What buy siders should know about sell-side equity research?

What value does equity research actually add?

Recently, I came across an equity investor on Twitter venting frustrations about sell-side equity research models. I'm not here to defend the sell-side—I know that can be a losing battle—but I think there’s an opportunity for both sides to benefit more from each other. The key is understanding each other’s motives.

Having worked on both the buy-side and sell-side, I’ve seen firsthand how each group operates. I can safely say that most buy-siders probably don’t understand—and don’t care about—the day-to-day grind of sell-side analysts. The reverse is likely also true. We all tend to focus on our own little world. (Want to guess how many times people at tech parties ask me, “So, are you a day trader?” when I mention I used to work at a hedge fund?)

That’s why I want to explore why equity investors often fail to find sell-side equity research (which I’ll refer to simply as "equity research" throughout) useful for investment purposes.

Why no cares about rating and price targets?

Losing management access and business

Equity research needs to add value without directly generating revenue for the bank. One way it does this is by helping smaller investors gain access to management teams at large companies. But there’s a delicate balance: rating a stock as a “sell” can quickly sever that access. After all, management teams have stock options, and when the price drops, it hurts their capital allocation decision-making and them personally.

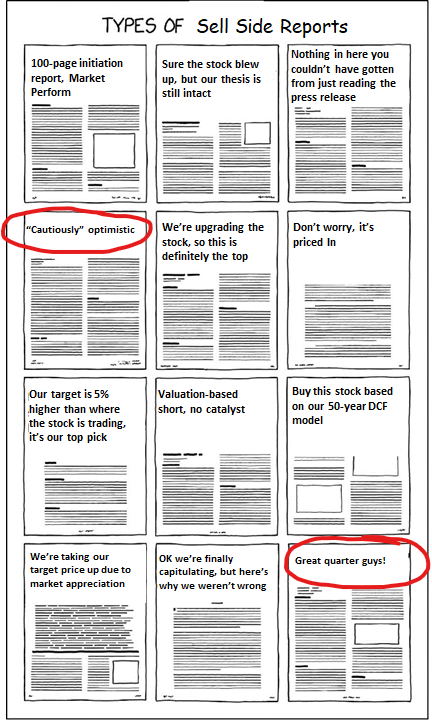

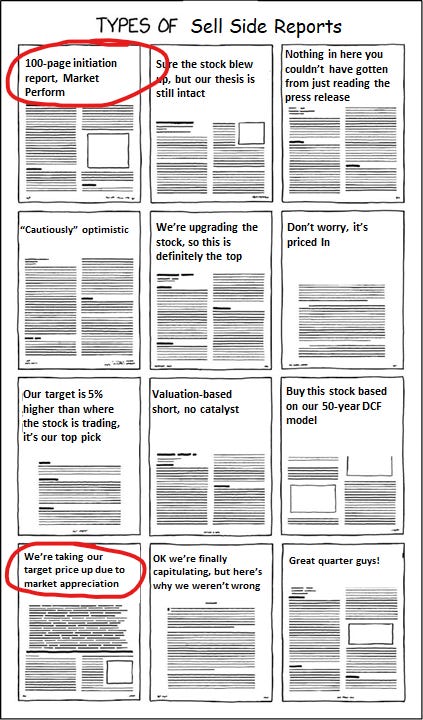

In many cases, equity research analysts end up acting more like messengers, taking management’s guidance and using it as the foundation for their forecasts. The rest of the sell-side tends to follow suit, sticking to a herd mentality rather than risking their necks by challenging the narrative. Given that an investor’s mandate is to be different from the herd, you can see why that creates a product-market mismatch.

Most people in the ecosystem aren’t naïve. They know there are whispered “mandates” within the bank—like how IPOs need to debut with a BUY rating, even when the company is a questionable SPAC run by people with shaky ethics.

Smaller research firms tend to be more brazen about this, but the larger firms aren’t much better—they just do it less frequently and use more balanced wording.

The result? Research reports that offer little to no value, and sometimes even negative value, for investors genuinely trying to uncover undervalued businesses.

Regulatory constraints

A neutral/hold rating is a strange thing. It adds no value, telling clients to do nothing. But buy-siders need to act to create value for their clients.

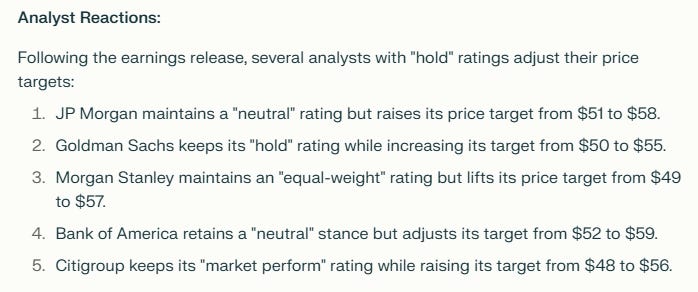

Yet, many analysts opt for a neutral rating across parts of their coverage for any number of reasons (and believe me, there are at least dozens). In order to not “rock the boat” (i.e. being out of the consensus), a neutral-rated stock’s target price can’t stray too far from the current trading price. This is why you’ll often see sell-side analysts, many of whom are neutral-rated, adjust their target prices in lockstep after a major event like an earnings release.

One of the reasons to give a stock a neutral rating is that the analyst simply doesn’t have the time to dive deeply enough into the company to justify taking a bold stance. So, they hug the market price and end up missing out on a multi-bagger.

Internal constraints

Hong Kong-based brokerage Emperor Securities was once referenced for giving buy ratings to all the stock it covers.

To address this kind of imbalance, banks have since added artificial constraints, such as enforcing rating distributions to create the illusion of objectivity. Ironically, this only made things worse, adding layers of complexity to an already busy analyst’s life.

For example, how do you distribute ratings if you cover 10 companies, all of which you genuinely believe are actionable buys? This creates logistical headaches: which of the 10 companies do I sacrifice to meet my sell-rating quota?

The result? Sell ratings end up being assigned to companies where the analyst is most willing to risk the relationship with management, rather than to the companies they believe will underperform. Sure, sometimes they’re the same, but more often than not, they aren’t. This has only made research ratings even less objective than they already were.

It’s a relative game - time horizon

Equity research target prices are typically set for a 12-18 month horizon. While research is supposed to serve all types of investors, in reality, the focus leans heavily toward multi-managers, who pay most of the commissions.

With that in mind, analysts often set target prices tailored to this group. That’s why, during crazier times, you’d see a SaaS company “undervalued” at 20x sales simply because it was cheaper than peers trading at 30x sales but growing more quickly—even though, in hindsight, all of them were grossly overvalued from an absolute basis.

Long-term investors miss that sell-side reports aren’t focused on absolute valuation or long-term projections. Wall Street is locked into a one-year horizon, prioritizes relative valuations and often ignores macro shifts, like the interest rate hikes we saw that crushed multiples for high-growth, unprofitable sectors.

It’s a relative game - differentiate from consensus while being part of consensus

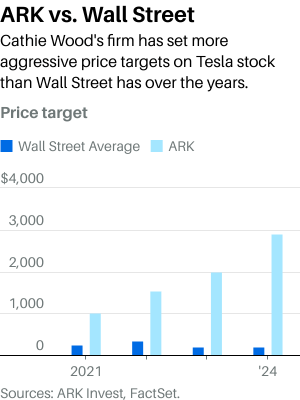

Consensus is supposedly the average of all sell-side estimates.1 If an analyst doesn’t use audacious numbers, salespeople won’t push their reports to clients, and no one will care. So, to stand out, equity research analysts need to offer higher estimates and loftier price targets. Ironically, by doing so, they end up shifting the consensus higher.

That’s when you start seeing inflated numbers, backed by narratives as wild as those from someone like Cathie Wood. This is how you get sell-side reports where the average target price is $200, and then one analyst comes along and slaps a $1,000 price target on it. And that’s the moment sensible investors start rolling their eyes and sighing.

And how do analysts come up with valuation multiples? Often, they don’t. They pick the price target first, maybe a nice round number, then reverse-engineer the valuation multiple to justify it. This is why any sensible buy-side investor doesn’t bother looking at sell-side estimates, multiples, or price targets—they know the game.

Why do sell-side financial models suck?

Most equity research analysts aren’t focused on helping their clients make money. Instead of publishing reports filled with actionable insights or maintaining financial models that are truly useful for the client’s investment process, their priorities often lie elsewhere. Why is this the case?

Many ways to add value to clients

There are plenty of ways to survive and even thrive on the sell-side without doing deep research. Analysts can be entertaining, outrageous yet thought-provoking, masters of relationships, or act as an information chamber for market flow. As a result, they often don’t bother with the actual research.

I personally know a senior TMT analyst who doesn’t know the difference in business model between two covered companies. I’ve also seen models where a company has three distinct segments, each with different growth rates, margin profiles, and capital expenditure needs—yet the analyst slaps a single multiple on the entire company’s consolidated EBITDA. This kind of analysis is useless. But the truth is, these analysts are doing something to keep their jobs—it’s just not the kind of work that helps your investment process.

Why don’t more sell-side analysts focus on stock picking? The reality is, if they had that skill set, they’d likely be on the buy-side. If they can make a solid living by excelling in other areas—whether it’s being entertaining, cutting deals, dressing like a clown on TV, acting as a diplomat who can get Fortune 100 CFOs on a 1-on-1 call, or serving as a market flow expert who knows who’s long or short on a stock and what might shift their stance—why would they risk sticking their neck out to actually be right on stocks? (Same reason why you rarely see MD-level sell-side analysts move to the buy-side) Especially when only exceptional investors are only right about 60% of the time.

That’s the core reason why the sell-side isn’t helpful for helping investors make money—though there are other factors at play as well.

There is no time

Equity research analysts have a lot on their plates, often racing against the clock. Take earnings season, for example. Analysts have to update their models at lightning speed. It’s a perfect setup for what Daniel Kahneman calls "fast thinking"—the kind of thinking that leads to shallow, reactive decisions when "slow thinking" would produce better insights. But the reality is, big commission-paying clients want updates immediately, so they can trade on the results in real-time.

Now imagine a night when five companies report earnings simultaneously, and the analyst has to update notes and models for all of them by the next morning. Sure, they’ll plug the numbers into the model and tweak the forecasts, but who has the time or energy to refine the model into something truly useful for clients? Not to mention, any model changes require approval from the Supervisory Analysts and an accompanying note explaining the rationale behind the change—adding yet another layer of hassle to an already time-crunched process.

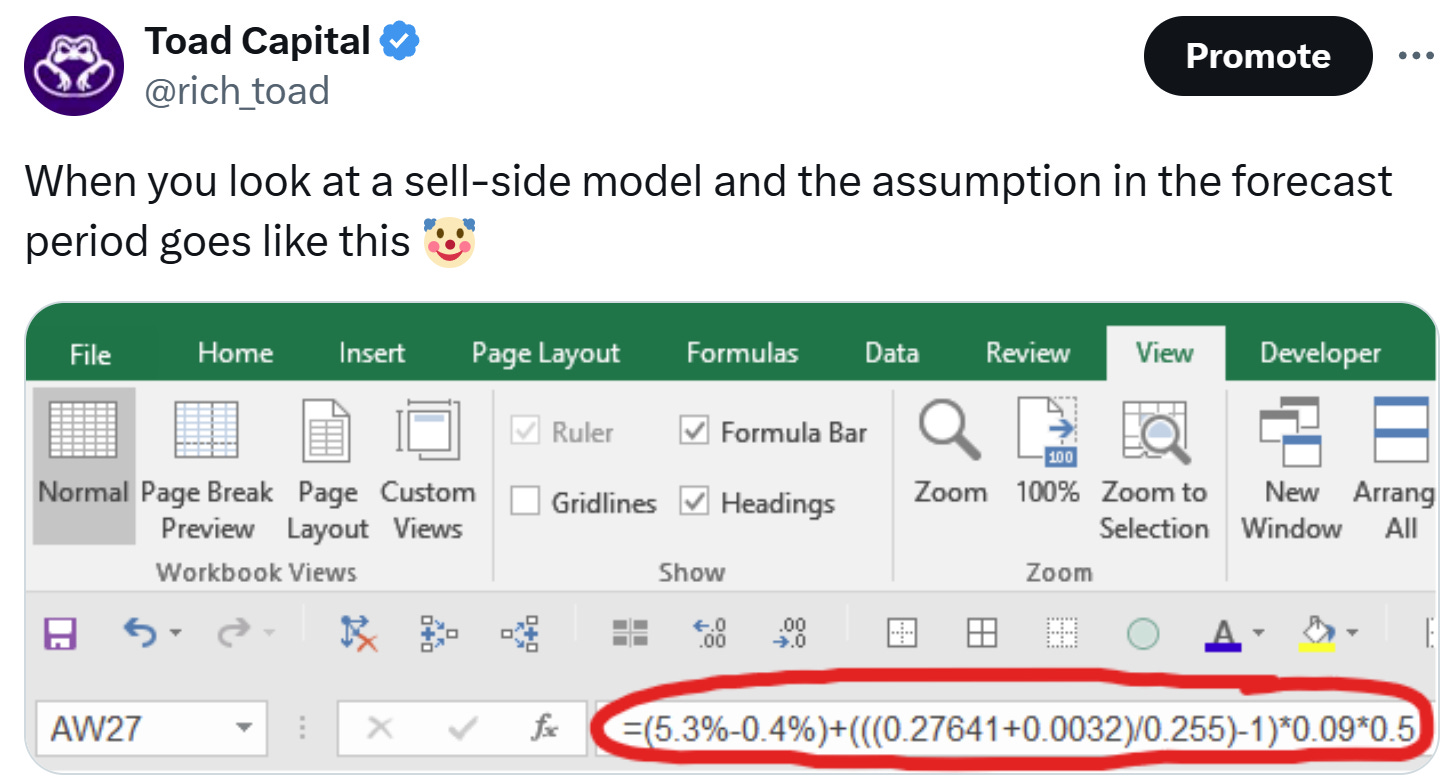

For buy-siders, this is a mixed bag. On one hand, you can rely on alternative providers or build their own models (which many do). On the other hand, if you work at a short-term focused shop, your portfolio manager will likely want you to understand how the sell-side is modeling the company. And that’s when the real nightmare begins—decoding an analyst’s convoluted logic in a model filled with unnecessarily complex formulas mixed with hard-coded assumptions.

Sometimes, you end up calling the analyst just to figure out what they were thinking, and trust me, no one is impressed by long strings of math operations packed into one line. Your job is to provide clarity, not create confusion. In many cases, the chaos stems from the fact that they’re just rushing—grabbing a number from management during the earnings call and not having the time to properly refine it.

Regulatory constraint, again

Most of the time, earnings summary notes are a complete waste of time. Yet, equity research professionals are forced to churn them out because fast-money clients want to hear your views the very next day. And to be able to share those views with clients or make TV appearances, by FINRA regulation, analysts must publish their views in a note first.

Earnings season is a key event for high commission-paying clients who rely on trading for a living. So, scrapping the earnings note exercise altogether is nearly impossible. If your firm decides to take a disruptive approach and opts out of producing these notes while competitors continue to do so, it can seriously hurt your market share. This scenario is a classic example of the prisoner's dilemma: the firm ends up doing what everyone else does, even if it’s just a formality.

Behind the scenes, each equity research note must go through an internal approval process by a licensed Supervisory Analyst. These analysts often bear the brunt of resentment from their equity research colleagues. Their primary role is to ensure that the language used in the notes doesn’t solicit investment banking activities or speculate on mergers and acquisitions.

This leads to a lot of time wasted compromising on note titles or removing phrases that don’t please the supervisory analysts. When it’s midnight, and you’re already stretched thin trying to get five notes approved so you can head home, it’s all too easy to cave to their demands. This unnecessary back-and-forth detracts from the opportunity to infuse the model and note with valuable insights.

As a result, models often come across as “lazy” or, worse, confusing. I recently encountered a model that I hoped would save me time, only to find it consumed even more time than starting from scratch. The analyst had inconsistent formulas throughout the forecasting period—basing costs of goods on historical trends for the next quarter, while modeling gross profit using gross margin from two quarters out and beyond. In certain cells, her “forecast” was a convoluted formula made up of hard-coded numbers, accompanied by a comment about their origin, yet lacking any real logic that I could discern.

I want to be understanding so I assume she was simply too overwhelmed. From the client’s perspective, all they want is a high-quality product that meets their needs, and unfortunately, in this case, it’s a model riddled with confusing historical and forecast assumptions.

This creates a conflict that diminishes respect within the client community and opens the door for disruptors to offer dedicated, unregulated, and superior solutions. It’s something sell-side research management needs to be acutely aware of, as the avenues through which sell-side research can add value continue to dwindle, hampered by their entanglement in so many processes on top of myriad of regulations.

And it doesn’t help when there is no budget to support your work on the sell-side, even if you want to do your job well.

No budget

Each year, the budget for equity research faces cuts as bank management views it as a cost center. While the reality of whether equity research generates revenue (my view is that it does) is more nuanced, the narrative remains a tough sell, leading to a steady decline in funding for research departments.

Investors seek models that break down segment revenues and costs into unit drivers—information often absent from public company disclosures. However, achieving this may require access to proprietary datasets that correlate with segment performance or a deep dive into unit economics. Unfortunately, the time and financial resources needed for such endeavors are increasingly scarce in equity research, making it nearly impossible to deliver high-quality work.

As a result, buy-side investors often criticize the sell-side for producing subpar work, failing to grasp that the primary role of equity research isn’t solely to make investors money. However, the best analysts can provoke thought, save time, and facilitate access to management—all invaluable resources, particularly for smaller funds that lack the scale to negotiate direct access to critical information.

Conclusion

By offering buy-siders a glimpse into the life of a Wall Street (sell-side) research analyst, I hope to foster a better understanding of their reality, which isn’t quite as enviable as it may seem. While sell-side analysts might not be stressed about the consequences of being wrong, they contend with challenges that most buy-siders don’t face.

My aim is for you to learn how to leverage the offerings of Wall Street equity research while exercising a bit more understanding and less criticism. Ultimately, a more nuanced understanding can lead to a more productive collaboration, benefiting both sides of the public equity market.

Next time, I will dive into what equity research analysts are actually occupied with throughout the year.

Thanks for reading. I will talk to you next time.

If you want to advertise on my newsletter, contact me 👇

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you. 🙏t

In reality, investors set the real consensus—often called the "buy-side bogey."

I worked for some buy-side boutique roles (Very small ones that don't utilize sell-side research) and I find it hard to believe that sell-side analysts use hard-coded numbers to calculate forecasts. How do they do their jobs updating hard-coded numbers lol