The Non-target with the Best Buy-side Seat

Hear from Todd Combs, Warren Buffett's right-hand man

Todd Combs is often mentioned as a potential successor to Warren Buffett as the next Chief Investment Officer of Berkshire Hathaway. In addition to managing Berkshire’s equity portfolio with Ted Weschler, he has been the CEO of GEICO since January 2020. He received his undergraduate from Florida State University and has an MBA from Columbia Business School.

To WATCH this article:

Todd recently made a rare appearance on a podcast. Let me share with you what I learned and my take on his viewpoints.

Todd's parents didn't attend college, which put immense pressure on him, to succeed and grab the opportunities they missed out on.

Thankfully, things worked out. Todd is the first in his family to attend college, and now, many would say he's secured the best seat in the world of investing: he has unparalleled access to Warren Buffett and Charlie Munger and collaborates with Ted Weschler to oversee the deployment of capital with a genuinely long-term perspective.

Todd’s take on investing

Todd believes that investing is a simple concept but not an easy one to master. He argues that anything worth pursuing is rarely straightforward, and many people look for shortcuts and quick fixes to achieve short-term gains. He cautions against such shortcuts, drawing wisdom from the likes of Warren Buffett and Charlie Munger, who stress the importance of hard work.

When you find yourself asking a question around “what’s the quickest (or easiest) way to …” it’s a sign you are seeking that shortcut that DOES NOT EXIST.

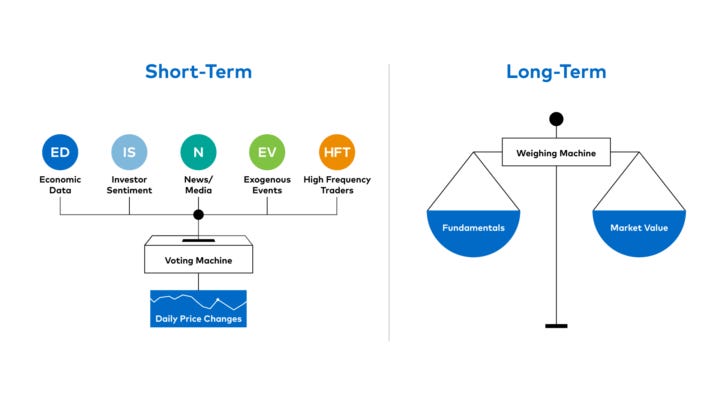

As a long-term investor, Todd finds it more manageable to predict the long-term outcome rather than the short-term, a perspective that sets him apart from a significant portion of the equity market.

In his journey to establish himself in the world of investment management, Todd leveraged his expertise in the complex realm of insurance, and his specialty in the broader financial institutions sector. His background as a bank regulator and his experience in data science at Progressive provided a unique edge.

When he decided to pursue a transition to buy-side via Columbia Business School (“CBS”), Todd negotiated a safety net with Progressive, allowing him to return to the company if he encountered challenges securing a buy-side role.

Entering the buy side often involves good timing, especially for nontraditional candidates like Todd. At the time, Progressive did not do investor calls, or call-back and provided no guidance.

The managers at Progressive who wrote Todd’s CBS recommendation letters suggested that Todd talk to Wall Street analysts about Progressive. He got in touch with Weston Hicks, the #1 II insurance analyst. Weston then put Todd in touch with the Tiger Cubs who turned out to be actively researching the insurance industry and shorting some of its stocks.

Todd's profound knowledge of insurance intricacies played a pivotal role in helping funds build conviction as a specialist. This expertise set him apart in a field that few are interested in or qualified to explore.

During his time at CBS, Todd worked at Blue Bridge Capital, collaborating with his mentor, Pete Danekar, who specialized in financials for John Griffin. After graduation, Blue Bridge proved invaluable in connecting Todd with opportunities in funds seeking a financial institutions (FIG) expert.

Todd constantly sought to expand his circle of competence and remain focused on understanding things from on a first-principle basis. He enrolled in speciality finance courses at NYU in the evenings and on weekends to learn how credit card collateralization transactions work. The course is targeted toward investment bankers, but Todd wanted to fill a knowledge gap in consumer finance as a FIG specialist. This drive exemplified the value he placed on genuine curiosity and a comprehensive understanding of his sector, refusing to take shortcuts.

Key to Success

Todd didn't offer any groundbreaking insights you haven't heard before. Success boils down to curiosity, hard work, sound judgment, intelligence, and clarity of thought. When these qualities compound over time, they lead to remarkable achievements.

So, what's holding most people back from succeeding? They don't push themselves hard enough. Or said more simply: they are lazy.

Todd highlighted that a whopping 90% of success hinges on your mindset and your ability to keep pushing, even if it's just by a mere 1% more each day. If you do this consistently, it compounds over time, setting you apart from the pack.

Kobe Bryant, the legendary NBA Hall of Famer, who tragically left us too soon, echoed a similar sentiment. He talked about outworking others consistently, making it impossible for others to catch up over time.

When two wildly successful people make the same point, it's a recipe worth following.

You should follow Charlie Munger's advice and strive to go to bed a little smarter every day. Just like the network effect in businesses, the latticework of the mental models popularized by Munger suggests that knowledge scales exponentially.

Unfortunately, most people lack the work ethic and consistency to reach the exponential phase of growth. That's why influence and wealth tend to concentrate in the hands of a select few individuals on this planet.

Generalist vs Specialist

Todd aligns himself with the camp of generalists. Drawing inspiration from David Epstein's book, "Range." Epstein highlights that generalists may initially progress slower, akin to delayed gratification. Some athletes excel in their chosen sports because they dabbled in various disciplines beforehand.

Todd views the world of investing as highly interdisciplinary and acknowledges that, as a nontraditional candidate, he had to build a framework over time. What propelled him forward was his unwavering passion and determination.

I can personally relate: When I looked at a 10-K for the first time in my life, I had zero idea what to pay attention to and what’s the end goal. However, I kept reading more and more 10-Ks and investing books. Gradually, clarity emerged, and I gained the framework to conduct due diligence on companies, showcasing the value of delayed gratification.

For those with boundless curiosity, an essential quality for fundamental investors, the challenge lies in striking a balance between their broad interests and the narrower circle of competence required for action. The latter necessitates truly knowing what you are doing.

Nevertheless, Todd stresses that curiosity offers its benefits, as prior knowledge can be a valuable asset in understanding new situations, exemplifying the generalist pattern recognition that spans various industries.

I attended an event this week, where the famed venture capitalist Vinod Khosla also suggested not to specialize too early in your career. Instead, learn how to learn, so you can be prepared to understand whatever new things you need to deeply master. Over your lifetime, your likes and dislikes will change a lot anyways.

On young candidates’ mistake of “back-solving"

Todd's journey highlights the critical lesson of not underestimating one's current work environment, even if it's unconventional. Every experience can be a building block for the future, and Todd's past role as a bank regulator is a perfect example.

Despite the lack of glamour and perceived prestige in that role, it offered Todd a unique opportunity to interact with bank management, almost like having insider access. His ability to ask questions and engage with bank CFOs gave him valuable experiences that set him apart from his peers.

For the longest time, a common issue among college students is the tendency to "back-solve" by chasing prestige and pay with resume-worthy names like Goldman Sachs or McKinsey.

Todd, on the other hand, argues that tangible industry experience holds far greater long-term value, such as operating experience in different industries that are not typically provided by traditional finance roles.

Furthermore, Todd cautions against solely pursuing wealth or prestige, recognizing that people change and evolve over time. These pursuits may yield short-term results, but they don't lead to the exponential growth phase where you can gain outsized wealth and influence.

Todd draws a parallel to the power law, where significant rewards are reaped by those who achieve exponential scaling. Hence, discovering one's passion and pursuing it vigorously is essential. This principle very much applies to an investing career, where only those who are passionate and continue to work on their craft reap the big financial reward.

So you should embrace possibilities and remain open to change in your career.

I echo Todd’s comment. That’s why I have been an advocate for Bernstein’s equity research model of hiring industry experts, instead of finance wizards, to cover their respective sectors.

That said, I don’t blame aspiring candidates because their behaviors are heavily shaped by how the industry is structured where firms value rigid prerequisite work experience and the concept of exit opportunities is heavily imprinted in candidates’ minds during college.

On short-selling

Todd's background in hedge funds has instilled in him a belief in the value of short selling. However, he acknowledges that both Charlie Munger and Warren Buffett have encountered their fair share of challenges when it comes to shorting, leading them to disagree on its necessity.

To underscore the difficulty of short selling, Todd suggests that one needs to be approximately 85% correct on the short side to generate profits.

Short selling, in Todd's view, requires a high level of expertise and precision. He points out that short-selling skills can significantly benefit the long side.

By identifying weaknesses in a company's moat, investors can discover compelling long opportunities. From my personal experience working at a long/short hedge fund, I also did not enjoy short-selling but appreciate the philosophical argument that a long thesis is solidified when one can conclusively refute the short thesis on the same name.

On running his own fund

Todd had a successful and profitable experience running his own hedge fund. He underscores the significance of being genuinely committed to your work in a highly competitive environment. Passion serves as a driving force, and without it, it's challenging to persevere and excel, a recurring theme in his philosophy.

Todd advocates taking risks when you're young, as the downside risk is limited. This concept aligns with the idea of asymmetry, as described by Nassim Taleb. The more net worth or earnings power one possesses, the less asymmetric the risk-reward profile becomes, and the more “fragile” that person is to changes in conditions.

In the business world, this concept is akin to the idea of counter positioning, where disruptors have little to lose by challenging incumbents, who risk losing a significant portion of their existing revenue. The incumbent has much more at stake, making risk-taking a more favorable strategy for disruptors.

The same principle applies to younger professionals as well when you have a lot less to lose than if you don’t have a high-paying day job and family obligations.

Thanks for reading. I will talk to you next time.

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you.

To listen to the podcast: