The financial services industry can feel like an unbreakable class structure, but many people, including myself, break into high finance daily, proving it's possible. I receive numerous questions on this topic but have never organized my thoughts—until now.

I'll discuss how non-front office professionals break into high finance in the context of a middle office (risk management) employee, though the advice applies to back office roles (HR, IT, operations, etc.) as well. Let’s dive in.

Don’t say “I want to work in the front office”

We "go front office" for the money, but simply stating "I want to work in the front office" won't help. The front office includes various paths, each requiring different skills and stories. Often, your aim is simply to earn more and escape your current job. However, the hiring manager is looking for candidates committed to their specific path.

Therefore, you need to tailor your messaging: be clear about wanting to enter investment banking (“IB”), hedge fund (“HF”), quant, and so on, rather than vaguely “aiming for the front office.” Being specific helps others help you.

Not many transferable skills

You might think, "I have a PhD and do mathematically rigorous work. Why can't I do front office work?" However, the goal of a business is to generate revenue and profit. Front office professionals generate revenue. And they do so with simple math and slide decks.

In contrast, middle office roles don’t generate revenue. Of course, non-compliance with regulatory risk requirements can hurt shareholder value, but their work doesn’t create incremental shareholder value, no matter how complex the math is (it can get rocket science-ish quickly.)

The higher you go in the corporate world, the less it is about technical expertise. Big-picture thinking, qualitative insights, decision-making, and political acumen are more crucial. Without business acumen or communication abilities, you will be overshadowed by those who excel in these areas.

As you move from the middle to the front office, the rigor of analytical work paradoxically decreases, and few skills transfer, necessitating upskilling. Front office jobs require qualitative and strategic thinking. While investment bankers and private equity or hedge fund investors do financial modeling, their industry insights, understanding of business drivers, and sales skills create value for their clients and firms.

I was drawn to equity investing for its qualitative and strategic aspects, and I had to adjust to the imprecision compared to middle office work involving equations and coding. If you want a front office job, realize now you need to develop a set of “softer” skills.

Stop gathering professional badges

Most of you crave structure. That’s why your first instinct is to sign up for professional exams when you don’t want to make an effort to understand how to get into a high-caliber career path. And you think professional credentials will magically earn you a seat at the table.

But how many of your middle office friends have CFA and FRM and are still stuck in the middle office? Plenty. Selling hopes is clearly a great business model.

The reality is that front office roles are looking for people with soft skills and ability to apply technical skills to real world problems. Almost all can do the math on a spreadsheet, but fewer can build relationships and sell. Instead of piling on more certifications, you should prioritize developing the needed skills. Get people to like you and build a network. This leads to my next point.

Communication skills

Work on your communication skills, especially if you are not a native English speaker. Front office professionals may not tell you this directly because it could be misconstrued as discriminatory, but communication matters immensely. If you can’t communicate, you won't go very far in the corporate world in general, and you certainly won’t succeed in high finance.

To improve, read a lot and write consistently. Practice public speaking by joining groups like Toastmasters. It’s not what you know that gets you the job, it’s what others think you know that gets you the job.

I've seen this play out during my MBA. Before investment banking recruiting started, I could already tell who would get an IB offer and who wouldn’t. In hindsight, my hit rate was high.

My assessment wasn’t based on intelligence or credentials but on their general "smoothness." At recruiting events, some candidates struggle with English or lack knowledge of cultural references, some are socially awkward, and some just have poor fashion sense.

These individuals are often quickly eliminated from contention while their peers advance. If senior bankers don’t like you, they can’t envision working with you or seeing your potential to become like them.

If you aim for the front office, think about whether you have the necessary soft skills. This is true even for seemingly introverted paths like private equity and hedge funds. Hedge fund analysts don’t just sit in their offices reading 10-Ks; they meet many CEOs and CFOs and talk to industry contacts to deeply understand each investment situation. If you are likable and ask good questions, you’ll gain valuable insights. Otherwise, you might as well just read.

No matter where you go, people skills are essential. Work on them. What is it like to have people skills? Well, that leads to my next point.

Network with front-office professionals

Wayne Gretzky tells us to skate to where the puck is going, not where it has been. So, make more friends with front office people. Get coffee with them. There is no better way to gain insights into what it takes to go where you want to go.

Networking offers numerous benefits:

Identifying Necessary Skills: You will understand the specific skills required for the roles you’re interested in.

Gaining Perspective: You can get a realistic view of what it’s like to work there, helping you decide if it’s truly the path you want to pursue.

Vouching for Your Candidacy: Your contacts can advocate for you when opportunities arise, if they think you are good, of course.

Not knowing what you are getting yourself into is where many stumble because they discover they don’t love what they pursued after getting into the profession. Which leads to my next point.

Self-introspection

There is no career path that offers more money and intellectual stimulation without more stress, hours, and career risk. You need to understand what you are signing up for and then decide whether this is truly something you want to pursue.

A few months ago at a tech party, I told someone that I used to work at a hedge fund. Her first question was, "Oh, why did you quit? You make so much money at hedge funds." I said, “Yes, but it’s stressful,” and then she had her “ahah” moment. It’s common that most think one-dimensionally when making career decisions, but in reality everything in life has trade-offs, which I have discussed in the past as the “grass is greener syndrome".

In hedge funds, you are never really detached from the news when the market is closed.

In private equity, you work long hours and endure endless administrative tasks and bureaucracy to push through deals.

In venture capital, you have to socialize all week at events to find the next Mark Zuckerberg and feel pressured by the partners questioning why you haven’t brought in new deals.

In investment banking, you are always on call, and every vacation can be interrupted by a “please fix” that forces you to whip out your laptop while you are in the middle of a nice dinner.

Yes, you get paid better, and the work is more impactful and intellectually rewarding, but are you willing to suffer for it? It’s a yes if you are motivated by the content of the work. It’s a no if you are only motivated by the money, or worse, the prestige of claiming to work in the profession to compensate for a lack of self-esteem stemming from deeper issues that cannot be solved by your professional identity.

Persistence and aggression

But you need to be persistent in putting yourself out there because opportunities won’t be handed to you on a silver platter. And you will get rejected a lot.

Some may call it sheer aggression, but those who go for it get to eat. That’s how competitive it is to get into the front office. That’s how competitive it is to survive and thrive in the front office as well.

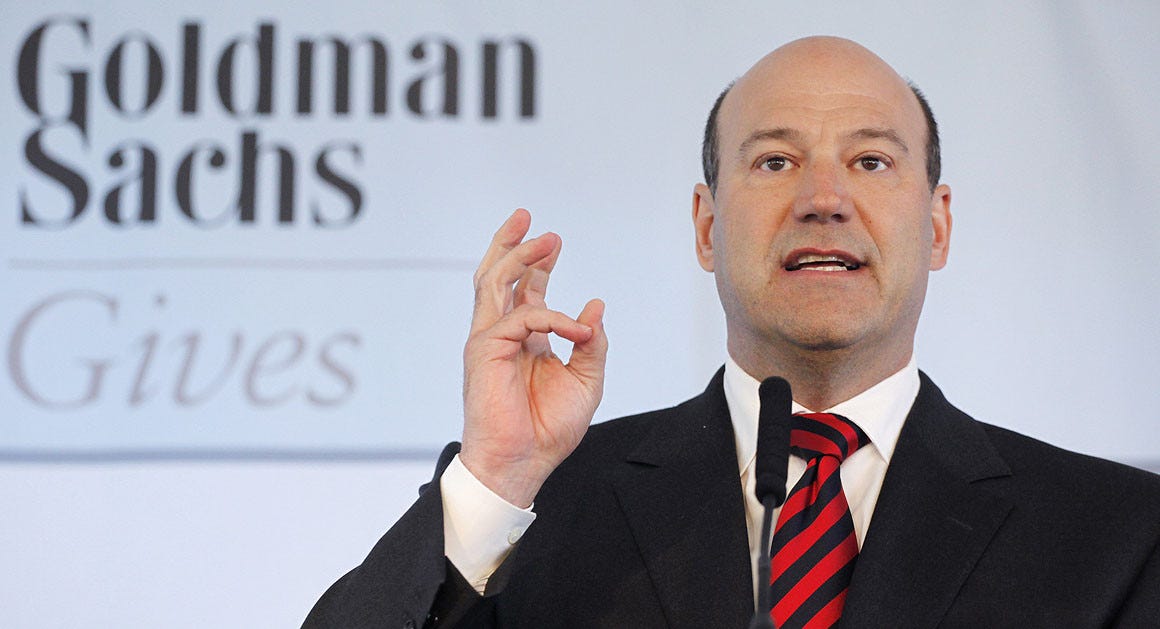

Gary Cohn, ex-Chief Operating Officer of Goldman Sachs, got an interview with a non-target school background because he offered to share a cab ride with a commodity trader to the airport and he impressed the trader during that 45-minute ride. The rest was history.

You need to develop that mentality to get shots on goals.

Cast a wide net

Be open-minded about where your first front office seat will be.

Just as I discussed the pitfalls of having a Tiger Cubs or nothing mindset for hedge fund recruiting, you can't have a Bulge Bracket (BB) or nothing mindset. Tiger Cubs, BB banks, or mega PE firms have brand recognition and therefore bargaining power in attracting candidates.

Smaller firms are usually more open-minded about taking candidates with a non-traditional background, so you should include them as your search targets. Perform well on the job you can get and continue to build your brand through networking. Sooner or later, you can level the perception and land at your dream firm. However, it's unlikely you can land at a brand name firm in a desired function in one shot.

This leads to my point on prioritizing functional relevance over brand.

No advantage as an internal candidate

A firm’s cost centers, such as risk management (middle office) or operations (back office), are not respected by your front office colleagues.

Even if you work at a prestigious firm like Goldman Sachs in operations or risk management, you will not interact with the firm’s investment bankers or equity research associates.

Therefore, definitely don’t base career decisions solely on the firm brand because you don’t have much insider advantage (aside from sharing the same email handles.) Instead, prioritize getting into the functions you want. For example, if you aspire to a career in equity research and you have offers from Goldman Sachs in operations and from a middle-market bank in equity research, take the equity research offer. It’s always easier to move across firms when you have functional competence than trying to move within the firm without transferable skills.

MBA as a last resort

When all else fails, consider a full-time MBA program. But I always consider an MBA as the literal last resort because most of the time someone growth-minded can achieve the move without a certificate with high explicit costs (tuition and living expenses) and implicit cost (foregone salary).

Keep in mind that business schools also want candidates with clear post-MBA career goals, so we are back to the first point that “don’t say, I want to break into the front office”. That’s unlikely to impress in your admission essay. Instead, articulate why you want to pursue a specific career path, such as investment banking, and how an MBA will help you achieve your professional aspirations. But the topic of MBA deserves its own video series, so I will not elaborate further.

If you want to advertise in my newsletter, contact me 👇

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you.