How to Break Into Public Equity Investing

and why you might be failing

I share the key lessons I have learned on how I broke into the investment management industry from sell-side equity research.

Mindset training

You might be wondering: Why is mindset training on top of the list? The reason is: going to the buy-side is one arduous journey - there will be rejections, there will be ghosting, etc. You have to believe that perseverance will pay off (I am an example and so are others who have made it).

The best book on the subject is Mindset by Carol Dweck. Read the book, internalize it, and go get what you deserve. I also recommend Influence by Cialdini, because you will be networking a lot and the timeless techniques in the book are super helpful for your search and more importantly for you to become a better person.

Buy-side is a very intrinsic profession

You need to demonstrate the ability to think about businesses and the market and then articulate concisely why an investment opportunity is attractive. These skills cannot be crammed - a strong candidate will easily show passion and knowledge in the interview.

Value investing has now been very well popularized that any amateur can throw out words like "margin of safety" or "Mr. Market" without knowing how to apply them. Sadly no one pays you to recite Ben Graham's book, you only get paid for finding the next 50-cent dollar bill.

Create real work products

Hiring firms will want to see a stock write-up or two at some point in the recruiting process. From the interviewer's vantage point, it helps eliminate candidates who aren't passionate and can't demonstrate the intrinsic ability to pick stocks. "Everyone wants to go to heaven, but nobody wants to die." So the stock write-ups are a highly effective way to weed out people who "don't want to die".

There are a few good articles on the forum on how to do a stock write-up, so I won't go into that. Make sure you have a few strong stock pitches (long and short) that are concise. It's always better to have strong pitches in smaller numbers than to have 10 mediocre pitches. These pitches help you land networking calls and interviews. You will likely do a stock case for the final round interview anyways.

Define philosophy and addressable job set

You will find that a lot of buy-siders are very biased toward their way of thinking about investing (so much for appreciating the diversity of thinking). You need to know what kind of stock situations/businesses resonate with you. All the tools I have been building are there to help you.

It's going to be a balance between having more job leads where you have to somewhat bend your philosophy and having fewer job leads but you will be a nearly perfect fit. If you decide to go for a larger addressable job set, you have to prepare more tailored stock pitches - eg. two value stocks, two growth stocks, two special-situation stocks, etc.

Although Mr. Buffett says growth is part of the value (which is true), you likely won't get an offer from a value shop by pitching Carvana (and you definitely won't get an offer from a growth shop pitching a highly cyclical commodity business).

Networking

Networking is not optional - it's the core search activity. That's how you get job leads. There are a lot of people on the buy-side who are willing to give back - especially the ones who have been in your shoes. You just have to ask. And this is the reason why I created the buy-side networking course to guide you.

My tips would be:

Have a CRM system. Use a spreadsheet to keep track of your connections (search on WSO for a template).

Do your homework: know their professional / education background obviously, but also know the fund's strategy (using Form ADV) and positions (using Whalewisdom and Dataroma; mutual funds' short positions can be found in the prospectus / annual filing)

Rehearse your story / pitches: rehearse a 2-minute story of your resume and don't ramble, buy-siders are assessing your ability to get to the essence - a core competency. The same goes for stock pitches. Time yourself and refine if it's longer than 2 minutes.

Be consistent with your brand: One of my favorite graduation speeches is from Jamie Dimon at HBS where he said "there is already a book written about you". Buy-side is an incredibly small community and people know each other.

As you network, build a consistent brand so that your future employers don't sniff out lies when talking to other funds about you. For example, I got an interview with a very respected value fund because the Director of Research talked to someone at the hedge fund where I was an intern and that someone put in good words for me.

LinkedIn is most effective. Buy-siders get a lot of emails (sell-side spamming included), I have found that LinkedIn has the highest response rate. Use your judgment on how much you want to tailor your message because of the time tradeoff: the goal is to convince your connection that you will not waste their time.

Twitter and Substack: Twitter + Substack combo is not that differentiated in the investment world anymore. If you can put out good stock write-ups and have insights to share with the Fintwit community, you never know a job lead could come through your DM (I have seen smaller funds tweet job openings). The key is your products (write-up and comments) need to be good.

Keep your relationships: Connections have lifetime values, it's your responsibility to keep them. Don't think of them as just a means to get jobs - they are mentors who can make you a better thinker, person, and investor. Send them interesting articles and big reports your team puts out, follow their fund's quarterly letters, and generally be of value to them. Reciprocity is a powerful thing - focus on giving.

Have an ask at the end: At the end of your informational interview, ask for a referral to talk to two other people.

Sourcing Job Leads

The toughest part is to even know where the job openings are - buy-side is so relationship / lineage-focused. Few points:

The less publicized the job is, the better it is because it is likely zero competition.

You never know - always apply / reach out, maybe you saw a role that you are over/underqualified for, but HR/hiring manager might forward your resume to a team that has an unposted opening that is suitable for you.

Be open to relocations.

I categorize the sourcing channels into the following:

Equity salespeople: I did not build close relationships with them but I heard they are an excellent source of jobs. Just make sure you are really personally tight with them to comfortably fly under your boss' radar.

LinkedIn: Set up job alerts under keywords such as "investment analyst"

Firm career website: create accounts on the investment management firm's career website, submit your resume, and set up alerts for investment-related jobs. If something comes up, find out who the hiring team is, use your bank's CRM system to cold email the hiring team, attaching your resume and stock write-ups. Avoid dealing with HRs until after you have gotten the job.

Job board sites: such as eFinancialCareer, GoBuySide, Pinebase, etc.

Bloomberg Terminal: a lot of small funds post on the terminal for openings

Investment platforms: this takes the most amount of work but you can submit your stock write-ups to Value Investor Club (VIC) and SumZero and hope to be accepted as a full member.

SumZero particularly has a job board where small funds post. Submit your best work for a chance to be accepted.

VIC has secret meet-ups among members, but I presume it's hard to get invited to those even if you are a full member.

Recruiters: They are much more useful for candidates who "fit the bill" (the 2-year IB program “graduates” with a top-20 U.S. university degree), but you never know - build relationships with recruiters and they might tell you some good leads, most of their searches are for more short-term minded funds.

Deciding on offer

It came down to 4 criteria for me:

Investment philosophy: Perfect alignment doesn’t exist. So, just make sure it does not violate too many of your core principles as an investor (eg. the trading-the-quarters and event-driven/special sit shops are my no-go zones)

Quality of capital: "Investor alpha" is real, preferably you want to be where the capital lock-up is solid

People: The buy-side generally has small teams. Make sure the people (especially the founder) are not assholes and can teach you their process and investment acumen.

Monetary: hopefully the founder is willing to monetarily take care of you as the fund grows, and be open to a pay cut on the base salary to trade for the future upside

Types of Struggling Candidates

It’s no myth that investment management (the “buy-side”) job openings are scarce and competitions are fierce. Based on interactions I had with aspiring candidates, I felt the need to lay out what doesn’t work.

Before I start, I will note two exceptions (that I can think of) to the rule: 1) the “idiot sons and daughters of clients / LPs” type, who can get anywhere without conforming to my criteria below, but most of us aren’t born rich, so read on 2) the type who broke in despite having fatal flaws, whom I believe will have limited longevity in the profession than the truly prepared.

In my opinion, a candidate should possess the “3Cs” below (cheesy, but for the marketability of the article):

Content: actionable stock ideas

Concept: frameworks to analyze and value businesses, and processes to identify compelling ideas

Connections: a network of buy-siders who can refer you to openings

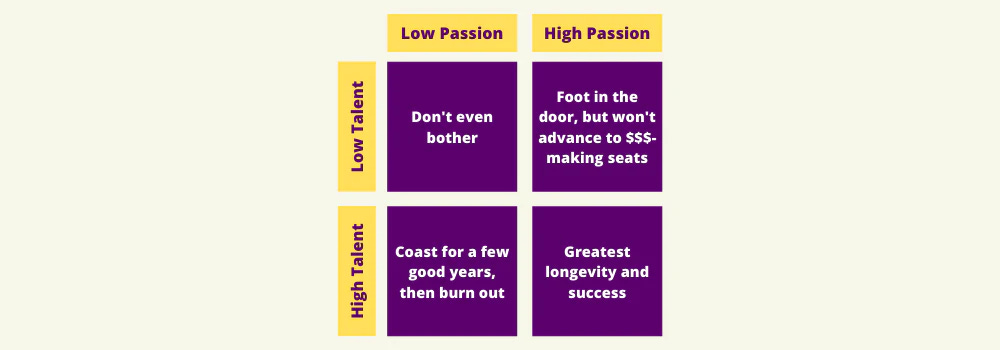

For reference, I really loved flaco’s (on WallstreetOasis) 2x2 matrix concept that’s related to how I am framing this:

Candidates come in the following categories with their shortcomings:

The Clueless

The worst candidates. They make no effort to understand the day-to-day of a research analyst and have no passion for investing - just here for the money and the prestige. They see buy-side as a career path where the financial reward is limitless (true) and work-life balance is great (also true), but missing the complete picture of the deceptively many hours of personal time dedicated to better understanding the world, forming contrarian views to identify mispriced stocks to generate alpha and refining personal investment process. This is the same type who will most likely ask how much salary one makes at a hedge fund or which tiger cub is “better” (if you are asking how much people make on the salary side, it's the first telltale sign that you don’t know where the action is in this business). I am not going to bother discussing them here, other than saying: you guys are not breaking into the buy-side.

The Producer (not a good way)

Stock idea (content) matters, but how can one come up with a solid work product without a process of identifying ideas, analyzing industries and businesses, and finally valuing that business? This type of candidate needs to develop a toolkit to alleviate a hiring firm’s concern about whether the candidate has a repeatable process to handle whatever stocks are given to them. I suggest reading a few classic investing literatures (think Seth Klarman, Phil Fisher, Joel Greenblatt, etc.) but don’t overdo it, and then start looking at stocks and applying the concepts. There are always going to be more people who can recite famous investor names or quote jargon such as “margin of safety” and “Mr. Market” than people with the ability to generate real alpha. Become the latter.

The Networker

Buy-side is more skill-based than other professions. It’s a wrong approach to start networking without first developing intrinsic skills. So before you start reaching out to people, produce real stock ideas, develop your own research process, and rehearse your story of “why buy-side now, why this firm, why this style of investing”. Trust me, you can know thousands of buy-siders, but if no one is willing to refer you when a good opportunity comes along, you are better off quietly grooming yourself as an investor first.

The Theorist

I fall into this camp, hard. I self-taught investing by excessively consuming Buffett letters, investment books, and hedge fund letters and it’s not a good thing. Yes, I have a lot of frameworks, but in hindsight, I should have spent more time looking at different companies. As nice as it is to speak passionately about the theory of identifying, analyzing, and valuing stocks, funds pay me to apply concepts - make money. So there IS such a thing as too much reading. For those that think they might fall into this camp, remember to allocate enough time to studying more businesses and industries.

The Directionless

There are infinite ways to skin a cat as an investor. You cannot be a jack of all trades, so the buy-side search becomes a balance between breadth and depth. Obviously, you don’t want to be too limited to a niche where there are five funds in the world that perfectly suit your personal style, but you also don’t want to be stretched too thin by trying to please, for example, both a multi-manager and a long-only. The solution: talk to investors from many styles, read a survey book (John Train’s “Money Master of Our Time” is the best one, “More Money Than God” by Mallaby is another good one), and assess for yourself what styles you resonate with, and then it’s your decision of how big of an opportunity set you to want to target, which directly impacts how many stock ideas you need to produce. Finally, remember that as long as you are not the portfolio manager, perfect alignment does not exist, so you should focus on finding a firm where you don’t have to adapt (or bend yourself) too much.

The Flawed Personality

Just like any job, the buy-side role has a selling component: convincing a PM to allocate capital to your stock ideas (or to give you the job, that’s the first sale!), asking the right questions to get what you need from company management / investor relations / sell-side analysts, and so on. You need to interact with many external parties and that requires strong written and verbal communication skills and being a good human being. Both arrogance and social awkwardness can hurt but I view arrogance as a much bigger deterrent because in a typical hedge fund small team environment if you fail the “airport test”, tough luck getting in or surviving the job. With that said, there are tons of a-holes and antisocial types in this business at the top, so maybe it’s not as big of an issue as I think.

The Mentally Unprepared

In a profession where most jobs are filled without ever hitting a job board or a recruiter, it can be frustrating for candidates who get rejected, not knowing when the next opening comes up. I’ve been there and have the following suggestions:

First, accept the reality that it’s not a fair game - for every opening, you could be competing with someone who has 3-5 years of real buy-side research experience. From the hiring manager’s perspective, a plug-and-play is always better than having to train someone, no matter how much potential you have.

Second, it is a numbers game and it’s a cliché but it’s true - you only need one job, this search is as much about the ability to get back up than about getting in. Stay persistent.

When I was in business school, I wondered why Carol Dweck’s book “Mindset” appeared on a reading list for an investment management club. After reading the book and going through the journey myself, I wholeheartedly put Carol Dweck’s on the top of my investing reading list as well. For those who have read the book, remember that growth mindset can help you stay resilient. So, if you get rejected for that long-only role, pick yourself up and remember it does not invalidate your competence and you just need to keep getting better and eventually someone will give you a chance.

The One Trick Pony

As previously mentioned, job openings are hard to find. If you have trouble knowing where the job openings are, think outside of the box. Use as many channels as you can: start a Substack, start a Twitter account and interact with real investors on it, submit your write-up to Value Investor Club and SumZero; Hell, submit your stock pitch to Sohn Conference Competition (what’s the worst outcome? You don’t hear back, but you got nothing to lose, rest is all upside, you could be that Wharton undergraduate who got hired by Ruane Cundiff).

Continue to use the more traditional methods as well - cold-email (or LinkedIn) associates and PMs on the hiring team, applying on career website (worst method, going back to my philosophy of “avoiding HRs at all cost”), and applying on other independent job boards (or closed-loop job boards at your business school or undergraduate school). Make sure to get a buy-sider to “bless” your stock idea before building your brand on more public channels like Twitter, Substack, VIC, and SumZero because you should start off on the right foot (especially if you decide to use your real name) when building an online presence. Always assume everything you have published online is permanently searchable.

Conclusion

Buy-side search is hard, but I think openings will continue to exist. The industry is shrinking but if public market investing is what you are truly passionate about, don't give up and be consistent and persistent. Continue to work on your craft as an investor. Finally, pay it forward by helping future aspiring investors.

Good luck!

Thanks for reading. I will talk to you next time.

Resources for your public equity job search.

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | LinkedIn | YouTube

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you.