My 2024 Year-in-Review

Reflections, Lessons, and 2025 Goals

As we approach the end of the year, it’s that time again—your feeds are flooded with creators’ year-end reviews: a mix of personal reflections, key lessons, and goals for the year ahead.

Here’s my look back at 2024: how I performed against my goals, what I learned along the way, and what’s next for 2025.

2024 Self Evaluation

Goal: Find a damn job

Self-evaluation: When I left my hedge fund analyst role at the start of 2022, it wasn’t because I didn’t enjoy the work—it was a misalignment of styles. Deep down, I knew it was time to move on.

Career coaching had always been a quiet passion of mine, and with encouragement from friends, I decided to take the leap into entrepreneurship. (By the way, I do not endorse pursuing entrepreneurship full-time when you don’t have product-market fit)

The early days were tough but rewarding. I earned some money in 2022 and 2023, but it wasn’t enough to put meals on the table. Without product-market fit, there was no real growth. As a self-funded entrepreneur, I had the cash runway to keep going. However, I couldn’t justify pouring years into a venture that wasn’t progressing. My career needed to move forward, so I made the decision to pursue a full-time, non-investing role.

In early 2024, I devoted myself to the job search, sending countless cold messages and having productive interviews. Despite my efforts, I didn’t receive a single offer. While the job market was undoubtedly tough, I can’t overlook my own missteps—particularly my attempt to transition into tech corporate finance after years in equity research, all without a network in that space. Most of my connections are in high finance, and the shift turned out to be a steeper hill to climb than I’d expected. I have a lot of say about the exit from equity research to corporate, but I will leave it for another time.

By mid-2024, I had a choice to make. My entrepreneurial ventures, while modest, were showing signs of life. Revenue streams started to trickle in—enough to get by—and I decided to go all-in as a founder again.

What surprised me most was how a growing audience opened doors I hadn’t even considered. I’m not rolling in cash, but I’m building something more sustainable and learning as I go. It’s messy, humbling, and, somehow, incredibly fulfilling.

Andy Grove’s1 words often ring in my ears: “Only the paranoid survive.” I’m paranoid every waking hour, but I’m also enjoying the creative and financial freedom with the founder life.

Maybe years later looking back, I should thank all the companies who didn’t give me a job, so I can build Richard Toad into a bigger presence.

So, at least those of you who read this won’t ask me in 2025: “How is the job hunting going?”

Goal: Have more fun

Self-evaluation: I did okay.

The top highlight was I got a free ticket to attend the 2024 Sohn Conference in New York City, where I also met a few long-time supporters for the first time in person—and, of course, satisfied all my cravings for Xi’an Famous Foods (that place is a major carb-vana.)

A few months ago I went to the Southern Hemisphere for the first time in my life to Australia and New Zealand, had a great time.

Goal: Build More Products

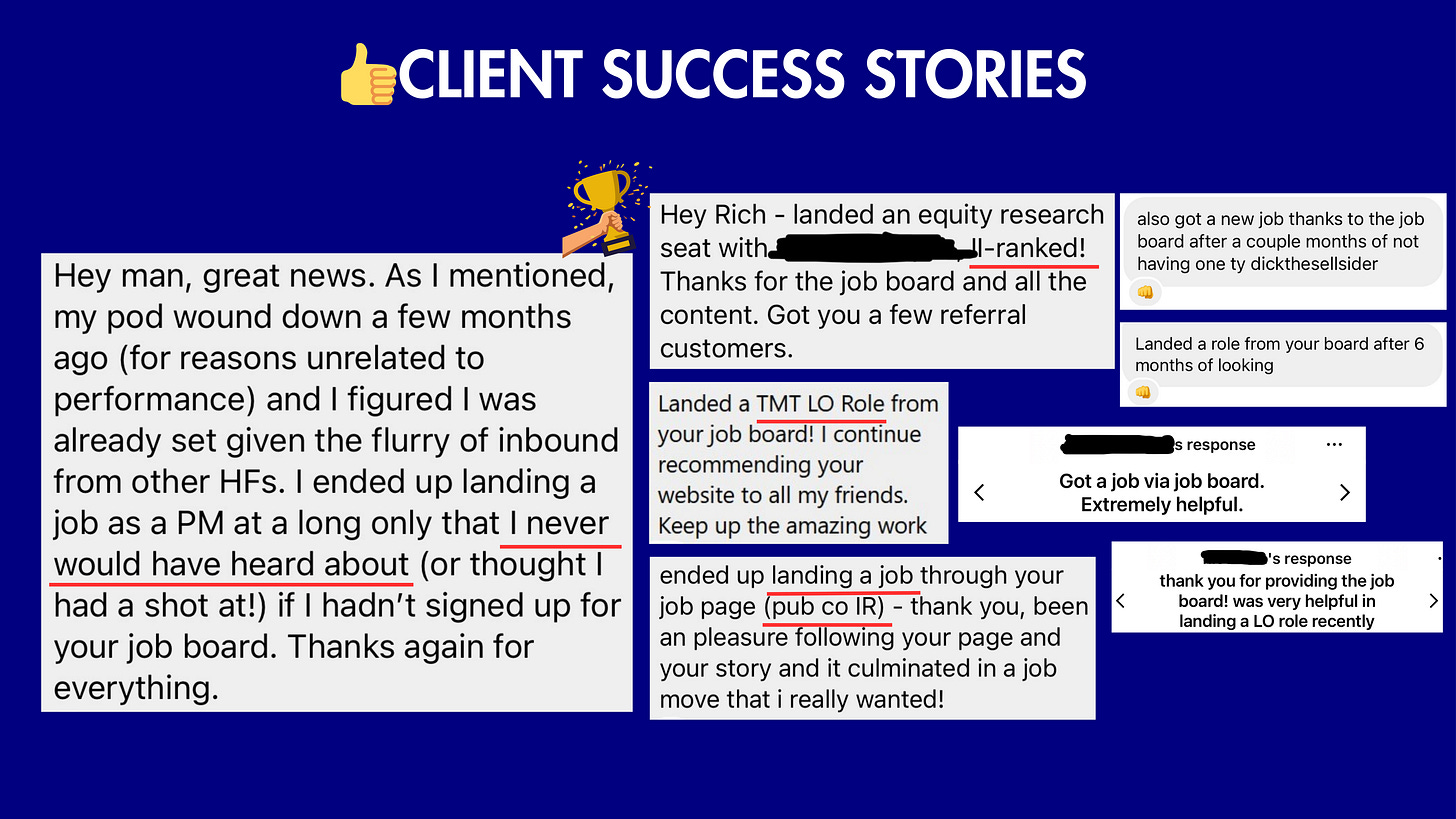

Self-evaluation: I launched the job board as a paid product on January 1, and it’s now a vital part of supporting myself financially. What is more rewarding is seeing clients DM me about getting offers thanks to the leads I provided—this is exactly why I started Richard Toad in the first place. Over time, I expanded the scope into credit, investor relations, Canada and the U.K.

I also launched my networking course. Had a lot of trouble branding the product. As of now, the course is “under construction” because I launched it when I was anonymous. The new version will have new sections while you will see me talk throughout the course. Stay tuned.

This newsletter grew to ~5,000 engaged subscribers. I need to get better at attracting newsletter ad sponsors.

Paid subscriptions haven’t seen much growth, but I view them as a “bond”—stable and steady. Thank you all paid subscribers for supporting the publication!

Running a newsletter is always a delicate balance between growing free sub count versus converting free to paid. One subscriber pointed out I’m not paywalling the right content, so I need to be more thoughtful about how to add value to paying subscribers. I have ideas about premium career-related content for 2025. Stay tuned.

Goal: Be Metrics-Driven

Self-evaluation: I grew to ~55,000 followers across platforms this year. Tracking subscriber counts helps understand where I get the best return on time and effort. And clearly forecasts don’t mean sh*t, especially true for nonlinear internet-based entities, because my guidance was way off in a good way. Therefore, I will not be providing guidance for 2025 (if I were publicly traded, my stock will probably get cut in half after this release.)

Here is a variance table for my subscriber counts (for those scarred by earnings seasons, sorry), as of 12/25/2024 vs. 12/25/2023:

YouTube: from 1,696 to 4,558

Substack: from 2,129 to 4,964 (my guidance was 3,500)

Instagram: from 16,588 to 37,201 (my guidance was no growth, but I reinvented content layout and reignited growth, with my Dwight Schrute’s “Steak … Rare” Meme going viral at 4.1M views)

Twitter: from 1,231 to 5,500

LinkedIn: from 0 to 1,640

TikTok: from NA to 1,180 (I didn’t track)

Goal: Do More Business and Stock Analysis

Self-evaluation: My Moat GOAT series brings me joy. It’s something I can produce at an acceptable quality within a week, and I plan to do more of it. While it’s more time-consuming compared to career-focused content, it adds depth to what I offer. Even though I no longer work in investing, I still love learning about businesses—especially when there’s no pressure to predict what moves a stock in the near term.

2024 Lessons

Think Bigger

This year brought new challenges, such as dealing with bad actors. Running a business serving college and MBA students means many are "broke," aka. they’d rather spend on beers.

I got hit with a few payment disputes, which was infuriating. What I learned: you will spend 95% of your time dealing with the 5% of difficult customers. I had to implement disclaimers, fight disputes more aggressively, and accept the cost of doing business. Thankfully the issue improved.

The bigger takeaway is if I want to continue solving more problems, I can’t be bothered by things like this. I will instead focus on creating more value for the 95% of good actors who do value what I do.

More is Good

Last year, I talked about focusing on fewer things. But Alex Hormozi’s books shifted my perspective. He made the point everyone should be marketing more aggressively than they have been.

Implication? I’ve ramped up my posting frequency for those who’ve noticed. I am also back to the meme posts that first propelled Richard Toad onto the scene. I’m looking up to the big dawg that is Elon Musk and following his lead.

When my Instagram growth stalled last year, I expanded to multiple platforms, and I’m getting better at navigating other social media channels.

Twitter: Grew from ~1,200 to ~5,500 followers.

LinkedIn: The big wildcard for 2025. My content fits the audience perfectly, so I’ll invest more time there.

TikTok: Slow but steady growth—no virality, just consistency. With the imminent ban in place, my lack of a knack for short-form videos and a TikTok audience who prefers entertainment rather than learning means I will not focus there.

The upside of being everywhere? Someone recently said to me, “I see you all over the internet”—a good sign. The downside? Advertisers value dominance on a single platform when negotiating ad deals. For now, though, I’m focused on broadening my reach and building my brand without obsessing over ad revenue.

That said, I’m proud to have secured two major ad/affiliate partners, Fundamental Edge and Daloopa, this year, whose products I respect tremendously.

If you want to reach my 5,000 subscribers, majority of whom work in investment research, public and private, don’t hesitate to contact me to discuss how I can be of value to you.

Learn From Others

Nowadays, you don’t need to leave your house to learn and grow. There are countless free resources online. Naval Ravikant once said,

It’s not the lack of resources that hinders people’s growth; it’s the lack of will to learn.

And yes, I’ve learned a lot this year. However, I want to spend more time in real person, which I’ll dive into later in the 2025 goals section.

One entrepreneur I chatted with on Instagram shared his observation: startups take about four years to succeed or fail. I started this journey in April 2020, and now, 4.5 years later, I’m full-time with product-market fit and thus real cash flow. The timeline checks out. I’ve heard this four-year mark mentioned on several podcasts as well, so it’s clearly a widely recognized rule of thumb. Something I would not have learned if I didn’t talk to this entrepreneur.

I recently came across a Chinese motivational influencer (below, it’s English subtitled, I didn’t need the sub of course) on Instagram who gave me a big “eureka” moment. She said, "If you’ve achieved big success recently, trust me, it’s not because you worked so hard. Instead, it’s likely because you’ve finally activated your natural talent." Reflecting on this, I’ve created far more value as an online career coach and influencer than I ever did as a professional stock picker. I’ll probably never know whether I could have been a consistent alpha generator, but I am good at marketing myself, have valuable tips to share and am good at delivering in a compelling format.

The lesson for you? When you are younger, try a lot of things and take risks. You might think you want to be an investor who reads all day, but in reality, you have natural talent of selling. Or you want to become a creator because MrBeast makes a lot of money, but your personality is better suited for reading 10Ks and doing investigative research work as a stock picker. Try your best to land where your passion and natural talent converge. I guarantee it: no matter how "unattractive" the industry seems (equity research is not an attractive industry, it’s not AI), you’ll find both emotional and financial fulfillment.

2025 Goals

Build More Products

Next year, I will focus on building: job matching and hedge fund database.

Majority of current equity research associates and many equity research aspirants are my followers, I can add big value to banks on supplying talented candidates.

To my bank partners, I need to dramatically up the standard in vetting candidates to save my bank partners from sifting candidates who aren’t qualified. If you work in sell-side research, please introduce me to your Director of Research.

To you job seekers, my value add is providing exposure that you might not get —whether your resume struggles to convey your intrinsic ability or you attend a non-brand name school.

If you want to save time and get more shots on goal for sell-side research jobs, bring your best work and join us.

Some of you have asked if I have a list of hedge funds that match an XYZ style. I do. But it’s not ready for sale. It’s on my roadmap and I will keep working on it.

Do More In-Person Activities

I revealed my identity on my own term this year. Honored to reveal in the same year as the GOAT, Liquidity. Unfortunately, he was forced to.

Since then, I’ve had the opportunity to appear on some great podcasts:

However, as one of my top supporters pointed out, I need to engage in more in-real-person activities because there is only that much automation I can do to get more leverage of my online content. That means doing more podcasts, more in-person talks, meeting creator peers, and finding mentors. With more brain storming and mentoring, I can go farther more quickly. The greatest thing about building a community is not the money, it’s the amazing people you can meet.

Back to video production

I capitalized on the holiday discount to upgrade video production equipment (can’t believe my old camera did not even have 4K). With new gears in hand, it’s time to get back to producing videos. I don’t care to be a YouTuber, but I do want a presence on a platform where you can see me deliver value with a real face and voice (what’s the point of revealing my identity if I don’t use it?) Plus, it’s great practice for public speaking. So, in 2025, I’ll be producing more YouTube videos.

Closing Thoughts

I hope you learned something from my creator and founder journey this year.

Thank you all so much for supporting Richard Toad.

Happy Holidays, and I’ll talk to you in 2025!

If you want to advertise on my newsletter, contact me 👇

Resources for your public equity job search

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you.

Andy Grove was the CEO of Intel who steered the company from being a memory manufacturer to going all-in on microprocessors when the Japanese memory makers, subsidized by the Japanese government, were going to crush Intel

Best of luck for 2025. Great to hear your story

May i ask why have u uploaded so much less on YT this year?