In a world captivated by digital semiconductor companies like Nvidia, it’s easy to overlook analog semiconductors—the quiet, essential workhorses operating behind the scenes.

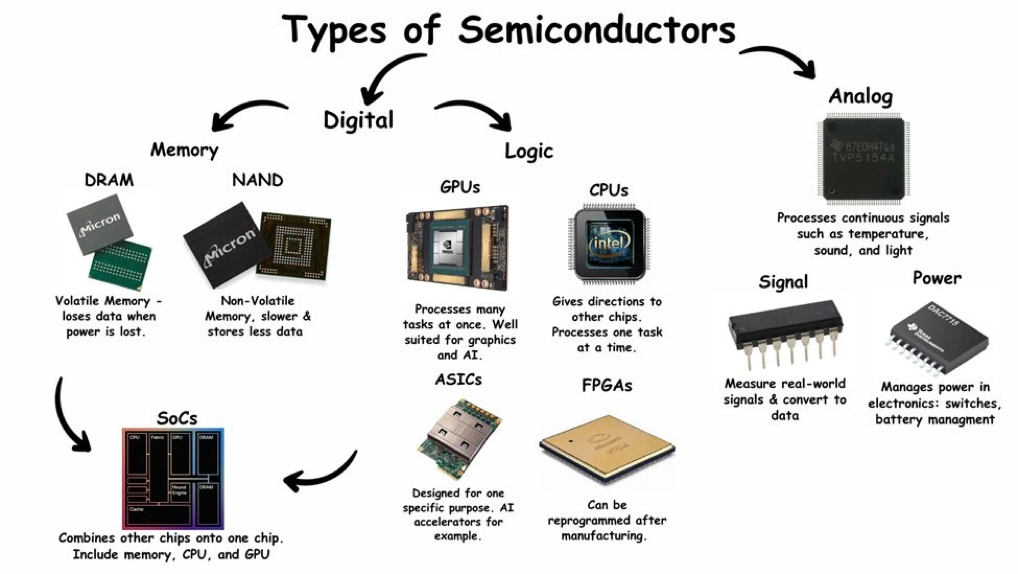

While digital chips power the heavy computational lifting for AI and data processing, analog semiconductors play an equally crucial role, bridging the physical and digital worlds. They convert real-world signals—such as heat, light, and sound—into data that digital devices can process. These chips manage the temperature in your home, regulate power in your smartphone, and fine-tune your car’s braking system, orchestrating the physical world in real time with remarkable precision.

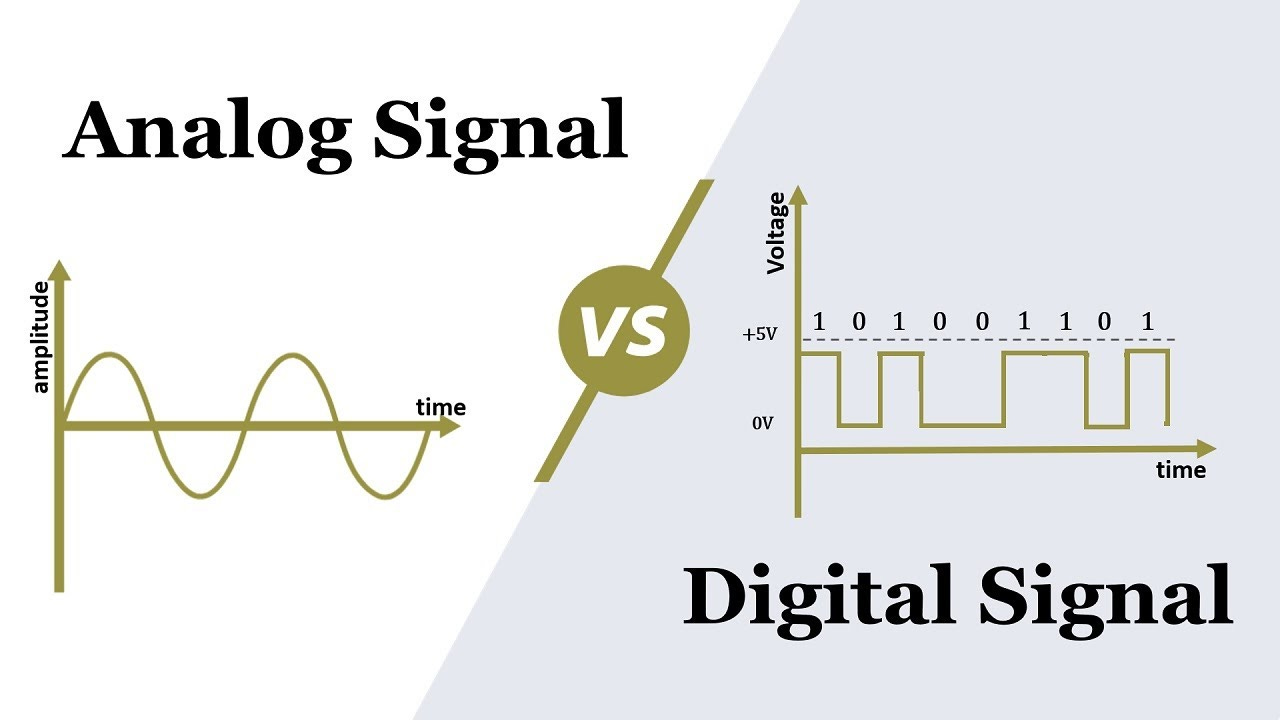

Unlike digital chips, which operate using binary states (1 and 0), analog semiconductors measure and process the continuous range of values found in the physical world, such as temperature, pressure, and audio. This essential capability drives enduring demand, as thermal control and sensors remain critical for managing the physical environment.

As technology continues to advance, analog semiconductors remain indispensable. That brings us to today’s main focus: Analog Devices, a leader and pioneer in the analog semiconductor space.

December Analyst Academy is open for enrollment!

You’re burning through countless days and sleepless nights trying to break into public equity investing. Yet, the door is firmly closed.

Because you’re missing the critical skills:

deconstruct industry & assess companies

unit economics and stock key drivers

valuation and bull/bear frame

following 20-60 stocks during EPS season

If you want a repeatable process ASAP, Fundamental Edge is your answer, built by an ex-Tiger Cub senior healthcare analyst, Brett Caughran.

Use WINTERTOAD for an instant 10% off!

Founding

In 1965, two MIT graduates, Ray Stata and Matthew Lorber, founded Analog Devices (ADI) with a vision to create high-performance electronic equipment capable of amplifying and processing real-world signals. That same year, the company introduced its first product: the Model 101 op amp, a hockey-puck-sized module designed for test and measurement equipment.

From the outset, ADI set itself apart by innovating in operational amplifiers, a critical component for processing analog signals. By the 1970s, the company expanded into data converters, establishing its reputation as a leader in analog-to-digital and digital-to-analog conversion—one of its flagship technologies.

During the 1980s and 1990s, ADI broadened its product portfolio to include high-precision, low-power chips for industries such as telecommunications, automotive, and healthcare. Significant investments in research and development during this period enabled ADI to outpace competitors and advance the field of signal processing technology.

Through strategic acquisitions, ADI has continued to grow its presence in high-growth markets driven by strong secular trends, including industrial automation, aerospace, 5G, automotive safety systems, and industrial IoT.

Revenue model

Analog Devices (ADI) generates revenue by designing, manufacturing, and selling analog integrated circuits (ICs) to distributors and directly to customers.

ADI revenue is segmented into four key end markets:

Industrial (53%): The largest contributor, driven by demand for analog chips used in factory automation, robotics, and process control. These applications require high reliability and have long product life cycles, benefiting incumbents like ADI.

Automotive (24%): Analog chips are vital for power management, battery systems, infotainment, and advanced driver-assistance systems (ADAS).

Communications (13%): This segment supports 5G, RF, and network infrastructure, serving telecom providers, data centers, and cloud operators.

Consumer (10%): While less stable, this segment relies on analog chips for audio, power management, and imaging in devices like smartphones, wearables, and appliances.

Many of these markets are experiencing secular growth trends driven by advancements in areas such as 5G, intelligent manufacturing, edge computing, electric vehicles, and digital healthcare.

That said, the ROIC in recent decade has come down significantly because of a few large-sized acquisitions in an effort to gain further scale and diversify into growth end markets.

Industry structure

The analog semiconductor industry operates as an oligopoly, shaped by the specialized expertise required to design and manufacture these chips.

Achieving linearity—a proportional relationship between input and output (e.g., current and voltage)—is one of the fundamental challenges in analog semiconductors.

Most semiconductor components, such as diodes and transistors, are inherently nonlinear. For example, in a diode:

At low voltages, little to no current flows.

Beyond a certain forward voltage threshold, current increases exponentially with voltage.

This inherent nonlinearity presents challenges in applications like audio amplifiers, sensor interfaces, and RF communication systems. Nonlinearity introduces distortion, degrading performance in systems such as communication networks. Maintaining signal fidelity—preserving the original waveform during amplification or processing—is crucial to avoid such degradation.

Several factors drive this oligopolistic structure. First, the scarcity of skilled analog engineers—many of whom are drawn to the AI-driven boom in digital semiconductors (e.g., Nvidia and AMD)—creates a high barrier to entry for scaling analog semiconductor production. Second, analog semiconductors typically have long product cycles, reducing the need for frequent updates. Customers are hesitant to switch suppliers, valuing decades of reliability data, rigorous testing, and proven performance from incumbents. As the saying goes, “if it isn’t broken, don’t fix it.”

New entrants face steep challenges unless a paradigm shift, known in the industry as a "socket change," occurs. Such shifts force customers to reevaluate designs from scratch, creating rare opportunities for new competitors to displace established players. However, these events are infrequent, further solidifying the dominance of the existing analog semiconductor giants. (A theme that came up in the elevator industry as well)

As a result, the analog semiconductor market is dominated by a few major players, including ADI, Texas Instruments, Infineon, NXP Semiconductors, and STMicroelectronics. While these companies often compete in overlapping markets, each has established a reputation for excellence in specific applications.

In the 7 Powers Framework, what are Analog Devices’ moats?

What’s are ADI’s moats?

To me, the primary powers behind ADI’s success are cornered resources, switching costs, and process power. To a lesser extent, scale economies also contribute.

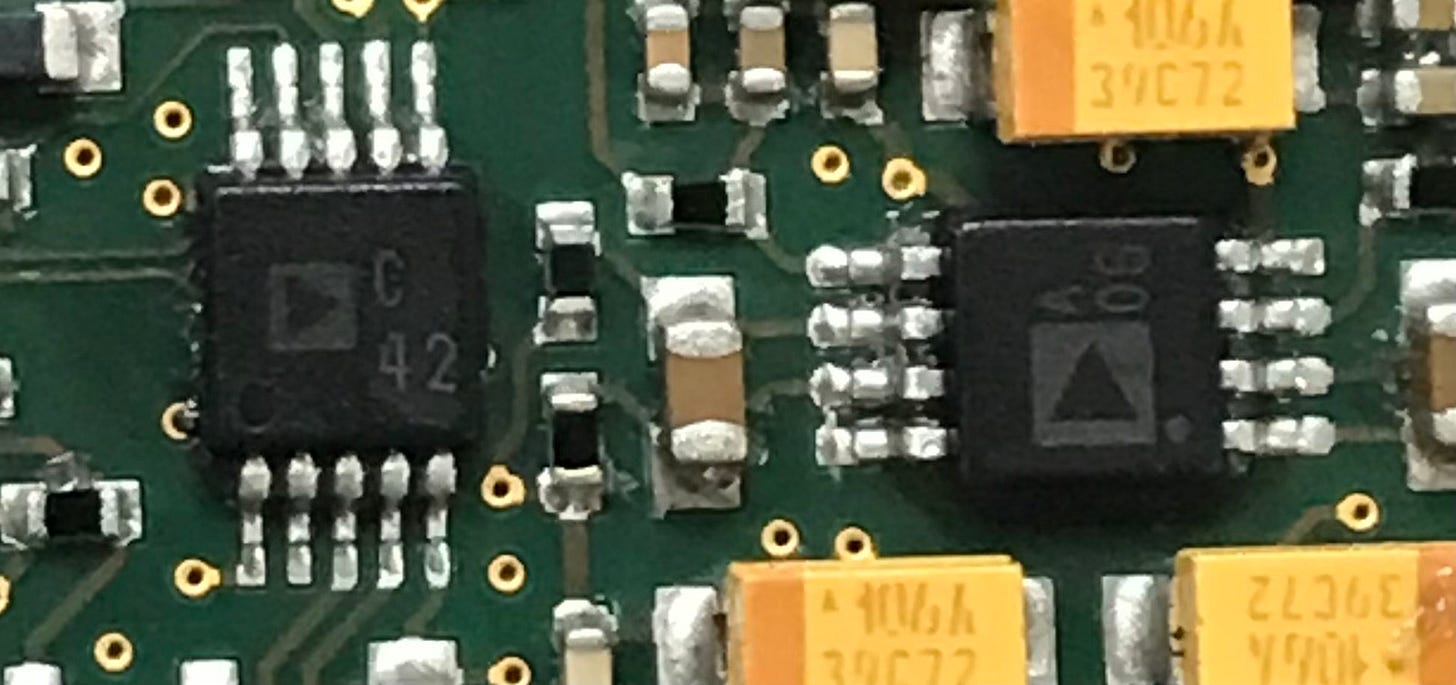

Analog ICs are integral to countless devices. While these chips are not expensive, their reliability is critical because they are embedded in the final products that customers sell. A single failure on a circuit board can tarnish a manufacturer’s reputation and lead to significant business losses. Given their widespread use, the stakes are high.

Over decades, ADI has built a brand synonymous with reliability. Its components are top-of-mind with engineers, often first encountered during their education. Many professionals know ADI parts by their model numbers, creating a default preference for ADI products during design selection. Additionally, the fact that most new semiconductor engineers gravitate toward the digital space has created a dynamic where analog engineers, familiar with ADI products, default to using them.

However, ADI’s dominance is not just a result of longevity—it stems from its unique empirical data on reliability. While ADI and its competitors conduct rigorous in-house testing, the true assurance comes from decades of real-world use. ADI’s components have been deployed across countless devices, amassing a vast reservoir of reliability data under diverse conditions. This extensive track record builds trust and creates substantial switching costs for customers.

Competitors would require years, if not decades, to build a comparable database of product performance across varied applications, assuming customers are even willing to give the competing products a try.

Switching suppliers is also costly. Redesigning printed circuit boards (PCBs) to accommodate a competitor’s product involves CAD redesigns, prototyping, and repeated testing—an expensive and time-consuming process. Engineers generally avoid these efforts unless there is a vastly superior alternative. Since device designs don’t change frequently, customers prefer proven solutions to mitigate risk, reinforcing ADI’s incumbent advantage. In fact, reliability is the primary competitive factor in the analog space, and ADI’s robust data and reputation provide it with a near-insurmountable edge. According to one industry expert, competitors rarely attempt to directly challenge ADI on its core products.

One of ADI’s key value propositions is its ability to serve smaller customers who need a few analog ICs for their devices. Instead of investing heavily in R&D to develop these components in-house, these customers find it more cost-effective to purchase from ADI, a company that specializes in these solutions. With a vast customer base, ADI holds significant bargaining power on pricing.

The long lifecycle of analog semiconductors further bolsters ADI’s position. Approximately 50% of ADI’s revenue comes from products that are over 10 years old. This longevity allows sunk capital expenditures to generate cash flows over extended periods with minimal incremental capital investment. Semiconductor equipment is durable and does not require frequent replacements.

New entrants face steep challenges due to higher unit costs stemming from a smaller revenue base and similar fixed-cost investments. Additionally, acquiring customers is difficult; most are unlikely to switch from an established supplier like ADI unless a “socket change”—a fundamental redesign—forces them to rethink their choices.

Forward growth drivers

Several of ADI's end markets are undergoing secular transformations that will drive both unit growth (e.g., the rise of electric vehicles) and increased content per unit (more analog semiconductors per EV). These trends are set to expand ADI’s footprint in high-growth sectors, particularly in the automotive (namely, electric vehicles) and industrial markets.

However, there are a few risks on the horizon.

One of the main risks stems from ADI’s exposure to China, where local customers are increasingly turning to domestic suppliers. As China aims for greater self-sufficiency in semiconductors, local companies focused on trailing-edge manufacturing—such as those producing analog chips—are gaining ground. This shift is further exacerbated by the fact that some of these local players were founded by former ADI employees, who are enticing current ADI employees with higher titles and pay. This could undermine ADI’s market share in the region. Whether this can be offset by nonlinear unit growth in the U.S. remains to be seen.

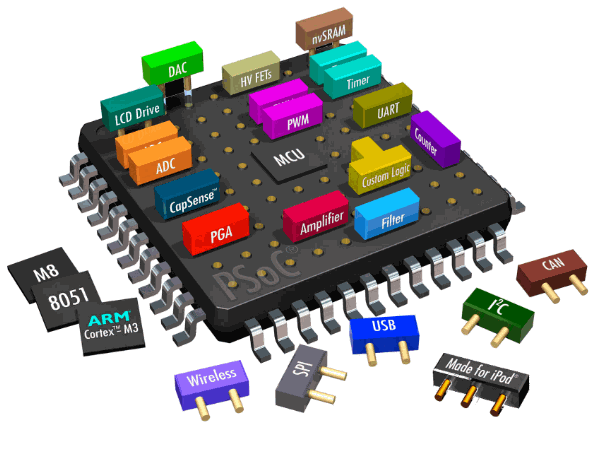

Another challenge to ADI’s growth comes from the increasing trend toward System on Chip (SoC) designs, which integrate multiple functions into a single chip, reducing the need for multiple discrete components. This trend is a “socket.” SoCs have the potential to improve performance, power efficiency, and lower costs, particularly in sectors like communications (e.g., 5G infrastructure), where they can handle both analog and digital functions. For ADI, this shift could impact demand for individual analog components, which have traditionally been its core business. However, ADI has been addressing this by diversifying its product offerings into mixed-signal and digital solutions. ADI’s ongoing push into more complex, integrated solutions helps mitigate the risks posed by SoC development, allowing it to remain competitive as the market evolves.

If you want to learn about the other moat GOATs I have written about, click this.

Thanks for reading. I will talk to you next time.

Disclaimer: I have no positions in the companies discussed in this article

If you want to advertise on my newsletter, contact me 👇

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you. 🙏

Wonderful article!!! Their specialised technical expertise, the mission-critical nature of their products, and the resulting high switching costs create a significant "moat" around their business. https://latebloomr.substack.com/p/analog-devices-adi-business-assessment