Generalist vs. Specialist

There is no perfect model – many successful investors came from different coverage models and there is no empirical evidence that the generalist or specialist is better than the other.

Generalist

Under the generalist model, a research analyst has no constraint on what kind of companies or industries she can invest in or do research on. Famous proponents of this model include Charlie Munger, Warren Buffett and Seth Klarman (Baupost)

Aside from my time on the sell side, I have always been a generalist. One of the greatest advantages of the model, in my opinion, is the ability to see mental models translate across industries, helping a generalist uncover situations that a specialist will likely miss because she is too focused on her industry / sector.

A quick example is how I understood the SaaS business model based on my knowledge of cable companies. Cable companies evolved from a single product (pay-TV) to multi-product bundles (“triple-play” pay-TV, broadband, mobile telephony) to drive per-customer spending and higher customer lifetime value (by increasing switch cost with multiple products.)

Similarly, SaaS companies employ the “land and expand” model whereby they sell customers a core product and then upsell additional products. As a SaaS company goes from a single-product company to a multi-product one, they started selling bundled offerings. This is the exact same playbook as what cable companies have done prior to the rise of SaaS.

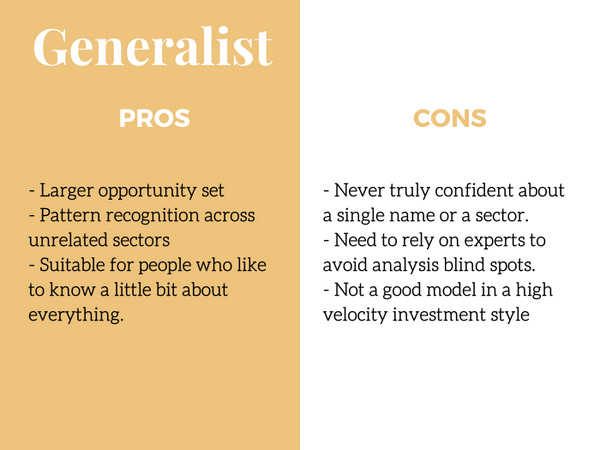

Pros and Cons:

Specialist

Most sell-side research firms run Sector Specialist models, where a team is covering a sector such as Semiconductor or Oil Pipelines within a broader industry. In this case, Technology or Energy.

Sell-side equity research employs the specialist model because they cater to a broad array of institutional investors. The depth of knowledge on a narrower set of companies ensures the sell-side can add value to as many clients as they can.

Questions such as “How this sector has changed over time” or “What happened to this company 10 years ago” can only be answered well if one follows the same sector for a long time and develops deep knowledge.

Given multi-manager hedge funds are sell-side research’s biggest clients and they primarily run sector specialist models, it also made sense for sell-side research to employ a similar coverage model.

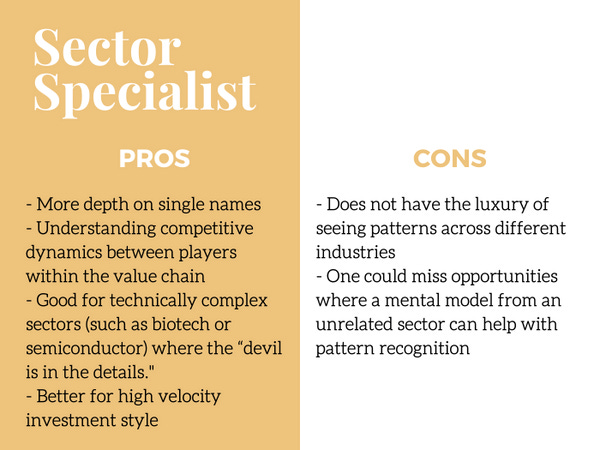

Pros and Cons:

Other Models

Another model is an Industry Specialist, which is a middle ground between Generalist and Sector specialist. An Industry Specialist covers a broader industry that encompasses many sectors.

For example, a Technology specialist covers companies spanning software, hardware, internet, semi, telecom sectors, and so on. So it balances the pros and cons of Generalist and Sector Specialist models.

Conclusion

A well-established coverage model is very crucial for the development of junior research analysts and for ensuring the scalability of an investment fund. However, there is no perfect model.

For those deciding on which model you want to operate under on the buy-side: Choose based on which model you can see yourself performing optimally.

There is always something you don’t know, and it’s almost always the thing you don’t know that makes you lose money on a stock. So, be aware of the intellectual blind spots and be humble.

Thanks for reading. I will talk to you next time.

If you want to advertise on my newsletter, contact me 👇

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you.