How (Sell-side) Equity Research Works

Yes, investment banks provide the back-end such as office space, payroll, distribution channel, etc., but analysts have 100% discretion on how to run their research team based on their vision.

The franchise nature of the profession explains why asking “which bank has the best equity research report” does not mean much, because the highest-ranked internet analyst (Brian Nowak, Morgan Stanley) and the highest-ranked large-cap biotech analyst (Umer Raffat, Evercore ISI) don't sit in the same firm.

How is the sausage made?

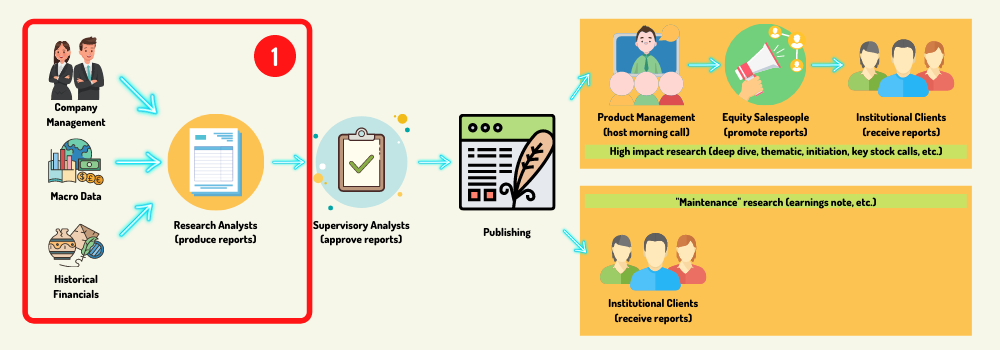

In this section, I am going to show you the whole process of equity research – from content creation to reporting dissemination. I will use the initiation reports (to be explained later) as an example, but the process is similar for all report notes.

Research Analyst / Team

The research teams are the sources of content. They produce the research reports and create the financial models based on management guidance, macro data, and historical financial data of the covered company.

Per FINRA regulation, analysts are not allowed to speak their views on stocks without first publishing reports that contain their views. Therefore, every time analysts join a new firm, they will “initiate” on the stocks they intend to cover (also known as “launching coverage”). The initiation reports are detailed reports that describe the business, competition, products, market size, investment thesis, etc.

Supervisory Analyst (SA)

After the reports and financial models are finished, they are sent to Supervisory Analysts (SAs) for review. SAs are the biggest impediment to report dissemination. So they are disliked by equity research across the industry, but they are a staple feature of the profession.

For example, SAs will check to make sure reports do not solicit investment banking businesses (such as speculating on mergers or acquisitions not confirmed by the press) or do not contain provocative language (things get subjective quickly and that's when research teams frequently get into shouting matches over email with SAs).

Every single equity research report needs to be approved by an SA before it’s published and disseminated to clients.

Equity Sales & Product Management

After the initiation notes are approved, the analyst will tell Product Management that she will go on the morning call to market the product.

The morning call is a daily meeting that occurs before the stock market opens. During the meeting, research analysts who are scheduled to appear will take turns pitching their high-impact research (such as initiation, deep dive, key stock upgrade / downgrades) to equity salespeople, so that the salespeople can promote their research to institutional clients. (For more routine research reports such as earnings notes, analysts don’t go on morning calls.)

During this process, two additional constituents are involved:

Product Management: They manage the morning call process. They: 1) Decide whom to let on the morning call (because every analyst thinks every research report of theirs is high impact); 2) Provide guidance on best practices for research reports based on client feedback; 3) Keep track of readership metrics; 4) Manage the firm’s annual institutional investor poll process, such as strategy to get more votes and move up the firm ranking.

Equity Sales: They are the distribution channel. They attend morning calls every day because that’s when they receive the products to sell to clients for the first time on that day (if sales know an analyst stock upgrade before the report is published, that's the same as having access to insider information).

Salespeople have their coverage of client accounts (eg. Hannah covers 5 industrial pods within Millennium Management and a mega single manager hedge fund; while Josh covers technology portfolio managers within Wellington Management, a long-only, and a few $200 million AUM long/short hedge funds in Boston).

Some of you might be wondering: If the notes are disseminated to clients’ inboxes directly, why the need for salespeople? The reason: Clients have access to 30+ sell-side firms who all send research reports to them every morning, you think they saw your analyst’s note?

So equity salespeople add value by amplifying the research reports by calling the clients personally: “Hey, Dick Toad put out this amazing deep dive on the flying car industry today. No one on (Wall) Street has done this depth of work in this space. You should check it out.” That nudge gets the client’s attention and drives readership if the salesperson and the analyst’s pitch are good.

Why does Equity Research exist?

A simple industry structure analysis explains well in my opinion: equity research is two-sided aggregation due to the highly fragmented nature of its two key constituents: investors and companies (issuers).

Investors: There are tens of thousands of equity investment funds out there. Smaller investment funds can leverage equity research to access the management of publicly traded companies of various sizes. Without equity research, these smaller funds would not receive management access because companies prioritize their internal investor relation resources on serving the largest shareholders. This is why research analysts host their own conferences where clients get to do 1-on-1 sessions (for a fee of course) to meet with the CEO of companies they are researching.

Companies: Yes, we all know about the S&P 500 companies, but there are many more companies with lower market capitalization who need investor attention. Equity research provides that reach for these companies.

Even S&P 500 constituents wouldn’t mind relying on the sell-side to reach a broader, fragmented group of investors who can be incremental buyers of their company’s stock. As mentioned before, there is only that much an in-house investor relation department can achieve.

What value does equity research really add?

From the vantage of an outsider (or even those in the industry), a lot of things do not make sense. I think incentives are what made equity research how it is.

Sell-side research is not in the business of generating alpha. Some do differentiate by stock picks. But most add value via other routes that are less stressful than being right on stock picks.

There are analysts within sectors that even the best buy siders respect what they say, but they are the outlier, not the norm.

Some of equity research's value add:

Saves time for buy-siders: financial models, understanding the sector, understanding the history of a company, understanding a business with complex product or business model

Corporate access: analyst conferences, non-deal roadshows, etc.

Promote the company (the equity issuer): even most outsiders understand the role research, especially senior analysts, plays in winning IPO deals for her investment bank, so there is no misconception here.

What Do Equity Salespeople Exist?

When I started in equity research, I wondered why salespeople existed on the trading floor. All they do is on the phone with clients every day, wine and dine with them, and schedule calls. What’s their value add? I argue equity sales is an absolutely essential feature of equity research.

Equity salespeople liaise between sell-side research analysts of their firm and external public equity investor clients. Equity salespeople add value in the following ways:

Amplifying: An investment firm with a decent trading budget gets emails from 30+ equity research firms every morning. Let’s face it – do you read all the free newsletters you get this morning? The buy-siders are also not reading most of the emails. That’s where equity sales come in: A salesperson will call a portfolio manager client to deliver a 30-second idea pitch in hopes of generating readership and arranging a call (for a fee) with the analyst who published the idea. Equity research is definitely not an “if you write it, they will read” profession.

Relationship cultivation: While some smaller hedge funds will never scale, some will become the next large fund. Sell-side analysts just don’t have the bandwidth to build intimate relationships with all the hedge funds out there. Salespeople fill that void by cultivating the relationship from the day one fund launch. Shocking fact: small funds want their existence to be acknowledged too. To whom do you think that small fund will allocate trades to when it scales?

Product-market fit: Investment management firms have widely divergent beliefs on how to make money in the stock market. This makes it hard to have a one-size-fits-all research product. Sell-side analysts are only motivated by a growing audience, but every client wants different things. Salespeople must exist to repackage research to appeal to different clients. A good salesperson takes good notes on their client’s specific needs: For example, Susan, PM at a deep value fund, likes mining and energy names and has a 3 to 9-month time horizon. Nick, the PM at a hyper-growth fund, likes disruptors in the consumer sector with hard catalysts. If a sell-side analyst pitched an idea that fits the filter, the salesperson will funnel the idea selectively to her clients, thus improving product-market fit and amplifying the effectiveness of the idea. As the salesperson interacts more with the same client, she only better understands the client’s needs, which enhances client relationships and should drive incremental trading volume and commission for her firm.

So equity salespeople are essential in the equity research value chain.

What is “II”?

If you have remotely contemplated pursuing investment research, you probably have heard of II rankings. II stands for Institutional Investor, a magazine company that annually surveys public equity investors about their favorite Wall Street research analysts. The votes are aggregated and weighed by trading commissions to rank top analysts by sector.

Let us set the stage by reintroducing the players:

Buy-side: Public equity investors – mutual funds, hedge funds, family offices, etc.

Sell-side: Investment bank that houses the equity research function

Companies: Businesses whose stocks are publicly traded

The most important thing to know: Being II ranked does not mean an analyst is a good stock picker. Hell, the sell-side equity research profession was not built under the premise of making money for clients.

However, being II-ranked does mean a research analyst is useful to the buy-side in some way, which includes:

Company management access

Channel checks

Industry knowledge

Fun client events

Knowledge of market flow

Making money (you should not be surprised how few choose this route)

How does II ranking matter to the constituents below?

Buy-side

Firms that pay trading commissions have a higher weight in a sell-side analyst’s II rating as II is a commission-weighted voting process.

The high trading commission generally means an investment firm buys and sells stocks very frequently, so sell-side analysts who want a ranking should prioritize adding value to the shorter-term funds that trade a lot (generally pod shops and single-manager hedge funds trade more frequently than mutual funds, long only).

Buy-side portfolio managers and analysts call a sell-side analyst that adds the most value to their investing process. Because II ranking is commission-weighed, being II ranked directionally is a reflection of likeability by hedge funds rather than by mutual funds.

Companies / Issuers

The companies care about the visibility of their stocks. Every company wants research coverage from II-ranked sell-side analysts because these analysts have higher visibility in front of equity investors who can be incremental buyers of the company’s stock.

Stock price going up (because of incremental buyers) is good for the company’s investors and the company management. Because of the prospect of better visibility, companies are more inclined to bring investment banking services to that II-ranked investment bank as the issuer will get a better price for secondary equity issuance.

Sell-side

Obviously, being II-ranked as a firm is good for branding, given the issuers value the benefit of going with an II-ranked investment bank for services. For the boutique research firms without investment banking services who rely on selling report subscriptions, they don’t care about II as much.

So, the research people at firms with investment banking services care about getting votes because their job security and bonus depend on it

That is all you need to know about II.

Does working for an II-ranked sell-side analyst matter? You will hate this answer – it depends on your goal:

Become a sell-side senior analyst: You should work for an II-ranked analyst to learn how to get ranked.

Work at a long-term investment firm: It does not matter because you want to work for a sell-side analyst who has deep industry knowledge and can pick long-term winners, but their value-add doesn’t mean getting votes from shorter-term trading clients, who have a bigger say in II votings.

Work at a short-term trading firm: It matters because you learn how to add value in the areas of calling quarters accurately and develop good contacts for channel checks. You will also get access to clients you want to work for because they respect your analyst.

Work at a covered company: It could matter if your analyst has strong access to company C-suites and can place you in an unpublicized, high-profile corporate role. She can just make a phone call for you; provided you have built enough goodwill and the relationship is good.

Thanks for reading. I will talk to you next time.

If you want to advertise in my newsletter, contact me 👇

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you.