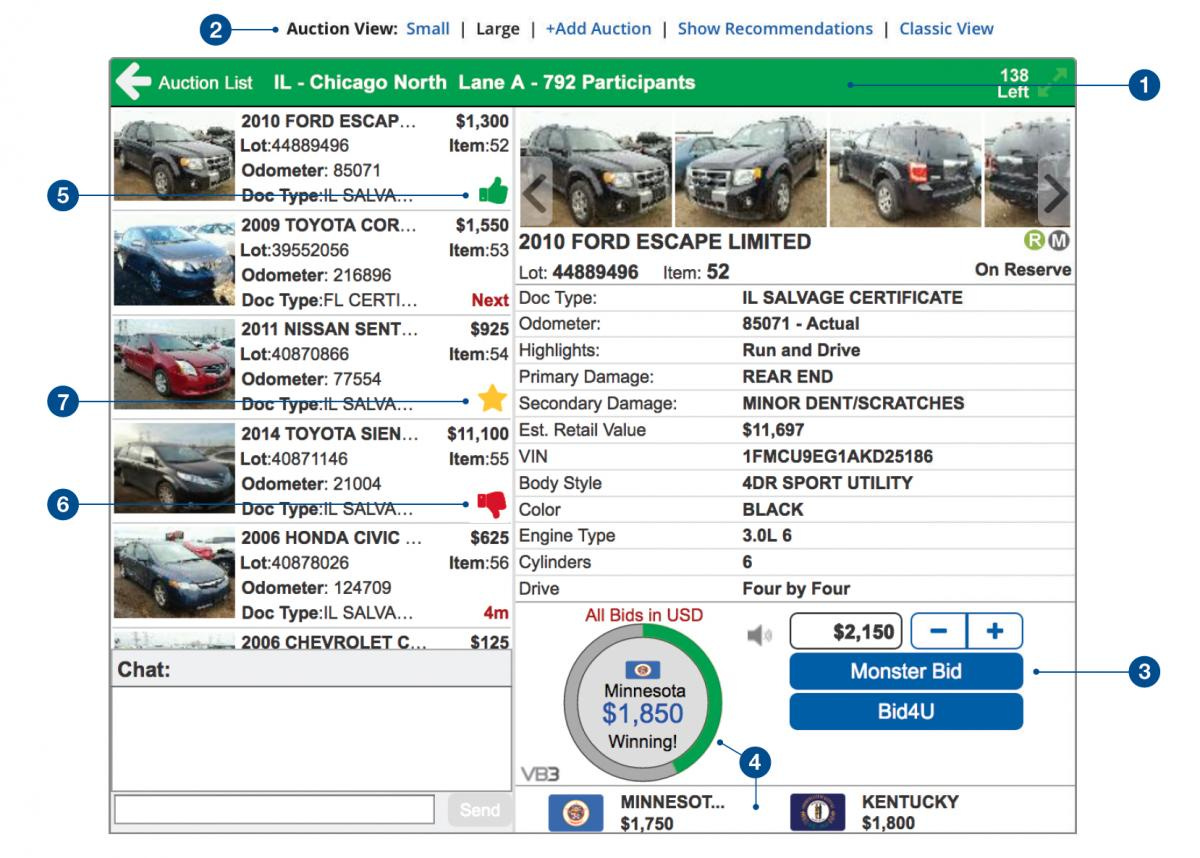

Sellers typically auction the vehicles on a consignment basis for a fixed fee or a percentage of the sales price. According to Most Borrowed Ideas, the fee primarily depends on the value of the vehicle being sold and can vary from $300-$400 for a $2,000 car to as high as 4-7% of the final price for vehicles worth over $10,000. Copart takes a cut from both buyers and sellers of the vehicle; buyers typically contribute around 70% of the total fees, while the rest is borne by sellers. This mix is likely due to the lower bargaining power of buyers compared to the insurance carriers, who drive a significant portion of the inventory volume for Copart.

What’s Copart’s moat?

Here’s a reminder of Hamilton Helmer’s 7 Powers, which are seven features of a business that allow it to earn sustainably superior ROIC compared to its peers in the industry. With that kind of ROIC, there is definitely Power involved.

Cornered Resource: Despite selling all of their cars online, salvage yards need physical land to store them. The real cornered resource that new entrants find hard to obtain is land. Starting a salvage yard involves dealing with toxic materials and chemicals, leading to resistance from local governments and residents due to the NIMBY (Not In My Backyard) effect.

In states like California, where even getting a new permit to build housing is challenging, forget about buying land and getting a permit to start a new salvage yard. Of course, if the salvage yard is already operational, that’s a different story, which makes incumbents like Copart the only player in town.

Without competition, Copart has been strengthening its lead by acquiring more land with its free cash flow, ensuring it can never be caught up. Competitors must spend capital to enter the market at the current market price of land, where lands have been appreciating. Alternatively, they can lease the land, but leasing is subject to the same inflation trend and doesn't build equity in the land.

The car salvaging industry has been a duopoly for a long time, with the other major player, IAA, leasing land instead of owning it. IAA was PE-owned, and sponsors eyeing exit in a fixed timeframe didn't invest in acquiring land, which turned out to be the very strategic cornered resource that allowed Copart to earn superior ROIC.

As a result, IAA had better near-term cash flow but was left in an inferior strategic position. The cost of leasing the land must have gone up over time for IAA and growth is an issue too because of the risk of not being able to continue the lease should local municipalities disallow the lease for salvage yard purposes.

Over time, this industry has consolidated to an 80% market share by the duopoly of Copart and IAA, with IAA ultimately being bought by Richie Bros. The insurance industry is also consolidated, making it hard for new entrants to scale quickly versus if the seller industry was fragmented.

Network Economics: In any two-sided marketplace, critical mass is key and inherently creates a flywheel effect. Buyers seek the largest inventory to find what they need, while sellers want the most buyers to maximize their sales prices. As more sellers join, more buyers are attracted to the marketplace, which in turn attracts even more sellers, creating a positive feedback loop.

By owning the most land and thus having the most salvage yards, Copart can sell the most cars, which is valuable to sellers. This creates a critical mass that is hard to dislodge.

According to Copart’s annual report, sales of U.S. vehicles to Copart members registered outside the state where the vehicle was located accounted for 66.2% of total vehicles sold. Of these, 32.2% were sold to out-of-state members within the U.S., and 34.0% were sold to international members, based on the IP address used during the auction process, all conducted online. This global network effect enhances the marketplace's value by attracting a diverse and extensive range of buyers and sellers.

Unlike hyperlocalized networks like Uber and DoorDash, where the number of restaurants or drivers in Boston is irrelevant to a San Francisco resident, or radial networks like Western Union, where transactions occur only between specific points, Copart has a global network. This scale makes it difficult to displace.

Scale Economics: The business involves significant fixed costs, and the company with the largest revenue base can spread these costs more efficiently. Competing with Copart requires a big investment to replicate its extensive physical footprint. Over time, land values typically appreciate, making it costly for entrants.

Additionally, as Copart's network density (i.e., more salvage yards within a region) grows, its transportation costs and times decrease. This dynamic creates a formidable competitive advantage, similar to that of LTL transportation (eg. Old Dominion) or Amazon, both of which benefit from high-density logistics networks.

Switch Costs: Sellers and insurance companies have established technical integrations with major players like Copart and IAA, creating some switching costs for new entrants. Convincing these entities to adopt a new product that is easy to integrate is a challenging task.

Although buyers and sellers often use multiple providers to achieve their goals (technical jargon would be “multi-homing” — similar to how gig drivers operate on both Uber and Lyft, or short-term rental hosts list on both Airbnb and Vrbo), they are unlikely to integrate with a third player for just a marginal increase in visibility of their car inventories (e.g., an additional 5%) due to the operational hassle required.

While there are some switching costs to entry, I believe the primary competitive advantages for Copart are the cornered resources and network economics.

Forward trends

I believe Copart's moat is both strong and defensible, as the barriers to entry are tremendously high from both capital intensity and regulatory standpoints. Aside from valuation, which I won’t touch on because that would require understanding past stock movements, the other key point is its reinvestment runway—a critical criterion for continued compounding. For example, $100 of invested capital at a 30% ROIC means a $30 return. The goal is to reinvest that $30 at a 30% ROIC again (hence the compounding), which requires that the market opportunity is not fully penetrated and that competition isn’t driving down the ROIC over your investment horizon.

Copart has identified its revenue drivers as 1) miles driven 2) the number of accidents per mile driven, and 3) the salvage rate. While miles driven have been slowly increasing, this is not expected to be the primary driver going forward. Accidents per mile driven have been trending upwards over the years, particularly post-COVID, as people’s driving behavior has worsened due to reduced driving during the pandemic.

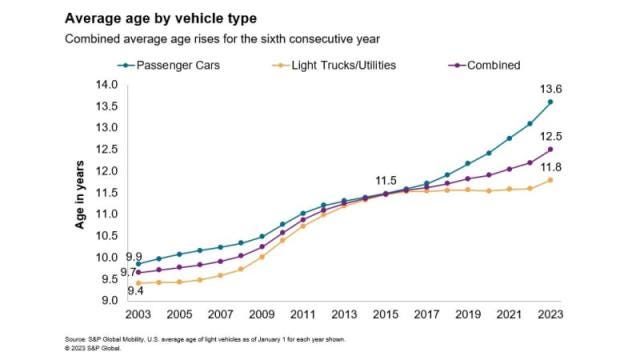

Additionally, the salvage rate is rising as the U.S. faces an aging fleet of cars. High inflation and persistent high primary and secondary market car prices have led to fewer new car purchases, driving up the average fleet age on the road.

The increasing value of car parts has resulted in more cars being deemed totaled due to high repair costs. All these factors point to slow and steady growth for the industry. Given its moats, Copart has the opportunity to buy up smaller players and further leverage its fixed costs.

A long-term risk to Copart's business is the advent of autonomous driving. If a significant percentage of cars are driven by AI and Lidar systems, car accidents could dramatically decrease, potentially making Copart’s services obsolete. However, this scenario is highly speculative and depends on the advancement of fully autonomous driving technology, enabling legislation, and whether a critical mass of drivers will relinquish control of their vehicles to autonomous systems.

Another risk is international expansion. To accelerate growth, Copart has been focusing on international expansion. However, this comes with operational challenges due to varying car ownership and salvage laws across different jurisdictions. While some countries, like the UK and France, have laws similar to those in the U.S., others, such as Germany, have less favorable regulations for car salvage. Successful execution and lobbying for the adoption of consignment models will be crucial. Given Copart’s extensive experience and owner-oriented, infinite-game mentality, I believe Copart will successfully navigate these operational challenges.

Stay tuned for the next issue in this series as I continue to explore other high-value creation businesses and industries and the factors that drive their success.

Please let me know if you have information on Copart that I might have missed and/or where I am wrong (as long as you are not being a d*ck.)

Thanks for reading. I will talk to you next time.

Disclaimer: I have no positions in the companies discussed in this article

If you want to advertise on my newsletter, contact me 👇

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you. 🙏

Sources:

https://www.mbi-deepdives.com/cprt/

Most of its revenue is a service fee which comes with a 50%+ gross margin, it does a little bit of buying and selling salvage cars like a traditional auto dealer (~10% gross margin)

ROIC = profit margin (NOPAT / sales) * sales turnover (sales / invested capital)

Interesting read! Would love more pieces like this!