As we head into the new year, Wall Street turnover will spike as folks get disappointed by the likely lackluster bonus.

I want to lay out all the issues aspiring investors exhibit, so you can be self-aware and stand out from the crowd in the hopefully upcoming surge in job openings.

My mission is to reduce the number of clueless folks one at a time.

The grass is greener

Every day, thousands of people in finance want to explore another path in finance. Most seem completely oblivious to the downsides of their new destination. The "grass is greener" syndrome is real: the movement between hedge fund and private equity is a prime example.

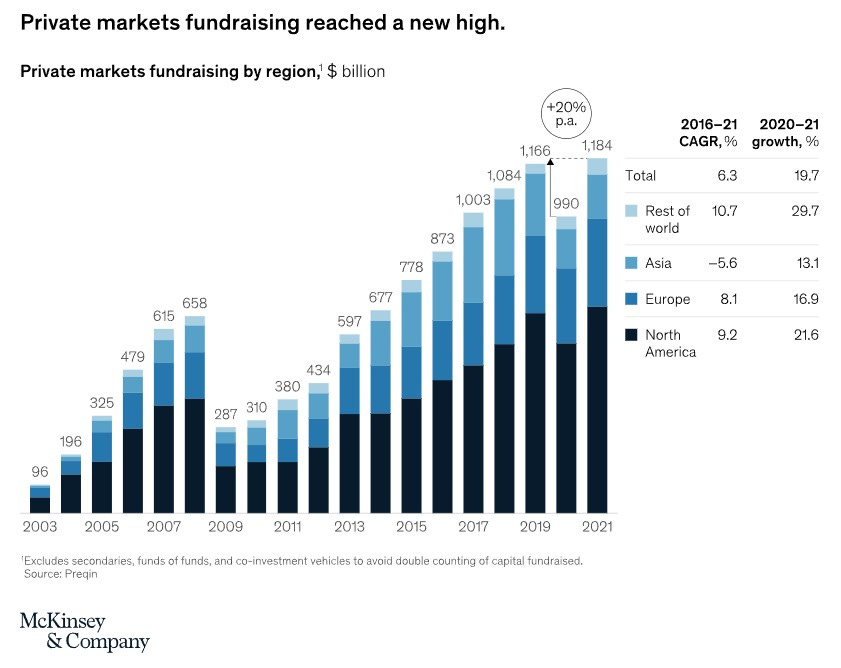

Hedge funders envy private equity for its stability and the ability to hide behind a 5-7 year time horizon. As an asset class, private equity has enjoyed capital inflow over the years.

Meanwhile, private equity professionals hear hedge funders boasting about that million-dollar bonus in a single year, and they start to wonder whether they should pursue an "eat-what-you-kill" career. They appreciate the less bureaucratic work environment and the agility to act on their ideas without worrying about laborious processes and working with their portfolio companies, investment bankers, lawyers, and consultants.

Hedge funders, what do you not realize?

Private equity has bad hours, much like investment banking in most cases. You will have to deal with politics and processes. Plus, you lose the ability to make quick decisions and spend 80% of your time on the 20% of portfolio companies that are always causing you stress.

Finally, most of your portfolio companies aren’t good businesses; otherwise, why would they be PE-owned in the first place?

Private equity professionals, what do you not realize?

The stock market is not predictable in the near term, yet hedge funders have to worry about day-to-day stock price movements because a hedge fund doesn’t have long-duration capital. The moment the portfolio manager puts on the trade, you have nowhere to hide. There is always something "actionable" as stocks move up and down every day, putting you on a hamster wheel of generating new ideas to "keep the portfolio working."

Your compensation suddenly becomes very lumpy, realizing a million-dollar bonus doesn't happen every year, and you could get a goose egg bonus and be left with a $150k base salary for the year (zeroth world problem, ofc) while being paranoid 24/7 about your positions.

Meanwhile, your private equity peers are slowly and steadily earning mid-six figures with a set timeframe for promotion and compensation increases.

All that is to say: Don’t forget the greener grass comes with dark sides too.

Focus diligence on PM and the portfolio

When you know you are aiming for a research role for a specific portfolio under a particular Portfolio Manager (PM), please focus on that PM and strategy instead of on the firms.

Fidelity is bigger than Clearbridge in AUM, and Citadel has more value-creating PMs than Balyasny (because the returns say so). However, you will be working for a particular portfolio and a PM, not for the entire firm. Citadel and Fidelity have subpar PMs, and Balyasny and Clearbridge have star PMs.

In most cases, your PM has high discretion on how they treat you, mentor you, and compensate you. Picking the right PM/portfolio is 95% of the battle. Unless you are working for a firm that is a sinking ship, the firm doesn't matter nearly as much as whom you work for.

However, there are exceptions. For example, you could be gunning for a centralized research role at a long-only; in that case, the firm does matter because you will be interfacing with all PMs of the firm. The same logic applies if you work for a single-manager hedge fund, because the PM is the firm.

When I see questions about “Which shop is the best, Citadel, Fidelity, or Viking Global?” (well, this is an extreme example of cluelessness) I can’t help you without knowing in what capacity you will be functioning there.

Comp and trend surfing are bad moves

We pursue a finance career because we want to make a lot of money. Nothing wrong with that. Otherwise, I would have joined Teach for America.

However, you must realize the majority of compensation upside comes in later years. To reach that Senior Analyst and Portfolio Manager (PM) level, you must independently contribute money-making stock ideas.

This requires:

Finding (investment) style alignment

You acquire the skills and pattern recognition to add value consistently

Without alignment, you won’t be passionate enough to work hard at a firm where you don’t believe in the ways things are done. And you will get discouraged and fail, and never ascend to the big $$$-making roles.

So make sure you maximize fit instead of choosing the role with the highest pay when entering a performance-driven industry like investing. Of course, as I am writing this article, someone probably DM me how much a pod shop pays, for the hundredth time.

Many of you choose the first multi-manager research analyst opening simply because there are always openings there and capital is flowing into the genre as it has had a few years of stellar returns during a turbulent market.

Yet, I am certain not 100% of you know what you are signing up for and this oversight may prove to be a fatal mistake for enough of you for me to make this point.

As you gain more experience under one investment style, transitioning to another style becomes more challenging. What will you do when long-only strategies become more popular five years from now (just an example, I am not interested in debating whether that’s a possibility)? Will you reshape yourself to appeal to a style that doesn’t focus on quarterly set-ups and what alt data are saying?

So, please, take the time to truly understand the type of investor you want to become and be patient with the right opportunity.

The labor market is efficient most of the time: The best opportunities rarely present themselves. Conversely, if something is in more abundance, there is a reason (pod shops are always firing and hiring, it’s just their business model). While you wait, you can always work on honing your skills as an investor on your own time.

Alignment and passion will take you further in any career than blindly following any industry trend ever will, That principle does not just apply in investing.

Do … your … f**king … work

Nothing irritates me more than candidates who expect information to come to them. If the Tiger Cub analysts are are putting in 80-hour weeks to create value for their clients, I don’t know what your excuse is for asking first-level questions and expecting to break into the buy-side (forget succeeding).

The information is out there: Google, ChatGPT, read a 10-K, transcript, Twitter, read a 13-F, Whalewisdom/Morningstar, etc. When you go into an interview asking second-level questions, it won't get you the job, but it will help you avoid being dinged in the first round.

For example, someone asked about Walleye Capital when they could have Google’d it, I guarantee Patrick O podcast shows up on the first search page.

I also see questions on shortcuts all the time: how to quickly identify actionable ideas, how to rapidly ramp up on an industry or a stock, and how to master something complex quickly.

People envy their peers’ research efficiency and wonder if there is a shortcut. I have news for you: it's called experience. It's called repetition. There is no shortcut.

They know everything about what they are looking at, and that’s why they know what matters because they have been studying their company/industry for a long time.

You truly understand something by knowing everything about it. Over time, you will discern what matters. However, when examining new industries and companies, you have to put in the work and develop a first-principle understanding. Over time, you will develop the mental framework that can be applied to the next unrelated industry to save time, but you need to have known stuff to learn other stuff more quickly than others.

Maybe it’s me because I lack the experience, I always spend time learning things on a first-principle basis so I can explain things to a 5-year-old. Stop asking on online forums about that secret book, blog, FinTwit person, or primer that will grant you full mastery of something quickly. They may save time, but they are not the holy grail most of you are hoping for.

I guarantee that.

Last minute doesn’t work

You can't expect to shine in a buy-side interview by rehearsing 400 interview questions for a week. Investing is the last liberal art, there is nothing formulaic about it and it requires interdisciplinary skills.

You are expected to know how to play the game before they let you into that locker room. That means there is no such thing as, "Let me borrow a stock idea, and I will cram it and pitch it in 3 days." I can easily ask you questions about the nuances of any business and industry to expose your lack of preparation.

If you can get a buy-side job doing that, either you are gunning for a subpar shop, or you are more ready for the buy-side than I think you are – maybe you are already on the buy-side, or you have been researching stocks since your teenage years.

If this is your first-ever buy-side job interview, please give yourself adequate time. Yes, you need to get your behavioral questions and stories down. Most importantly, you need an actionable stock idea delivered concisely and know how to defend it during the Q&A. That requires you to know the company and industry inside out, and all that takes time.

For many of you in traditional paths like investment banking, I know you are so used to the concept of recruiting as a structured process. Let me warn you: there is nothing structured about public equity investing recruiting. Funds add headcounts based on need (when there is attrition or significant asset inflow). They are looking for the best candidate who is perceived to be most ready at the moment of the interview, and you could always be competing with someone with buy-side experience already. It's an unfair competition.

You need to overprepare to stand a chance against competitors who might have had many years of a head start. Start preparing today, even when there is no job opening. Learn to generate your actionable ideas - you can leverage my stock idea article. Know as much as you can about your investment ideas, and follow your companies’ progression.

And you can't pitch a stock idea that has worked. So you might need to find a new idea when a real job opportunity presents itself. That's the sad nature of the profession—it's time-consuming and it sucks, but do you want the job or not?

Don't wait until the last minute when the job opening shows up. Your competitors’ day job could be to generate stock ideas so they are good to go or they are already hunting for the next money-making idea. If you want to win, start today so you are not behind in an already unfair game.

Tiger Cub-or-nothing mindset won’t help

Stop fixating on the Tiger Cubs. If you don't fit a certain academic and professional profile, you might never get a job there.

I don't want to be fixed-minded because, as you know, I am not. It’s just that elite firms can afford to choose, and they like to window-dress their team with junior folks who 'fit the bill.' This tendency stems from senior people's desire to seek out individuals who mirror their lineage, and these backgrounds also help portray a certain credibility to external investors.

Some of you might think: “If I have stock-picking skills as good as Dan Sundheim, I can land a role at D1.” As an investor, I think about the base rate. Has anyone from North Dakota State ever broken into D1 in an investment research role? I doubt a single one. Are you going to be the exception? Maybe, and I hope you make it onto Bloomberg News for becoming that outlier and proving my entire article wrong. But the odds are severely against you, if you attend ND State (sorry, I have to pick some school).

If the entire investment team is full of Ivy League bros who are ex-athletes, will you enjoy the work environment? So much for diversity of thinking when everyone is a Wharton grad who did GS or MS banking and then was PE at Blackstone. Thus, you might be working too hard to try to break into somewhere you don’t belong and won't enjoy.

The good news is there are thousands of hedge funds, many of which are willing to give you a chance if you prove yourself.

So, stop fixating on an elite fund just because all you hear is they have amazing economics. Unless you have a traditional profile, you need to be flexible in your entry point.

Don’t prioritize badge-getting

Over time, I have softened my tone on this CFA thing, not because I suddenly think the CFA is a useful program that makes you a better investor. More like I am very helpless that the world doesn’t work the way I want it to.

I hoped getting a skill-based job would be 100% about intrinsic skills. The truth is, go-to-market matters: Less qualified candidates with a good understanding of how they brand and pitch themselves can win the game against more intrinsically talented candidates.

That said, you should prioritize working on your core fundamentals. Know how to think like an investor, practice modeling and valuing real businesses, and have views. And I still stand by my statement that the CFA is not useful for the practical application of investing.

Only if you have solid fundamentals and still feel you are struggling with go-to-market, and you want to pursue paths that value the CFA, sit for the exams (pass them obviously), and see if it opens doors for you.

But I again remind you, if you suck as a stock analyst and investor, don’t expect passing CFA exams to magically convert to job offers, even if passing exams help you land interviews.

There are many more effective ways to get in front of hiring managers than hoping "passing CFA exams" can get your resume picked up by HR or some robot. The CFA is not your magic key to a buy-side seat.

The buy-side is not a 9-5 job

Public equity investing is not a 40-hour-a-week job. If you are looking for a 9-5 job, do something else, because you will lose to all of us who love this game too much to put in the bare minimum.

Only those who understand the world a little better than the masses stand a chance of consistently outperforming the market.

Even if you work only 40 hours a week on the buy side, the intensity of deep focus during those hours is way more draining than working 40 hours at a corporate job. On the other extreme, if you work under a specialist coverage model at a multi-manager, you will be putting in somewhere between 60 to 80 hours a week.

Even with all the hours put in, there is no guarantee you will be a great investor. You can only increase the odds. Because, to say it bluntly, we have different emotional temperaments and intelligence (I will be the first to admit I am no wunderkind.)

The buy-side is still less painful than other high-intensity pressure that stresses face time. You can come home with a stack of 10-Ks and research reports to read on your couch, versus having to work overtime in office.

But make no mistake, if you just want to Netflix and chill after work, I can guarantee you won’t get very far in this profession. Just know your competitors are putting in the work and can be on the other side of the same trade. And only one of the two sides is right in the stock market; you just don’t know until after the fact.

Action over reading

You must love reading, and it’s good for you. But you can’t hide behind someone else’s opinion for the rest of your career. Your PM hires you for your opinion, not what Howard Marks or some random hedge fund letter said.

Hit the few classic literature pieces in your investment style. You can check out my reading list for that. Then get out of your comfort zone and apply your knowledge and skills to real stocks. You WILL impress with your theoretical knowledge during interviews, but you won’t get a job without a well-prepared stock pitch. You can’t ask Howard Marks when you are given a stock idea as an interview case study.

That’s why buy-side interviewers always ask for a stock pitch, even when you have no idea generation responsibility as a junior. They want to assess your potential to ramp into an idea-generating analyst rather than a doer for the rest of your life. Being a lifetime doer is bad for your career or the firm.

Even if you are super passionate about learning from great investors, allocate at least half of your time to studying companies and industries and forming views.

Once you have read that 5th or 6th investment book in your genre, the marginal benefit of reading another extra investment book read is very low, and you should dedicate 100% of your time to developing sector expertise of your choice so you can develop pattern recognition.

Ultimately, you are hired to make money with your ideas, not to recite lines from the book 'Margin of Safety.' It’s a great book, but almost all of us have read it.

You need to do the hard things.

Be open to relocate

The buy-side is a shrinking industry. You need to be open-minded about relocation. If you are asking questions like “Any good funds in Charleston, South Carolina, or Orange County, CA?” My friend, you lost the battle before the war even began.

Harsh as it may sound: no one cares about your personal circumstances. If your life situation prevents you from relocating to a big financial hub, you are going to have a tough time getting a job in institutional investing.

I know you might be thinking, well, maybe I can work remotely for a fund in a big financial hub.

I think that’s bad for your learning, as the investing process is best learned in person through osmosis. I can speak from experience: a lot of things get lost in translation when you are not in the trenches with your PM and senior analyst in the same office.

Investing is more performance-driven, but as long as you are working for a company, there is always a people component. Imagine two junior analysts, one works in the office, one is fully remote, and neither has P&L responsibility. Assuming both are equally competent, whom is the PM most likely to promote next year? I think remote only works when you are a “grown-up,” independently idea-generating senior analyst and a PM who can create real value without much supervision. Otherwise, even if you can land a remote job, I strongly recommend you relocate to where your firm is located for your career longevity.

If you want to advertise in my newsletter, contact me 👇

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you.