In this Moat GOAT piece, we will delve into Old Dominion Freight Line, a leading player in the less-than-truckload (“LTL”) shipping industry. If you've missed my previous Moat GOAT articles, I highly recommend catching up, as we continue to explore companies with strong competitive advantages.

Why does LTL shipping exist?

LTL shipping, as the name suggests, involves transporting goods that do not completely fill a truck. This service is particularly valuable for small and medium-sized businesses (SMBs) that lack the inventory to warrant a full truckload shipment. LTL carriers allow these businesses to ship smaller quantities more frequently, ensuring better inventory availability. The market for LTL shipping thrives in a landscape where customers have various shipping options, including rail, ocean, air, and full truckload (FTL) services.

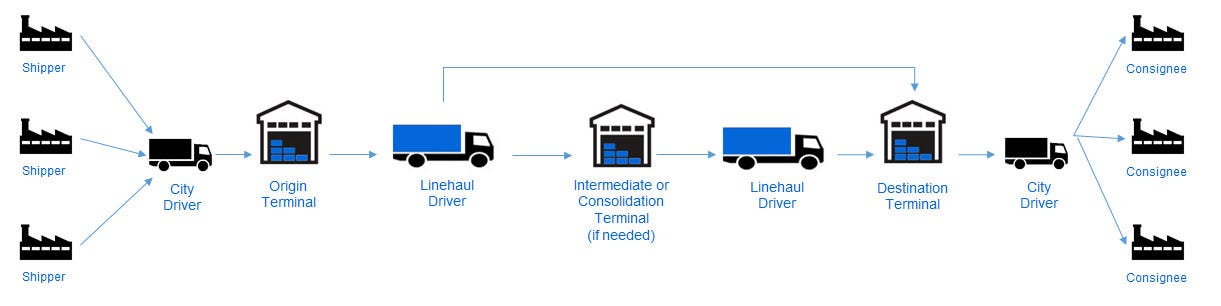

Unlike truckload shipping, which is a straightforward point-to-point operation that virtually anyone with a truck and license can enter, LTL shipping operates on a hub-and-spoke model. This model involves picking up loads from multiple shippers, transporting them to local service terminals, and then consolidating them at larger cross-dock terminals for further distribution. The capital-intensive infrastructure required for this operation—terminals, vehicles, and equipment—along with lower unit costs for incumbents who can spread those fixed-income investments over a larger revenue base, results in a high barrier to entry and a consolidated industry structure.

The top 20 LTL players command 62% of the market, even before Yellow’s recent bankruptcy. This industry is known for maintaining excess capacity to benefit from economic upcycles while remaining disciplined on pricing during downturns, making it an attractive space for incumbents.

In stark contrast, the truckload industry is highly fragmented, with the top 20 players holding a mere 8% market share. A staggering 96% of truckload fleets operate fewer than 10 tractors on average, indicating low barriers to entry and a highly competitive environment. This often leads to price wars and value destruction, similar to the airline industry.

While LTL is a more stable and attractive industry, it is not without its challenges. The industry has seen minimal tonnage growth (industry unit growth), averaging just 1% per year over the last 15 years. Consequently, growth has largely been driven by market share gains rather than increased demand, making it a sector where only the strongest players thrive. And that strongest player is Old Dominion.

Why is Old Dominion great in an already good industry?

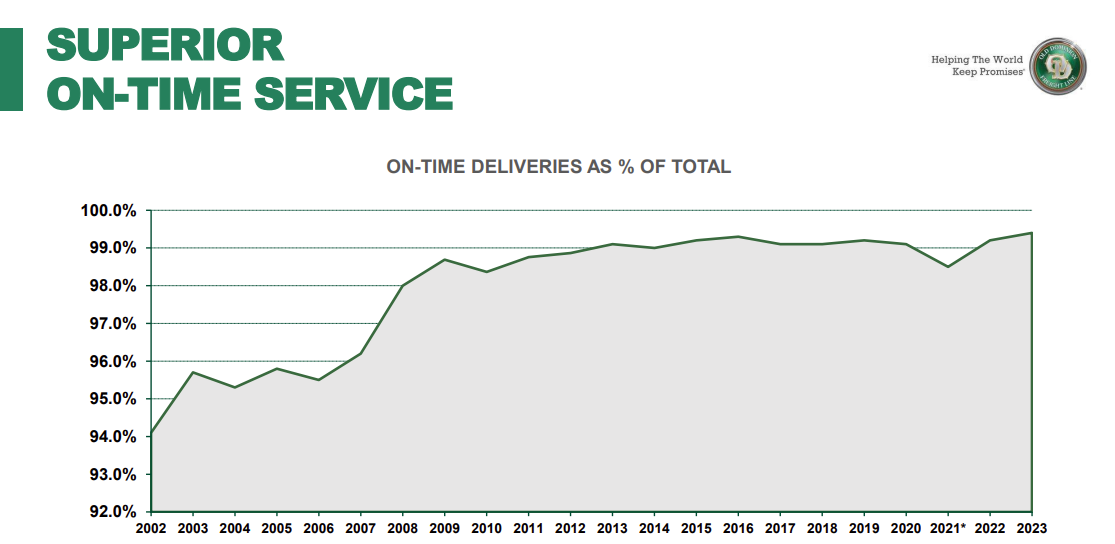

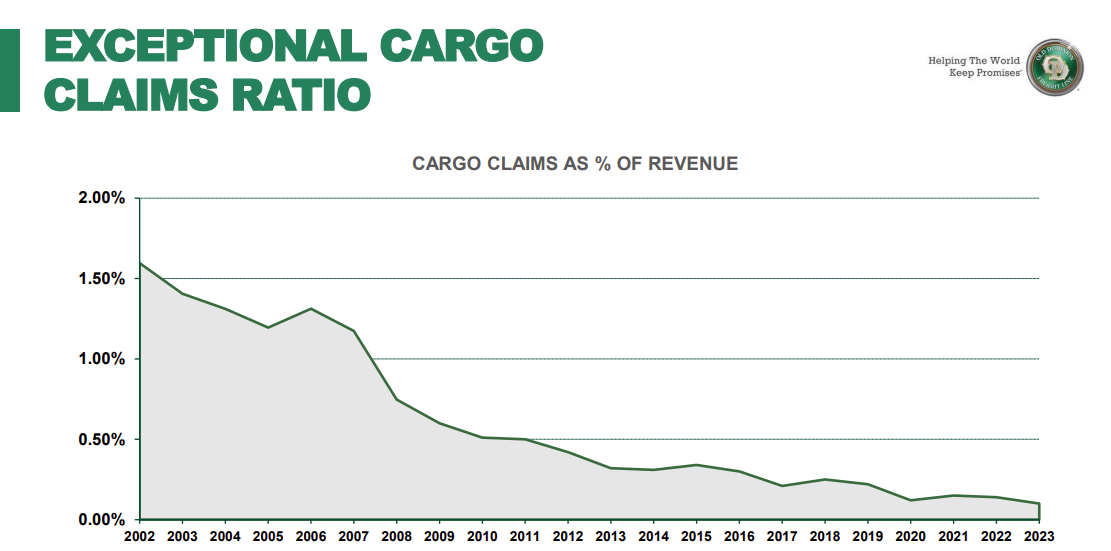

Old Dominion Freight Line ("OD") has emerged as a gold standard in the LTL shipping industry, primarily due to its superior service quality. The company has earned its reputation through consistently low damage rates and high on-time deliveries—two critical factors that every shipper values. But what truly sets OD apart, and why has it managed to outperform its competitors so effectively?

The answer lies in the company's exceptional processing power, which I believe is its core moat. Processing power, coupled with resultant branding, allows OD to command a premium price for its services. This success stems from several key factors:

Culture: OD's culture emphasizes the importance of shipment quality and network efficiency. While difficult to quantify, this culture is reflected in the company's operational metrics, particularly its on-time delivery and low damage rates.

Alignment: OD aligns its employees’ incentives with the company’s goals by offering bonuses for safety and quality, ensuring that everyone is working toward the same objectives.

Control: OD’s strategic decision to own its assets has provided a significant operational advantage. This approach mirrors the investment patterns seen in other industries. For instance, in my discussion of Copart, we saw how Copart’s ownership of land became a key strategic advantage over IAA, a private equity-owned competitor that leases its land for better near-term cash flow. Similarly, Carvana’s ownership of reconditioning facilities and last-mile shipping capabilities provided it with a competitive edge during the COVID-19 pandemic over Vroom, which leases these assets. In OD’s case, owning 91% of its service center locations as of December 31, 2023, has allowed it to better control the customer experience, optimizing delivery times and reducing damage rates. This ownership strategy has also enabled OD to reinvest profits into expanding its network, further enhancing its competitive advantage.

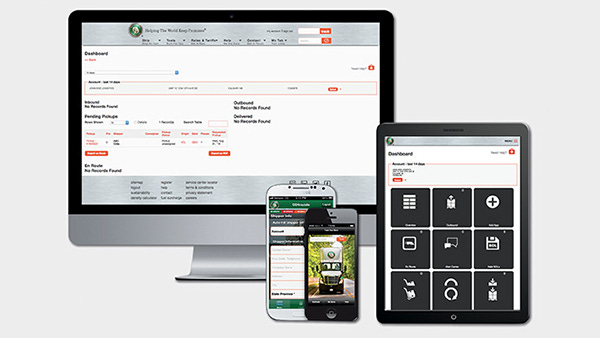

Another aspect that contributes to OD’s success is its reputation for technological enhancements. According to Mastio & Company's annual LTL Customer Value Study, some customers specifically cite OD’s helpful technology as a factor in their satisfaction. While I haven’t delved deeply into this point, it likely represents another component of OD’s industry-leading operational performance.

On the cost side, OD benefits from a senior management team that is compensated based on metrics like the operating ratio, which measures operating expenses as a percentage of revenue. OD's operating ratio has been consistently in the low 70s, approaching the efficiency levels seen in Class I railroads, which are considered benchmarks of efficiency in the transportation industry. Moreover, OD’s union-free workforce provides a cost advantage, especially when compared to Yellow, which was burdened by a heavily unionized labor force before its bankruptcy in August 2023.

OD's scale economics further bolster its competitive position. The company's significant fixed-cost investments, reinforced by reinvestment into more service centers, have created a flywheel effect that makes it difficult for new entrants to compete.

While there are financial and operational costs associated with switching LTL carriers, including potential termination fees and the learning curve of integrating new logistics systems, these switching costs are not the primary reason for OD’s success.

Interestingly, OD doesn’t rely on cornered resources, meaning it doesn’t have exclusive access to unique assets that would allow it to earn superior returns on invested capital (ROIC) over its peers. Theoretically, a new entrant with access to infinite capital can replicate the fixed assets needed to be an OD, minus the operational excellence, of course.

Its impressive ROIC, consistently above 20%, is driven by high NOPAT, which in turn is fueled by pricing power and disciplined expense management.

Forward trends

I believe Old Dominion’s moat is both strong and defensible, much like that of Copart. The barriers to entry in this industry are high, particularly from a capital intensity and processing power perspective. Competing carriers have tried for years to replicate Old Dominion's success, yet the Mastio survey consistently shows that OD’s reputation score has widened over its competitors. This suggests that there’s something in OD’s "black box"—its unique processing power—that makes it fundamentally better than everyone else in the field.

While Old Dominion's high ROIC is impressive, it wouldn't mean much without a runway for reinvestment. Although the LTL shipping industry isn’t experiencing significant tailwinds, the sector’s fairly consolidated nature offers opportunities for OD to continue gaining market share with its superior product. The key will be Old Dominion’s ability to maintain its value proposition and execute effectively, allowing it to capitalize on these market share gains and continue its track record of strong financial performance.

Looking ahead, OD may eventually reach a point where further expansion of its service centers in the domestic U.S. LTL market is no longer necessary. At that stage, incremental profits would require little to no additional capital investment, potentially driving a significant improvement in ROIC and a corresponding expansion in its stock’s valuation multiple. This scenario presents an intriguing opportunity for investors as OD continues to strengthen its position as a premium service provider in the LTL industry.

Please let me know if you have information on Old Dominion that I might have missed and/or where I am wrong (as long as you are not being a d*ck.)

Thanks for reading. I will talk to you next time.

Disclaimer: I have no positions in the companies discussed in this article

If you want to advertise on my newsletter, contact me 👇

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you. 🙏

Thanks for another great piece!

curious what you think of the other two public competitors ability to increase their service quality / OR while raising price above odfl rates. Also idea that odfl drafted off yellow share losses to outgrow