Book Summary - Material World

Recently, I read Ed Conway’s book "Material World", recognized as one of the best books of 2023 by The Economist.

The book opened my eyes to how we often take basic materials for granted, yet underestimate their roles in geopolitics, economics, societal progress, and negative externalities.

The book is divided into discussions on six materials: sand, salt, iron, copper, oil, and lithium. These materials’ significant impact on our lives is underpinned by their abundance and low cost.

Sands

A country's territorial waters are determined by its coastline, where land and ocean/lake meet, and that’s where you can find sand.

Geopolitics

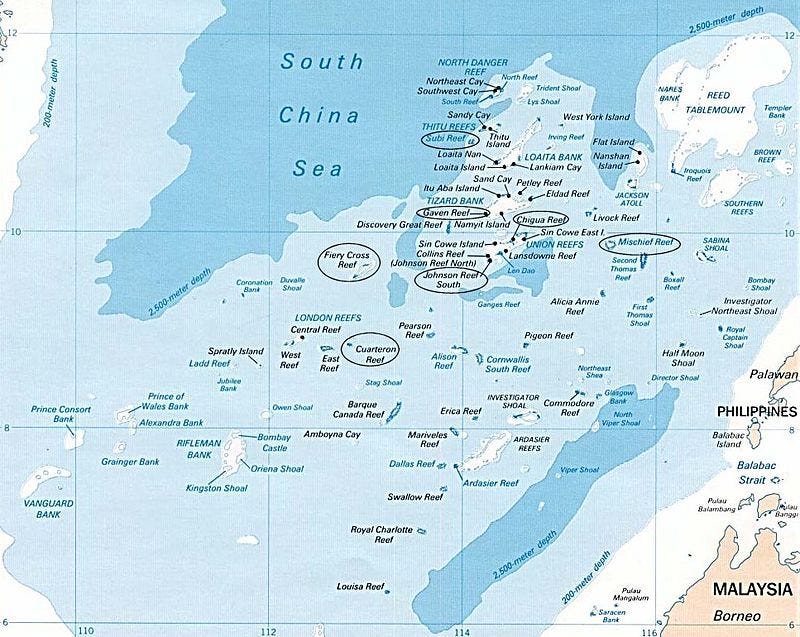

The larger the territorial water area, the more fishing, offshore drilling, and mining rights and shipping routes a country can obtain. Thus, sand has become a currency in 21st-century diplomacy.

For many years, China has aggressively built artificial islands in the South China Sea to assert its presence, often referred to as the Great Wall of Sands.

Negative Externalities

Due to global warming, many island nations are experiencing the shrinking of habitable lands. For instance, the Maldives have been using sand and rock to build barriers around their capital, Malé. Singapore, facing similar challenges, is the world's largest sand importer.

With the rising demand for sand, some countries resort to exporting sand as a source of revenue, leading to ecological implications.

This has prompted governments to crack down on excessive exports. Consequently, illegal sand mining has emerged, with entities like sand mafias bribing law enforcement and politicians, kidnapping and even murdering to procure sand for illegal exportation.

Glass

The main ingredient in glass is silica, an oxide of silicon, commonly found in nature as quartz. In many parts of the world, silica is the major constituent of sand.

Geopolitics

Wars have historically been fought over the production of essential items made from basic materials like glass.

In the Venetian Republic, Murano glassmakers faced death if they attempted to leave the island to prevent the theft of glassmaking techniques. This can be analogized to scientists today being prevented from smuggling trade secrets from the West.

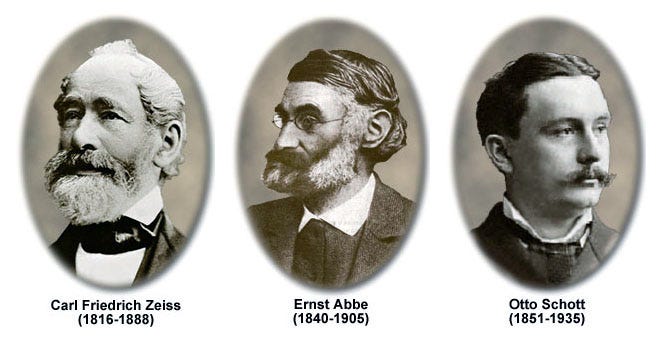

Germany once held a global monopoly on precision optics, including binoculars, telescopes, periscopes, rangefinders, and other scientific lenses. This dominance, particularly in telescopic rifle sights, gave German snipers a considerable advantage in the early stages of wars.

Germans like Carl Zeiss and Otto Schott played pivotal roles in advancing the optics industry. During WWI, the British, despite their ability to assemble binoculars, had to rely on Germany for optical glasses.

Why would the Germans be open to sending lenses to the British so that they could kill German snipers? It turns out Germany needed rubber, which is crucial for tyres, fan belts, and other components. Not only were Britain, its allies, and the British colonies among the world’s biggest rubber producers, but they had successfully blockaded German imports, starving Germany of natural resources of rubber latex.

How did the Germans establish such dominance against a nation where the Industrial Revolution took place? Part of it is hard work by Carl Zeiss and Otto Schott, the other part is policy. At the time, the UK imposed a window tax that applied to all things glass from window glasses (so big houses with more windows got taxed more) to glass raw materials and anything in between, which forced glassmaking businesses to consolidate and stifled innovation in glass making, such as precision optics engineering. Meanwhile, in Prussia, the state provided financial support and guaranteed orders for the nascent glass sector.

The British eventually reversed the window tax. Over time, British scientists reverse-engineered German glass products and were able to produce glass for its troops and allies. The importance of access to high-quality sands, such as those from Fontainebleau, furthered the British optics industry.

One major challenge in glass production is silica melts at very high temperatures, making it difficult without a reliable energy source. Glassmakers have addressed this issue by introducing a "flux" that helps silica melt and flow at lower temperatures, reducing impurities in the glass and improving the final product.

The British needed German potash as a flux, but they managed to secure alternative sources during the war. World War 2 presented additional challenges, with the Nazi occupation of France and Fontainebleau affecting the supply of materials. Thankfully, the UK opened a quartz sand mine, Lochaline Mine, providing essential sands for optical factories. The Lochaline Mine became a site of military and national importance during the war.

Economics

Throughout history, rising economic power tends to be the global center of gravity for glassmaking. From ancient Egyptians and Romans to the Venetians in the thirteenth century, the Dutch in the sixteenth century, the British and the French in the eighteenth century, and the Germans in 1914, the economic strength of nations has influenced their prominence in glass production.

Two historians looked at 20 of the great inventions that advanced human knowledge such as Newton’s theory of light to Faraday’s investigations into electricity. All but four of them relied in some way on glass contraptions.

Optical Fiber

Glass played a crucial role in enabling the rise of the broadband internet.

Societal progress

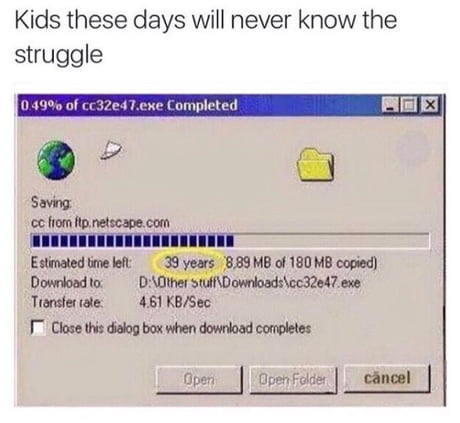

Those old enough remember the first-generation DSL, which relied on copper wire (and even older, dial-ups, ugh). The maximum capacity achievable through copper wire pales in comparison to what fiber optics can achieve today.

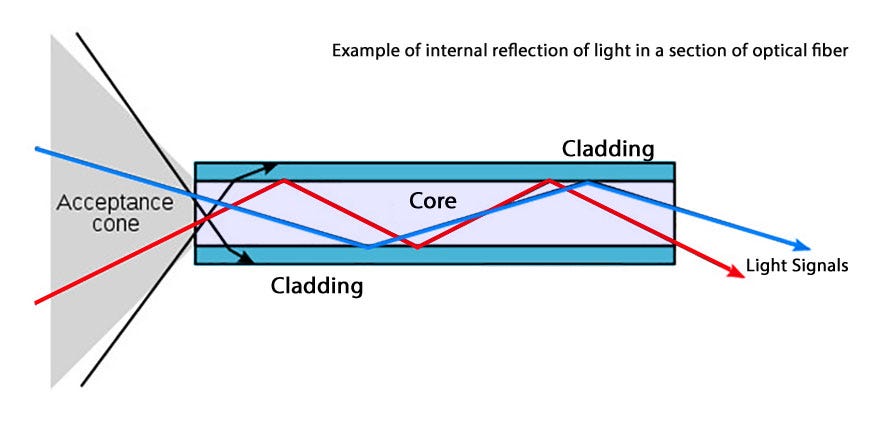

Fiber optic cables transmit information, represented as light, over long distances using two strands of glass wires. The outer strand bends the light back inside to minimize information loss. The dramatic improvement in bandwidth enabled many internet businesses we have today (and in the future) and it doesn’t require further elaboration.

Cement

Societal Progress

Cement plays a vital role in lifting nations out of poverty. In underdeveloped countries, people often live in shacks with dirt floors. Walking barefoot outside can help spread parasitic diseases within households and communities.

A concrete (using an analogy, cement is like flour, while concrete is like bread) floor can prevent transmission of diseases, reducing healthcare spending and improving productivity.

Initially, producing cement at scale posed challenges until Thomas Edison perfected its mass production. He introduced a crucial innovation: a rotating kiln's surface that operated continuously. This innovation allowed for continuous production, enabling plants to churn out thousands of barrels of cement per day, covering the costs of fuel and raw materials.

Negative Externalities

Despite the benefits, cement production comes with significant negative externalities. The cement production process is one of the largest emitters of carbon dioxide on the planet (7-8% of global carbon emissions), surpassing even aviation and deforestation combined. Additionally, the production process accounts for approximately a tenth of the world's industrial water use. Addressing these issues is crucial for achieving carbon neutrality and mitigating environmental impacts.

Silicon

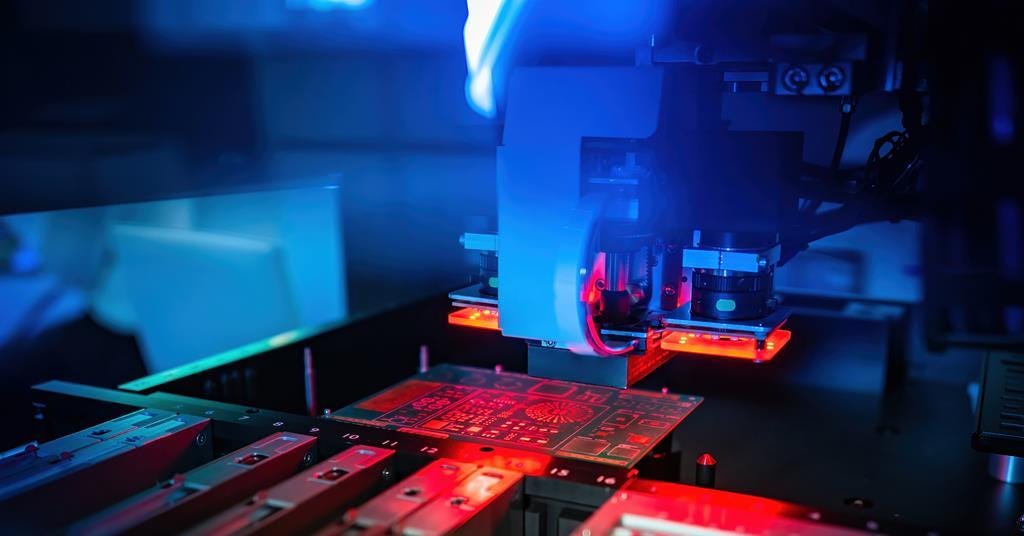

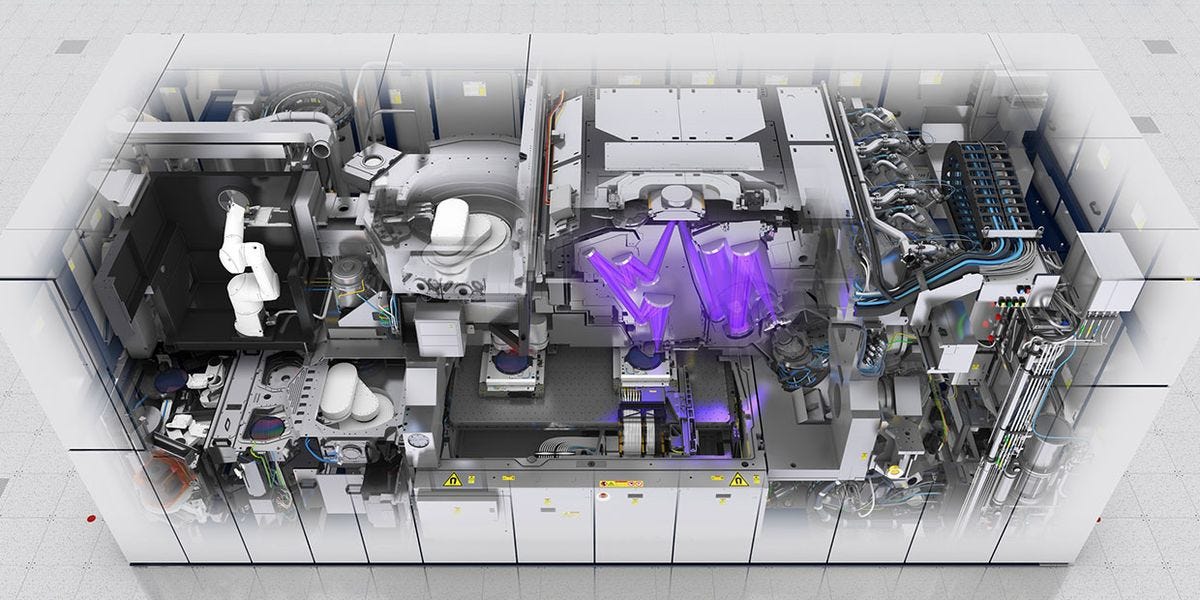

The press often focuses on the chip designers and manufacturers. However, there exists a vast ecosystem of players involved in transforming raw quartz into silicon metal.

Geopolitics

Currently, a significant portion of the raw ingredients required for producing silicon metal is mined in China. Some of the players are as crucial to the industry as Taiwan Semiconductor Manufacturing Corporation (TSMC) - any disruption in their operations could lead to a six-month downturn in global semiconductor and solar panel production.

While China excels in producing relatively lower-grade polysilicon for solar panels, it has yet to master the manufacturing of semiconductor-grade polysilicon.

Under the current geopolitical landscape, leading nations could use access to these cornered resources to establish choke points on rivals.

Societal Progress

Silicon metal is an essential component in the production of chips that power the AI era, contributing significantly to human progress.

Negative Externalities

Similar to cement making, silicon making is energy intensive. The process of converting quartz rocks into silicon, known as smelting, requires a tremendous amount of power. The energy cost of producing ultra-pure silicon is more than 3,000 times that of cement production and 1,000 times that of turning iron into steel. Even if the electricity used in the smelting process comes from hydropower, it still contributes to carbon emissions.

With AI at the beginning of a massive S-curve, it’s certain chip makers are not slowing production in consideration of the environment, which reiterates one of the key takeaways from the author: negative externalities are always present.

Salt

Salt plays a crucial role in our life. Before modern refrigerators, salt was the primary method for food preservation. Salting raw foods not only imparted a unique taste but also bought time. Suddenly, a fish caught yesterday didn’t have to be sold today.

Salt is far more significant than most people assume; it was the bedrock for economic trade, the tool of power, and the icon of protest.

Economics

For much of the ancient world, salt was a signifier of wealth.

In the ancient Venetian Empire, the salt office became the heart of its fiscal system, accounting for more than one in seven of every ducat earned by the entire Venetian state.

In China, political creeds from feudalism to communism have come and gone, but throughout Chinese history, the salt monopoly was the one constant. Today the market is still dominated by the state-owned giant China National Salt Industry Corporation (CNSIC); many contend that the CNSIC remains a monopoly in all but name.

In India, the British were able to exert their imperial dominance because India relied on British salt. That’s why Gandhi led a Salt March as a campaign of tax resistance and protest against the British salt monopoly.

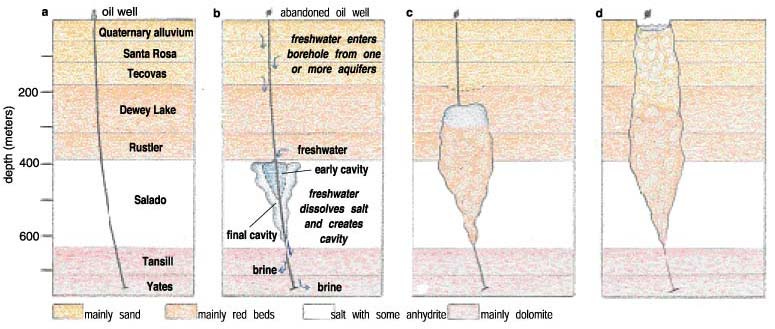

Solution mining is one of the main ways we get salt these days. In the UK, the caverns in early salt mines had too few pillars to hold the roofs, causing frequent collapses. The pumping of brine eroded the rock salt that underlies the country and created sinkholes. In one extreme example, a two-story pub had to make its second floor the new ground floor after the bar fell one floor into the ground.

Inevitably, when the supply of an item grows exponentially, the salt price falls exponentially. Cheshire’s salt producers formed a cartel that would agree on prices and production levels. The experiment was a failure.

Geopolitics

For much of history, those who controlled these substances controlled the world. That’s why one of the first things a country would do before going to war is to stockpile salt.

Saltpeter was often found underground in old cellars and crypts. Mix this salt with a tiny fraction of sulfur and charcoal dust, and you have gunpowder.

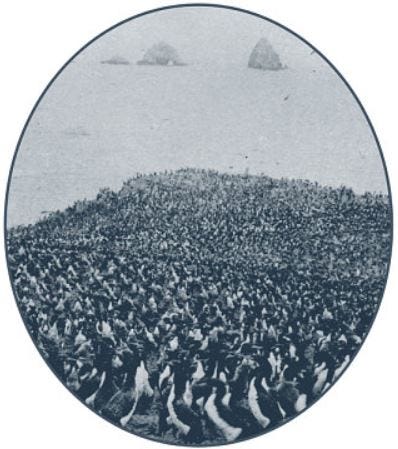

In the mid-nineteenth century, the Americans and the Europeans discovered Chincha Islands off the coast of Peru. These are a set of rocks where the birds' droppings from boobies, cormorants, and penguins have accumulated into a crust more than a hundred feet deep. This turned out to be one of the finest natural fertilizers in the world, a combination of phosphate and nitrogen compounds.

A nitrate taxation disruption brought Peru, Bolivia, and Chile into the Nitrate War (Saltpeter War in the book) with Chile winning and gaining control of some of the most important mineral resources in the world, not just the nitrates, but the world’s biggest reserves for copper and lithium. As a result, Chile became the richest nation in Latin America.

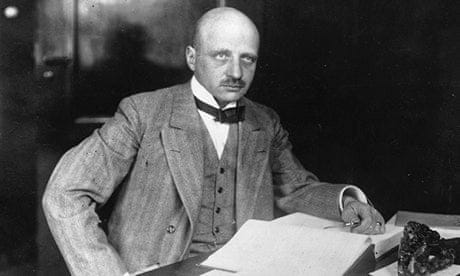

Leading up to World War I, Germany was the world’s biggest importer of Chilean nitrates to use as a fertilizer and an explosive. When World War I broke out, no other country was more exposed. Following a series of battles, Germany was cut off from Chilean mineral deposits for the remainder of the war. With Germany suddenly vulnerable to starvation and, without any source of explosives, catastrophic military defeat, the government looked about desperately for help. They found it in the form of Fritz Haber. He had taken inspiration from how nature did it and tried to simulate lightning, but eventually, he used a combination of heat and pressure to persuade the nitrogen from the air to bond with hydrogen gas. He worked with chemical engineer Carl Bosch to turn a laboratory demonstration into an industrial process.

By 1913, BASF, the company Bosch worked for and eventually led, had begun to manufacture ammonia – that nitrogen/hydrogen compound which could then be converted into fertilizers and used to make explosives. The Haber–Bosch process, as it has become known, is one of the most important scientific and industrial discoveries in history for which Haber won the Nobel Prize in Chemistry. It has, in the subsequent century, helped us to feed billions of people.

The Haber–Bosch process delivered a near-fatal blow to Chile’s nitrates industry. Following World War I, Daniel Guggenheim, a member of the famed mining family, pivoted into the nitrate mines in Chile just in time to see it backfire horrendously as the Haber-Bosch process rendered nitrates obsolete. Today, most of the old nitrate outposts have closed.

While nitrogen is by far the most important fertilizer, there are also two others: phosphorus and potassium. Together these three – NPK as they are often called after their chemical symbols – constitute the holy trinity of fertilizers.

For example, potassium owes its name to potash, and potash got its name from the technique used to create it back before the discovery of underground reserves of potassium chloride. Farmers would scrape together the ashes from burned wood, leaching them in a pot, and then evaporating this potash to produce a white salty substance.

The potash industry is an opaque one. Just as there is an oil cartel, OPEC, there is a potash cartel. The Russian invasion of Ukraine in 2022 created a sudden global shortage of fertilizer since Russia and its ally Belarus provided roughly a quarter of the world’s potash (with Belarus producing 20% of the world’s potash fertilizer alone).

Negative externalities

The recurring theme in the Material World is the negative externalities. Roughly half of the nitrogen scattered and sprayed onto our fields has ended up not in our crops but in our air and water. It has dissolved into streams and rivers, where it has fueled giant algal blooms that suffocate other aquatic life.

Salt as a feedstock

Salt remains the cornerstone of the pharmaceutical and chemical sectors.

The chlor-alkali process stands out as one of the most significant industrial achievements of the modern age. Brine is directed into a room filled with hundreds of electrolysis cells, where a powerful current is passed through it. This process yields chlorine and sodium hydroxide, the latter commonly known as caustic soda.

Caustic soda is often underestimated despite its widespread use in various industrial processes, including the manufacturing of paper, aluminum, soap, and detergents. Many of these items are taken for granted today, but in the late nineteenth and early twentieth centuries, soaps and detergents were considered luxury items.

Even today's pharmaceutical and chemical companies continue to be situated next to salt mines, demonstrating the continued influence of salt in our lives.

Negative externalities

And again, the dark side of the chlor-alkali process is that its products have also been utilized as raw materials for manufacturing chemical weapons.

Iron/Steel

Iron, a seemingly unassuming element, holds a profound significance in various aspects of our lives. Particularly, its transformation into steel came to define the very essence of modern civilization.

Not everything in the world is made of steel, but nearly everything is made with machines made of steel. For example, John Deere mass-manufactured steel plows. Today Deere is a Fortune 100 company.

To make steel, the iron needs to be separated from the oxygen and a tiny amount of carbon needs to be added. The steel was made ubiquitous thanks to Sir Henry Bessemer’s invention of the Bessemer process that made steel in minutes instead of in hours or days.

Negative Externalities

Steel production is carbon-intensive, responsible for ~7-8% of the world’s greenhouse gas emissions.

The good news is: that in much of the rich world, the demand for iron ore and newly blast-furnaced steel is diminishing because steel is relatively easily recycled. More than two-thirds of America’s steel is now made from scrap.

Ironically, using coal for steelmaking was a solution to environmental problems created by using charcoal. The shortage of timber stocks catalyzed the need for a new fuel source. And people discovered that if they pre-baked the coal, much as you did with wood to make charcoal, they ended up with a purer form of coal with fewer nasty contaminants – coke, as it became known. Since coal was a far more energy-dense fuel than wood, not to mention far more abundant, Britain’s iron production rocketed ahead, prompting a series of other innovations.

Societal Progress

The more coal and iron Britain used, the more it needed to mine, and the deeper it mined, the more work it took to pump water out of the pits. The demand for machines to assist in mining catalyzed the invention of the steam engine.

With the invention of the steam engine, a new use case for coal emerged to power a moving wheel and push a locomotive. Coal and iron were helping to birth the industrial revolution – coal to fuel the machinery, iron to build it, marking the first great energy transition, with humankind shifting from wood and charcoal power to fossil power. No longer was Britain limited by how many trees could be grown on its landmass.

Economics

And the economic implication? By the early nineteenth century, Britain was 80% richer than France.

During different periods of history, steel production has been conflated with a nation’s prosperity because steel is a foundational material used to make machines and factories.

In China, during the Great Leap Forward in the late 1950s, Mao Zedong encouraged families to donate anything iron to make steel and made Citizens build “backyard furnaces” to make steel. Pots and pans, tools and plows were used as raw materials, and homes were torn down so wood would be used as fuel. Iron production was boosted, but not steel because the raw materials were useless iron. Instead of a “leap forward,” China experienced the worst famine in history with a conservative estimate of 17 to 30 million deaths.

Australia has the largest amount of the world’s iron ore reserves. However, this abundance has a dark side: indigenous peoples' lands have been subject to dynamite explosions to clear the way for iron mining.

As consumers, we are complicit in enabling such behavior by major miners in Australia. The availability of cheap Australian iron ore has contributed to China's ability to produce inexpensive goods for the global market, as it is transformed into the steel used in China's factories.

Geopolitics

Ukraine became one of the world’s biggest industrial producers of neon as a byproduct of steelmaking. Aside from its more known use in luminescent signs (hence “neon light”), neon is a noble gas used to control the laser wavelengths in photolithography machines in semiconductor manufacturing.

Since Ukrainian steel mills were responsible for producing nearly half the world’s supply of neon, in the weeks after mills shut down because of the war, the world began to run short of neon gas.

When one obscure side product turns out to be essential for another seemingly unrelated supply chain on the other side of the planet, an investor with a deep understanding of second-order effects can profit handsomely.

Copper

Copper is another material we take for granted. Few other metals have the same combination of desirable functions:

heat and electricity conduction

natural ductility: you can roll, pull, and twist into wires without snapping

strength

anti-corrosion nature

recyclability

Take this metal away and much of the electrical infrastructure we rely on is gone.

Just as Thomas Edison did for concrete, he helped turn lightbulbs into a mass-market product. He realized he had to build the electrical infrastructure to power the lights. And that meant a lot of copper: copper to connect the streets of New York and copper to go into homes and workplaces, to string around wheels of the generators. So Edison redesigned the bulbs and his electrical network to not require thick copper and instead use thin ones.

However, one mile out, the power will start to go out. Thankfully, George Westinghouse and Nikola Tesla invented a new trick to solve the problem, alternating currents (AC).

Instead of the constant flow of currents, AC sends pulses of currents which allow high voltages to be sent along very thin wires, which reduces the demand for copper. As a result, people can get electricity despite being too far from a power station.

Societal Progress

For every discovered copper reserve, miners will need to dig further over time to extract the ores as the low-hanging fruits are depleted. As one digs deeper, the ore grades fell: the quantity of stone one needed to move and process to produce a single tonne of copper rose from 50 tonnes to 800 tonnes.

Yet over time, rather than increasing, the inflation-adjusted copper price was essentially flat, driven by human productivity and technological innovation.

During the twentieth century, the number of people working in copper mining and production in the United States fell by two-thirds, but the amount of copper produced more than quadrupled. It is a productivity miracle, just as impressive as Moore’s law for semiconductors.

Additionally, we came up with niftier mining techniques and equipment to extract copper.

Geopolitics

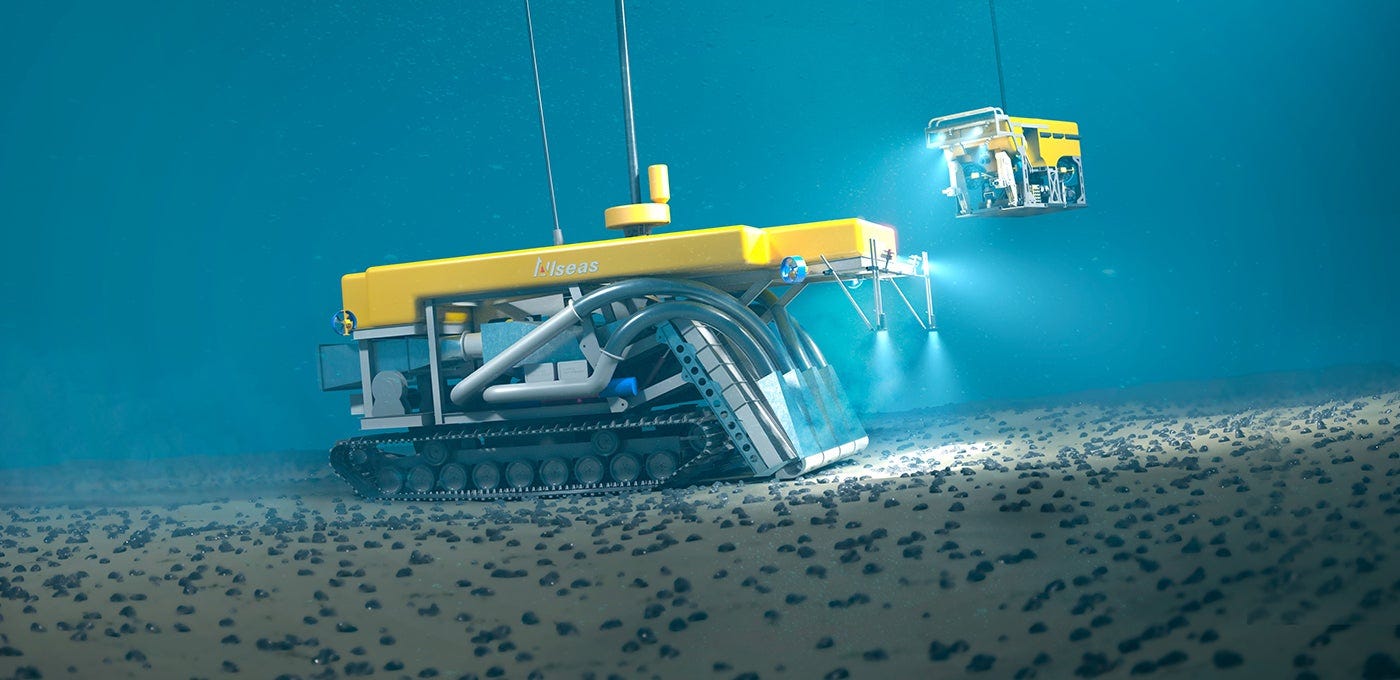

The race for secure commodities such as copper means an unconventional race in the deep seas for resources.

The International Seabed Authority is handing out permits for major nations to mine in the deep sea, creating geopolitical tensions between big nations like China and Russia who have already received permits.

Economics

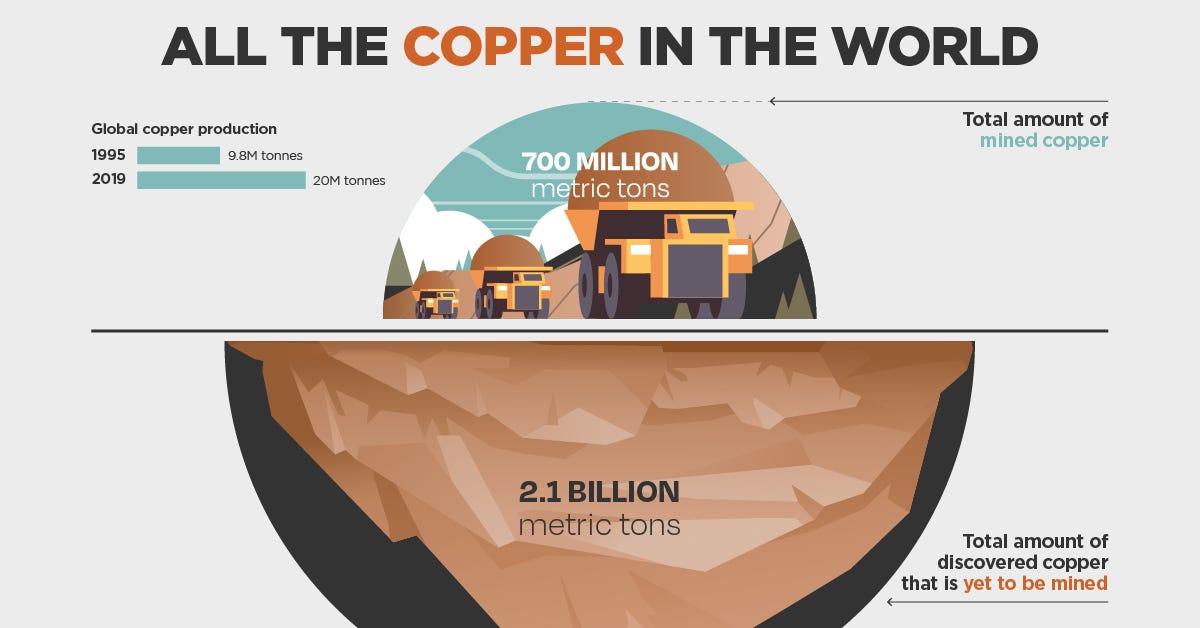

Are we going to run out of copper? No, we are not.

The reason we only have about 30 to 40 years’ worth of copper reserves left is not because that is what’s left in the ground, but because that’s the time horizon over which miners tend to make plans.

Supply growth of copper will comfortably outpace the mining of it. Between 2010 and 2020 we mined 207 million tonnes of copper around the world, but the total global reserves of copper grew by 240 million tonnes.

Between 2020 and 2050 the share of our primary energy coming from electricity is forecast to rise from 20% to 50%. All of a sudden copper becomes the backbone of, well, everything. In electric cars, we need three or four times the amount of copper.

Many have expressed their bullish view on basic materials that are thematically tied to carbon reduction and electrification, as discussed by Eric Mandelblatt of Soroban. The thesis is straightforward: demand for copper is accelerating, while the supply will be slow to come online due to the natural long lead time of copper mines. The risk lies in whether technology will accelerate mining productivity further, thereby reducing unit costs to keep the market price flat.

Oil

In 1859, crude oil was discovered at Titusville, Pennsylvania. The rush to extract oil exploded, without understanding how oil reserves are formed. Such behavior has happened often in the history of pursuing wealth.

The ancient Chinese recognized millennia earlier how salt deposits can help trap oil reserves underground, by burning the natural gas from salt mines to aid in brine evaporation.

Geopolitics

The discovery of oil caused a seismic shift in geopolitical and economic power in the world. Before the 1930s, the Gulf Region’s main expert had been wild pearls, until Kokichi Mikimoto's breakthrough in artificial pearl cultivation disrupted the market, causing an instant collapse in wild pearl revenues.

Thankfully, the discovery of salt deposits in the Persian Gulf region paved the way for the emergence of major oil-producing nations. Iran struck oil in 1908, followed by Iraq in 1927, and subsequently, Kuwait and Bahrain in the 1930s. This transformation had profound socioeconomic implications for the Middle East.

Geologist Ernie Berg's discovery of the Ghawar field exemplified the Gulf's immense hydrocarbon reserves. The Ghawar field initially puzzled geologists who realized that wells drilled miles apart were tapping into the same reservoir.

What makes the Gulf remarkable – still as of 2023 comfortably the most hydrocarbon-rich area on the planet with about half the world’s oil reserves and 40 percent of the gas – is that its geological features tick all of the boxes for preserving oil: the ancient algae in the right rocks, the right amount of heat and pressure over time, the perfect set of permeable reservoir rocks with just the right kind of traps to seal in all that oil and gas.

Despite a global reduction in coal consumption, reliance on oil and gas remains around 55% of the world's energy needs. This percentage has been consistent for decades, highlighting the challenge of transitioning to alternative energy sources.

Saudi Arabia continues to hold a pivotal role as a "central bank" for the global energy market, often serving as the producer of last resort during times of crisis.

Since the Ghawar field's discovery in the 1940s, it's been customary for every US president to journey to Saudi Arabia for oil negotiations. Despite facing criticism following the assassination of Jamal Khashoggi, President Biden adhered to this tradition by engaging in discussions during his visit to Riyadh.

Economics

The discovery of oil prompted the development of the oil production value chain, such as refineries.

Refineries, through processes like fractional distillation, separate crude oil into various compounds based on their properties. Interestingly, the techniques used in refineries initially came from alcohol manufacturing during the Prohibition Era.

The shale oil revolution in the United States introduced a new challenge to domestic refineries. The distinction between "sweet" and "sour" crude, determined by sulfur content, influences refining processes and market prices. While American shale oil is light and high-quality, existing U.S. refineries are optimized for heavier, sour crude from countries such as Canada, Mexico, and Venezuela.

Refineries produce a diverse range of end products, including gasoline, diesel, petrochemicals, kerosene, waxes, lubricating oils, and asphalt. Each product serves various industries and applications, underscoring the integral role of refineries in modern society.

For example, World War 2 became a conflict centered around refineries. Hitler's reliance on synthetic fuels produced from coal using Friedrich Bergius' technique provided some advantage initially, but by 1945, the German air force was severely handicapped.

The Allies were out-refining their opponents, as the higher-octane fuel meant Spitfires and Lancasters could be equipped with superior engines, allowing them to fly 15% faster than their German counterparts. Ultimately, Germany lost due to inadequate fuel reserves.

Societal

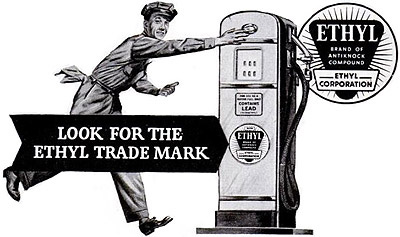

An octane rating is a measure of how well fuel can withstand pressure in an engine without prematurely exploding or ‘knocking’. In the early days of auto manufacturing, knocking was a big issue for General Motors.

GM Engineer Thomas Midgley discovered that adding tetraethyl lead to gasoline appeared to increase octane levels and eliminate engine pinging. However, the use of lead poses severe health risks, particularly to children.

At a New Jersey refinery, workers were hallucinating and working themselves up into a frenzy. Six men died. Despite the dangers, Midgley attempted to downplay the risks by publicly demonstrating the safety of tetraethyl lead, even though he had experienced lead poisoning himself.

GM and its lawyers attempted to shift blame onto the victims, advocating for progress over inefficient engines. As regulations were relaxed state by state, leaded petrol became the norm. Rather than seeking alternatives to lead, GM cosmetically renamed the chemical "Ethyl."

It wasn't until the 1980s that the U.S. formally banned leaded gasoline, marking a dark chapter in human history due to the widespread health and environmental damage caused by lead pollution.

Negative Externalities

The connection between carbon intensity and meat consumption may not be immediately obvious, but it becomes clearer upon examining the reliance of crop production on nitrogen fertilizers derived from natural gas. Crops sustain both livestock and human diets, creating a cycle where carbon emissions from natural gas contribute to agricultural productivity, including livestock feed.

Moreover, carbon dioxide, a key component of photosynthesis, can be artificially increased in greenhouses using CO2 captured from natural gas flue emissions. This accelerates plant growth, further highlighting the interconnection between fossil fuel use, agricultural practices, and carbon emissions.

Plastics, derived from petrochemicals, revolutionized various industries by offering lightweight, versatile materials that could be tailored to specific needs. Despite being less carbon-intensive than alternatives like paper, plastics come with their own set of environmental and health challenges. So the initiative to reduce plastic waste is a paradox when the world might be forced to use more paper, which is more carbon-intensive to produce.

Lithium

The transition away from fossil fuels and towards renewable energy sources necessitates widespread electrification of various sectors. This shift will lead to increased demand for materials like copper for electrical infrastructure, discussed in Part 3, and lithium for energy storage.

The Salar de Atacama in Chile stands out as a major source of lithium, with SQM emerging as a leading producer, initially by chance through potash production with lithium as a by-product.

Despite its potential, there are limited lithium mining operations and relatively small lithium pools. The "lithium triangle" comprising Chile, Bolivia, and Argentina holds significant reserves of this critical resource.

However, lithium refining presents environmental challenges, particularly when sourced from hard rock, resulting in higher greenhouse gas emissions and water usage compared to lithium extracted from brines. Outsourcing refining to countries like China merely shifts environmental responsibility away from the mining nations.

The rise of the battery age also reshapes global geopolitics, with countries like Chile, Argentina, Australia, and China emerging as key players in lithium extraction and refinement. China dominates battery production, influencing the composition and performance of lithium-ion cells. This control over production capacity positions China strategically in the emerging industrial landscape. While demand for minerals is increasing, there are uncertainties regarding the readiness of "electrostates" to meet this demand.

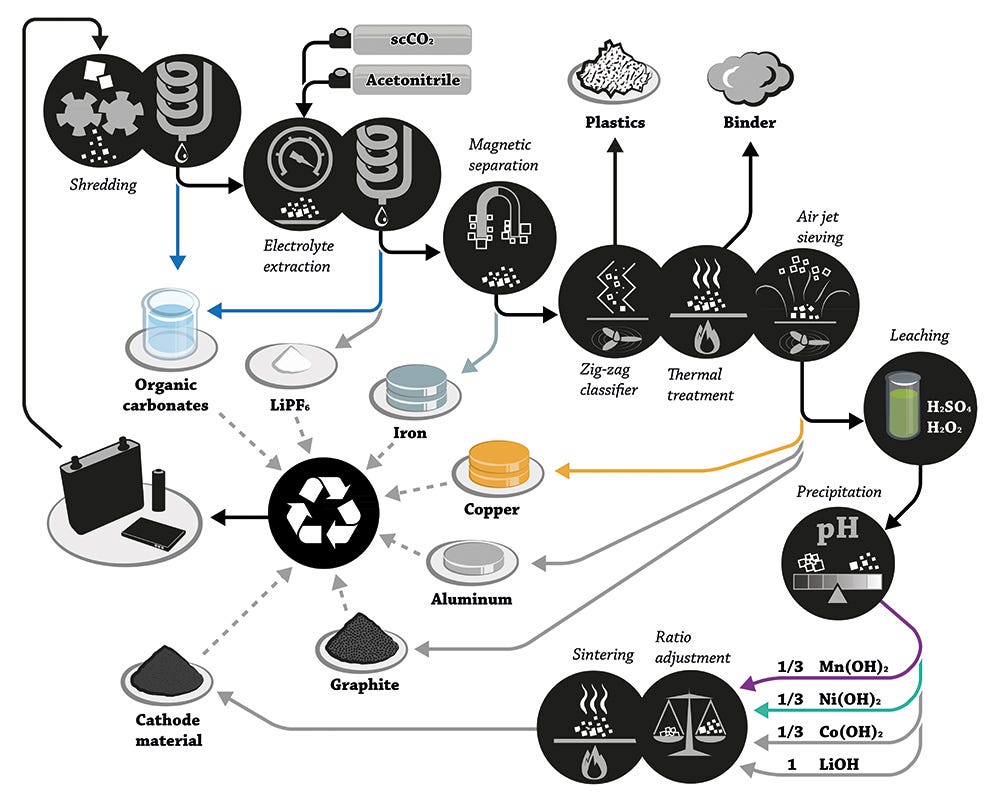

Unlike traditional energy sources, lithium-ion batteries store energy rather than burning it, offering the potential for recycling and reducing reliance on mining. Recycling presents a promising avenue for sourcing materials, shifting from primary mining to secondary sources like discarded electronic devices. However, challenges remain in developing efficient recycling processes, particularly in disassembling battery packs safely.

In the future, recycled materials may become the primary source for battery production, reducing environmental impact and promoting sustainability.

Conclusion

This finally concludes the summary of the entire book Material World. The book is worth a read, especially when we take basic materials for granted.

Along with The World for Sale, another fascinating book on the history of commodity trading, understanding the basic material industry can improve your understanding of geopolitics, societal progress, and asset price movements.

Thanks for reading. I will talk to you next time.

If you want to advertise in my newsletter, contact me 👇

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you.