So, you've set your sights on sell-side equity research. And every job posting you've come across reads something like this:

We are looking for someone with 2-3 years of experience in equity research, buy-side experience, or investment banking experience in the sector we are hiring for.

I know what you're thinking: how on earth do I land my first job in a field that requires me to have prior experience in that exact field?

Well, I’m here to show you how to do it.

If you want to WATCH this article:

One big takeaway (if you don’t want to read on)

If there’s one key takeaway from this video, it’s this: You have to know how to do the job before you get the job. If you can’t answer technical questions about accounting, fundamental analysis, and valuation—or if you don’t have a sharp, actionable stock idea you can explain clearly—you’re not getting hired. Let that sink in.

On the flip side, if you’re genuinely passionate about this career, it will show. You’ll outperform the competition and land multiple offers. But first, let’s clear up a few misconceptions that might be holding you back.

Misconception #1: "2–3 years of experience" is a hard requirement.

This is a rule of thumb, mostly for recruiters who don’t know any better. Firms prefer candidates with prior sell-side experience because they can step in and contribute immediately—especially if they’re moving within the same sector. But that doesn’t mean you’re automatically out of the running.

Misconception #2: You need a job to build the skills.

The great thing about public equity is that you can develop the necessary skills without being hired first. If you can build models, interpret earnings results, value businesses, and understand what moves stocks—**and if you don’t have any personality flaws that would make it risky to put you in front of C-suite executives or institutional clients—**you can get the interview.

The challenge? Most people lack the passion and discipline to bridge the skill gap. Don’t just prepare for interviews—prepare for the job itself. Getting hired at all costs won’t help if you can’t perform once you’re in the role. Most teams won’t train you. Senior analysts are focused on generating revenue and strengthening relationships, not hand-holding. If you limp your way into a seat, you’ll still fail. Why not actually get good at researching companies now, so you can shine once you're on the job?

Where are these elusive jobs?

Equity research teams operate lean. The largest sector teams might consist of only 5-6 people, and unlike in investment banking, turnover is minimal. If you've been eyeing this profession, you've likely noticed the scarcity of job openings.

To save you time, you can leverage my research job board where I handle the cross-checking and setting up job alerts with all the firms for you. So that you can focus on perfecting your stock pitch and networking.

To help you navigate, I've compiled a list of firms that offer equity research to institutional investors. They are your potential next employers.

Broadly, these firms fall into three categories:

Big banks: Think Goldman Sachs, J.P. Morgan, Bank of America, and Morgan Stanley.

Regional and middle-market: Think Piper Sandler, Raymond James, Truist, and TD Cowen. There are also tons of lesser-known ones. This segment has been consolidating, such as Piper Jaffray merging with Sandler O'Neill and TD acquiring Cowen, Suntrust merging with BB&T to form Truist.

Boutiques: They don't offer investment banking services, so they tend to be more objective and monetize their products differently. Major players include Bernstein, Wolfe, Melius, and Zelman. Research boutique is a really tough business and is typically started by a legendary analyst who used to work in one of the former two categories (eg. Ivy Zelman - Credit Suisse First Boston, Dana Telsey - Bear Stearns)

Now that you understand the landscape, apply the two-pronged approach: develop a strong stock pitch and source jobs by networking.

Leverage job boards

Create LinkedIn job alerts with keywords such as "Equity Research." You'll need to sift through them one by one to ensure it’s an active search.

Next, set up job alerts on firms with career websites. For some firms, you'll need to bookmark the website and check it daily, while for others, you can sign up to receive emails for new openings.

Check general finance job boards like eFinancialCareer daily. Finally, leverage profession-specific job sites if you are focusing on specific industries. For example, Docjobs for biotech and life science seats.

With so many job board options, the process can quickly become overwhelming. That’s why I created my own job board, aggregating research job openings daily to save you time. I handle cross-checking, validation, and set up alerts across firms, so you don’t have to. If you want to save time, check out my equity research job board.

As you expand your sell-side research network, keep an eye on senior analysts' LinkedIn/Twitter accounts; they can post "I am hiring associates" statuses. This is your cue to send a tailored message and a stock pitch to initiate a conversation. Be particularly diligent between January and April, as associates tend to move after bonuses, creating job openings.

Networking

Networking not only keeps you top-of-mind when a job opens up but also provides insights into your future boss’ work style and mentoring abilities.

Target three broad types of people:

Junior Employees (Jr. Analyst, Associate, VP)

Senior Analysts (i.e., the MD or Director with sector coverage)

Director of Research (DoR)

You can choose whom to reach out based on your affinity with them.

The DoR manages the entire equity research department, including talent sourcing. The DoR can connect you with future openings within the firm, giving you a steady pipeline of leads. Just keep in mind that you won't fully understand a team's dynamics until you speak with the hiring senior analyst and his/her juniors. Nevertheless, DoRs serve as a powerful top-down funnel and should be part of your job search strategy.

With sector team junior employees and senior analysts, you can make a more relevant pitch because job openings will come from specific teams.

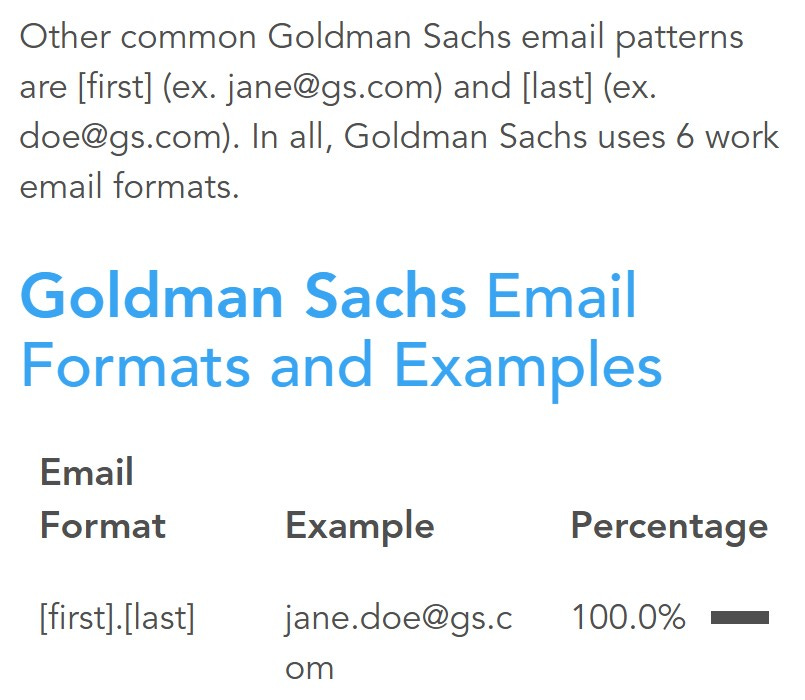

To find their contact information, start by searching for equity research reports. This is an easy way to uncover: 1) Your contact's email address.; 2) The email format for a particular research firm.

Tools like Rocketreach can provide insights into the probability of the email format for a given firm, though you may face challenges if the firm uses middle names in their email addresses (if so, you have to ask around.) Additionally, some comprehensive reports include the entire research department roster along with their email addresses. Certain firms also list their analysts and their contact details directly on their websites.

In preparation for networking, prepare three items: an introductory message, a stock write-up, and an Excel financial model.

Your introductory message should effectively convey:

Why you're reaching out: If there's a current opening, express your interest: "I am interested in working on your team." If not, convey your intention to learn about their successful career in equity research. Some schmoozing doesn’t hurt even if you are talking to a bottom-of-the-barrel tier analyst.

Know your story: Explain your professional background. why you're pursuing a career in sell-side equity research, your passion for stock investing, and how your past experiences prepare you for this role. Highlight transferable skills.

Wall Street professionals are busy. Keep your message brief and focused. Remember, it's your responsibility to make the sale.

Lead with a stock pitch. Attach your stock write-up and Excel financial model with your intro message to demonstrate your technical skills. Senior analysts always prefer current research associates. First of all, the laterals—they can model, they already know how to write. Second, they already understand a typical sell-side workflow. The latter is impossible to learn without being in a seat before, but your stock pitch can 100% reduce someone's concern about your technical skills.

Pitch a stock outside of your interviewer's covered industry. For example, if you're interviewing with a media analyst, pitch a non-tech stock. Aim to be as far away from TMT (Technology, Media, Telecom) as possible.

Prepare multiple stock pitches if you want to broaden your opportunity set. You can pitch your tech stock to the healthcare analyst and your healthcare stock to the tech analyst.

If you're not applying for an MBA associate position and this is your first job in sell-side research, your stock call doesn't need to be correct. Focus on delivering a well-rehearsed pitch and demonstrating a clear understanding of what drives the business and your thesis logic.

Familiarize yourself with the major industry trends in the sector you're interviewing for. This demonstrates your interest and allows you to ask insightful questions.

End with a call to action: Ask to set up a call or an in-person coffee chat to further discuss opportunities.

Here's when you should avoid reaching out:

Mondays: People are usually catching up on tasks after the weekend, making it a hectic time.

During market hours: People are focused on market activities, making it difficult to focus on non-work related things.

During earnings season: When big banks release earnings reports, earnings season starts. Try to schedule calls before the start of earnings season because everyone in the ecosystem is working longer than usual hours.

Holidays: people don’t want to talk about work on vacation

Friday afternoon: Many people are already winding down for the weekend, and productivity tends to decline, particularly before a long weekend.

If you don’t receive a response: Follow up once after one week. Follow up once more after two weeks. If you still don't receive a response, take it as a hint and refrain from further follow-ups. It's best to move on and focus your efforts elsewhere.

Keep track of your outreach efforts using a spreadsheet to stay organized and efficient.

What the hiring team wants to ascertain

Can you model and write effectively? A stock write-up and Excel financial model can convince them that.

Do I like you? Am I comfortable putting you in front of buy-side clients or executives? Show enthusiasm for the role and industry, and ensure you come across as personable and reliable.

Are you committed to the profession? Convey your passion for equity research and your dedication to building a successful career in the field

Why we should choose you over other candidates? Emphasize any relevant experiences, skills, or achievements that set you apart from others.

Soft skills play a crucial role in this industry, so focus on aspects like your fashion sense and ability to communicate fluently in English. Effective communication is essential for influencing others to buy into your ideas.

Make sure you work on things like fashion sense and just the ability to speak fluent English. This is particularly true for non-native speakers because you need to communicate well verbally and in writing to sell your ideas to the salespeople, who then sell your idea to institutional buy-side clients—which are the hedge funds, mutual funds, or family offices that trade single stocks.

To paint you a picture - In equity research, there's a daily morning call where senior analysts pitch their stock ideas or thematic reports to salespeople. If you can't articulate your ideas concisely within 2-3 minutes, salespeople may not relay your pitch to buy-side clients, which can hinder your career progression. Therefore, honing your ability to communicate complex ideas clearly and succinctly is critical for success in this field.

Sell-side has a heavy emphasis on people skills because it’s a sales job, especially at a senior level. When the profession has the word “sell” in it, they really mean it.

As a Senior Analyst, you will be managing relationships with 20+ sets of company CEOs and CFOs, hundreds if not thousands of institutional investors, equity salespeople within your firm, and other contacts that help you understand your sector or provide channel checks. There won’t be as much spreadsheet work involved, it’s all people skills.

Here's how you can demonstrate your likability:

Read and Practice Techniques: Invest time in studying books by authors like Dale Carnegie and Robert Cialdini, who offer insights into effective communication and persuasion techniques. Practice their strategies to enhance your interpersonal skills. Leverage other resources from my recommended list if you find Carnegie and Cialdini insufficient for your needs.

Find Common Ground: Identify commonalities with your future team members to foster rapport and demonstrate fit within the team culture. Do your homework to uncover shared experiences, such as attending the same alma mater, sharing hobbies, or recently reading the same book.

Highlight Commitment: Even the lifers know the sell-side is not for everyone, but you need to convince the interviewer that you are not a flight risk. Every candidate approaches this question differently. You can highlight how you value that the sell-side gives you exposure to the diversity of investment styles (vs buy-side where you commit to a style), or continuity of coverage (vs. investment banking, which is transaction-based, meaning you won’t care how the company performs after you take it public, which becomes equity research’s job to cover it)

While soft skills are essential, your analytical skills provide the technical foundation. When it comes to modeling, here's how you can excel:

Colleges are not going to teach you this stuff, so you’ve got to teach yourself. The basic investment banking courses—they’re great for learning the mechanics, but to really stand out, you’ve just got to take it a little bit further.

Think about the drivers of revenue and cost for a business, especially when the company themselves disclose that kind of information. It’s really embarrassing if you don’t account for that. So don’t just plug in, “Revenue grew by X%” or “Cost is Y% of revenue.” You’ve got to go a little bit deeper.

Think from common sense how businesses work. We’re not really just cranking a three-statement model—which AI can do. Anyone who’s taken an IB modeling course can do that. What we’re expecting is that you add some unit economics to your three-statement model to show you understand what is really driving the business.

That alone will set you apart from others who are just keeping it at the surface level. I can immediately tell if you have no idea what drives the business and your assumptions going forward make zero sense—if it’s just “10% baseline revenue growth for the next five years” and you’re adding two minus two for your bull and bear case. That makes no sense.

Why you?

Be growth-minded: Never assume you are less competitive than others with more relevant experiences. You never know the trait that tips the scale in your favor. When I had zero professional experience in equity research, I got the job against a competitor who had 5 years of equity research experience because I have statistics and data skills that are valued by my team. An underdog mindset is good to have but it should only fuel you, so think hard about what makes you unique and lean into that strength.

For example, it could be:

Real industry experience (eg. you worked in life science sales, as an oil and gas engineer, developed an iPhone app, etc.): You dramatically underestimate how much of an edge industry experience is versus college grads who hit the research desk reading 10-Ks all day. I bet the oldies will tell you it’s the intel they gather by talking to people and “going into the field” at conferences or actual physical plants that gave them the biggest investment insights.

Special skills: Programming - VBA/SQL; BI/Data analytics - Tableau/Qlik/Alteryx

How do I break in from a unique background?

A lot of you come to me with the question:

"What about me? I'm coming from this profession—Big Four, private wealth, FP&A, middle office, risk. What’s my chance of getting into equity research?"

It doesn’t matter where you came from.

As long as it’s not a traditional path that equips you with core technical and soft skills, you think your situation is really unique.

It’s not.

Regardless of where you came from, you have to develop the skills sell-side equity research expects from you before you get the job.

Hope this helps. Make sure to read my other career articles on sell-side equity research. Let me know your thoughts in the comments.

Thanks for reading. I will talk to you next time.

If you want to advertise in my newsletter, contact me 👇

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you.

Very detailed article Richard, thanks loads! 2 questions: 1) Attaching resume in the cold email (with and without a job listing), yes or no? 2) How about cold emailing buysiders (PMs)? Thank you!