Book Summary - The Almanack of Naval Ravikant

I just finished reading The Almanack of Naval Ravikant, and wow—what a book!

In this post, I'll dive into the lessons that resonated most with me: how to get rich, is there luck, how to learn, how to build a brand, and so on. I'll also add my perspective as a creator.

Naval is an entrepreneur, co-founder of AngelList, and an early investor in companies like Twitter, Uber, and Notion. With a massive following on Twitter, he shares invaluable insights on wealth-building, making smarter decisions, and living a more fulfilled life. But what truly sets him apart is his philosophical approach to success.

How to get rich

If you want true financial freedom, you have to own things. That’s the only real path to building wealth.

Focusing too much on pay? That’s a beta mindset. It keeps you comfortable, but never truly free. The best path to freedom is creating your own thing—a business or a product. And to do that, you need two key skills: learning to build (a product) and learning to sell.

And you need to develop three qualities:

specific knowledge (something you’re uniquely great at)

accountability (the willingness to take risks and own your work)

leverage (capital, people, or tools that amplify your output).

Specific knowledge

AI is a real secular trend, but if you’re not all in on it, someone else who is will completely outclass you. And not just by a little—they’ll outperform you by orders of magnitude. Why? Because in fields driven by ideas, compound interest and leverage amplify everything.

Don’t chase trends if you aren’t passionate about it. Instead, follow your curiosity and passion.

Specific knowledge is what sets you apart. It’s highly technical, deeply creative, and impossible to outsource or automate. There are no shortcuts. You don’t learn it in school—you learn it by doing, often through apprenticeship.

Being a mile wide and an inch deep won’t get you anywhere. My experience running Richard Toad for four plus years confirms this - dominating a hyper niche area got me on the map.

To learn, you need a strong foundation and zero ego. Real knowledge isn’t about memorizing buzzwords—it’s about understanding from the ground up (or called “from first principle”.)

Study foundational subjects: microeconomics, game theory, psychology, persuasion, ethics, mathematics, and computers. The smartest people explain things simply—if someone’s using big words and complex jargon, they probably don’t get it themselves. And a big ego clouds your judgment.

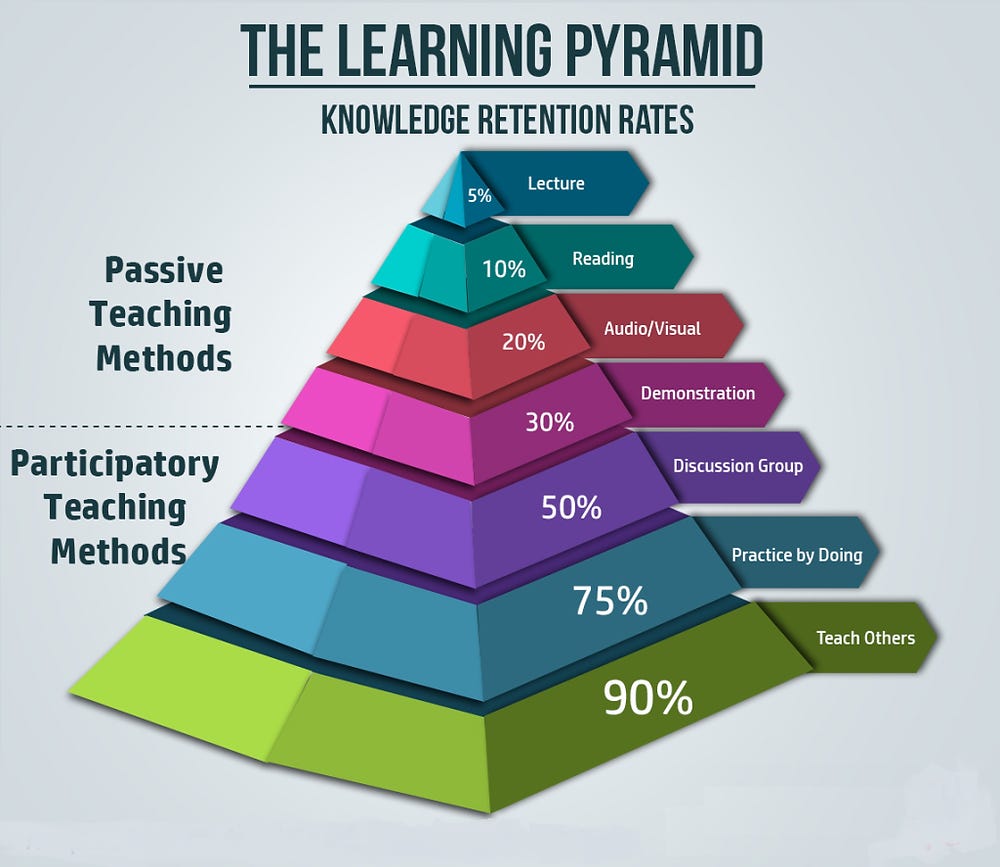

Reading is faster than listening. You learn exponentially faster by doing than watching others. There’s no skill called “business.” Skip business magazines and MBA classes (I have an MBA and barely showed up for classes.)

The most valuable skill today is being a lifelong learner. It’s far more useful to become an expert in a brand-new field within a year than to have studied the “right” thing a decade ago. Especially in the AI era, don’t fixate on what to major in, study a field that teaches you how to think. Learn and apply.

If your interests align with what society eventually wants, you’ll get paid well. The real game is figuring out what people need before they even know they need it—then delivering it at scale. The internet makes this easier than ever: code, books, podcast, tweet, YouTube videos. These are all permissionless—no one’s stopping you from starting today. It’s just: few ever start, and even fewer finish.

Accountability

To succeed, you must own your work from start to finish—idea to execution to distribution. That means understanding not just what you’re doing, but how it fits into the bigger picture (the “why”).

One of the complaints I hear from senior equity analysts is that new employees complete their assigned tasks without “taking things to the next level.” If you care about your professional success, understand this: you grow by taking things off your boss’s plate. The more you can take off, the more time your boss has to focus on higher-level work—and the faster you step into their role.

Always think about how your assign tasks fit into the bigger goals of your team, department, and company. That’s how you level up.

Everything you do at work is sales. Influencing your boss is sales. Negotiating for promotion and higher pay is sales. Making yourself visible is sales. It’s not what you do that gets you promoted—it’s what higher-ups think you can do that gets you promoted. No one is born a great salesperson, but sales is a learnable skill.

Sure, some people may have picked up sales skills early—on the playground, with their parents—but it’s not something you learn in a classroom. You can study Robert Cialdini, take a sales seminar, or even do door-to-door sales. It’s tough, but nothing will teach you faster. Like any skill, the more you practice, the better you get.

Leverage

Fortune requires leverage. Leverage comes from capital, people, and infinite distribution—like code and content.

You can throw money at a problem to accelerate growth, or hire more people to scale progress. The best form of leverage, though—the one Naval favors and the one I use—is infinite distribution.

Code and media are permissionless leverage. They work for you while you sleep. Once created, they can reach unlimited people with no extra effort. If you can’t code, write books and blogs, record videos and podcasts—because content (code) and distribution (internet) are why seven of the ten richest people on Earth made their fortunes in tech.

The internet has completely changed what’s possible when it comes to careers, and most people haven’t figured that out yet. You don’t need permission from anyone to find an audience, build a business, create a product, and generate wealth. You can do all of that just by uniquely expressing yourself online (for good and for bad, of course.)

And the great thing is, every person is different, meaning everyone is the best at something: being themselves. In the age of AI, more and more robotic avatars are reading off scripts. Escaping competition comes down to authenticity. If what you’re building is a genuine extension of who you are, no one can compete with you on that.

Leverage also creates a (good) disconnect between inputs and outputs. I write this article whether five people read it or 50,000, but if 50,000 read it, my influence multiplies exponentially. That, in turn, boosts my brand.

Another form of leverage is labor, but you need to know how to delegate. If delegating a task costs less than your hourly rate, outsource it. If fixing a problem saves you less than your hourly rate, ignore it.

The people who gain the most power in modern society are the ones willing to fail in public under their own names. The downside risk isn’t as big as people think—if you’re honest and put in a high-integrity effort, people will forgive failures.

Of course, this doesn’t apply to mission-critical industries like medicine, aviation, or civil engineering. But in internet-based industries? Totally fine. People don’t remember. So take risks. Build. Sell. Scale.

Difference between salaried jobs and ownership

If you’re earning a salary, you’re renting out your time—even if you’re a lawyer, a doctor or an investment banker. When you stop working, the income stops too. There’s no passive income, no upside from ownership.

The people with wealth own something. The company, the brand, the intellectual property—that’s where the leverage is. Your employer will always pay you the minimum necessary to get you to do the job, even if that minimum is high (for an investment banker, lawyer, doctor, or someone working at a VC/PE/HF).

The doctors and lawyers who are wealthy aren’t just employees—they own private practices or are law firm partners. That’s the difference. Ownership gives you a stake in the upside. Whether it’s through stock options or starting your own company, equity is what builds real wealth.

Investors, for example, are buying ownership. That’s the game. And while picking the right thing to own is a skill that takes a lifetime to master, the key is participating in the outcome, which in many cases grows nonlinearly to the founder’s input (due to the three forms of leverage we talked about previously).

But I argue even investors are on a treadmill unless they are the owners. Stephen Mandel, Andreas Halvorsen, and Steve Cohen no longer influence investment decisions at their firms, but the value created by their employees continues to flow into their pockets.

Being an employee is easier. As much as people complain about it, a job gives you structure and security. Products, distribution, brand, compliance—everything is established for you.

Owners, on the other hand, are paid for their judgment and output, not for completing tasks. Building a business means you start with no brand, product, or distribution.

The best jobs are the ones where you control your time and are measured on results, not hours worked. The more creativity a job requires, the less tied inputs and outputs are.

That’s why certain career paths—like equity investing—are so lucrative. A portfolio manager doesn’t care if you work 10 hours or 100 hours; if you’re generating profitable ideas, you’re valuable. If you’re consistently making bad calls, no amount of hard work will save you.

I get tons of life science graduate students telling me they can read a science paper and they deserve a biotech investing seat. Great—so can your classmates. What really matters is judgment. Can you look at a small-cap biotech stock and understand what’s priced in? If their drug gets FDA approval, how much should the stock go up? If it fails, how much will it drop? That’s what separates real biotech investors from the aspirants who think the job is just reading research papers. And by the way, it’s a high-stress, unstable field—not the decent-paying alternative to working in a lab.

Good judgment comes from proactive learning and experience, but early in your career, the only way to develop it is by working hard. You don’t yet know what matters, so you have to put in the effort across the board. But hard work alone isn’t enough—if you’re not improving your judgment, you won’t progress.

And that ties back to leverage. If you want scale, you need judgment—whether that’s in picking the right product to distribute online, writing copy that converts, or knowing what to delegate so your team can focus on the right things.

Most college graduates won’t be able to build a business that benefits from leverage because they don’t have the specialized knowledge yet. So, what are their options?

Work hard at a good company under a good boss and learn as much as you can.

Become a learning machine, use the internet’s free resources, and find a niche where you can dominate. I know of a 19-year-old YouTuber who scaled to over two million plus followers by obsessively learning and teaching world history. But that’s the outlier not the rule.

In the AI era, the moat is in judgment and decision-making that produce output. If you don’t want to work hard, there’s no path to wealth for you, because you are not valuable enough to anyone. And with AI taking over low-value work, you will be in a tough position.

Is there luck?

All get-rich-quick schemes are ways for someone else to get rich off you (through a course, workshop, etc.). Everyone wants to make money fast, but the market is efficient, and if it were that easy, everyone would be doing it. The real path to success? You’ve got to put in the time and effort.

You have to make the hard choices now so your future is easier. Jensen Huang hopes suffering happens to you—that’s how you build something that lasts.

That said, opportunities matter. From my own experience, you do get lucky the harder you work. There are four kinds of luck.

First, there’s blind luck—like fate or fortune. That’s the type of luck I don’t rely on. The only time I’ve “won” luck was when I got a free Slurpee at a Nashville hot chicken joint.

Then there’s luck through persistence—where you create your own luck by working hard and hustling. This is what I preach to anyone trying to land a job in equity research. You increase your “luck surface” by building relationships one by one. You can’t just wait around for opportunities to fall into your lap. It won’t happen.

Next up, there’s luck through skill. If you’re really good at something, you’ll start to spot lucky breaks that others miss. Like Bill Gates and Jeff Bezos believing in the internet early on or Reed Hastings betting on broadband’s ability to stream video. Even Jeff Skilling tried to do content streaming at Enron, but he was a little too early—broadband infrastructure wasn’t mature enough. Great startups are about identifying these inflection points and being right. Michael Saylor’s bet on crypto is another example, though the jury’s still out on whether he’s right.

And then there’s the hardest kind of luck—the luck that finds you because of who you are. When you build a unique character, a personal brand, a mindset that stands out, luck will come to you. This is what I am hoping for: mentors to find me to accelerate my growth as an entrepreneur, investor, and person. If what you’re creating is interesting, people will want to know you.

Be impatient with actions, but patient with your results. Ideas are not worth much if you cannot execute. There will be unexpected obstacles along the way. Don’t give up, and stay patient with the process, but you have to start now.

Long-term relationships with good people

Understand the power of compound interest. It works in business relationships too. If you build a strong reputation and keep reinforcing it over decades, it becomes exponentially more valuable. Someone just as talented, but without that long-term trust, won’t even come close in influence or opportunity.

The reason CEOs and investors managing billions get to that level is because people trust them. Trust simplifies everything. If you’ve worked with someone for five or ten years and still enjoy it, that’s a sign of real trust. In those relationships, you don’t need to get bogged down in endless negotiations—things just flow because you know each other will follow through.

That’s why, when you find the right people to work with and the right things to work on, you should go all in. Sticking with it for decades is how you see outsized returns, both in money and relationships.

Naval shared you can predict a chimp’s behavior based on the five chimps it hangs out with the most. The same goes for humans. You become the average of the people you spend the most time with. Be intentional about who you surround yourself with.

And above all, protect your integrity. If you do things you’re not proud of, it will come back to haunt you. If someone constantly talks about how honest they are, they’re probably not. People don’t really change, so once Naval sees those red flags, he just cuts them out of his life. You should too.

How to learn

Most people don’t read enough. You should make reading a habit. The number of books you finish doesn’t matter. As you become knowledge, you’ll find yourself putting down more books unfinished because there might be just one new idea in each new book. What matters is finding new ideas that can improve your thinking.

Most books are just rehashing one core idea with example after example. Be okay with ditching a book halfway if you’re not getting anything new. Jump to the next one that promises a fresh, life-changing idea. I even stop reading a book five pages in if I already know I won’t learn anything or if it’s poorly written.

How do you internalize your learning? Explain it to someone else. Teaching is the ultimate way to cement knowledge in your brain. That’s exactly what this summary is all about—me explaining to you what I’ve learned, which helps me learn it better too.

Building a solid foundation of knowledge is key. Stick with the basics: mathematics, the hard sciences, microeconomics. These are the bedrock that everything else builds on.

When you’re solving problems, remember this: the older the problem, the older the solution. If you’re trying to figure out how to drive a car or fly a plane, you need to learn from modern solutions because those problems were created recently, and the solutions are up-to-date. But if you’re tackling something like how to keep your body healthy or how to stay calm and peaceful, you’ll find the older solutions are probably better.

A corollary I learned from Nassim Taleb is that you are always better off eating "real" or traditional foods that have stood the test of time. He argues that these time-tested habits or foods are more likely to be beneficial for health, while modern processed alternatives are harmful.

Books that have survived for thousands of years have been filtered through generations of people, so they’ve stood the test of time. The principles in those books are more likely to be correct. That’s why Naval wanted to get back into reading those timeless classics—they’ve survived because they have something valuable to offer.

How to be happy

I worked on my mindset for a long time because I knew breaking into research without knowing all the technical stuff was going to be tough. And let’s not even talk about entrepreneurship—terrifying doesn’t even begin to cover it. So, I had to learn how to feel better about it all and tune out the distractions. That became my curated people skills book list.

Here are some golden lessons I picked up from Naval:

First, get out of the "relative mindset." When you start comparing yourself against others, you’re constantly going to feel jealous or envious. That’s the thing with status—it’s a zero-sum game. To win, you’ve got to bring someone else down. Society loves ranking people, creating these fake clubs like Forbes 30 Under 30 or Michelin stars. People take that stuff so seriously that they’ll beat themselves up if they don’t get it, sometimes even to the point of suicide. It just makes you angry and combative. It’s a toxic cycle.

If you play a positive-sum game, you’ll see things differently. The long-term game is all about giving. Pay it forward. Karma works because people are consistent. Over time, what you put out into the world will come back to you. It’s not about cutting up the pie—it’s about baking it bigger so everyone benefits.

Happiness? It’s not about avoiding suffering—it’s about not desiring things all the time. It’s about embracing the present moment, being okay with what is. Too many of us are caught up in the past or obsessed with the future, and we forget to live now. Life is a single-player game, at the end of the day. You’re born alone, you die alone. But you can learn the skills to make the world better and to make yourself better.

Time? It’s all you really have. Naval doesn’t try to make others happy and is notorious for leaving parties, events, or dinners if he realizes it’s a waste of his time. I know Amos Tversky, who shaped the field of behavioral economics with Nobel Prize winner Daniel Kahneman, is the same. Naval cares about making himself happy, and that’s what matters most.

Naval doesn’t want to be angry, and he doesn’t want to be around angry people. So, he just cuts them out of his life. He just learned being angry doesn’t help.

The smartest, most successful people Naval knows started out as “losers.” If you see yourself as someone society cast out, you have nothing to lose. You’re more likely to do your own thing and find your own path to success. I can strongly relate to that.

If you fully get what you’re doing is futile in the grand scheme of things (because death is the only certainty), it actually brings peace. It’s all a game, and realizing that takes the pressure off.

Humans evolved to be hunters and gatherers, working for ourselves. Agriculture made things more hierarchical, but thanks to the internet, we’re moving back to that individualistic mindset. Naval loves solving problems more than making money because he has money, and that’s why I started Richard Toad—because I like to solve problems.

Some people ask me what my backup plan is if Richard Toad doesn’t work out. I have no backup. If it doesn’t work (knock on wood), I’ll figure it out. But the thing is, even if you fail at entrepreneurship, you still gain the skills to make it on your own. In fact, failure in Silicon Valley is just part of the process. They actually encourage it.

So, take risks. If you want freedom and you don’t have a trust fund, you’ve got to solve problems and exchange value for money. If you solve the money problem, you can focus on helping people without worrying about keeping the lights on.

The best way to avoid the endless chase for money? Don’t upgrade your lifestyle as you start making more. Keep it simple, keep it focused, and you’ll stay grounded.

Thanks for reading. I will talk to you next time.

If you want to advertise on my newsletter, contact me 👇

Resources for your public equity job search

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please share it with your friends/colleagues. Sharing is what helps us grow! Thank you.