Releasing tomorrow: a deep dive on GS risk arbitrage desk, Robert Rubin and his protégés

Hello!

Dropping tomorrow at 12:00 PM ET: a 7,500-word deep dive on the Goldman Sachs risk-arbitrage desk that Robert Rubin built — and how his protégés turned that tiny trading desk into one of the most powerful lineages in hedge-fund history, available for our premium subscribers:

Below are the content we have published for our premium subscribers. Active premium subscribers - please read the email header for migration instruction.

What you will get:

Fund Primers by Region (# of funds)

Connecticut (81)

New Jersey (16)

NY Long-only’s (76)

NY HF - Tiger lineage (39)

NY HF - Biotech / healthcare (26)

NY HF - Activist (38)

NY HF - Market-neutral SM (36)

NY HF - Event-driven / Special Sit (39)

NY HF - Value, Growth, Style-agnostic (119)

Boston and U.S. Northeast (VT) (73)

California (133)

Chicago (41) | U.S. Midwest (MN, WI, MI, OH, IA, MO, NE, KS) (55)

Florida (58) | U.S. Southeast (AL, AK, GA, KY, NC, SC, TN) (32)

U.S. Mid-Atlantic (DE, MD, PA, VA) (59)

Texas (58)

U.S. West (CO, OR, UT, WA) and Puerto Rico (40)

Hedge Fund Deep Dives

Goldman Sachs Risk Arbitrage lineage (Farallon, Perry, Eton Park, Och-Ziff/Sculptor, ESL, TPG-Axon, Taconic) - releasing tomorrow

Mutual Fund Deep Dives

Fund Primers by Sector Specialty

U.S. Biotech / Healthcare (68)

U.S. TMT / Consumer (82)

U.S. Energy / Materials (29)

U.S. Financials (20)

More to come

Fund Primers by Investment Style

U.S. Activists (70)

U.S. Tiger Lineage (70)

U.S. Market-neutral SM (76)

U.S. Multi-managers

U.S. Event-driven (76)

Fund Primers by Key Person Alma Mater

Columbia (91)

University of Chicago (35)

Cornell (23)

Dartmouth (29)

Harvard (129)

MIT (18)

NYU (41)

UPenn / Wharton (107)

Princeton (35)

Stanford (61)

UVA (34)

Williams College (14)

Yale (46)

Industry Insight Series

Multi-managers 101

Short primer on how to analyze biotech stocks

Learnings from analyzing 1,000+ U.S. funds

2024 Sohn Conference Summary

How to Build Moats in a Hedge Fund Business?

Why Do Hedge Funds Fail?

What hedge funds don’t tell you

Coatue’s Wisdom on TMT Investing

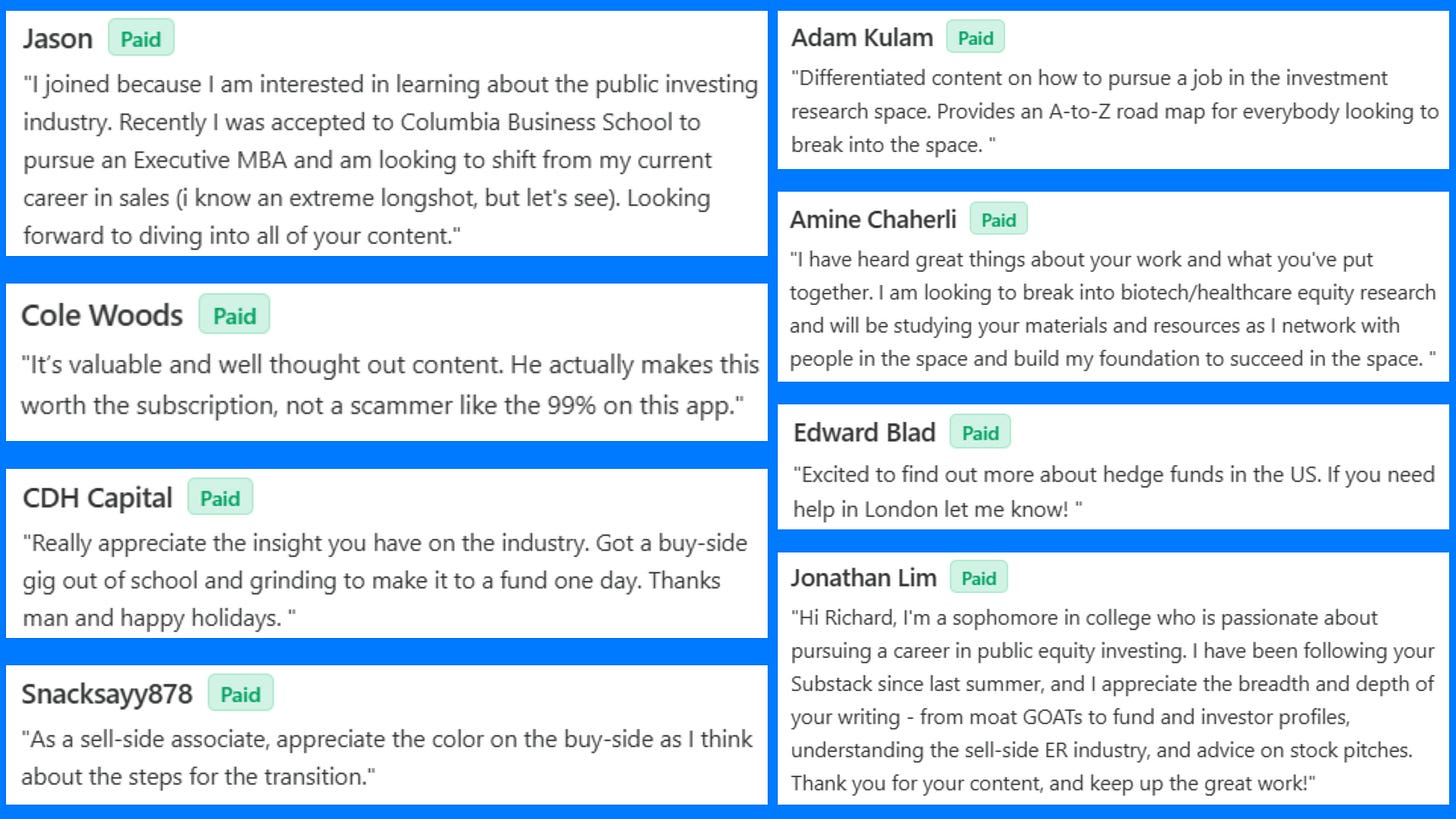

Here is what some of our readers are saying:

The deep dives are NOT paid for by the covered firms. The newsletter relies solely on reader subscriptions. Your readership and support are much appreciated.

Talk to you tomorrow,

Richard