Moat GOATs: specialty distributors

What makes (some of them) great?

Welcome to the inaugural issue of my new series, where I dive into exceptional business models. I will focus on the strategic moats and problems these companies/industries solve, rather than delving deeply into individual financial trends.

For this first issue, I will explore the concept of distributors as a business model.

Why Do We Need Distributors?

Distributors are fascinating entities that primarily rely on capital turnover to create shareholder value, rather than pricing power1.

Distributors solve a critical problem in the value chain. Manufacturers often prefer to focus on production rather than shipping or customer interactions, especially when dealing with a large number of fragmented customers. Distributors step in to handle logistics and act as an outsourced go-to-market function, especially for products that require high-touch support before purchase. This two-tier distribution model—where manufacturers sell to distributors who then sell to end customers—adds value in industries with fragmented supplier and customer bases.

For example, a department store is a distributor. If the store buys many bags from a manufacturer but customers don't purchase them, the store will be stuck with excess inventory. As a result, the store will be reluctant to buy more from the manufacturer.

In this case, "sell-in" refers to goods purchased by distributors from manufacturers, while "sell-through" refers to sales from distributors to end customers. Understanding these metrics is important because weakening sell-through is an early indicator of deteriorating sell-in.

How do distributors establish a moat?

Distributors can build moats through several key strategies:

Logistic Infrastructure: Customers value speedy delivery. Investing in a dense network of warehouses and branches enhances delivery speed. Companies with extensive infrastructure can offer unmatched service speed, making them difficult to compete against.

Scale: Large distributors benefit from economies of scale, spreading fixed costs over a growing revenue base. This cost advantage makes it difficult for new entrants to compete.

Technical know-hows: Distributors often provide technical support and purchasing guidance to customers, who are typically mom-and-pop stores that lack sophistication. This assistance is vital for complex, mission-critical buying decisions, creating a barrier to entry for competitors.

Bargaining Power: By pooling procurement, distributors can negotiate better prices from suppliers and pass these savings on to customers, creating a win-win situation.

Network Effect: Distributors aggregate suppliers and customers, serving as the go-to-market arm for suppliers and offering customers a wider selection. This network creates a virtuous cycle, attracting more suppliers and customers.

Examples of high-ROIC industrial distributors

W. W. Grainger GWW 0.00%↑

W. W. Grainger, a distributor of maintenance, repair, and operating (MRO) products, serves a broad range of customers from small businesses to large corporations and government entities. With a network of 5,000 suppliers worldwide, Grainger’s value proposition lies in speed, product breadth, and complex purchasing support, leading to an average ROIC of over 20%. Their customers need handholding when making buying decisions so that’s a big value add for Grainger.

Pool Corp POOL 0.00%↑

Pool Corp, a wholesale distributor of pool supplies and related leisure products, enjoys a highly fragmented customer base of over 125,000 independent contractors and small businesses. This fragmentation, along with a similarly fragmented 200,000+ suppliers, gives Pool Corp significant bargaining power and network effects. With 60% of pool spending being non-discretionary maintenance, Pool Corp enjoys stable growth and has sustained a consistent ROIC above 25% over the past five years.

Watsco WSO 0.00%↑

Watsco distributes air conditioning, heating, and refrigeration equipment and parts. Serving 125,000 contractors and dealers, Watsco operates in a market with a concentrated supplier base of 8 major players2, limiting its bargaining power. However, with 85-90% of industry unit sales coming from the replacement market driven by the aging of AC and furnace, and energy efficiency requirements, Watsco enjoys stable growth and has improved its ROIC to over 20% from a historical 15% ROIC player (if someone knows the name well, please educate me on what has driven the ROIC improvement in recent years.) Watson also has exclusive distribution agreements in certain territories with their top suppliers Carrier, Rheem, and Mitsubishi.

Fastenal FAST 0.00%↑

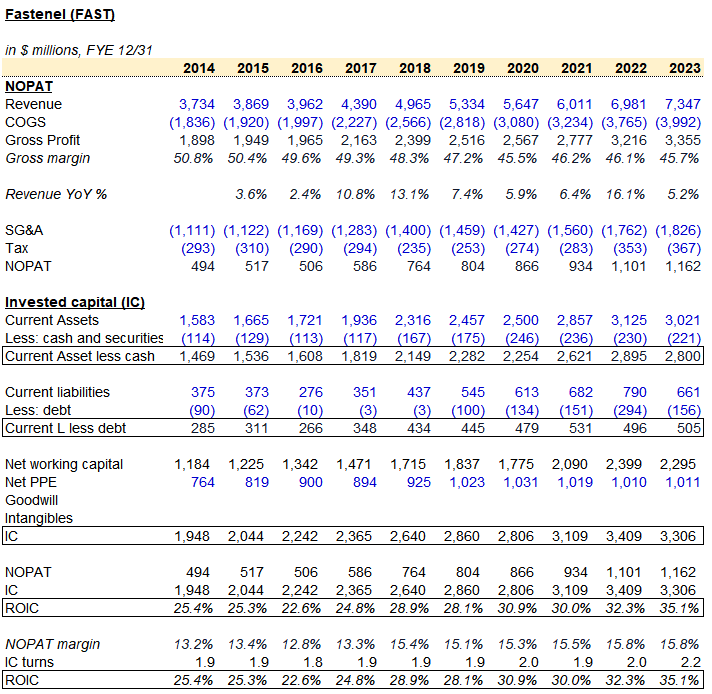

The name says it all: Fastenal is a distributor that began by supplying fasteners to industrial clients. They serve corporate clients, a sizeable portion of whom are in industrial manufacturing. While this may sound dull at first, it becomes fascinating when you realize they have averaged a 25-30% ROIC for an entire decade. Sometimes, boring is great.

Distributing fasteners is no simple task: the fasteners are heavy and have a low dollar value. Yet, they are mission-critical in every machine within a plant. Without these parts, machines stop working, and business grinds to a halt. There are numerous operational processes involved in understanding the volume and types of needs of local clients. Most of the parts are manufactured outside the US, so an international logistics infrastructure needs to be established. Moreover, fasteners come in all sorts of shapes and forms. Customers rely on Fastenal to know what parts to use and stock.

The company took things to the next level by evolving from a warehouse-branch model to establishing mini-stores and vending machines inside their clients’ facilities. This approach offers multiple benefits:

The speed of delivery is unmatched.

Fastenal’s on-site personnel can deeply understand clients' daily operational challenges and dynamically adapt to their needs, optimizing the supply of necessary items. Essentially, the company becomes its customers' outsourced inventory management arm for high-volume, mission-critical supplies—areas where customers prefer not to specialize (which is the essence of outsourcing).

I might be wrong, but I suspect the vending machines yield higher gross margins as customers use them for last-minute essential purchases.

The company works with a large number of suppliers, and the same product can be sourced from multiple vendors. This suggests that suppliers don't have much bargaining power over the company. Additionally, they serve over 100,000 “accounts”, indicating a fragmented supplier and customer setup that justifies the understandably high ROIC.

Not all distributors are equal

Not all distributors achieve the same level of success.

For example, beer distributors face significant competition and lack bargaining power due to the consolidated nature of the brewery industry. Similarly, frozen food distributors like Sysco operate in a mature industry with moderate ROIC and limited growth prospects, also due to the consolidated food manufacturer (like Tyson) supply side.

Conclusion

Distributors play a vital role in various industries by providing essential logistics and market access functions. Their ability to build robust logistic infrastructures, achieve scale, offer technical expertise, leverage bargaining power, and create network effects enables them to sustain high ROIC and create significant shareholder value. Through these mechanisms, distributors like GW Grainger, Pool Corp, Watsco, and Fastenal demonstrate the potential for exceptional return on capital in boring sectors.

Stay tuned for the next issue in this series as I continue to explore other high-value creation businesses and industries and the factors that drive their success.

Thanks for reading. I will talk to you next time.

Disclaimer: I have no positions in the companies discussed in this article

If you want to advertise on my newsletter, contact me 👇

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you.

ROIC = profit margin (NOPAT / sales) * sales turnover (sales / invested capital)

Carrier Global, Daikin, Rheem, Trane, York International, Mitsubishi, Nortek, and Lennox International

On WSO’s “optical” ROIC improvement —massive price inflation of HVAC through COVID and massive pull forward of HVAC units through COVID. Sustainable?