Did I become the angel of death for sell-side equity research?

The good news is I got featured on Bloomberg. The bad news is the article is about the decline of the sell-side equity research profession. Oh well, I cannot change facts.

I got a lot of great statistics from the article and the legend Bloomberg Opinion columnist Matt Levine even opined on it, which inspired me to highlight my key implications for you.

Is equity research still worth pursuing?

Absolutely, but if you're unaware, no one makes 8-figure paydays in this profession anymore. The days of Henry Blodget and Jack Grubman1 are long gone.

Today most sell-side research aspirants have the long-term goal to move from advisory (sell-side research) to principal (buy-side research), which aligns with my expectations and my own primary motive for joining sell-side equity research.

Early in your career, it’s not about the paycheck; it’s about learning the skills to set you up for bigger opportunities later, which may include becoming a paid newsletter creator (more on that later) or social media influencer.

There will be no shortage of people wanting sell-side equity research roles because, to them, the profession is still a better gig than what their peers are doing. Compared to starting as an FP&A analyst at a random industrial manufacturing company, equity research pays more and is more interesting.

Plus, you learn invaluable financial and strategic skills. How many 25-year-olds can confidently talk about how an entire industry works, how companies make money and compete, and which strategies win or fail? These are insights that carry over into any career you choose next.

Sell-side research associates also get to work with senior analysts who are experts in their fields, meet Fortune 100 CEOs, and interact with portfolio managers managing billions.

Public markets will always set the bar for what private businesses are worth. Learning how markets value businesses is a skill that allows you to grow your money.

Now, some of you will dunk on the profession because it’s declining. If you can land something better, go for it. If equity research is your best shot, it’s still competitive, and you need to prove you can do the job before you get it.

For those of you who can’t get a job or struggle to even pass Series exams, I advise you to focus on becoming more useful to the firm instead because there is no shortage of talents who can and will replace you.

Whether you stay in the profession or use it as a springboard, sell-side equity research still provides an incredible foundation to build on.

The sell-side needs to evolve

Matt Levine’s observation that sell-side equity research is essentially a marketing function is something I’ve highlighted before. It might be time to rename the profession—something like "issuer relations" or "issuer coverage" would better reflect the core purpose of sell-side equity research in connecting companies with investors. I doubt this will happen, but it’s worth putting on the table.

I don’t view AI as the biggest threat to sell-side research. The bigger challenge is the rise of vendors like Tegus. These next-generation players operate with a tech culture: they are well-funded, move fast and are free of the regulatory constraints that come with being a broker. They provide expert networks, prebuilt models, earnings quick-takes, and dynamic transcripts, many of overlapping value-add of sell-side research.

I’m not getting compensated for saying this, by the way. I just know that a good product will get adopted by practitioners. Though Tegus, if you’re reading this, let’s discuss how my reach to the investment research profession can help you grow.

For sell-side research to remain relevant, it needs to focus on what it does best and stop trying to compete in areas where it’s losing ground to tech-driven vendors. The value lies in management access, hosting events, building relationships with private companies, and providing market flow intelligence. These are the strengths of sell-side analysts and reflect how they already spend much of their time—not in picking stocks or conducting deep-dive research on individual companies (just to be clear, alpha-generating analysts exist on the sell-side, but most of them work at a research boutique, not at an investment bank.)

As long as the investor ecosystem remains fragmented, most smaller funds will still rely on intermediaries like the sell-side to facilitate relationships with company C-suites. Matt Levine’s framing of sell-side research as building relationships with investors on behalf of issuers (the public companies) is a good way to think about the profession’s future. By leaning into these relationship-based strengths, sell-side research can carve out a sustainable role in the capital markets ecosystem.

Regulators need to make things easier

Sell-side analysts have tons of valuable insights they’re dying to share but cannot because of regulations. For example, analysts cannot speculate on potential M&A activity without it being labeled as soliciting investment banking services. Guess when an M&A rumor hits the press, what do clients call the sell-side about?

Meanwhile, all these rules haven’t really cleaned up the industry. IPO recommendations are still overly positive, and research is just as biased as the Jack Grubman days. The conflict of interest is still here, and now we’re stuck with a bunch of pointless rules that just slow everyone down and make industry professionals' lives miserable.

Take earnings notes, for example. Everyone in the industry knows they’re a waste of time. They’re mostly maintenance work that buy-siders barely look at, yet every firm keeps churning them out because if they don’t, their competitors still will and it makes the firm look bad. It’s a classic prisoner’s dilemma.

Clients are getting the earnings results faster and cleaner elsewhere. FinTwit and tools like StreetAccount are blasting the same info in seconds. So why are we even doing this? It’s a lose-lose situation for everyone. That same time can be reallocated to thinking about the results and what it means for the stock.

Then there’s the whole compliance nightmare. Shuli Ren, a Bloomberg Opinion columnist who worked at Lehman Brothers equity research, nailed it: “Bureaucracy and banking regulations have steadily eroded the value-add that analysts can provide”.

In sell-side research, Supervisory Analysts (SAs) are there to make sure notes follow every little rule, but instead of focusing on what really matters—like the quality of the analysis or factual information about the covered companies—they’re nitpicking chart labels, note titles and line 21 of the regulatory disclosure. No client cares about the disclosure, not a single one. But research teams have to stay up until 3 a.m. fixing it all to make sure the note is approved for client dissemination, just so their bosses can go on a morning call at 7am on the same day to market the note. It’s exhausting, and honestly, pointless.

The reality is that these rules were made for a different era, way before FinTwit or next-gen vendors were around. If regulators gave analysts more freedom to share their real opinions more timely, they could actually add value to clients and compete with faster, less-regulated players. It would also make the job way more rewarding.

Right now, the profession is stuck in this cycle of low pay, long hours, and endless frustration. Research management complains about the quality of talent pool (some of which is due to attitude issues with the younger generation), associates complain about the low pay, long promotion path (takes an average of 4-6 years to go from associate to VP), lack of interesting work and exit opportunities. Nobody is happy.

The industry desperately needs a reset. If things don’t change, sell-side research will keep spiraling down into irrelevance. But if we cut the red tape and let analysts do what they’re good at—building relationships and sharing timely insights—the sell-side could become a place where talented people actually want to work. It would mean better services, happier clients, and a future that doesn’t look so bleak.

Why most analysts won’t live off a newsletter

The Bloomberg article highlighted two successful investment newsletters and shared how much revenue they are bringing in. As someone who has run my own newsletter and gone paid for the last two years, I want to remind you—it’s hard to scale a newsletter to that revenue run rate.

Some of the newsletters I respect the most either publish very thoughtful long pieces (Edwin Dorsey and Most Borrowed Ideas come to mind) or publish every day (Ben Thompson and Byrne Hobart are top of mind). And they are not writing just for the sake of writing. Their writing makes me think and/or makes me money.

For experienced sell-siders thinking newsletter is your way out of the profession: you won’t suddenly thrive as an investing newsletter writer because you must add real value to their investment process—either by helping them make better decisions or by making them money. Unlike on the sell-side, entertainment won’t cut it. Dressing up like a clown on TV might have afforded you a lifestyle on Wall Street, but it won’t get you paying subscribers.

Competitive dynamics differ as well: The number of sell-side analysts covering a stock is limited by the number of investment banks. As banks consolidate or shut down their equity research divisions, competition decreases. Additionally, many seasoned analysts have exited the industry in pursuit of better lifestyles or alternative career paths. Building a franchise and securing II votes is now less competitive than it once was.

In the newsletter world, those constraints don’t exist. The internet can theoretically support infinite publications, and power law will dominate - only a few newsletters will scale into full-time, sustainable income streams.

The competition is also fiercer and more diverse. Your competitors could be former buy-siders with years of risk-taking experience (Marc Rubinstein of Net Interest comes to mind), or passionate self-taught investors who couldn’t land an institutional buy-side seat because of visa issues.

There are two types of sell-side analysts who leave the industry: those who can do better and those who add no value on the sell-side. The former don’t need to write articles for a living. The latter cannot write articles for a living.

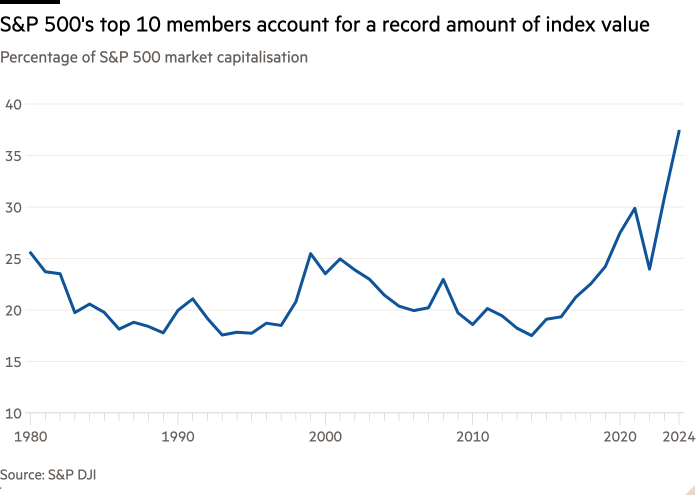

Smaller companies will have trouble access $$$

Per Financial Times, today just 26 stocks account for 50% of the S&P 500’s total value. As a result, much of the research effort focuses on these giants. This dynamic is compounded by the fact that large investment firms keep getting larger, leading them to ignore smaller-cap names because they don’t move the needle on their portfolios.

The entire ecosystem, including sell-side research, has become increasingly focused on mega-caps and abandoned coverage of smaller-cap and unpopular sectors.

On top of this, the private market has overshadowed the public market. Companies are staying private longer, raising massive late-stage rounds like Databricks’ Series J, and avoiding the scrutiny and volatility of public markets.

Even within the public market, the role of fundamental, active stock-pickers has diminished. Passive strategies now account for 60% of the market, while the remaining 40% of active investors are increasingly non-fundamentally driven (macro, thematic, quant, etc.).

The rise of ETFs and passive investing disproportionately benefit larger companies and have made it harder for smaller firms to attract investor interest. Thomas Laffont of Coatue Management, a famed growth crossover investor, shared that startups now need to scale to $1 billion in revenue to go public. Those that can’t meet this threshold often have to rely on riskier or less reputable funding sources, which can lead to unfavorable outcomes.

Of course, the active public investing industry has itself to blame for the change in market composition, because most don’t add value, which in turn reduces the number of firms willing to pay for equity research. Fewer investment firms mean fewer buyers of equity research, especially when forced to pay for it standalone. All these trends have real implications for sub-scale businesses looking to the capital market for financing needs.

Conclusion

I reiterate, Wall Street equity research is not going away. I am very confident no one will invest in an IPO after listening to an AI avatar doing their roadshow. Investing is deeply personal, especially to long-term investors who are betting on the management’s ability to steer a company through ups and downs.

Sell-side equity research is at a pivotal moment. However, the potential for sell-side research remains. By leaning into its strengths—facilitating relationships, offering timely insights, and leveraging access to key decision-makers—sell-side research can remain valuable. If it evolves to focus on these areas, the industry could continue to thrive, attracting talent and delivering real value. Equity research isn't going away, but it must adapt to stay relevant. And that adaptation requires both internal and external efforts.

Let me know what you think. Thanks for reading. I will talk to you next time.

If you want to advertise on my newsletter, contact me 👇

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you.

Confessions of a Wall Street Analyst, the seminal read on the profession, is about the author’s rivalry with Jack Grubman before the establishment of Reg FD

Congrats Richard on your appearance on Bloomberg and thank you for the insightful post.

There is no money in the business and as long as analysts are restricted, the business will die--its days are counted. So the demand for sell-side analysts will decrease.

But also the supply of sell-side analysts will decrease. Newer generations are skipping the sell-side stepping stone and going directly to the buy-side. It makes sense, more money and a better life-work balance.

Thanks Richard! Great analysis as always. I would say that the modeling on the sell-side is still useful as some buy siders I talk to still use it and play around with the inputs to flesh out their own model rather than switching over to a service like Tegus, even if they have access to it. But yes, conferences and site visits will always be able to provide value for smaller investors who can’t get access on their own to mgmt.