How to Generate Stock Ideas Quickly

Steal, Screen, Cover, and Network

Every research interview requires an actionable stock pitch, sometimes even more than one. But where do you find an idea when you barely have a grasp of how to read a 10K and construct a model? Let me show you ways to expedite the idea-generation process.

Announcement - I added a job board on my website. If you are actively looking for buy-side and sell-side research jobs, bookmark it.

To WATCH this article:

“Steal” Ideas

Thanks to the Internet, everything is public now, so there really isn't any excuse. I suggest the easiest way to start is by borrowing ideas.

Since we're dealing with public investing, if someone else shares an idea, you're not prohibited from using it; you just need to ensure you conduct your own due diligence to reach the same level of confidence as the idea's original publisher.

Whalewisdom / Dataroma

Every public equity fund must file its domestic long holdings 45 days after the end of each quarter in a 13-F report. There are two excellent tools available to track these holdings.

One of these tools is Whalewisdom, which is most useful when you follow low-turnover concentrated funds.

I'll use Dorsey Asset Management1 as an example. In long-duration funds like Dorsey's, even ideas that have been held for a long time can still be actionable if the stock price simply hasn't moved. This is because these funds are not as reliant on catalysts.

With Whalewisdom, you can analyze top holdings, changes in position sizes, new purchases, and sales.

It's also valuable to be aware of new positions and exits among a group of firms that you highly respect and that fit the long-duration concentrated definition, as this information could be a signal.

However, due to the 45-day lag, 13-F filings can be deceiving. Funds may engage in 'window dressing' around quarter-end to conceal their true portfolio for competitive reasons (or create an illusion that they have created value by buying stocks that went up during the quarter on the last few days of the quarter.)

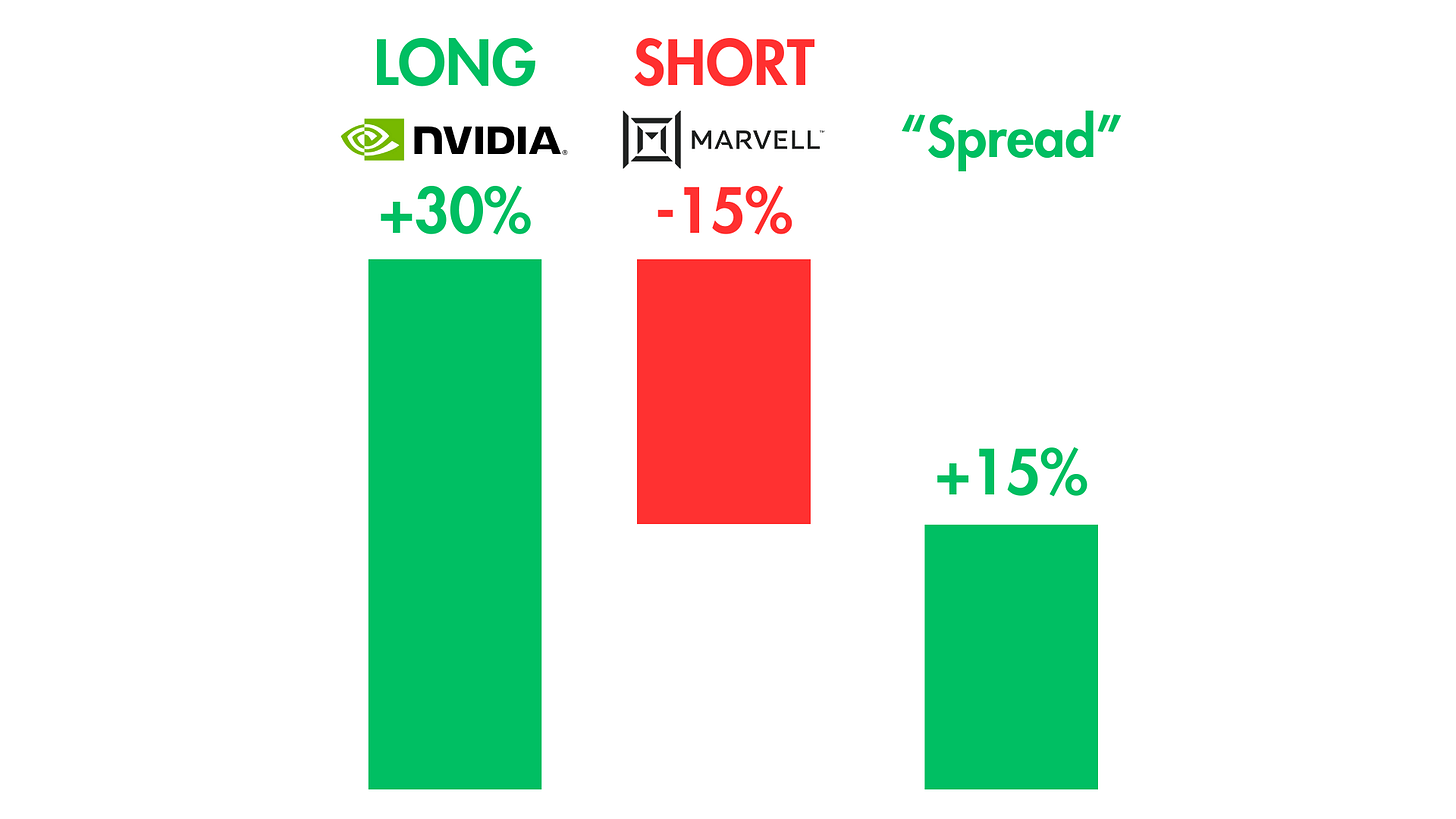

For long/short funds, take extra caution. A long position might be part of a pair trade. A relative value manager may be playing for the long position to rise more than the short position.

For example, the relative value manager might be long on Nvidia and short on Marvell, but in reality, both positions are probably long. Nvidia might be up 30%, while Marvell is up 15%, so the manger made 30% on Nvidia long and lost 15% on the Marvell short, resulting in a 15% positive 'spread'

Another similar tool is Dataroma, which provides the same information on more curated set of funds. While I don't know the specific criteria for a fund to be listed on Datamarama, you can find every fund’s 13-F on Whalewisdom.

Hedge Fund Letters

Reddit compiles hedge fund letters on a quarterly basis. Additionally, you can bookmark the websites of funds you respect.

When reading these fund letters, you don't have to focus on their macroeconomic commentary, though you can if you're interested. Funds often disclose high-level information about new positions they've acquired or provide updates on existing holdings. To me, that’s more interesting.

If you know your investment style, expand your knowledge by exploring other funds in the same category.

On Twitter, take a look at who the founders of your favorite funds are following. You can also rely on word-of-mouth recommendations to identify like-minded investors.

Pay attention to influencers like myself who curate valuable information. Some newsletters even highlight investment pitches from other bloggers.

Utilize Whalewisdom to discover investments held by your favorite fund and identify other concentrated owners. Chances are, these owners share a similar investment style.

You can even engage with the founders of these funds on Twitter. There's little to lose in reaching out. In the worst case, they may not respond, but in the best case, they could provide insights into their investment style and engage in a meaningful discussion about the ideas you're exploring or the investments they own.

Keep in mind that the world of investment management is relatively small. Small fund founders may have job leads or eventually hire you at their own funds. Repeating this process will gradually expand your knowledge of equity investors.

Twitter / Newsletter

Leverage Twitter. Investors congregate on Twitter, and this includes not only famous investors but also disgruntled long/short investors who might be venting about their experiences.

Among the usual social butterflies are individuals like Ricky Sandler, Paul Enright (who is no longer on Twitter due to joining Jain Global), and Gavin Baker. Additionally, there are anonymous users like Jerry Capital and Pythia Capital, who often share insightful perspectives. I frequently monitor their posts and the accounts they follow.

This is another effective way to expand your knowledge. Prominent figures in the financial Twitter (Fintwit) community regularly tweet their thoughts on various stocks. There's no excuse not to delve deeper into the topics they discuss.

Many Fintwits have newsletters, including the one you're currently reading. Borrow ideas from them.

You don't necessarily have to read their entire write-up at first; simply be aware of the stock ticker they're discussing. Reading their full articles might influence your perspective. I recommend conducting your research first and then reading the article to compare notes.

Engage with the author by leaving a comment on the article or sending them a direct message on Twitter to exchange thoughts. As a bonus, this interaction offers an opportunity to make a positive impression for job leads and lifelong friendship / mentorship.

Value Investor Club / Sumzero

Most of you are likely familiar with the Value Investors Club (VIC). To gain access to this exclusive club, you must submit a high-quality pitch. If you don't have an idea, you'll have to wait for 45-day delayed access.

Fortunately, VIC primarily features special situations and deep-value ideas, many of which may not have fully played out even after 45 days from publication. Consequently, I believe VIC remains a fertile ground for actionable ideas, even with the delay.

On the other hand, SumZero has unfortunately become entirely paywalled. To become a full member, you must submit an idea.

SumZero's ideas align more with hedge fund strategies, while VIC caters to a more traditional value-focused audience.

Mutual Fund Idea Generation

Morningstar is particularly valuable for long-only investors. Mutual fund companies offer a multitude of funds across different strategies, but they typically file only one 13F report under the firm's name.

Therefore, when you use Whalewisdom, it can be challenging to find insights.

In contrast, mutual fund filings provide visibility into their non-U.S. holdings as well. Focus on funds you respect. For instance, I have great respect for David Samra at Artisan International Value, which operates under the Artisan mutual fund platform. He consistently outperforms the market as a long-term, high-quality international investor.

Some of the mutual funds I follow offer free quarterly investor calls. During these calls, portfolio managers and analysts provide updates on the portfolio and individual positions. These sessions are invaluable. Occasionally, the analysts even present a detailed pitch for a new position they have recently acquired. If that doesn't qualify as a free source of investment ideas, I'm not sure what does.

Networking

Information from people-oriented sources is consistently of higher quality.

If you're outside the profession and trying to break in, it's likely that you're already networking actively with like-minded investors. Ask them about the funds they hold in high regard, and if you have an idea, discuss it with them. Ask how they generate ideas.

By mastering the power of reciprocity, consistently adding value and sharing ideas with your counterparts, you'll begin receiving ideas that align with your investment style promptly. Therefore, it's crucial to nurture these relationships.

If you're already working on the buy side, you have ample opportunities to connect with industry peers at sell-side conferences and analyst days. You simply need to take a proactive approach to provide value and build meaningful relationships to access a high-quality stream of investment ideas.

If you have direct access to company management as a buy-sider, ask them questions to uncover changes which typically means uncertainty in the stock price.

Ask management:

Who is doing interesting things in the sector?

Who keeps them up at night, in what product segment/geography?

Is the industry rational?

Is everyone adding capacity or no one is?

Who is taking market share and why?

Which competitor’s management do you respect?

One data point does not mean much. If you talk to several management teams within the same industry and start to hear recurring themes, it gets interesting.

In this case, unlike in investing itself, the consensus is the signal to dig deeper.

Magazines, Newspaper, and Book

You should actively read The Wall Street Journal (and the Financial Times for my European readers) – not just for the facts, but also to understand the implications for the direction of the world and how a news piece affects various industries.

Barron’s is an excellent publication explicitly for investment ideas, while Fortune is a valuable magazine for gaining insights into business trends and emerging business models.

If you are a long-time follower, you know I am a big fan of Columbia Business School and its reputation in recruiting for investment management.

I regularly read their CSIMA newsletter, which often contains stock ideas.

Not many books explicitly talk about stock idea generation. The only one I recommend will be The Manual of Ideas, which is skewed toward deep value and special situations.

Screens

Stock movement

The software you use to trade stocks probably tell you what stocks are at 52-week high / low. Just beware the market is efficient most of the time. Unless you have a solid grasp on the intrinsic value of the business, big stock moves don’t mean the stock is actionable.

Business fundamentals

You can also screen for various financial metrics such as revenue, EBITDA, EPS growth, gross margin, operating margin, and ROIC. However, strong business fundamentals tend to come bundled with high valuations. There's no free lunch in investing.

I argue that screening for business fundamentals is more valuable because it helps you understand what makes these businesses great. This knowledge can be especially beneficial during times of controversy, allowing you to seize an opportunity to own a great business at a very reasonable price.

For instance, one of my mentors heavily invested in Nvidia when it was trading at around $150 per share. I also know a buy-side friend who bought Transdigm significantly after March 2020.

So, it's worth doing the groundwork on great businesses in advance and patiently waiting for the right pitch that Mr. Market can offer from time to time.

Events

For special situation ideas, screen for events. There are websites that help you track spin-offs and so on.

You can use transcript search features to find C-suite revealing intentions to unlock value via corporate actions.

There are also tools that track company insider buying / selling. My PM always taught me “People sell for many reasons, but they buy for one (reason.)” It’s worth digging into companies that have had sizeable insider buys.

Building the coverage

My preferred and, admittedly, the most labor-intensive method involves building sector coverage. You can begin with a small subspace.

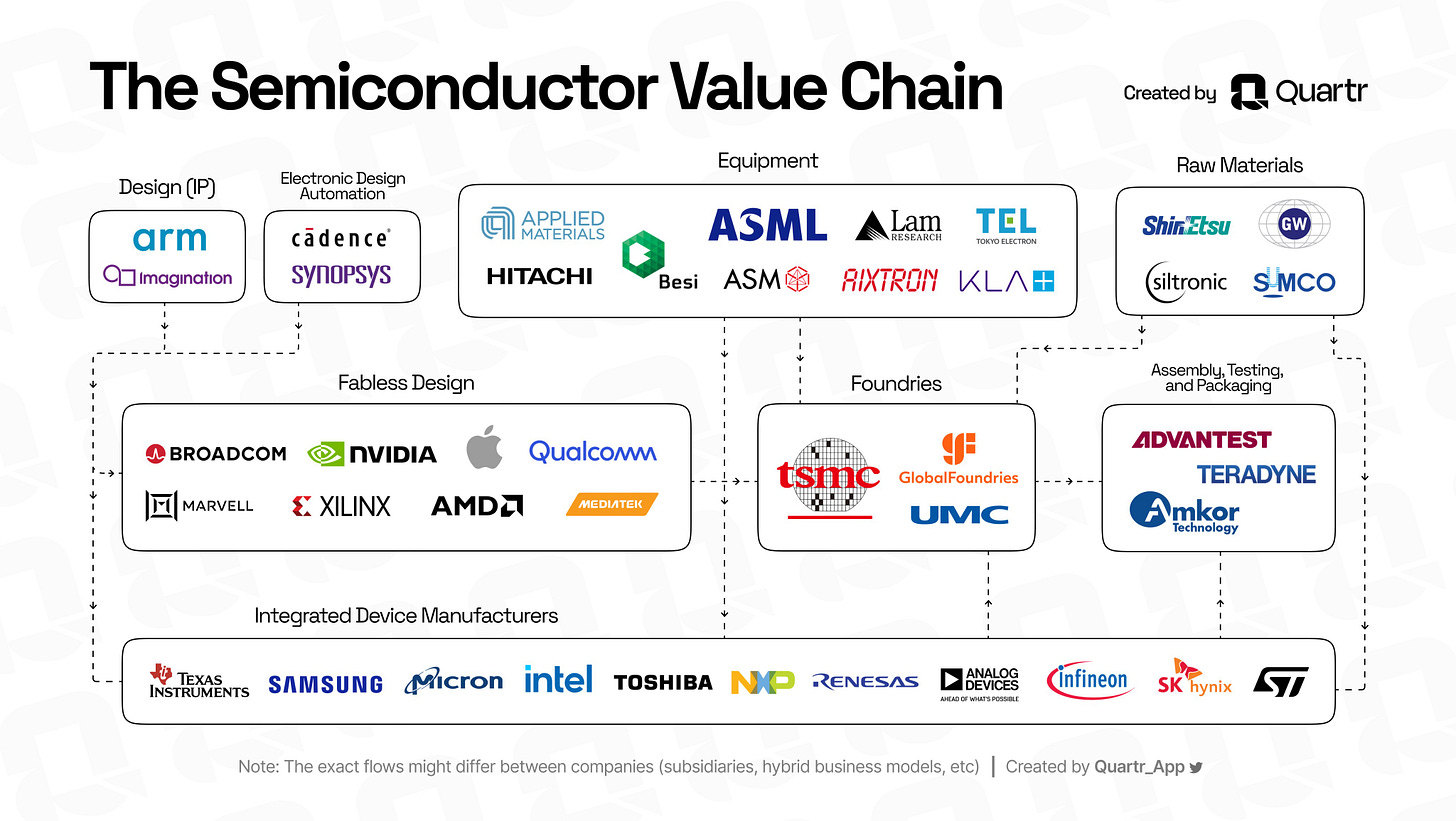

For instance, you might decide to cover the semiconductor equipment sector, including companies like ASML, Applied Materials, Lam Research, KLA, and Tokyo Electron.

In this approach, you thoroughly study these companies, gaining insights into their strengths, weaknesses, and competitive advantages.

You can rank them based on factors like the quality of their business, product offerings, and the caliber of their management.

Additionally, you create detailed financial models, dissecting the various drivers that affect their revenues, costs, and ultimately, free cash flow.

Lastly, you closely monitor major events related to these companies, such as analyst days, sell-side conferences, and earnings calls.

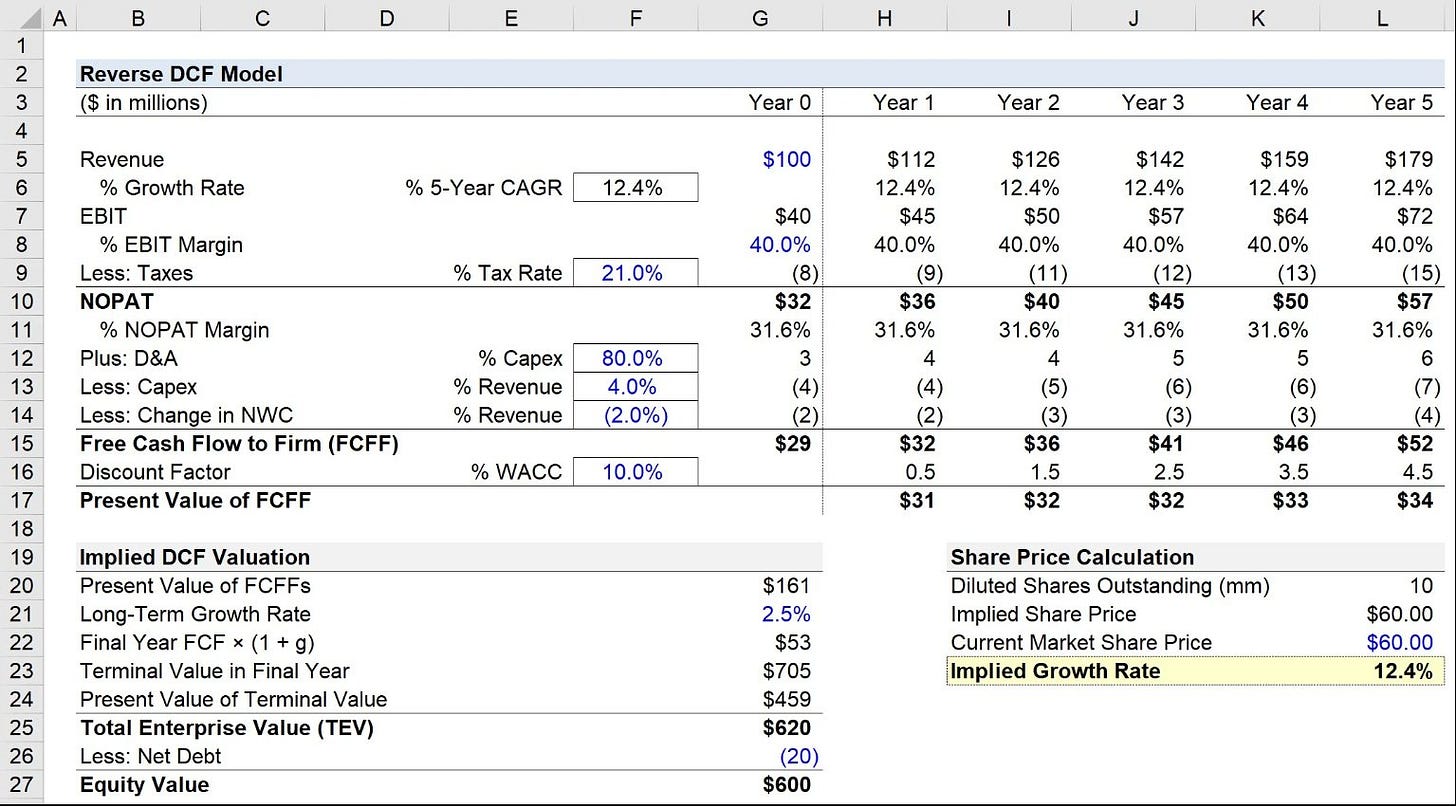

This deep dive allows you to form your own opinions about whether these companies are worth selling, holding, or buying. Alternatively, you can perform a reverse DCF to understand what assumptions are required to justify the current stock price – are they unrealistically high, surprisingly low, or within a reasonable range?

This approach offers several advantages.

It helps you develop expertise in a specific industry.

It provides a practical understanding of whether this profession aligns with your interests as you engage with it day-to-day.

It leads to actionable investment ideas.

You can even take the next step by investing in the stocks you like (although I wouldn't recommend shorting stocks you dislike, as that involves a completely different set of challenges).

After investing, continue tracking your investment thesis and record your views over time. This process will help you identify patterns in your decision-making, highlighting areas where you've been correct and wrong. The objective is to refine your investment process and enhance your accuracy in forming opinions.

As you master this approach for a select group of companies, you can expand your coverage to other segments of the value chain. For instance, if you've become proficient in semiconductor capital equipment, repeat the same process for these other segments to accumulate more insights and patterns.

By examining how the entire value chain evolves over time, you'll be better positioned to identify potential winners and losers. Even when your immediate investment idea isn't actionable, your knowledge of broader changes within the value chain can lead you to areas of actions.

Mapping the industry

Similar to building industry coverage, I've long been a fan of the exercise of 'mapping out the industry.' This entails meticulously laying out the industry's value chain, starting from the most basic suppliers to the end customers.

By the way, ChatGPT can now perform this task in a rudimentary manner. You can refer to my prior article on various ways to save time in your fundamental research.

The objective is to identify all the companies involved in the value chain, those that contribute to and capture economic value throughout the transaction process.

For example, consider the airline industry. Who manufactures the aircraft? It's dominated by the duopoly of Boeing and Airbus. Moving upstream, who are the engine suppliers? It's an oligopoly involving GE, United Technologies (Pratt and Whitney), and Rolls Royce. Going further upstream, who are the raw material suppliers? Companies like Alcoa for aluminum and precise cast parts (owned by Berkshire Hathaway) that manufacture castings and forged components.

Now, let's look downstream. How do Boeing and Airbus sell their aircraft? Do they use wholesaler brokers, or how does the distribution work? Are these intermediary companies publicly traded?

Additionally, there are aircraft lessors like Aercap, Air Leasing, and Fly Leasing. Are these considered good businesses? Continuing further downstream, what do the aircrafts need in terms of consumption, such as fueling and in-flight Wi-Fi?

How do end customers make purchases? They often use online travel agencies (OTAs) like Expedia and TripAdvisor. Finally, you need to consider global distribution systems (GDS), such as Sabre, Amadeus, and Travelport.

Once you understand where the margins and ROIC lie within this value chain, you are better equipped to make informed investment decisions, betting on companies that create more value than others within the ecosystem.

It's also important to remember that the world doesn't remain static. Based on your interactions with company management and your analysis of industry trends, you can take action based on your conviction regarding how the industry's value is shifting in the future. Of course, this should be done if your view isn't already fully priced into the stock.

Thematic

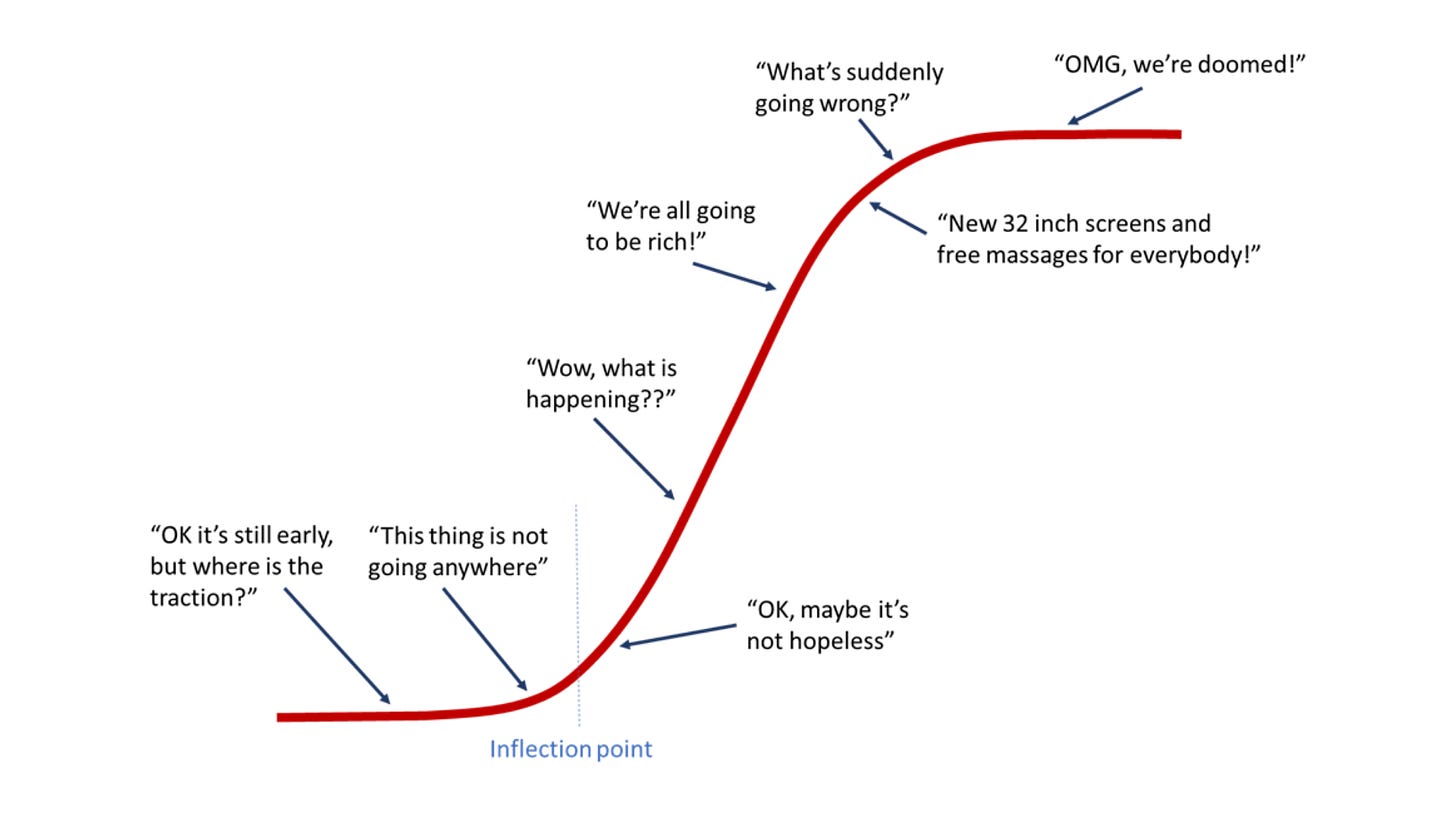

A popular framework for idea generation in hedge funds involves investing in themes. Personally, I'm not a big fan of this approach because themes often tend to be driven by momentum. They could mark the beginning of an S-curve or turn into a full-blown mania. Nevertheless, the stocks associated with these themes might still perform well.

While I don't typically invest this way, you might want to consider if the thematic approach can complement your investment toolkit. Generally, it's helpful to pay attention to changes, especially rapid ones, as they are often linked to high-growth industries. Large markets tend to attract entrepreneurs eager to capture value, resulting in both winners and losers. Consider these examples:

When Amazon acquired Whole Foods, it led to a sell-off in all retail REITs.

When Amazon entered the pharmacy sector, it caused a drop in McKesson's stock price.

When ChatGPT was released, Alphabet's stock saw a decline.

Now, in hindsight, we can determine if the market's reactions were right or wrong. There is a correct answer, although it may not have been evident at the time. Opportunities often arise during times of uncertainty.

The challenging part is figuring out the best way to play a theme, and it doesn't always mean investing directly in the theme itself. Think about second and third-order effects, such as suppliers, customers, and adjacent industries.

For instance, consider the significant trend of AI. What will be impacted? We now know that compute power is a bottleneck, making NVIDIA a key player. Even the networking aspect is well understood, with companies like Arista Networks. Or, are the hyperscalers poised to benefit?

Additionally, themes such as 5G and energy transition are well-known, but what are the implications? Only those who allocate capital correctly to these themes reap significant rewards. Simply recognizing a theme exists isn't enough to make informed investment decisions. Ultimately, it comes back to the age-old adage: you have to do the work and think through it yourself.

Unconventional

The most powerful buckets of idea generation are always the most unconventional. Pay attention to the world around you:

What is your partner buying during shopping?

Why is there a line outside that store?

Is that company publicly traded?

If it's private, what does it mean for the public names in that industry?

Is that something that can be replicated by the incumbent?

I can't teach this stuff because it's case-by-case basis, but having a nose for it is what makes the greatest investors great (think Peter Lynch).

Cautions on Idea Generations

Three cautions around idea generation.

There's no one-size-fits-all approach when it comes to generating investment ideas. The most effective methods are those that align with your personal style and preferences. It's crucial to understand your own investment style.

I often get asked about my favorite Substack, hedge fund letters, Twitter accounts, and so on. However, I can't provide a universal recommendation because our investment approaches may differ. What's valuable to me may not be as beneficial to you.

There are no secret formulas or shortcuts in this profession. You have to put in the effort and do your own homework. If stocks identified through a screening process were immediately actionable, algorithms and machines would arbitrage those opportunities instantly.

When considering ideas from public sources, exercise caution. If a fund discloses a position, it's likely that they've fully allocated capital to that idea, potentially leading to less favorable entry prices for you. If someone presents you with an idea, be aware that they may have motives that aren't aligned with your best interests. They might be skilled at pitching ideas because it’s their day job, or, in some cases, funds may share ideas on platforms like VIC just as they're exiting the position. Even established funds employ such tactics. Don’t become their "bag holder."

Finally, if you're not resourceful and determined enough to actively seek out and stay alert for investment ideas, you will struggle to succeed in this profession. Being a self-starter is a must.

Thanks for reading. I will talk to you next time.

If you want to advertise on my newsletter, contact me 👇

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you. 🙏

Pat Dorsey used to be head of Morningstar research, known for their moat analysis. He started his own firm obviously focusing on wide-moat investing.

Great article, thanks a lot for sharing.