The Death of Equity Long-Only

Gloomy outlook for gaining entry into my favorite investment style

There have been online discussions about a new threat to long-only mutual funds: the decline in entry-level investment roles. You will hear my perspective on this topic and its impact on the stock market.

Special thanks to my anonymous mentor for inspiring me to write this article.

WATCH this article:

Already a Melting Ice Cube

Currently, two trends are evident. First, shift towards passive investing, and second, active management faces significant fee compression. Many long-only firms fail to outperform benchmarks consistently. In fact, they often barely match or even underperform benchmarks. Clients question paying active management fees to fiduciaries who destroy value. Despite this, many investment firms persist, relying on marketing rather than value generation.

A respected contributor noted three long-only segments:

The "Mega-only" includes firms like T. Rowe Price, Capital Group, and Wellington, and the likes, amassing assets due to scale, brand, and distribution.

"Elite boutiques" genuinely generate alpha pre-fees, justifying future allocations.

The "fat middle" consists of "closet indexers" who mimic the index, charging active fees. They struggle to attract assets, losing market share to the above two segments. Remarkably, the fat middle represents about 60% of the market. They face significant fee pressures and struggle to attract talent, forming a cycle of subpar outcomes and intensified fee pressure.

Another contributor noted Canada's consolidation, which is more noticeable due to fewer specialty players in the Canadian market.

Relying solely on performance isn't enough to attract inflows. Smaller funds struggle with distribution challenges. Specialty managers are either selling businesses or engaging in minority interest deals with larger asset management firms. Insurance companies find this shift appealing as it can provide access to distribution channels and capital commitments in exchange for gaining in-house investment personnel.

However, smaller companies lacking a growth narrative will have harder time accessing capital.

Regardless of impressive returns, companies are disinterested in "pod shops" (ie. the multi-manager platform, most notably Citadel, Millennium, Point72, and Balyasny, the “Big 4”) due to rapid portfolio turnover that rivals the velocity at which Leonardo DiCaprio changes girlfriends. Stable, enduring capital sources from long-term investors such as a long-only are preferred over the “pod shops”.

Beyond large asset management firms, asset acquisition is tough. Consolidation offers significant cost savings. Merging two $10 billion AUM shops with 40% operating margins can save 10-15 points by cutting portfolio managers, leveraging research, automating tasks, reducing office space, and one more lever that has dire implications for your aspiration as a long-only investor, which leads to my next point.

Death of entry-level AM roles

A consensus is forming that long-only will employ fewer associates. Unfortunately, I believe this trend is real. Junior associates' key role, building models, faces competition from pre-built model services. These services recognize that model-building is a common task for junior associates and are actively addressing this issue.

During cost-cutting, existing employees must do more with the same pay: Associates will support more analysts, and analysts might assist more PMs.

There are two primary research models at long-only firms. One is the portfolio analyst model, which, in my opinion, is superior. Portfolio analysts support research across a few portfolios, aiding PMs and potentially multiple analysts. This model directly contributes to specific product performance within the firm.

The second is the centralized research model, resembling in-house sell-side research. It often lacks insights into how PMs and analysts apply your work to investment decisions.

Remember decision-makers, who ultimately influence portfolio construction and money's value, are always more valuable than doers.

As firms diminish associate roles, analysts may shift associates towards task-oriented roles rather than guiding them to become analysts or PMs. Centralized research associates have been in a structurally tougher position for a long time, but permanent downsizing of associate roles will likely make the portfolio research associates less engaged as well.

According to another contributor, associate roles are already cut in some firms and are increasingly shared by PMs. Mega long-only and elite boutiques might also reduce associates and conversions to analysts.

Associate-to-analyst conversion rates are historically low, as firms prefer fresh MBA grads (for marketing purposes). Analysts and PMs at top long-only shops have good prospects, but new entrants should only pursue it if you are genuinely passionate due to decreasing opportunities. The industry faces secular challenges, and little can be done to change that if firms continue to underperform.

Implication for Stock Market Structure

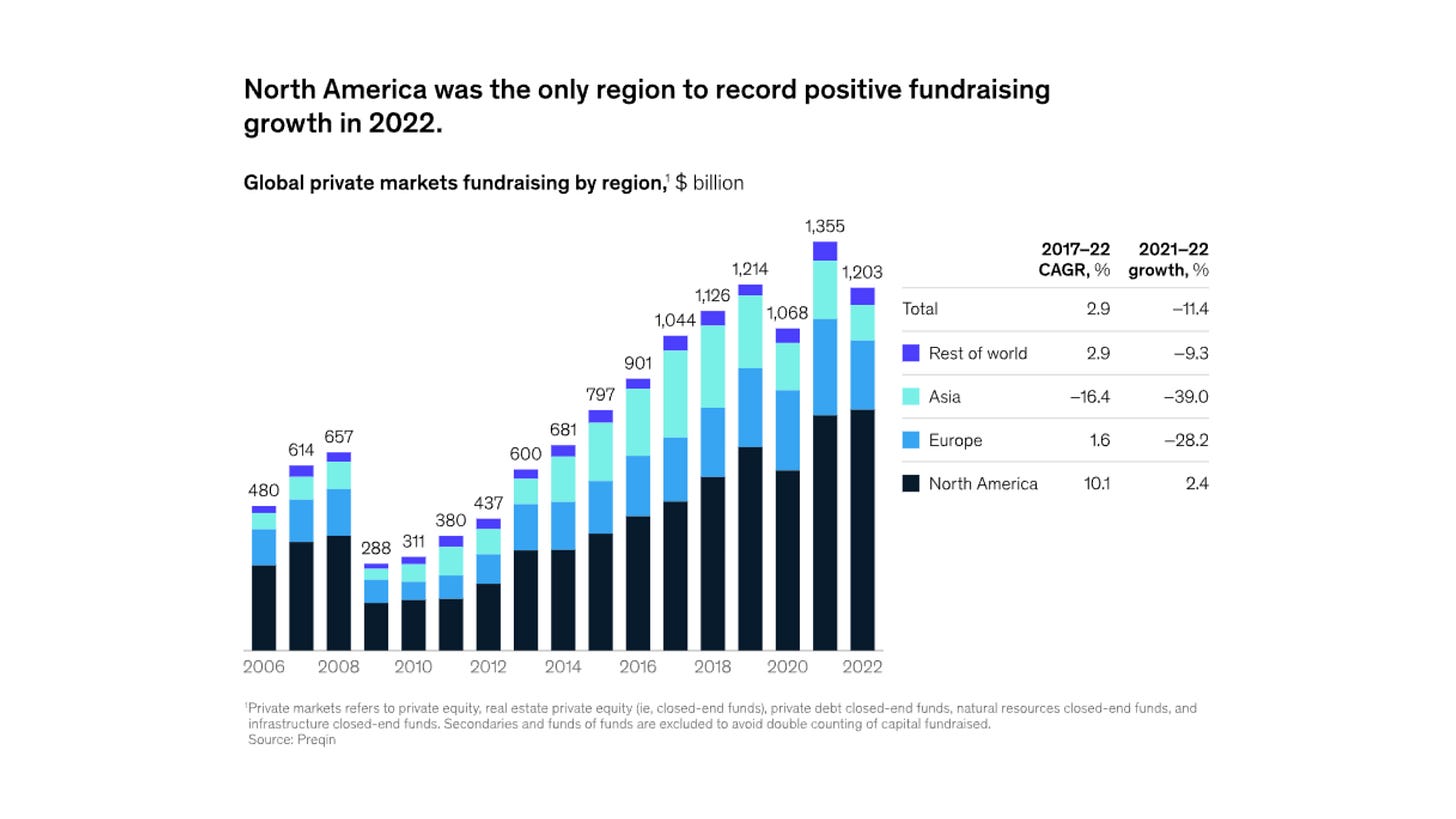

What are the implications for the composition of active investors in the stock market? A conversation with my mentor prompted this article. The rise of passive investing has led to an observation: the U.S. equity market seems increasingly rigged due to significant inflows into the S&P 500 from large passive shares and the 401K market every two weeks.

Moreover, clients are embracing passive strategies and channeling capital and fees towards private products like private equity. This shift has reduced the number of participants engaged in price discovery, resulting in a flow-driven market. Anyone monitoring the stock market should notice its erratic behavior in recent years.

Among active equity investing, multi-manager strategies stand as one of the few areas seeing capital inflow as the market-neutral approach has demonstrated substantial value creation recently. This trend implies an increasingly short-term investor base, despite their claims of being long-term investors.

Given the dominance of passive and short-term active investors, fixating on extrapolated rates of change, the market often exhibits inflated valuations where lows are insufficiently low and brief. Limited reinvestment options pose a significant challenge for long-term investors.

For instance, Meta’s stock dropped to $100, contingent on the Metaverse delivering or curbing spending. Fearing Meta stock’s downturn affecting employee retention due to heavy options compensation, the company cut costs and reduced capex. The stock price surged. However, momentum players propelled the stock to $300, presenting a new challenge for investors seeking to allocate proceeds by selling Meta stock.

This scenario echoes Google in 2013, transitioning under a new financial discipline with Ruth Porat as CFO, influencing the stock's trajectory.

As my mentor suggests, a lasting advantage lies in adopting a genuinely long-term view and identifying businesses with structural competitive edges. Equally important is finding patient, astute allocators willing to commit to the long haul. However, I'm realistic; executing this is harder than it sounds. The challenge involves spotting attractively priced businesses with these qualities each year. Otherwise, clients will lose patience and leave. Another hurdle is locating these intelligent allocators, which is likely a scarce and dwindling trait.

Despite my agreement with my mentor's rational investment approach, the trend toward passive investing will persist.

Growing assets under an active strategy can hamper alpha generation due to shrinking opportunity sets. Unlike active investing, the benefits of indexing compound with scale. Larger passive assets enable more efficient operations—closer index tracking, frequent rebalancing, lower trading costs via broker bargaining power, and internal cross-trading without transaction expenses. These efficiencies translate to lower fees, enhancing the appeal of passive products—a self-reinforcing cycle akin to the Walmart model. Additionally, substantial profits from securities lending become accessible with a sizable asset pool.

This brings us to the present state. While I lack a crystal ball, it will be intriguing to revisit this topic. A well-functioning market necessitates a balance of participants with diverse philosophies. While the presence of short-term investors doesn't concern me, as they aid long-term entry prices, an excess of both passive and active approaches can be problematic, especially when value isn't being added.

Let's revisit down the road how the landscape of public market investing changes. Feel free to share your thoughts in the comments.

If you want to advertise in my newsletter, contact me 👇

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you.