Finance Hall of Fame

The OG

These are the legends who pioneered an asset class or a financial product.

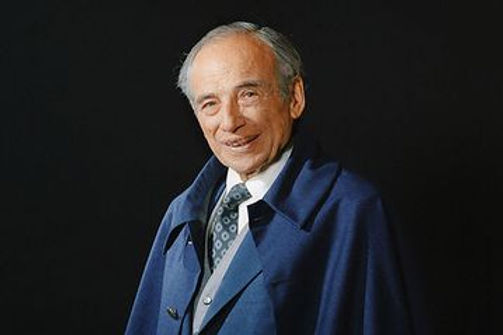

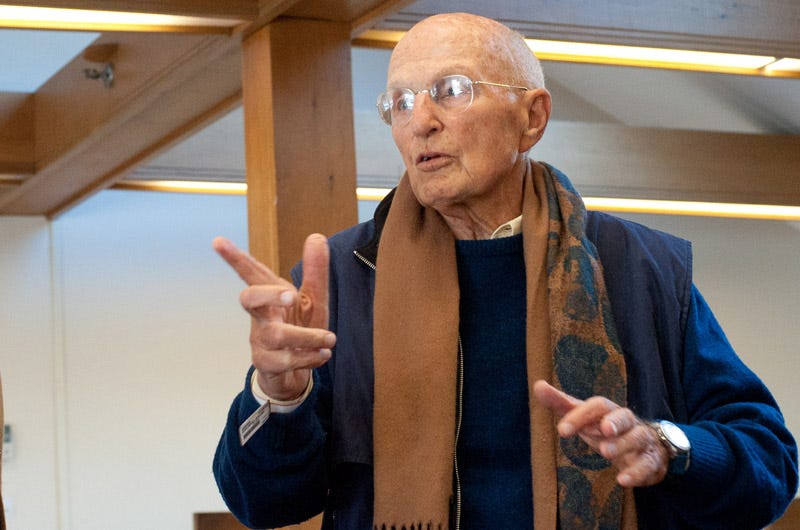

Warren Buffett

Warren Buffett (b. 1930, Omaha, NE) is the chairman and CEO of Berkshire Hathaway. He is widely regarded as the most successful investor of the 20th century.

Buffett earned a degree from the University of Nebraska and a master’s in economics from Columbia University in 1951, where he studied under Benjamin Graham, the father of value investing.

From 1951 to 1954, Buffett worked at his father’s firm, Buffett-Falk & Co., as an investment salesman. Eager to work on Wall Street, he was dissuaded by both his father and Ben Graham. Buffett even offered to work for Graham for free, but Graham declined. Returning to Omaha, Buffett worked as a stockbroker while also taking a Dale Carnegie course to improve his public speaking.

In 1954, Buffett joined Graham-Newman Corp., where he worked closely with Walter Schloss. When Graham retired and closed the firm in 1956, Buffett had amassed over $174,000 in personal savings (about $2 million today). He returned to Omaha and that same year launched a series of investment partnerships.

With $105,000 under management, he compounded capital at ~30% per annum over 13 years before merging it into Berkshire Hathaway. Under his and Charlie Munger’s leadership, Berkshire evolved from a struggling textile company into a diversified holding giant spanning insurance, utilities, railroads, consumer products, and financial services. Its Class A shares have grown from $19 in 1965 to over $800,000—a 19.9% CAGR versus the S&P 500’s 10.4% CAGR (including dividends) over the same period.

Buffett is admired not only for his investment acumen but also for his clear writing and storytelling, as seen in his widely read annual letters to shareholders.

A proponent of index funds, Buffett has long advised that those unwilling or unable to manage their own investments should stick to low-cost passive strategies.

On May 3, 2025, during Berkshire’s annual meeting, Buffett announced he will retire at year-end and that Vice Chairman Greg Abel will succeed him as CEO—bringing to a close a six-decade run that made him the world’s most influential investor.

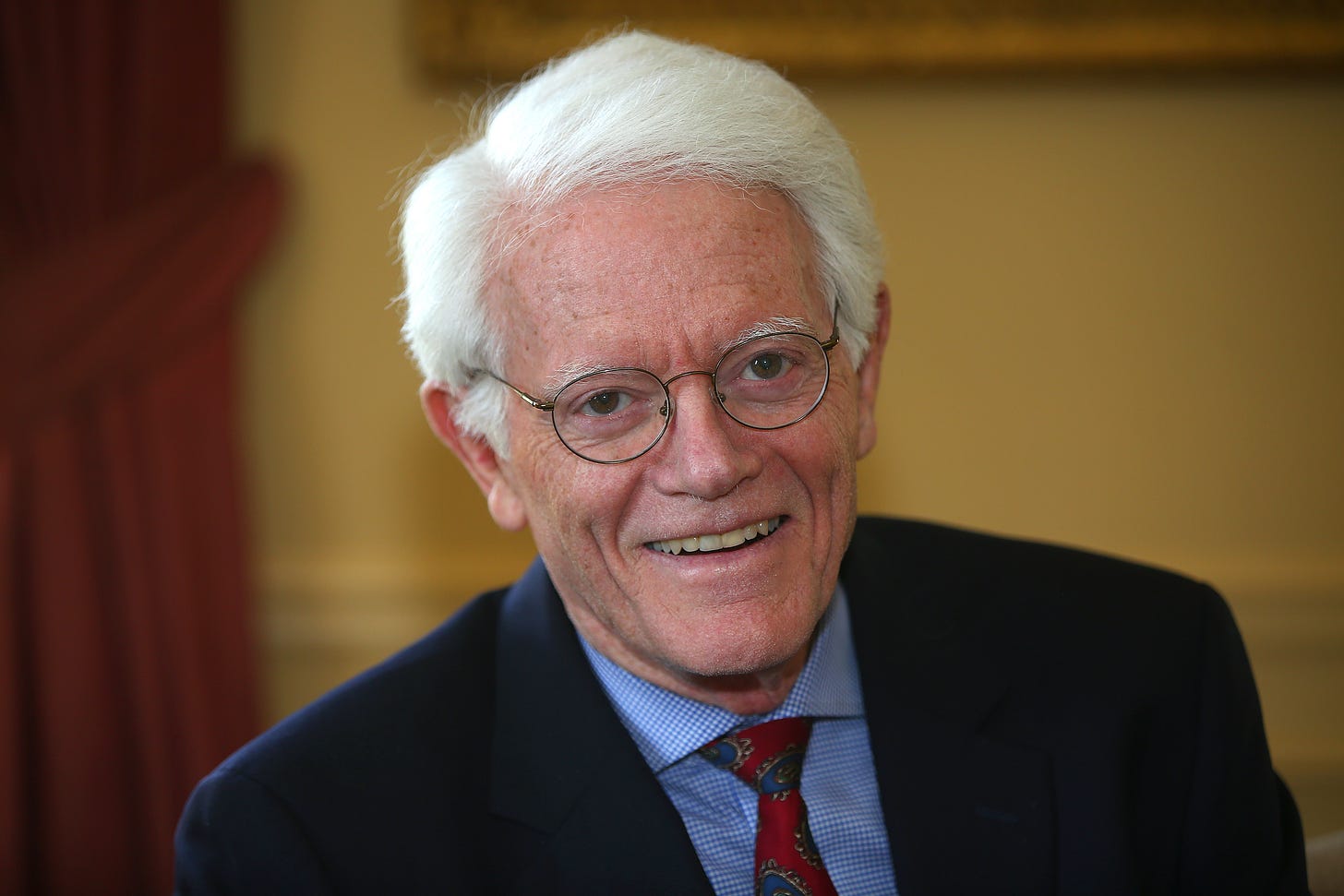

Jack Bogle

Jack Bogle was an American investor and the founder of Vanguard Group, known for popularizing the index fund.

Bogle was born in Montclair, NJ in 1929.

UG: Princeton University, Economics, magna cum laude

Walter L. Morgan, founder of Wellington Fund, hired Bogle after reading his thesis. Bogle joined Wellington, became assistant manager in 1955, and persuaded the company to diversify its fund strategy. By 1970, he had risen to chairman but was later fired for approving a poor merger decision, which he considered his biggest career mistake. This setback led him to form an index fund, adhering to Standard & Poor's indices, as the merger terms barred him from directly managing client money.

In 1974, Bogle founded The Vanguard Group. Influenced by economist Paul Samuelson, Bogle created the First Index Investment Trust in 1976, the precursor to the Vanguard 500 Index Fund, which initially received little attention. In 1984, he launched the Vanguard Primecap Fund with Primecap’s management.

Due to heart issues, Bogle stepped down as Vanguard CEO in 1996 and was succeeded by John J. Brennan, his handpicked heir and second-in-command, whom he had hired in 1982. Bogle returned to Vanguard as senior chairman but left in 1999 after conflicts with Brennan. He then founded the Bogle Financial Markets Research Center on Vanguard's campus.

Bogle distinguished between investment and speculation, believing that speculative trading based on market fluctuations rather than business fundamentals harmed the financial markets. He consistently promoted index funds over actively managed ones, arguing it was foolish to expect active funds to outperform low-cost index funds after fees. In the late 1990s, Bogle anticipated poor stock returns and better bond performance, selling most of his stocks. He advocated for simplicity in investing, summarizing his philosophy in eight rules.

Later in life, Bogle warned that the popularity of passive indexing could concentrate corporate voting power in a few large investment firms, which he believed was against the national interest.

Benjamin Graham

Benjamin Graham (1894-1976, b. London, UK) was a British-born American investor, widely regarded as the "father of value investing." His pioneering work in security analysis and investment philosophy laid the foundation for modern fundamental investing.

Graham graduated from Columbia University in 1914 and began his career on Wall Street. He later founded Graham-Newman Corp., a successful investment partnership that achieved approximately 20% annualized returns from 1936 to 1956, significantly outperforming the broader market. During this period, he also taught finance at Columbia Business School, where his students included Warren Buffett, who would go on to become one of the most successful investors in history.

In 1934, Graham co-authored Security Analysis with David Dodd, establishing a systematic framework for evaluating securities based on intrinsic value. His 1949 book, The Intelligent Investor, further refined his investment philosophy, introducing key concepts such as the margin of safety and the metaphor of "Mr. Market," which illustrated market psychology and behavioral finance. These principles became the foundation of value investing and continue to influence professional and retail investors worldwide.

Beyond his contributions to investment theory, Graham was an early advocate of shareholder activism. His involvement in the Northern Pipeline case highlighted the importance of uncovering undervalued assets and pushing for better corporate governance. He was the driving force behind the establishment of the profession of security analysis and the Chartered Financial Analyst designation.

Graham retired from active investing in 1956.

Graham’s most famous student, Warren Buffett, is among the world’s wealthiest individuals. His investment philosophy also shaped notable investors like Charles Brandes, William J. Ruane, Irving Kahn, Walter J. Schloss, Mario Gabelli, Seth Klarman, Howard Marks, John Neff, and Sir John Templeton, as well as hedge fund managers Bill Ackman, Whitney Tilson, and Nancy Zimmerman.

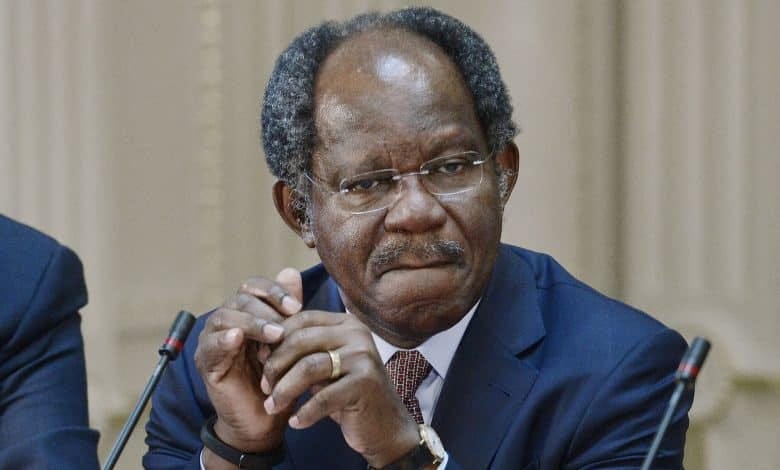

Alfred Winslow Jones

Alfred Winslow Jones was an Australian investor and hedge fund manager. He is regarded as the "father of the hedge fund industry" for inventing the concept of a hedge fund.

Jones was born in Melbourne, Australia, and moved to the United States when he was 4.

UG: Harvard University

Ph.D.: Sociology, Columbia University

During the 1940s, Jones worked for Fortune magazine where he wrote articles on non-financial subjects. In 1949, while conducting research for an article on the field of forecasting, Jones extensively studied stock market technicians and sought out investment approaches that offered better risk-reward than a fair game.

The research prompted him to try investing on his own. Two months after publishing the article, Jones established an investment partnership, A.W. Jones & Co., where he applied his own approach, which is now known as the factor-based approach to portfolio construction.

Jones is credited with coining the phrase "hedge fund," a structure he created in 1949. He combined two tools to develop what he considered a conservative investment strategy: using leverage to acquire more shares and utilizing short selling to mitigate market risk. By buying and selling an equal number of stocks, the value of the portfolio would be determined by the manager's decisions rather than the direction of the overall market.

Jones' fund circumvented the requirements of the '40s Act by limiting itself to 99 investors in a limited partnership. He chose to take 20% of the profits as compensation (similar to Phoenician sea captains who kept a fifth of the profits from successful voyages) and charged no fee unless he made a profit. These features remain core elements of hedge funds today. Jones' investors experienced losses in only 3 of 34 years.

In 1966, Carol Loomis published an article in Fortune magazine, popularizing the term "hedge fund." This led to a surge in interest, resulting in the creation of 130 hedge funds within the next three years, including George Soros's Quantum Fund and Michael Steinhardt's Steinhardt Partners.

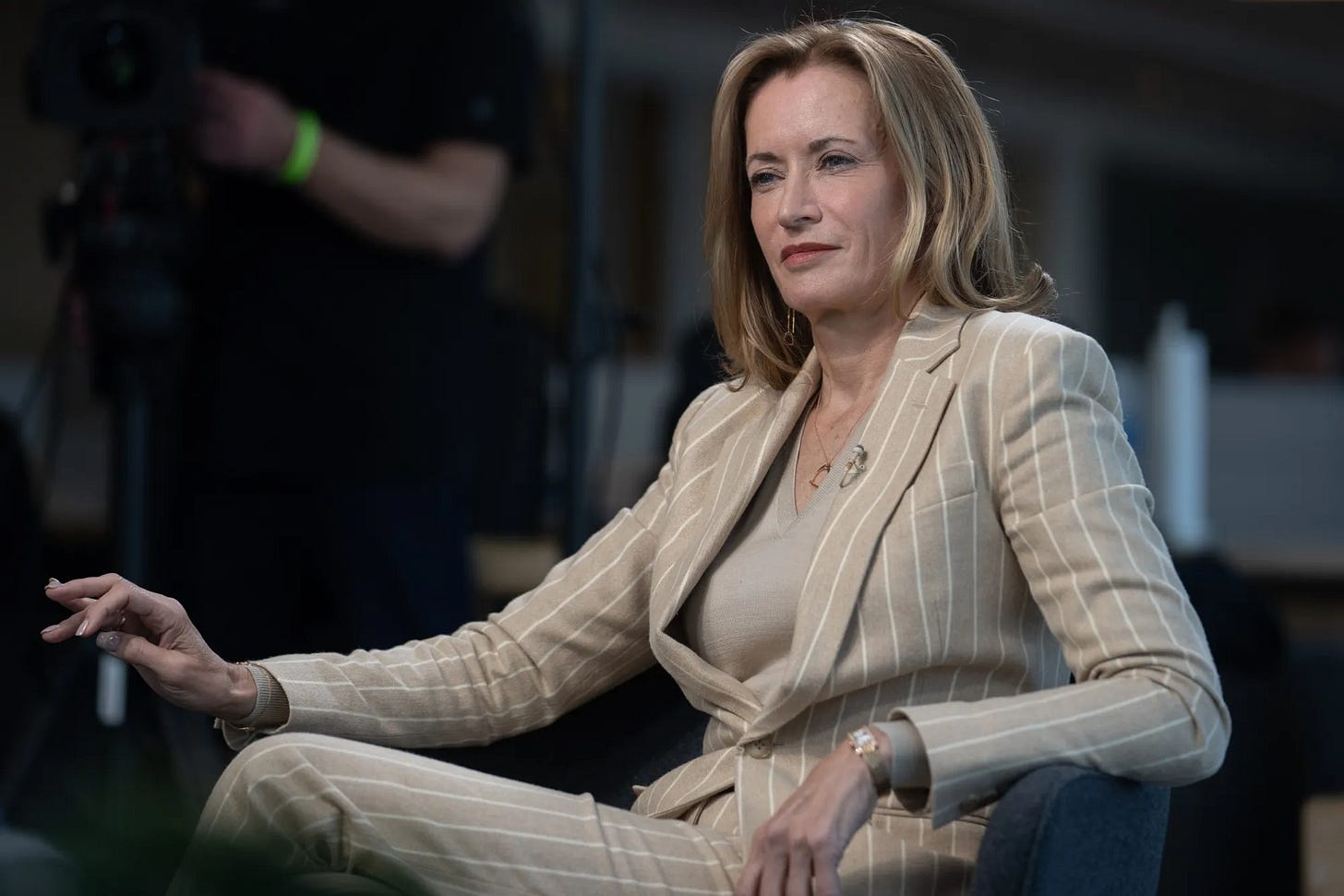

Blythe Masters

Blythe Masters is a British private equity and fintech leader renowned for shaping modern financial instruments. A former JPMorgan Chase executive, she is credited with developing the credit default swap, a financial innovation that transformed risk management and capital allocation.

Masters was born on March 22, 1969, in Oxford, England. She graduated from Trinity College, Cambridge, with a B.A. in economics in 1991.

Masters joined JPMorgan in 1991 after interning there as a student and, by age 28, became the youngest woman promoted to managing director. In 1994, she played a pivotal role in devising risk-transfer tools to reduce the bank’s capital exposure, innovations that later evolved into broader applications like the BISTRO credit derivative structure. Despite their widespread adoption, derivatives gained infamy during the 2008 financial crisis, leading to scrutiny of their misuse. Masters defended the original intent of these tools, emphasizing the importance of responsible risk management. She publicly supported financial reforms aimed at improving transparency and systemic stability.

Over her 27 years at JPMorgan, Masters held roles including CFO of the Investment Bank and head of Global Commodities. Under her leadership, the bank became the top revenue earner in commodities before regulatory scrutiny prompted the sale of its physical commodities business. Masters departed JPMorgan in 2014 after facilitating the $3.5 billion sale.

From 2015 to 2018, Masters served as CEO of Digital Asset Holdings, a blockchain startup focused on modernizing settlement systems. She secured $100 million in funding from major financial institutions and spearheaded projects for clients like the Australian Securities Exchange. Masters later transitioned to a strategic advisor role at the company.

Masters is a founding partner at Motive Partners, a fintech-focused private equity firm, and the current Group CEO of FNZ, a wealth management platform.

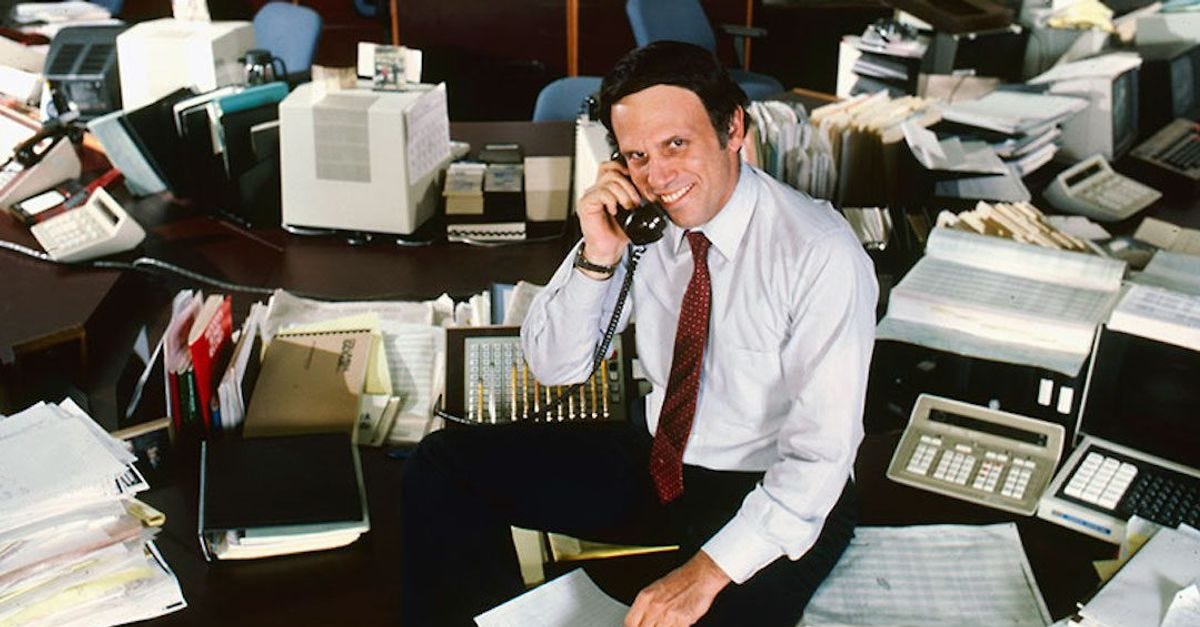

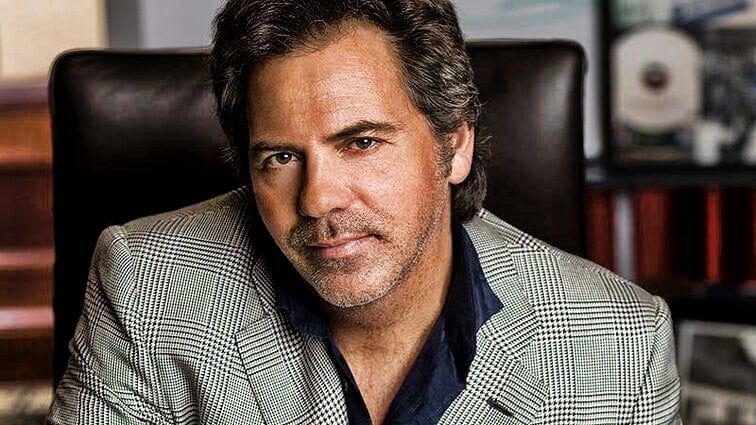

Michael Milken

Michael Milken is a former investment banker. He is best known for developing and popularizing the high-yield debt (“junk bond”) market, for which he earned the nickname “junk bond king.”

Milken was born in 1946 in Encino, California. He earned a bachelor’s degree from UC Berkeley in 1968 and an MBA from the Wharton School of UPenn.

In 1969, Milken joined the investment bank Drexel Harriman Ripley as director of low-grade bond research. He was permitted to trade using some of the firm's capital. Milken had only four down months over the next 17 years.

In 1973, Drexel merged with Burnham and Company to form Drexel Burnham. Milken became the head of convertible. He persuaded his new boss to let him start a high-yield bond trading department – an initiative that earned the firm 100% ROI. By 1976, he was making $5 million of income a year. In 1978, Milken moved the high-yield bond operation to Century City in Los Angeles.

By the mid-1980s, Milken has established a giant network of buyers for high-yield bond, allowing Drexel to raise large amounts of money quickly. Drexel became the key enabler of corporate raiding and the firm's “highly confident letter,” despite carrying no legal status, was considered as good as cash, as a financing tool for corporate raiders.

In 1989, a federal grand jury indicted Milken on 98 counts of racketeering and fraud, some of which are tied to his dealing with Ivan Boesky and Boesky’s insider trading. Milken paid $200 million penalty, served 22 months in prison and accepted a lifetime ban from any involvement in the securities industry.

Milken is a survivor of advanced-stage prostate cancer. He is the chairman of the Milken Institute, a think tank.

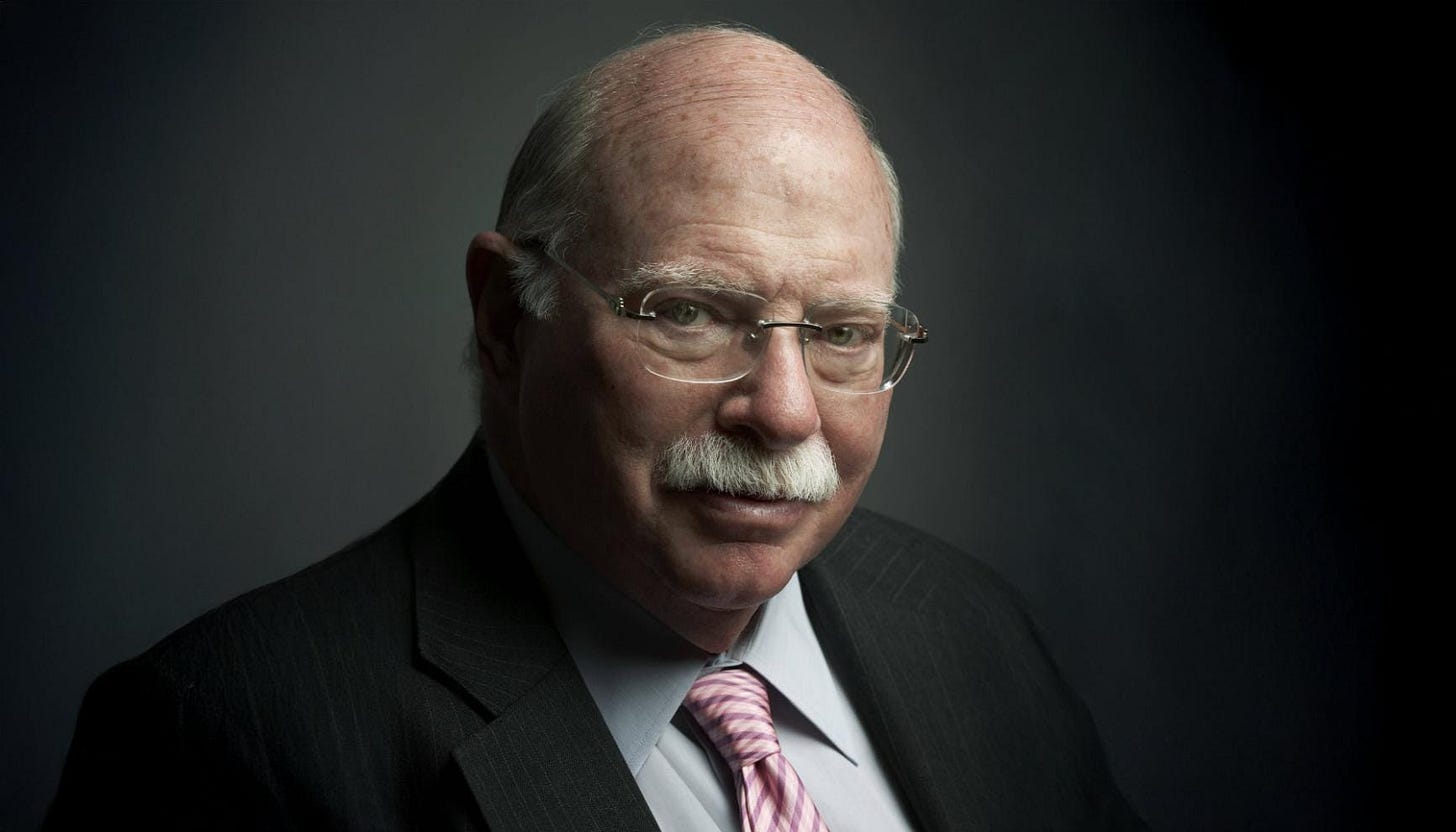

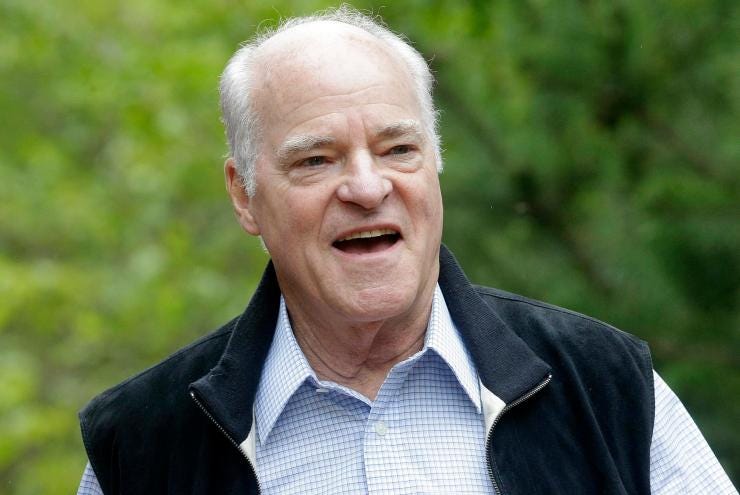

Lewis Ranieri

Lewis Ranieri (b. Brooklyn, NY, 1947) is a pioneering figure in finance, widely recognized as the "father of mortgage-backed securities" for his transformative work in the 1970s at Salomon Brothers. His contributions to the creation and proliferation of securitization reshaped the U.S. housing finance system and established the foundation of the modern mortgage-backed securities (MBS) market.

Ranieri started college at St. John's University but left before completing his degree, later earning a BA in English in 1986.

Ranieri began his career in 1968 as a part-time mailroom employee at Salomon Brothers. Rising through the ranks, he became Vice Chairman and played a pivotal role in developing the firm's mortgage trading desk. In 1977, he spearheaded the creation of MBS, turning them into a viable investment product. His lobbying efforts, along with strategic innovations like collateralized mortgage obligations (CMOs), broke down legal and tax barriers, allowing Wall Street to become a major player in the housing market.

Ranieri's leadership was instrumental in driving regulatory changes, including the Secondary Mortgage Market Enhancement Act (1984) and provisions in the Tax Reform Act (1986), which propelled the mortgage-backed securities market to $150 billion. His work also popularized the hiring of quantitative experts in finance, further professionalizing and expanding the industry.

After leaving Salomon Brothers in 1987, Ranieri founded Hyperion Partners in 1988. Under his leadership, Hyperion acquired and revitalized Bank United of Texas, turning it into an $18 billion regional bank before its sale in 2001. In 2007, he co-founded Selene Finance LP, a mortgage servicer focused on helping homeowners avoid foreclosure, showcasing his commitment to addressing the challenges in the housing market.

Although mortgage-backed securities were later scrutinized for their role in the financial crisis of 2007–2010, Ranieri maintained that the concept of securitization was sound and criticized Wall Street for misusing the structure.

Harold Simmons

Harold Simmons (1931-2013, b. Golden, TX) was an American investor, entrepreneur, and pioneer of the leveraged buyout. Simmons revolutionized corporate finance with his "all debt and no equity" philosophy.

Simmons earned a BA in economics in 1951 and an MA in 1952, from the University of Texas at Austin. After completing his graduate studies, he began his career as a bank examiner for the U.S. government and later joined Republic National Bank in Dallas. These roles shaped his understanding of capital management and laid the groundwork for his future investment strategies.

In 1960, Simmons launched his entrepreneurial career by purchasing University Pharmacy, a small drugstore in Dallas, with $5,000 in savings and a $95,000 loan. Over the next decade, he expanded this single pharmacy into a chain of 100 stores, which he sold to Eckerd Corporation in 1973 for over $50 million. This sale marked Simmons’s entry into the financial services and investment industry.

Simmons became known for his bold and strategic acquisitions, including his widely publicized—but ultimately unsuccessful—takeover bid for Lockheed Corporation in 1989. He acquired nearly 20% of the company’s stock, citing opportunities to improve corporate governance and unlock value through its overfunded pension plan. This effort, though unsuccessful, solidified Simmons’s reputation as an investor.

By the 1990s, Simmons had diversified his portfolio across multiple industries. In 1997, he invested $5 million in T. Boone Pickens Jr.'s BP Capital Energy Commodity Fund, an investment that grew to $150 million by 2005.

By 2006, Simmons controlled five publicly traded companies listed on the New York Stock Exchange: NL Industries, Titanium Metals Corporation (the world’s largest producer of titanium), Valhi, Inc., CompX International, and Kronos Worldwide. These companies spanned chemicals, titanium production, waste management, and component products, showcasing Simmons's ability to navigate and lead diverse sectors.

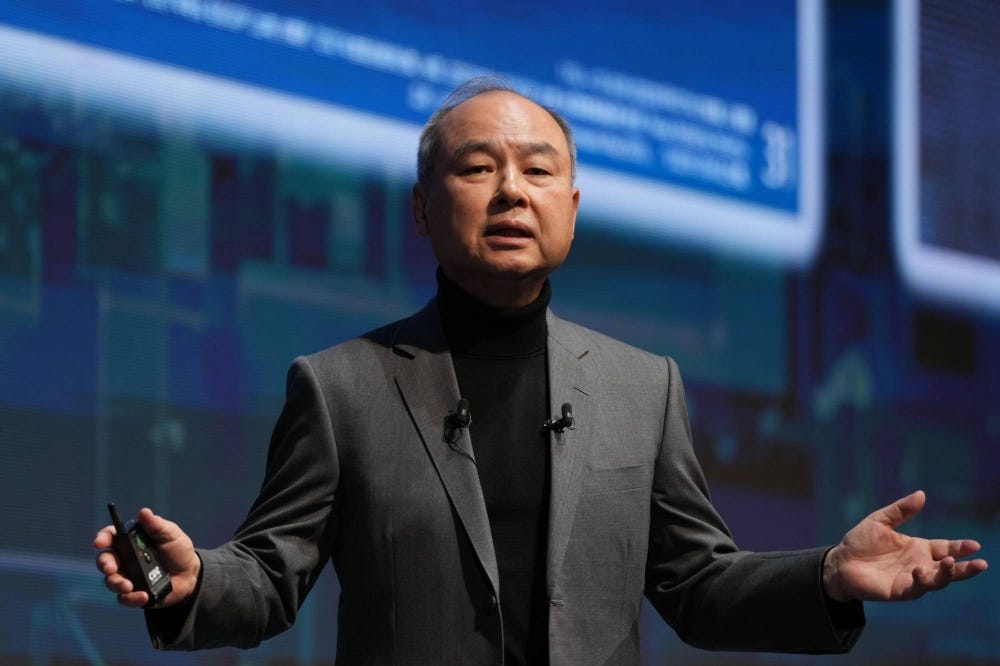

Don Valentine

Don Valentine (b. 1932, The Bronx, NY) was a venture capitalist who is referred to as the “grandfather of Silicon Valley venture capital.” He was the founder of Sequoia Capital, one of the most prominent venture capital firms in the world.

Valentine graduated from Fordham University and began his career in Southern California as a sales engineer for Raytheon, an aerospace company.

After less than a year with the firm, Valentine joined Fairchild Semiconductor and built the firm’s sales team. Some of today’s semiconductor giants were spun off from Fairchild, including Intel, AMD and National Semiconductor (acquired by Texas Instruments).

Valentine then joined National Semiconductor as a senior sales and marketing executive. While at National, he made personal investments in tech companies and his “side hustle” caught the attention of Capital Group, one of the largest mutual fund companies in the world.

In 1972, Valentine founded the venture capital firm Sequoia Capital with the backing of Capital Group and formed its first fund in 1974. Sequoia was one of the original investors of Apple Computer and Atari after Valentine met Steve Jobs when Jobs was an engineer for Atari. Sequoia went on to make early investments in companies such as Oracle Corporation, Cisco, Electronic Arts, Google, YouTube, Nvidia, and many more.

In 1996, partners Michael Moritz and Doug Leone assumed leadership of Sequoia Capital.

Valentine passed away in 2019 at age 87.

Public Equity - Value

Michael Burry

Michael Burry is a hedge fund manager, best known for being among the first investors to predict and profit from the 2007 subprime mortgage crisis.

Burry was born and raised in San Jose, California. He lost his left eye to eye cancer.

UG: UCLA, Economics

MD: Vanderbilt University

During medical school, Burry studied investing during his off-duty hours. He got his MD but never finished his residency.

Burry gained recognition for his value stock picks, which he began discussing on Silicon Investor message boards in 1996. His insights drew attention from Vanguard, White Mountains Insurance Group, and Joel Greenblatt. He is a traditional Graham and Dodd-style value investor.

After shutting down his website in November 2000, Burry started the hedge fund Scion Capital, funded by an inheritance and loans from his family.

In its first full year, 2001, Scion made 55% versus an 11.88% decline in the S&P 500. The following year, Scion made 16% while the S&P 500 declined by 22.1%. In 2003, despite the S&P rising by 28.69%, Scion outperformed with a 50% return. By the close of 2004, Burry had to turn away investors after AUM soared to $600 million. Burry achieved these gains in part by shorting overvalued tech stocks during the dot-com bubble.

In 2005, Burry shifted his focus to the subprime market. By analyzing mortgage lending practices, he accurately foresaw the collapse of the real estate bubble by 2007. His research on residential real estate values convinced him that subprime mortgages, particularly those with "teaser" rates, and associated bonds would depreciate once initial rates were replaced by significantly higher ones, often within two years. He promptly bought CDS from firms like Goldman Sachs to short against vulnerable subprime deals.

However, Burry faced an investor revolt as some doubted his predictions. Despite this, his analysis proved accurate, resulting in a personal profit of $100 million and over $700 million for his remaining investors. Scion Capital achieved a net return of 489.34% from its inception in November 2000 to June 2008.

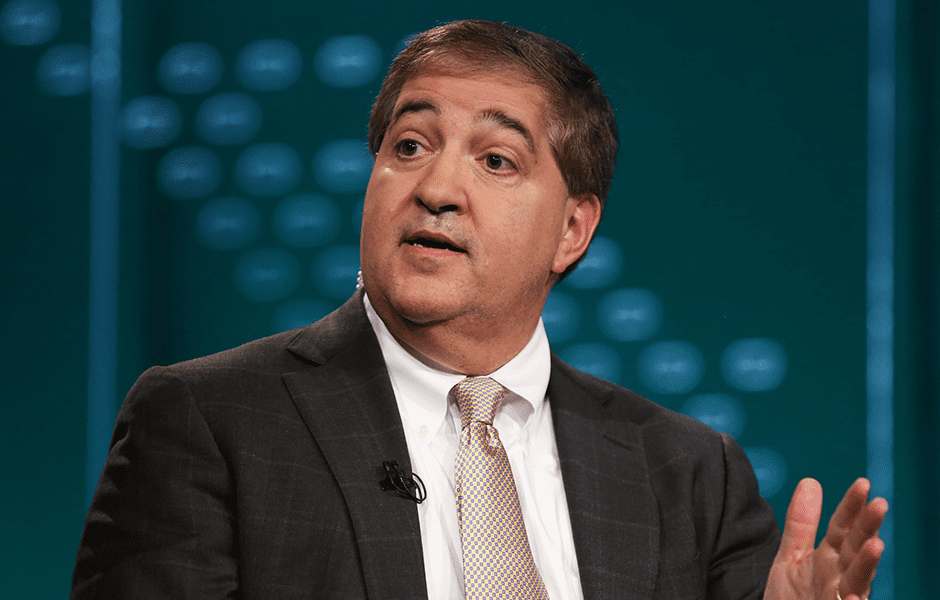

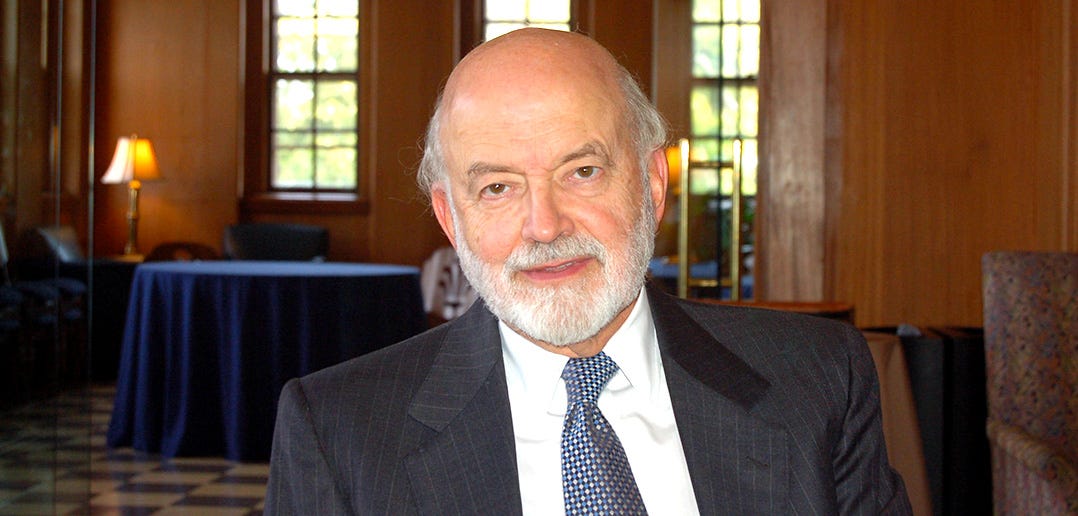

Leon Cooperman

Leon Cooperman is a billionaire hedge fund manager and the CEO of Omega Advisors.

Cooperman was born in the South Bronx, NY, in 1943, and he was the first in his family to attend college.

UG: CUNY Hunter College

After graduating, he became a quality control engineer at Xerox. Cooperman later received his MBA from Columbia Business School in 1967. He is a Chartered Financial Analyst.

Cooperman developed a passion for stock picking while at Columbia, especially in value investing. After class, Cooperman would race classmates Mario Gabelli and Art Samberg—future billionaire investors in their own right—to a payphone to call their shared stockbroker.

After his MBA, Cooperman joined Goldman Sachs. He spent 22 years in the Research Department as a partner-in-charge, Co-chairman of the Investment Policy Committee, and Chairman of the Stock Selection Committee. In 1989, he became Chairman and CEO of Goldman Sachs Asset Management and was the Chief Investment Officer of the equity product line. Cooperman was voted the II #1 portfolio strategist for nine years in a row.

At the end of 1991, Cooperman retired from Goldman Sachs. The next day, he launched Omega Advisors, Inc. The firm focused on value investing using broad and deep research.

While Cooperman is mostly a bottom-up investor, he uses macroeconomic analysis led by longtime top deputy Steve Einhorn to inform how much risk to take and when to dabble in other asset classes, such as international stocks, bonds, currencies, commodities, and equity indexes. The firm also shorts stocks, but the vast majority of its historical profits have come from the long side.

Those close to Cooperman credit his work ethic for Omega's success. Cooperman has taken only one two-week vacation in his entire career. Cooperman is a tough boss and once said, “You have to bring a total commitment to the business or you don't belong. Premium fees demand premium performance.”

Notable Omega alums:

Larry Robbins, Glenview Capital

David Fiszel, Honeycomb Asset Management

Michael Zimmerman, Prentice Capital

Brian Zied, Charter Bridge Capital

Steven Eisman

Steven Eisman is an American investor famous for profiting from the 2007-2008 US housing bubble collapse. Born in New York City in 1962, he graduated magna cum laude from UPenn in 1984 and earned his J.D. with honors from Harvard Law School in 1988.

Eisman’s parents, brokers at Oppenheimer, arranged a position for him at the firm as an equity analyst after he became dissatisfied with his law career. Due to anti-nepotism rules, they covered his first year's salary.

Eisman gained fame by betting against collateralized debt obligations at FrontPoint Partners, a hedge fund within Morgan Stanley. By 2010, he managed over $1 billion and gained prominence after being profiled by Michael Lewis.

He left FrontPoint Partners in 2011 due to investor withdrawals following an insider trading investigation.

At the 2010 Ira Sohn Conference, Eisman criticized the for-profit education industry, including Apollo Education Group, comparing their loan practices to the subprime mortgage industry during the housing bubble.

After the Department of Education tightened regulations, the for-profit education industry accused Eisman of trying to illegally influence the government. Following his Senate testimony, Eisman was criticized by groups like CREW, which was later found to have received payments from a for-profit university founder. An Inspector General review found no improper disclosure of information by the Department.

By the end of 2018, two for-profit university systems had become defunct due to reduced enrollment and loss of eligibility for government student loan programs.

In March 2012, Eisman founded Emrys Partners with $23 million in seed capital. The fund returned 3.6% in 2012 and 10.8% in 2013, both underperforming the market. In July 2014, Eisman shut down the fund, citing that focusing solely on company fundamentals was no longer a viable investment strategy.

In September 2014, Eisman joined Neuberger Berman as a managing director and portfolio manager for the Eisman Group. The group, which includes his parents as partners, manages stock portfolios for wealthy clients.

David Einhorn

David Einhorn is the founder of Greenlight Capital.

Born in New Jersey, Einhorn graduated summa cum laude with a BA in Government from Cornell University in 1991. He began his career in investment banking at DLJ. In 1993, he joined the hedge fund Siegler, Collery & Co.

In 1996, Einhorn founded Greenlight Capital, a long/short value-oriented hedge fund, with less than $900,000 (easier times huh). At its peak, Greenlight managed $12 billion of assets.

In May 2002, Einhorn recommended shorting Allied Capital, a BDC (Business Development Company) that invests in small and mid-sized businesses, at the Sohn Investment Conference.

The company’s stock dropped 20% the next day. Einhorn pointed out the company was defrauding the Small Business Administration while Allied accused him of market manipulation.

In 2007, the SEC found Allied Capital broke securities laws related to the accounting and valuation of loans on its balance sheet. Einhorn published a book on his 6-year fight against Allied, Fooling Some of the People All of the Time.

In November 2007, Einhorn recommended shorting Lehman Brothers stock at Value Investing Congress. In April 2008, after Bear Stearns had to be bailed out by the Federal Reserve, he announced his short position on Lehman. After a private conference call with Lehman’s CFO Erin Callan, Einhorn publicly criticized Callan and the stock fell sharply. Callan was fired a few weeks later. Lehman declared bankruptcy in September 2008.

In the recent decade, Greenlight generated poor investment returns. The fund dropped 20%+ in 2015, caused by a concentrated position in SunEdison (which went bankrupt). Some investors criticized Einhorn for not embracing high-growth stocks, but Einhorn stayed on his course.

Greenlight is also hit hard on the short side by high growers such as Tesla.

In May 2024, James Fishback, a former employee, sued Greenlight for defamation over his job title. Fishback claimed he worked as “head of macro” at the fund, but Greenlight Capital claimed that position never existed. The controversy was covered by various news outlets.

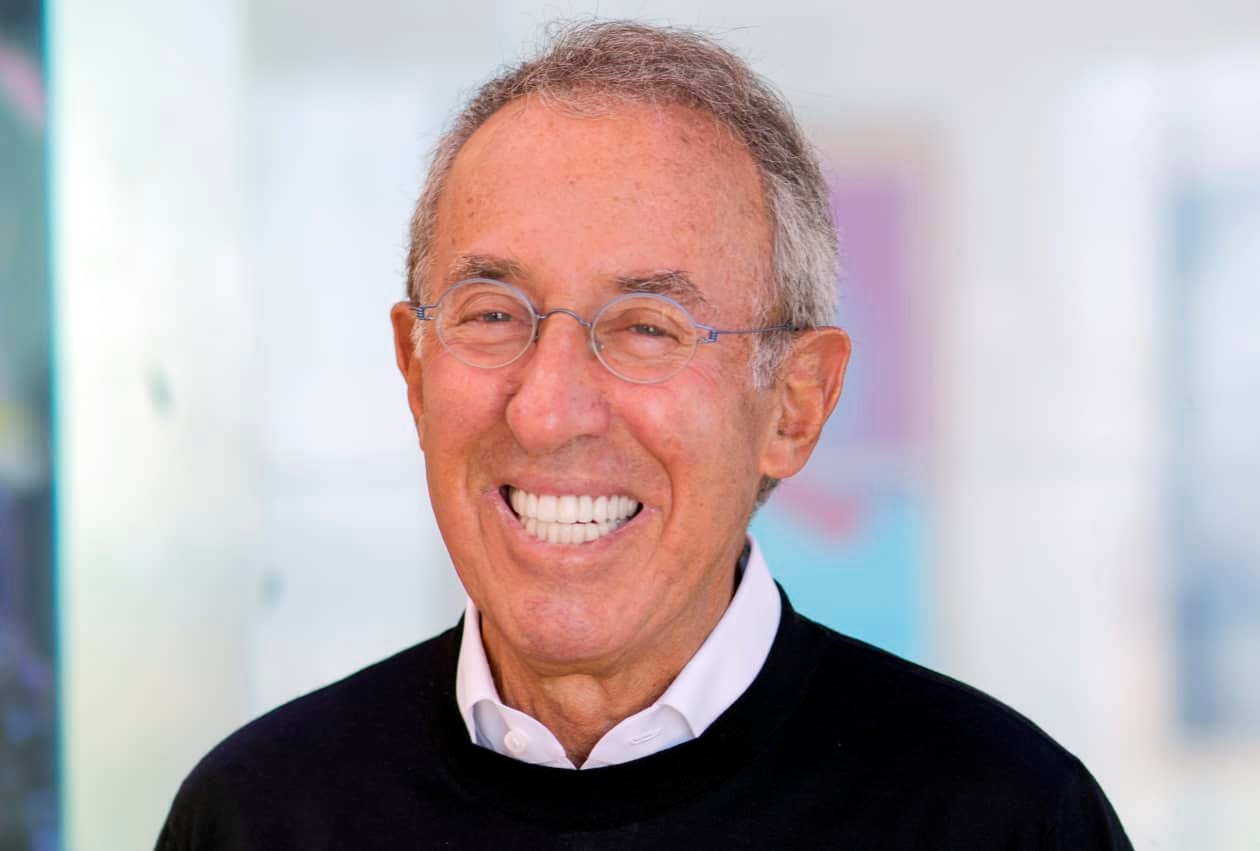

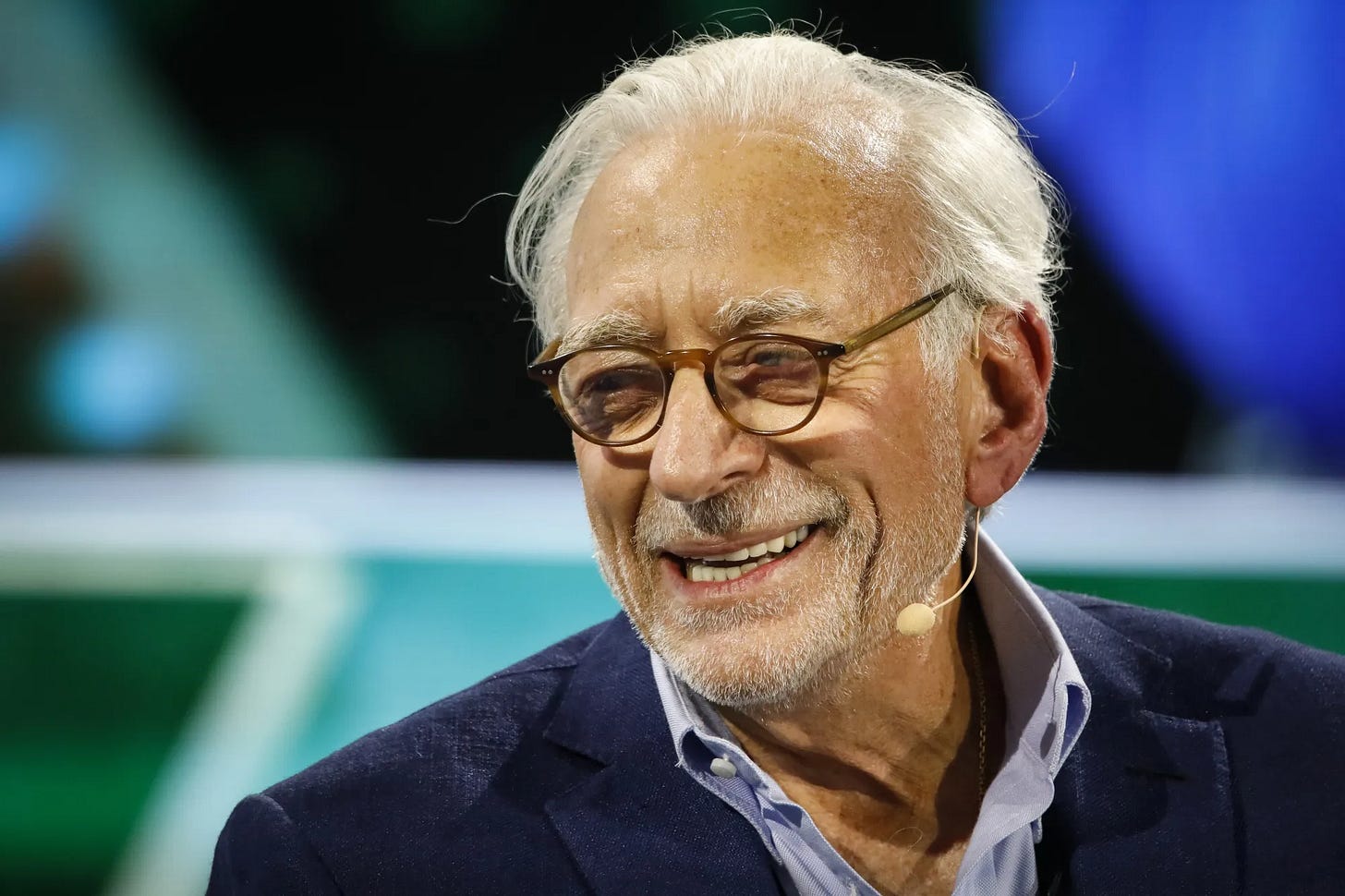

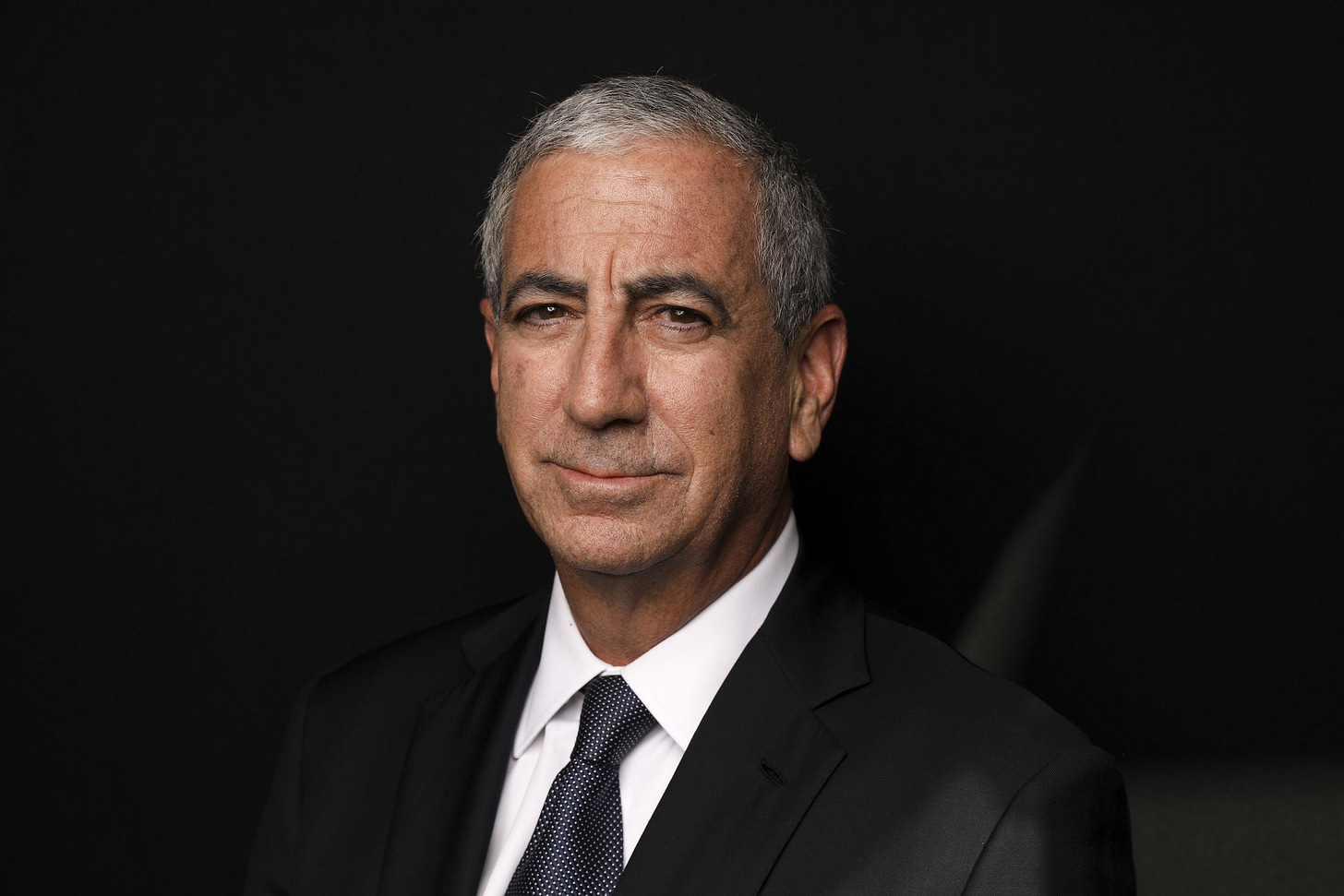

Mario Gabelli

Mario Gabelli is a billionaire stock investor and the CEO of GAMCO Investors.

Gabelli was born in The Bronx in 1942. He has said he read market reports for fun when he was very young and bought his first stock at the age of 13.

UG: Fordham

MBA: Columbia Business School (taught by Roger Murray, co-author of the Fifth Edition of Security Analysis), 1967

After MBA, Gabelli worked as a security analyst at Loeb, Rhoades & Co., covering farm equipment, auto parts conglomerates, and later, media and broadcasting. He rated companies not by earnings but by cash flow, analyzing a firm in great detail to calculate what he called private-market value. This value was not the share price at which a stock was selling on an exchange, but the price per share someone would be willing to pay to buy the whole company.

In 1976, Gabelli formed Gabelli & Co., an institutional brokerage house, with borrowed funds and money he had accumulated trading his own account.

Soon after, Gabelli formed Gabelli Investors (later GAMCO Investors) to manage money for clients. Gamco is credited with inventing the private market value with a catalyst investment philosophy, seeking to identify mispriced companies with strong businesses and the presence of a catalyst that can surface value.

In February 1999, GAMCO went public.

Joel Greenblatt

Joel Greenblatt is a value investor who founded Gotham Capital, a value-oriented hedge fund that earned an average of a 30% annual return net of fees for 10 years.

Greenblatt was born in 1957 in Great Neck, New York. He received his bachelor’s degree, summa cum laude, and his MBA from UPenn’s Wharton School. He pursued a law degree at Stanford Law School for a year before dropping out to pursue a finance career.

In 1985, Greenblatt started Gotham Capital, a hedge fund, with $7 million, most of which was provided by the "junk-bond king" Michael Milken. Between 1985 and 1994, Gotham generated a 30% annualized return net of all fees. Greenblatt specialized in "special situations" investing, such as spinoffs and other corporate events. In 1995, Gotham returned all capital of about $500 million to outside investors.

In 2000, Gotham Capital provided $1 million to help Michael Burry start his hedge fund Scion Capital after Greenblatt discovered Burry’s writings on Silicon Investor, a tech stock discussion website. Gotham invested over $100 million in Burry’s fund over time. However, in 2006, the relationship between Greenblatt and Burry became contentious when Greenblatt disagreed with Burry’s bet against the mortgage market. Greenblatt tried to withdraw Gotham’s capital, but Burry prevented the withdrawal until after a year.

Greenblatt eventually benefited from Burry’s call as the 2008 crisis broke out, but Greenblatt still withdrew capital from Scion.

Greenblatt co-founded Value Investor Club, an online community where members exchange value and special situation investment ideas. Free members can access ideas with a 45-day delay. Full members must contribute a minimum of two ideas per year to have live access. Gaining full membership is very difficult.

Greenblatt has written three books. His first book, "You Can Be a Stock Market Genius," is a must-read for anyone who wants to practice special situation investing.

Seth Klarman

Seth Klarman is the billionaire value investor and founder of The Baupost Group, based in Boston.

Klarman graduated from Cornell University in 1979 with a bachelor’s degree. He also holds an MBA from Harvard Business School in 1982 where he was a Baker Scholar, awarded to the top 5% of the graduating class.

In the summer of his junior year in college, Klarman interned at the Mutual Shares where he was introduced to Max Heine and Michael Price, the latter went on to be Klarman’s boss and mentor. After working at the Mutual Shares for 18 months, Klarman decided to attend Harvard Business School (HBS), where he was classmates with Jeff Immelt (ex-CEO of GE), Stephen Mandel (Lone Pine Capital), and Jamie Dimon (CEO of J.P. Morgan.)

After graduating from HBS, Klarman founded The Baupost Group with Harvard Professor William J. Poorvu and partners Howard H. Stevenson, Jordan Baruch, and Isaac Auerbach. The fund started with $27 million in capital and Klarman had a low salary of $35,000 a year. Today Baupost manages about $27 billion.

Early on in his career, Klarman used to ask Goldman Sachs salespeople so many questions regarding their thoughts on the markets that they were afraid to pick up the phone if they saw that Baupost was calling.

Klarman is a value investor. He published his only book Margin of Safety (on value investing book list in profile link) which was originally priced at $25 a copy. Now a used copy sells for up to thousands of dollars because it is out of print.

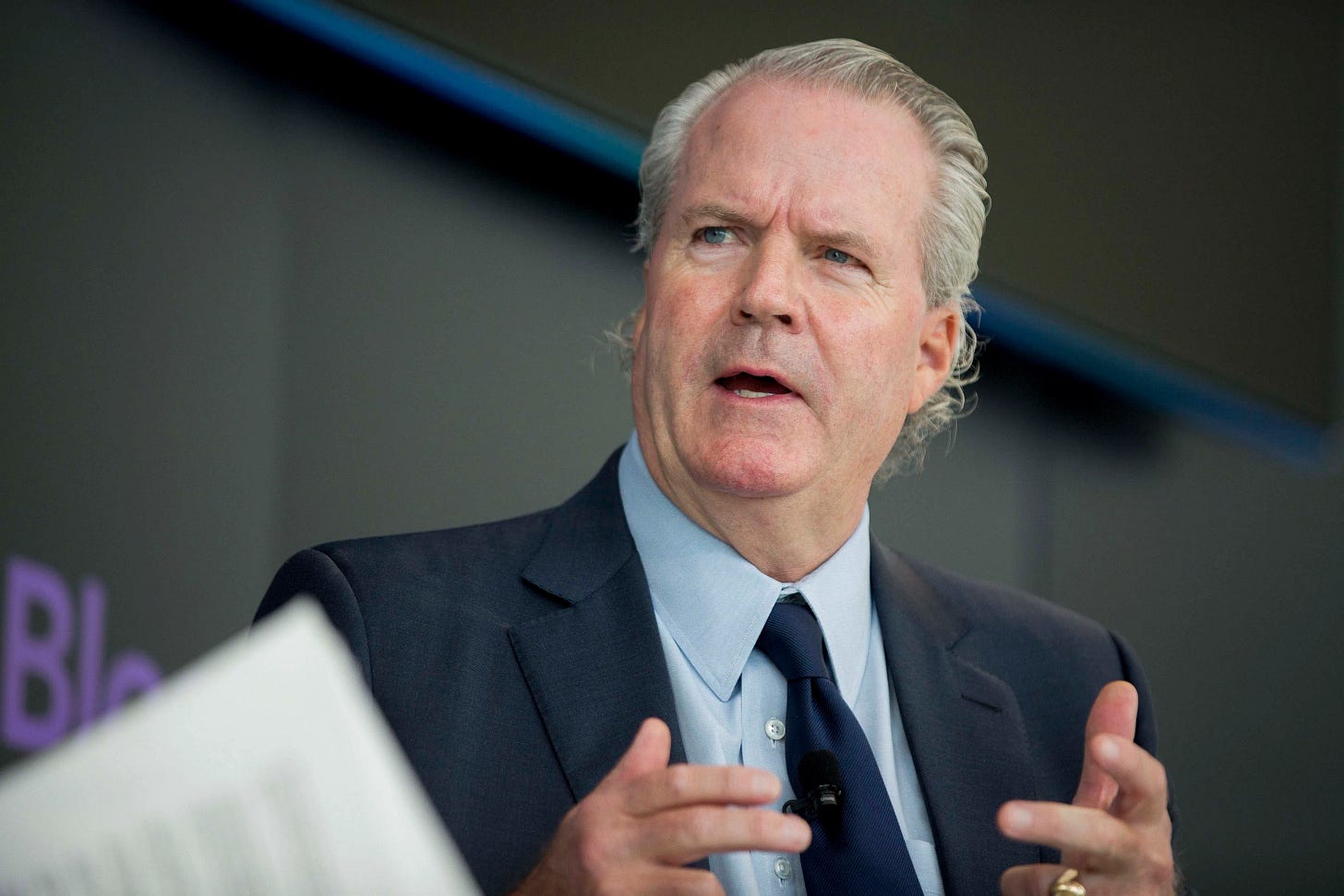

Bill Miller

Bill Miller is a billionaire value investor. Despite founding his own investment firm, Miller Value Partners, he is most known for running Legg Mason's Value Trust mutual fund, where he achieved after-fee returns that outperformed the S&P 500 for 15 consecutive years from 1991 to 2005.

Miller was born in Laurinburg, North Carolina, in 1950.

UG: Economics, Washington and Lee University

Ph.D.: Philosophy, Johns Hopkins University

Miller began his investment career as a security analyst at Legg Mason in 1981, having previously worked as a treasurer for a manufacturer of products for the steel and cement industries. He earned his CFA designation in 1986 and subsequently took on the role of managing the Legg Mason Value Trust mutual fund.

Under Miller's management, Value Trust consistently outperformed the S&P 500 for 15 consecutive years, and the fund's assets under management grew from $6.8 million to $20 billion by 2007. In 2007, he was elected Chairman of the firm and also served as its Chief Investment Officer.

However, Value Trust faced significant losses during the 2008 Financial Crisis due to its overexposure to financial stocks. Despite a strong rebound in 2009, Miller struggled to consistently outperform the market in subsequent years. In 2011, he stepped down as the portfolio manager of Value Trust and handed the role to Sam Peters.

During this time, the heavy losses in Value Trust, coupled with his divorce settlement, significantly reduced Miller's personal fortune by 90% in a matter of months. However, his earlier investments in Amazon and bitcoin proved to be fruitful. Miller had purchased a substantial amount of Amazon stock during the dot-com bubble when it was trading at less than $40 per share. Additionally, he made early investments in bitcoin at an average cost of $500. Thanks to these prescient moves, Miller is now a billionaire.

Larry Robbins

Larry Robbins is an American billionaire hedge fund manager and the founder of Glenview Capital Management. Born in 1969 in Arlington Heights, Illinois, Robbins graduated with honors from the Jerome Fisher Program in Management and Technology at the University of Pennsylvania in 1992. He earned dual degrees in Engineering and Business.

Throughout college, Robbins was a standout hockey player, serving as captain of the University of Pennsylvania's club team for three years. He also became a Certified Public Accountant in 1991 in Illinois.

After graduation, Robbins began his career at Gleacher & Company, a New York-based mergers and advisory boutique. He later joined Leon Cooperman at Omega Advisors, despite having no prior public market experience. Cooperman took a chance on Robbins, who spent six years as an analyst and partner on the US equity long/short team. Reflecting on his early days, Robbins recalled Omega's rough year in 1994, noting, "I was so young and inexperienced that I didn’t realize how risky that was. But nonetheless, I got a great education."

In 2000, Robbins left Omega to start Glenview Capital Management, naming the firm after the suburban Chicago hockey area where he began playing at age five. His big break came in 2012 when he made a successful bet on hospital companies he believed would benefit from Obamacare. The following year, Robbins made headlines by leading a campaign to replace the entire board of directors at Health Management Associates (HMA), earning Glenview and its clients an 84.2% return in a single year. This success significantly boosted the firm's assets under management and established Robbins as a powerful activist investor in the healthcare sector.

In 2014, Robbins earned a reported $570 million, further solidifying his reputation. Unlike many hedge funds, Robbins is known for holding stocks for the long term and avoiding stop-losses. However, after several strong years, Glenview faced a challenging period with consecutive years of underperformance, leading to significant asset losses as it worked to recover its high-water mark.

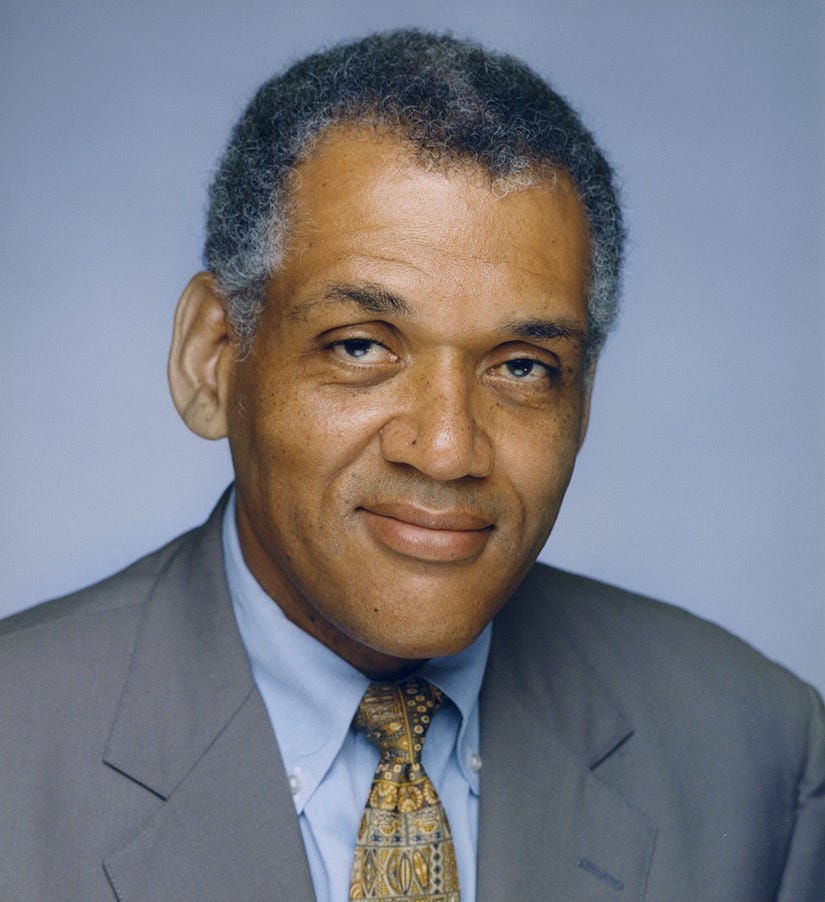

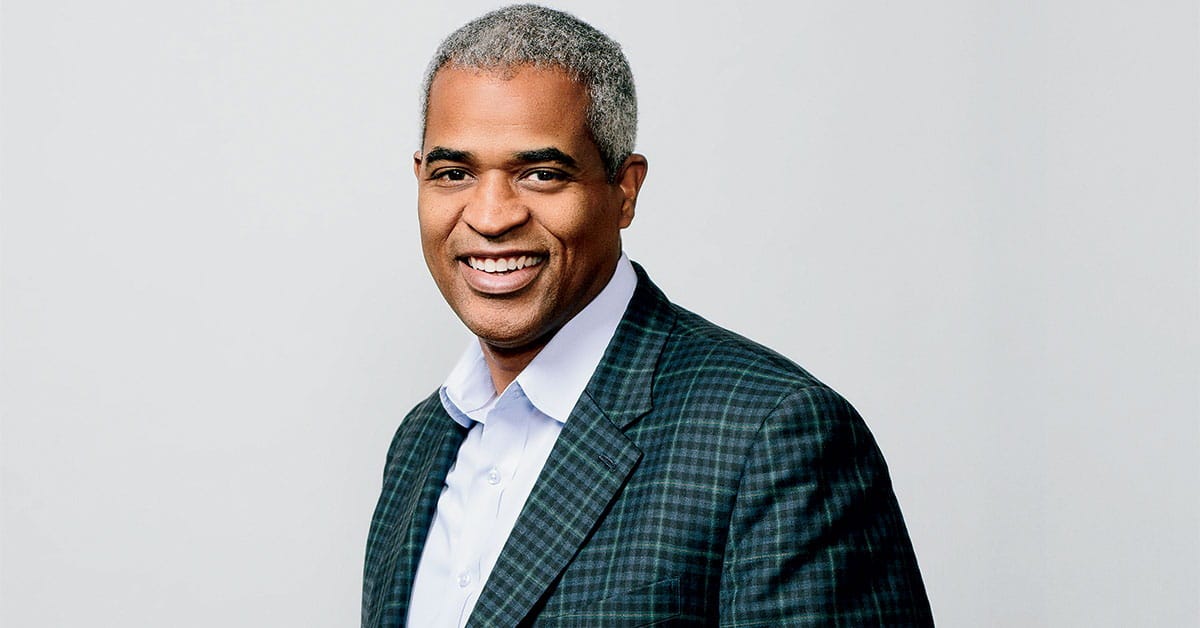

John Rogers

John Rogers is an American investor and the founder of Ariel Investments, the largest minority-run mutual fund firm in the U.S. Rogers was born on the South Side of Chicago, IL, in 1958.

Rogers graduated from Princeton University with a BA in Economics and was the captain of the 1979-80 Ivy League co-champion Princeton Tigers men's basketball team under Hall of Fame coach Pete Carril, who popularized the “Princeton offense.”

After graduation, Rogers worked for William Blair as a stockbroker in Chicago.

In 1983, Rogers founded Ariel Investments with money from friends and family, focusing on patient, value investing in small- and medium-sized companies. The Ariel fund went public on November 6, 1986.

Today, Ariel manages $15 billion in assets with offices in Chicago, New York, San Francisco, and Sydney, employing over 130 people. The firm is over 95% employee and board-owned.

In August 2003, Rogers beat Michael Jordan in a game of one-on-one at Michael Jordan's Senior Flight School in Las Vegas. The camp, attended by affluent businessmen in the early 2000s, had a registration fee of $15,000.

The Wall Street Journal posted a video in 2008 of a glasses-wearing Rogers driving and scoring on Jordan, winning 3-2 in a game of make-it, take-it after Jordan's last season with the Washington Wizards.

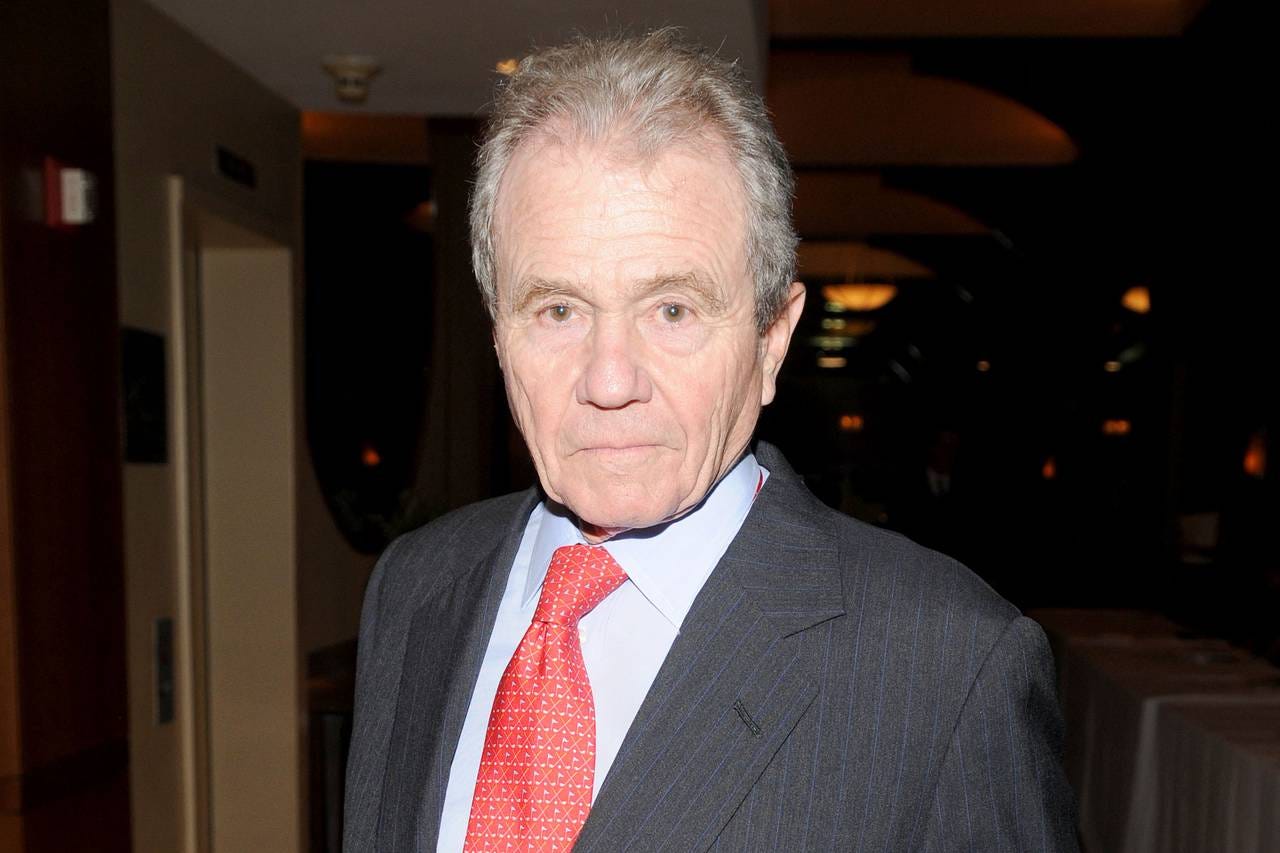

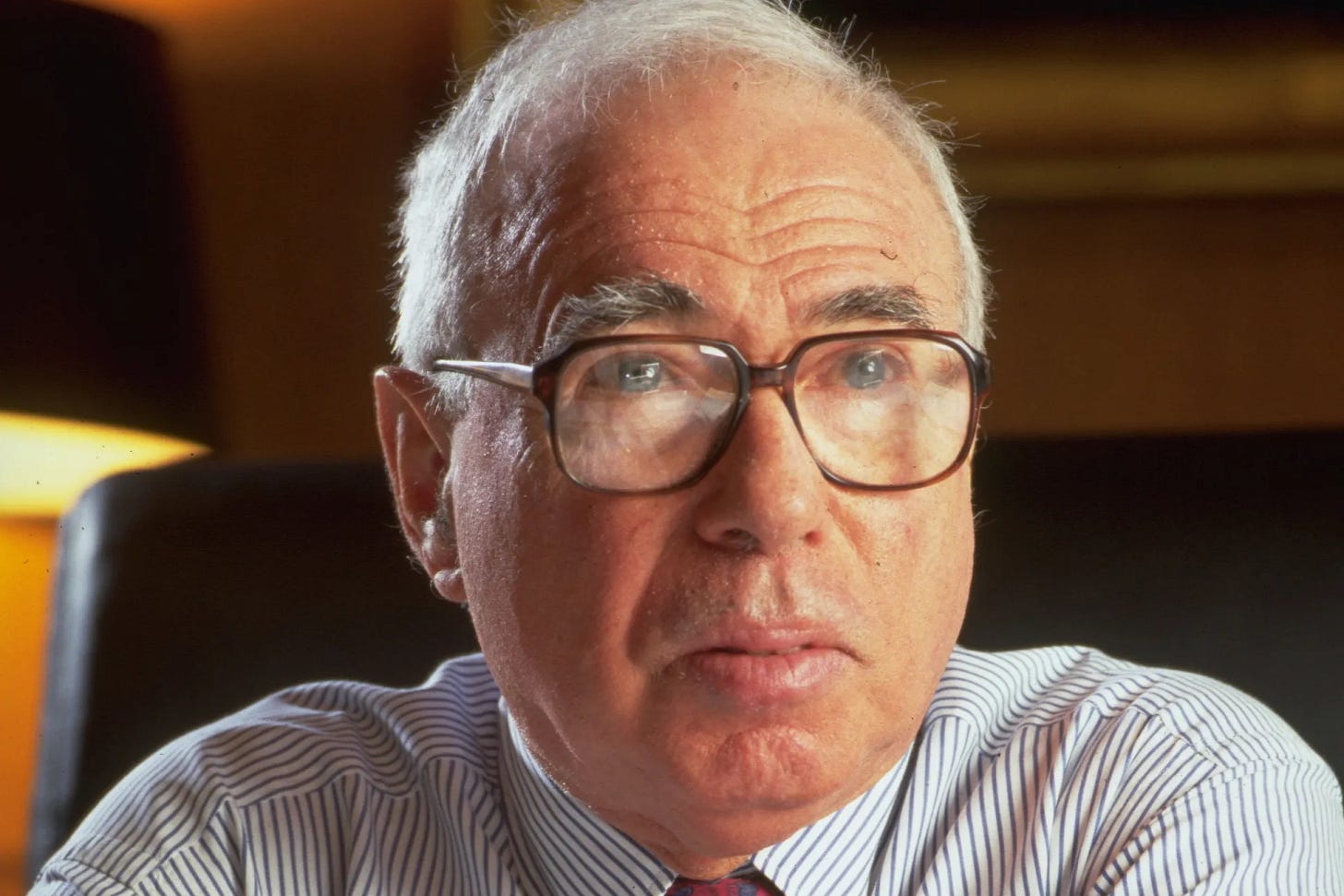

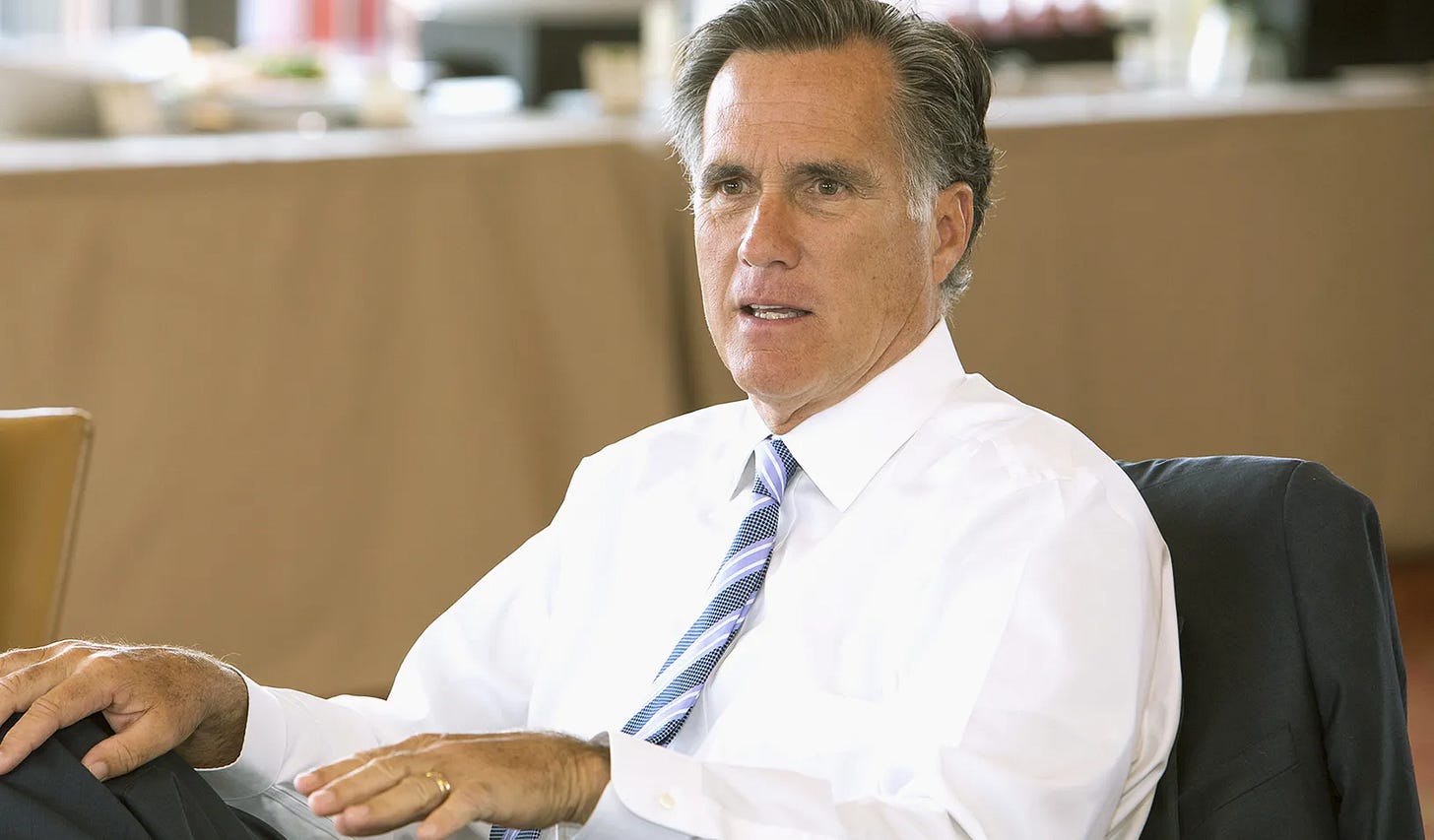

Robert Rubin

Robert Rubin served as the 70th U.S. Secretary of the Treasury. Prior to his government service, Rubin worked for Goldman Sachs for 26 years.

Rubin was born in 1938 in New York City and moved to Miami at an early age.

UG: Harvard College, A.B. in Economics, summa cum laude

Masters: London School of Economics; Yale Law School, LL.B.

After law school, Rubin worked as an attorney for two years before joining Goldman Sachs as an associate in the risk arbitrage department. Eventually, Rubin ran Goldman Sach’s stock and bond trading business and became co-chairman in 1990.

In 1994, Bill Clinton nominated Rubin as Treasury secretary. During Rubin’s time, the U.S. enjoyed economic prosperity with strong growth, near full-employment and bullish stock market while avoiding inflation. In 1999, Lawrence Summers succeeded Rubin as the new Treasury secretary.

In 1998, Rubin and Fed Chairman Alan Greenspan opposed giving Commodity Futures Trading Commission (CFTC) oversight of over-the-counter credit derivatives, which was proposed by then head of CFTC, Brooksley Born. As many of you know, derivatives went on to be a major problem during the 2007-2008 Financial Crisis.

In his biography, Rubin always believed the systemic risks derivatives could pose. Rubin also thought that many users of derivatives did not fully understand the risks they were taking (ask AIG about that). However, he believed the politics would have made regulation impossible. In an ABC interview in 2010, President Clinton said Rubin was wrong in the advice he gave him not to regulate derivatives.

Many who worked for Rubin at Goldman Sach’s risk arbitrage group founded their own successful hedge funds. They include Edward Lampert (ESL), Richard Perry (Perry Capital, shut down), Tom Steyer (Farallon Capital), Daniel Och (Sculptor, previously known as Och-Ziff), Eric Mindich (Eton Park, shut down), Dinakar Singh (TPG-Axon), and Frank Brosens (Taconic)

Thomas Steyer

Thomas Steyer is a billionaire hedge fund manager. Steyer was born in Manhattan in 1957. He graduated summa cum laude from Yale University in 1979 with degrees in economics and political science (Phi Beta Kappa, captain of the soccer team, member of the Wolf's Head Society).

After graduation, Steyer worked in investment banking at Morgan Stanley, earned an MBA from Stanford as an Arjay Miller Scholar (top 10%), and then joined Goldman Sachs in risk arbitrage under Robert Rubin. He later became a partner at the private equity firm Hellman & Friedman.

In 1986, Steyer founded Farallon Capital. He pioneered what would later be recognized as an "event-driven" hedge fund strategy. His Goldman Sachs-learned approach involved capitalizing on takeover announcements. When a bid was made, the target stock often surged towards the offer price. For example, a $30 stock might rise to $38 on a $40 bid. The choice then was to buy and potentially gain $2 if the merger succeeded or risk losing $8 if it fell through. Success relied on predicting regulatory actions, shareholder sentiment, and possible higher bids.

Steyer approached his work with intense dedication, occasionally excessive. Normally, Steyer would arrive at the office by 5:30 AM. After experiencing losses in the 1987 crash, he began arriving at work as early as 3:00 AM.

After Drexel Burnham Lambert filed for bankruptcy in 1990, Steyer bought a substantial portion of its debt at low prices. When he sold his stake in 1993, Farallon’s portfolio gained 35%. This move allowed Steyer to profit from both the mergers financed by Drexel's bonds and the firm’s collapse.

Steyer's strong performance impressed Yale's endowment manager David Swensen. Swensen met Steyer in San Francisco in the fall of 1989, and by January 1990, Yale invested $300 million in Farallon, boosting the fund's capital to $900 million.

Steyer ran for U.S. president in 2020. As a self-funded candidate, he invested heavily in campaign advertising. After finishing third behind Joe Biden and Bernie Sanders on February 29, 2020, he suspended his campaign.

John Paulson

John Paulson is a billionaire hedge fund manager worth $3 billion. He became famous in 2007 for using credit default swaps to bet against the U.S. subprime mortgage lending market, for which he earned $4 billion personally on this trade.

Paulson was born in 1955 in Queens, New York.

UG: Finance, summa cum laude, NYU, 1978

MBA: Harvard Business School, Baker Scholar (top 5% of class), 1980

After his MBA, Paulson worked at Boston Consulting Group and then left to join Odyssey Partners, a hedge fund that grew to $3 billion AUM at its peak. He then moved to Bear Stearns working in the M&A department and then to the hedge fund Gruss Partners LP, where he was a partner.

In 1994, Paulson founded his own hedge fund, Paulson & Co. with $2 million and one employee. He rented office space from Bear Stearns. By 2003, his fund had grown to $300 million AUM. Paulson & Co. specializes in event-driven investing that includes M&A, spinoffs, proxy contests, etc.

Paulson became famous globally in 2007 by shorting the US housing market via credit default swaps on mortgage-backed securities. In 2010, he set another record by making ~$5 billion in a single year on a gold trade, but his flagship fund fell sharply in 2011 due to losing investments in major commercial banks and the fraudulent Sino-Forest Corporation.

Public Equity - Growth

Lee Ainslie

Lee Ainslie is the founder of Maverick Capital. He was born in Alexandria, VA in 1964. He graduated from the University of Virginia in 1986 and holds an MBA from UNC Kenan-Flagler Business School in 1990.

At UNC, Ainslie got to work on the same board with Julian Robertson, after which Robertson offered him to join Tiger Management when Ainslie originally intended to join Goldman Sachs.

At Tiger Management, Ainslie initially worked under Stephen Mandel, who was already a well-respected investor who later founded Lone Pine Capital. Ainslie thought his first performance review was going to go horribly. Instead, he received a handsome bonus and was promoted to Head of Technology, a promotion vouched for by Mandel.

Ainslie is a “Tiger Cub”, one of the protégés of Julian Robertson who founded their own hedge fund.

In 1993, Ainslie was approached by billionaire Sam Wyly to start a hedge fund. Ainslie didn’t think he was ready but realized opportunity doesn’t come the second time. Therefore, Ainslie went for it and launched Maverick Capital with $38 million, most of which came from the Wyly family.

At first, Maverick had trouble gaining investor interest and the name “Maverick” didn’t help, which Ainslie chose because he was living in Dallas at the time and the name appealed to him. Unfortunately, investors associate the name with reckless risk-taking.

Maverick had a few years of strong performance after launch, which led to asset growth that made the business viable.

Read my deep dive on Maverick Capital in my newsletter linked in my profile.

Maverick alums with their own funds include:

John Fichthorn, Dialectic Capital

Prashanth Jayaram, Tri Locum Partners

Mike Pausic, Foxhaven Asset Management

Rishi Renjen, ROAM Global Management

Andrew Warford, Estuary Capital

Ronald Baron

Ronald Baron (b. 1943, Asbury Park, NJ) is an American billionaire mutual fund manager and the founder of Baron Capital, a growth-oriented investment firm that manages the Baron Funds.

He earned a chemistry degree from Bucknell University before attending George Washington University Law School at night on scholarship. His career began at the United States Patent Office before he transitioned to Wall Street in 1969.

From 1970 to 1982, Baron worked as an institutional securities analyst at various brokerage firms, selling research with a business partner. While his recommendations often led to stocks doubling or tripling in value, his commission-based compensation model encouraged short-term sales rather than long-term investment. This experience shaped his investment philosophy, emphasizing holding durable, competitively advantaged growth companies for the long term.

In 1982, Baron founded Baron Capital with an initial book value of $100,000 and a small office. That same year, he hired two employees, including Susan Robbins, who remains with the firm as a senior research analyst. His long-term, small-cap-focused investment strategy quickly gained attention, earning coverage in publications such as Barron's and The Wall Street Journal.

Under his leadership, Baron Capital grew into a widely respected investment firm known for its disciplined, long-term approach. In 1993, the firm launched the Baron Investment Conference, an annual shareholder event that has featured major musical acts such as Elton John, the Beach Boys, and Lionel Richie.

Beyond investing, Baron made headlines in 2007 for purchasing a $103 million home in East Hampton, New York, then the most expensive residential property sale in U.S. history.

Chase Coleman III

Chase Coleman III is the billionaire founder of Tiger Global Management with a net worth of $8.5 billion. He attended Deerfield Academy and graduated from Williams College in 1997. Coleman is a descendant of Peter Stuyvesant, the last Dutch governor of New York.

Coleman grew up with Julian Robertson’s son, Spencer, in Glen Head, New York on Long Island. After graduation, Coleman worked for Julian Robertson at Tiger Management as a tech analyst.

When Robertson closed Tiger Management in 2000, he gave the 25-year-old Coleman $25 million to manage. Coleman named the fund Tiger Technology Management which he later changed to Tiger Global.

Founded after the burst of the dot-com bubble, Tiger Global got off to a strong start, generating a 52% return in 2001. Coleman attributes the firm’s early success to Scott Shleifer, a Tiger Global partner, who invested in Sina Corp, Sohu.com, and NetEase, dubbed “the Yahoos of China” in late 2002, which multiplied their initial investment by mid-2003.

In 2003, Scott Shleifer led Tiger Global's expansion into the private market. From 2007 to 2017, the firm raised the most amount of capital among venture capital firms.

In 2022, Tiger Global suffered significant losses with the hedge fund (long-short) and long-only fund declining 56% and 67% respectively. The hedge fund rebounded with a 29% return in 2023.

Tiger Global alums who started funds include:

Andrew Bellas, General Equity Holdings

Alex Captain, Cat Rock Capital Management

Wang Chen, Serenity Capital

Feroz Dewan, Arena Holdings

Amit Doshi, Harbor Spring Capital

Lee Fixel, Addition

Karthik Sarma, SRS Investment Management

Joseph Edelman

Joseph Edelman is a billionaire hedge fund investor. He is the founder and CEO of Perceptive Advisors, a hedge fund specializing in life sciences.

UG: UC San Diego, bachelors in psychology, magna cum laude, 1978

MBA: NYU Stern School of Business, 1988

Edelman grew up in San Francisco, where his father Isidore was a professor at UCSF. He enrolled in the graduate program in psychopharmacology at UCSD but dropped out just after a few weeks.

Edelman moved to New York and enrolled in an MBA program while doing accounting work to support himself financially.

After his MBA, he worked as a sell-side biotech research analyst at Labe, Simpson & Co and then at Prudential Securities. After that, he was a senior analyst at Aries Fund, a biotech hedge fund under Paramount Capital Asset Management.

In February 1999, Edelman joined First New York Securities, a prop trading shop that gave him $6 million to manage. Later that year, he founded Perceptive Advisors.

According to the firm’s fundraising pitch book, Edelman chose the name Perceptive because of the way the firm analyzes corporate events in the biotech sector. Perceptive Advisors seeks to understand the “perception” of events and then only invests in “reality” after deep research.

The firm’s bread and butter is development-stage companies that make game-changing drugs, while applying careful risk management. Like many biotech hedge funds, Perceptive houses a few MDs and Ph.Ds. on the investment team but Edelman is not one of them.

Samuel Isaly

Samuel Isaly (b. 1945, Youngstown, OH, United States) is an American investor who is the founder of Exome Asset Management and OrbiMed Advisors, a leading healthcare investment firm.

He earned an A.B. in Economics from Princeton University, graduating magna cum laude and receiving the Percy Allen Ransome Sr. Prize in Economics. A Fulbright Scholar, he later completed an M.Sc. (Econ.) at the London School of Economics.

Isaly began his career as a pharmaceutical analyst, holding roles at Chase Manhattan Bank, Merrill Lynch, Legg Mason, and S.G. Warburg.

In 1989, he and colleague Viren Mehta co-founded Mehta & Isaly, a research-driven investment firm focused on the pharmaceutical sector, marking the start of a distinguished trajectory in healthcare investing.

In 1998, following a strategic split with his partner, he launched OrbiMed Advisors, which evolved into one of the world’s largest healthcare-dedicated investment firms.

Under his leadership, OrbiMed managed diverse strategies across public equities, private equity, and royalty/credit, investing in companies ranging from early-stage biotech ventures to multinational pharmaceutical corporations. He served as portfolio manager of the Worldwide Healthcare Trust Plc for 22 years.

In 2017, Isaly stepped down from his role at OrbiMed following internal allegations from former employees.

The next year, he established Exome Asset Management, where he continues to manage long/short healthcare investment strategies across global markets.

Mala Gaonkar

Mala Gaonkar (b. 1969) is an Indian-American hedge fund manager and the founder of SurgoCap Partners. She was previously a longtime portfolio manager at Lone Pine Capital, the Tiger Cub hedge fund founded by Stephen Mandel.

Born in the U.S. and mostly raised in Bengaluru, India, Gaonkar earned her undergraduate degree from Harvard College in 1991 and an MBA from Harvard Business School in 1996.

Gaonkar began her career at Boston Consulting Group. After MBA, she briefly worked as an analyst at Chase Capital Partners before joining Lone Pine as a founding partner in 1998.

Three years later, she was named portfolio manager overseeing investments in tech, media, internet, and telecom, and also co-headed Lone Pine’s long-only strategies. In 2019, when Mandel stepped back from day-to-day operations, he named Gaonkar one of three PMs, along with Kelly Granat and David Craver, overseeing Lone Pine’s $16.7 billion in assets.

In 2022, she left Lone Pine after 23 years to launch SurgoCap Partners, which debuted on January 3, 2023, with $1.8 billion under management—the largest-ever hedge fund launch by a woman. By 2024, SurgoCap’s assets had surpassed $3 billion. Its portfolio includes tech giants like Nvidia, healthcare firm McKesson, and energy player GE Vernova. In 2024, SurgoCap also joined Figma’s fundraising round after the collapse of Adobe’s planned acquisition.

SurgoCap’s strategy applies data science to identify how technology can enhance sectors like financials, industrials, health care, and enterprise data.

Gaonkar is also active in public health. In 2015, she co-founded the Surgo Foundation with Gates Foundation alum Sema Sgaier and author Malcolm Gladwell. The foundation used AI and data science to tackle global health issues like sanitation in India. In 2020, she expanded the effort into Surgo Ventures to partner with other organizations focused on data-driven solutions to public health problems.

John Griffin

John Griffin is the billionaire founder of the hedge fund Blue Ridge Capital, which shut down in 2017.

Griffin received his bachelor's degree from UVA in 1985 and earned an MBA from Stanford GSB in 1990, where he was a classmate of Andreas Halvorsen, a fellow "Tiger Cub" who founded Viking Global Investors.

After graduating from UVA, Griffin worked as a financial analyst at Morgan Stanley Merchant Banking Group for two years before joining Julian Robertson at Tiger Management.

At Tiger Management, Griffin served as president from 1993 until 1996, in addition to his role as a portfolio manager from 1994 to 1996.

Griffin is a "Tiger Cub," one of the successful protégés of Julian Robertson who went on to found their hedge funds.

In 1996, Griffin founded Blue Ridge Capital Management, a long/short hedge fund with $55 million under management. After a 65% return year in 2007, Griffin reportedly took home $620 million.

Blue Ridge delivered an average annual return of 15.4% to its investors over more than two decades, outperforming the S&P 500's return of 8.6% during the same period.

In 2017, Griffin shut down Blue Ridge, which was managing $6 billion at the time.

5 Blue Ridge alums have founded their hedge funds and became "Tiger Grand Cubs":

Rick Gerson, Alpha Wave Global (formerly Falcon Edge Capital)

Angela Aldrich, Bayberry Capital

Robert Mignone, Bridger Capital

David Greenspan, Slate Path Capital

Chris Hansen, Valiant Capital

Andreas Halvorsen

Andreas Halvorsen (b. 1961, Borge, Norway) is a billionaire investor with net worth of $6.6 billion. Halvorsen graduated from Norwegian Naval Academy and went on to be a leader of the Norwegian SEAL team.

He graduated with a degree in economics from Williams College in 1986 where he was a competitive skier. He continued his education with an MBA from Stanford GSB where he was an Arjay Miller Scholar (top 10% of the class.), graduating in 1990.

After a stint in Morgan Stanley investment banking, Halvorsen worked for Julian Robertson at Tiger Management as an Analyst and Director of Equities and was on the management committee.

Halvorsen is a “Tiger Cub”, one of the successful protégés of Julian Robertson who founded their own hedge fund: In 1999, Halvorsen co-founded Viking Global Investors with ex-Tiger Management employees David Ott and Brian Olson. Viking Global only had four down years since its founding and has been one of the hedge fund industry’s biggest successes. As of June 2022 per company website, Viking Global manages $25 billion for public equity and $11 billion for private equity.

Many Viking Global alums founded their own hedge funds. Most notably Dan Sundheim and Tom Purcell were once co-Chief Investment Officers of Viking Global who went on to found D1 Capital Partners and Alua Capital Management, respectively.

Other notable alums include Mina Faltas of Washington Harbour Partners, Steve Mykijewycz of Masterton Capital Management, Jim Parsons of Junto Capital Management, Ben Jacobs of Anomaly Capital Management, Grant Wonders of Voyager Global, Brennan Diaz of Fernbridge Capital Management, and Divya Nettimi of Avala Global.

Glen Kacher

Glen Kacher is an American hedge fund investor. He is the founder of Light Street Capital, a “Tiger Cub” hedge fund.

Kacher was born in 1971 in northern Virginia. He graduated with a B.S. in Commerce with Distinction from the University of Virginia’s McIntire School of Commerce in 1993. Kacher holds an MBA from Stanford University’s Graduate School of Business, obtained in 1998.

After graduating from UVA, Kacher received an introduction from his lecturers to Julian Robertson, the founder of the famed Tiger Management. There, he received an offer to pick hardware, software, and networking equipment stocks, getting the fund into names like Cisco and Microsoft.

After three years, Kacher pursued his MBA, where he learned that Silicon Valley was the center of the burgeoning internet industry. Originally planning to return to Tiger Management, Kacher was offered a job by Roger McNamee, co-founder of the first big tech PE firm Integral Capital Partners, which invested in both venture deals and public equities—a style now known as crossover funds. At Integral, Kacher led or co-led investments in companies such as LogMeIn, OpenTable, and Agile Software.

After 13 years at Integral, Kacher founded Light Street with McNamee’s backing. Light Street focused on four themes: mobile, social, cloud, and e-commerce. Light Street is a bottom-up shop but concentrates its positions in secular trends. Today, Light Street offers long/short, long-only, and private growth equity strategies, hunting for opportunities globally.

Light Street’s performance has been a roller-coaster in recent years: The firm lost 26% in 2021, and things got worse in 2022, losing 54%. Then it turned around in 2023 with a 46% gain. In 2024, it made 59.4%. Effectively, this results in a 5.7% compounded loss over the 4-year period.

Philippe Laffont

Philippe Laffont is a billionaire hedge fund manager. He graduated from MIT with a Computer Science degree in 1991.

Born in Belgium and grown up in France, Laffont worked as a McKinsey consultant after graduation and then worked for his future wife’s family company in Spain. During his time in Spain, Laffont traded tech stocks during the tech bull market, which drove his interest in the public market.

After returning to the U.S. with the goal of working in investing, Laffont worked for free for a small mutual fund firm. Through his French friend, he got a short meeting with Julian Robertson and Robertson hired him to be the European telecom analyst at Tiger Management.

Laffont is a “Tiger Cub”, one of the protégés of Julian Robertson who founded their own hedge fund: In 1999, Laffont founded Coatue Management with $45 million to invest in technology, media, and telecom (TMT). He named the firm after a beach off the coast of Nantucket where he frequently vacationed.

The environment was great for raising money for TMT hedge fund with the Nasdaq soaring. However, within a few months after Coatue’s founding, Nasdaq crashed by 80%. Laffont survived the dotcom era and emerged as a leading tech stock investor by long tech stocks tied to thematic trends and short companies being disrupted.

Laffont diversified into private equity investing by sending his brother Thomas, who worked as an agent for Hollywood movie actors before joining Coatue, to Silicon Valley to invest in startups. Like its Tiger Cub peer Tiger Global, Coatue became an important venture capital player and bought pre-IPO stakes in companies such as Snap, Lyft, Didi Chuxing and Instacart.

Li Lu

Li Lu is a Chinese-American investor and the founder of Himalaya Capital Management. Born in Tangshan, China, in 1966, he survived the devastating 1976 Tangshan earthquake, one of the deadliest in recorded history.

Li attended Nanjing University, majored in Physics, and transferred to Economics. In 1989, Li played a significant role in the Tiananmen Square student protests, emerging as one of the leaders and participating in a hunger strike. Following the government crackdown, he fled to New York City at the age of 23 to continue his studies at Columbia University.

In 1990, Li authored "Moving the Mountain: My Life in China," which inspired a 1994 documentary exploring the events of Tiananmen Square. He holds the distinction of being one of the first individuals in Columbia University's history to earn three simultaneous degrees in 1996: BA, MBA, and JD.

Inspired by a lecture from Warren Buffett at Columbia University in 1993, Li delved into investment, finding Buffett's principles concise and convincing. He began investing in stocks while still a student.

In 1996, Li began his career in investment banking at Donaldson, Lufkin & Jenrette, later establishing Himalaya Capital Management in 1997.

Charlie Munger, vice-chairman of Berkshire Hathaway, became Li's mentor and friend, investing $88 million in his fund, which Li grew to $400 million.

Dubbed the "Chinese Warren Buffett," Li stresses the importance of accurate information and intellectual honesty in investing.

His strategy focuses on long-term compounders, analyzing competition and predicting outcomes over a decade. He introduced BYD Company to Munger and Buffett and holds a stake in the company. While once considered a potential successor to manage Berkshire Hathaway's investments, Li withdrew from consideration in 2010.

Peter Lynch

Peter Lynch is the legendary investor who once ran the Fidelity Magellan Fund.

Peter Lynch was born in Newton, MA in 1944. His dad died early and Lynch worked as a caddie during his teens to support the family. During his sophomore year at Boston College, Lynch used his savings to buy 100 shares of Flying Tiger Airlines for $8 per share, which he later took profit at $80 per share to pay for his education, his first “ten-bagger” in life. Lynch graduated with a degree in history, psychology and philosophy. Later he earned an MBA from the Wharton School of the University of Pennsylvania.

Lynch secured an internship with Fidelity Investments partly because he was caddying for George Sullivan, Fidelity’s president, at the Brae Burn Country Club in Newton. While interning at Fidelity, Lynch covered paper, chemical and publishing industries. He returned to Fidelity full-time after serving in the Army for 2 years and covered textiles, metals and mining and chemical industries, eventually becoming Fidelity’s director of research from 1974 to 1977.

In 1977, Lynch was named the head of Magellan Fund, at the time a low-profile fund with only $18 million in assets. He ran Magellan Fund until his resignation in 1990 when it became a $14 billion fund with more than 1,000 stock positions. During Lynch’s time, the Magellan Fund returned 29.2% annually and as of 2003 had the best 20-year mutual fund return performance ever.

Lynch has written three books on investing: One Up on Wall Street, Beating the Street, and Learn to Earn. His most famous investment principles is “invest in what you know” and argues individual investors are more capable of making money in stocks than a fund manager because they can spot good investments from their day-to-day interactions with products and services that solve real problems.

Lynch also attributes his training in philosophy and logic to be more important than the math and finance he learned during MBA, a view that I strongly concur. Other successful public equity investors who studied philosophy include George Soros of Quantum Fund, Carl Icahn of Icahn Enterprises, and Bill Miller of Legg Mason.

Stephen Mandel

Stephen Mandel is the billionaire founder of the hedge fund Lone Pine Capital. He is a graduate of Dartmouth College in 1978. He also holds an MBA from Harvard Business School, graduating in 1982 where he was classmates with Seth Klarman (Founder of The Baupost Group), Jamie Dimon (CEO of JP Morgan), Jeff Immelt (Former CEO of GE), and Steve Burke (Chairman of NBCUniversal.)

Mandel began his career as a consultant for Mars & Co, focusing on supermarkets. After two years, he joined Goldman Sachs' equity research team to cover retail under Joe Ellis. Joe Ellis delegated the coverage of Walmart to Mandel and he dedicated a large amount of effort on Walmart.

After Goldman Sachs, Mandel worked for Julian Robertson at Tiger Management as a consumer analyst, eventually becoming a managing director. At one point, he was also Lee Ainslie’s boss, vouching for Ainslie’s promotion to Head of Technology, a career-defining moment that eventually led Ainslie to establish Maverick Capital in 1993.

Mandel is a “Tiger Cub”, one of the protégés of Julian Robertson who founded their own successful hedge funds. In 1997, Mandel founded Lone Pine Capital, named after a pine tree on Dartmouth's campus that miraculously survived a lightning strike in 1887.

Despite challenging performance in recent years, Lone Pine still manages $15 billion and generated a 15% annualized return since inception through July 31, 2023, outpacing global stock markets and many peers. Lone Pine offers both long/short and long-only products, named Cypress and Cascade funds respectively.

Subscribe to my newsletter (profile link) to learn more about Lone Pine Capital in my deep dive.

Lone Pine alums who founded their own hedge funds include:

Scott Coulter, Cowbird Capital

Paul Eisenstein, Vetamer Capital

Brian Eizenstat, Dilation Capital

Mala Gaonkar, Surgo Partners

Eashwar Krishnan, Tybourne Capital (co-founder)

Marco Tablada, Alua Capital (co-founded with Tom Purcell, ex-Viking co-CIO)

Li Ran, Half Sky Capital

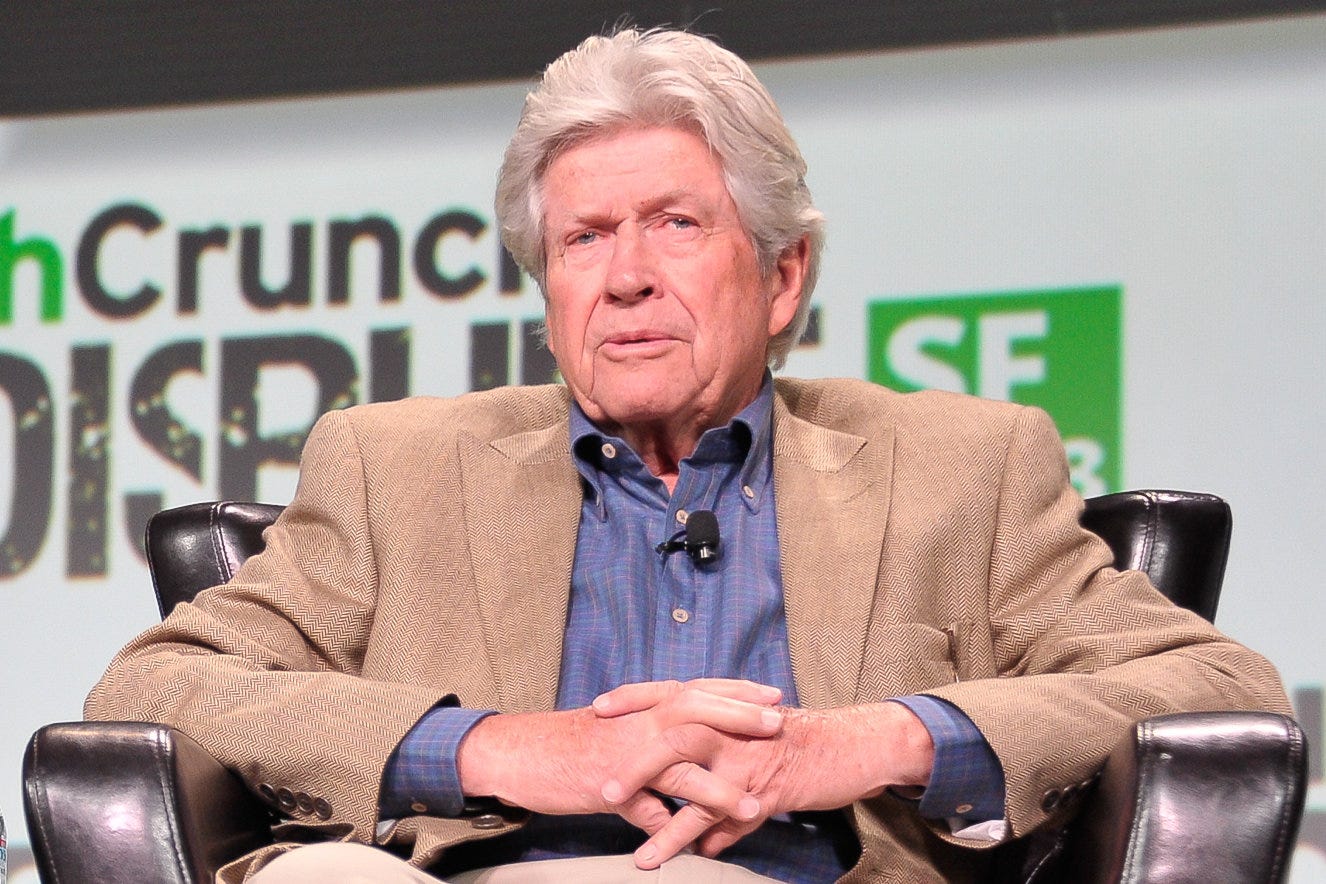

Julian Robertson

Julian Robertson was an American hedge fund manager who founded Tiger Management, one of the earliest hedge funds, in 1980.

Born in Salisbury, North Carolina, he graduated from UNC Chapel Hill in 1955 and served in the US Navy until 1957.

Subsequently, he moved to New York City to work as a stockbroker at Kidder Peabody, eventually heading the asset management division.

In 1978, he took a sabbatical and relocated with his family to New Zealand to write a novel.

In 1980, he founded Tiger Management with $8 million from family, friends, and personal funds, and the fund reached a peak of $22 billion in 1998. Notably, Tiger Management successfully avoided the dot-com bubble but faced challenges that led to its closure, primarily due to holdings in US Airways and losses in Japanese Yen.

From 1980 to its peak in 1998, the fund generated an impressive annual return of 31.7% after fees.

After shutting down Tiger Management in 2000, Robertson continued to support emerging hedge fund managers in exchange for a stake in their fund management companies.

Robertson played a pivotal role in mentoring and providing initial funding to several renowned hedge fund managers, known as Tiger Cubs, including John Griffin (Blue Ridge), Andreas Halvorsen (Viking Global), Stephen Mandel (Lone Pine), Lee Ainslie (Maverick), Chase Coleman (Tiger Global) and Philippe Laffont (Coatue).

Robertson passed away at the age of 90 in Manhattan on August 23, 2022.

Arthur Samberg

Arthur Samberg was an American hedge fund manager who founded Pequot Capital Management. Jay Samberg, born in 1941 in the Bronx, NYC, studied Aeronautics and Astronautics at MIT and earned an M.S. from Stanford University. Realizing engineering wasn't for him, he pursued stock investing and earned an M.B.A. from Columbia University in 1967.

Samberg began his career as a research analyst at Kidder, Peabody & Co. In 1970, he was the first professional hire at Weiss, Peck & Greer, eventually becoming a partner and serving on the management committee. Over 15 years, the firm grew to $8 billion in assets under management.

In 1985, Samberg co-founded and became president of Dawson–Samberg Capital Management in Southport, CT. The following year, they established the first Pequot hedge fund, which initially lost 20% before becoming successful.

In 1999, Samberg spun out his funds into Pequot Capital Management, co-founding it with Daniel C. Benton. By 2001, Pequot was the largest hedge fund globally, managing $15 billion. That year, Samberg and Benton split the fund, each taking $7.5 billion. Samberg's firm retained the Pequot name, while Benton formed Andor Capital Management.

In 2004, the SEC investigated Pequot's trading, focusing on Samberg's hiring of ex-Microsoft employee David Zilkha and trading in Microsoft securities. The case closed in 2006 but reopened in 2008. In 2010, Pequot and Samberg settled, agreeing to penalties without admitting or denying the allegations.

In 2009, Samberg shut down Pequot Capital and continued managing his family's holdings through Hawkes Financial. Samberg passed away from leukemia at his home in 2020 at the age of 79.

Terry Smith

Terry Smith is an English fund manager and founder of Fundsmith, known as “the English Warren Buffett” for his wide-moat growth investment style. Smith grew up in East London and graduated with a First in History from Cardiff University in 1974.

Smith worked at Barclays Bank from 1973 to 1984, managing the Pall Mall branch and later focusing on stock analysis. He earned an MBA from Henley Management College in 1979.

He left Barclays to work as a research analyst at W Greenwell & Co and later joined Barclays de Zoete Wedd, where he was the top-rated bank analyst in London from 1984 to 1989. In 1990, he was appointed Head of UK Company Research at UBS Phillips & Drew.

While at UBS Phillips & Drew, Smith's clients questioned why several high-profile FTSE 100 companies, like Polly Peck and British and Commonwealth, failed despite healthy profits. Smith wrote an analyst circular, "Accounting for Growth," revealing cash flow issues and misleading accounting practices.

The paper gained attention and led to a book deal with Random House. UBS asked Smith to withdraw it, but he refused, leading to his suspension, dismissal, and a lawsuit. Smith counter-sued, and the dispute was settled out of court 18 months later. The controversy propelled the book to No. 1 on the bestseller list, selling over 100,000 copies.

Smith joined Collins Stewart in 1992, became CEO in 2000, and led its flotation on the London Stock Exchange. Collins Stewart then acquired Tullett Liberty and Prebon Group, forming Tullett Prebon. After their demerger in 2006, Smith chaired Collins Stewart until 2010.

In 2010, Smith founded Fundsmith with a strategy of buying good companies, avoiding overpayment, and then holding them. As of December 2023, Fundsmith manages over £36bn.

Fundsmith holds 20-30 companies in its portfolio at a time, with no more than 70 stocks in the world that match the firm’s investment criteria, which typically span several decades and multiple economic cycles. Since its inception in November 2010 to the end of July 2024, Fundsmith has returned 15% annualized, compared to 12% for the MSCI World Index.

Daniel Sundheim

Daniel Sundheim is the billionaire founder of D1 Capital.

UG: Economics, UPenn Wharton, 1999

Sundheim began his career in merchant banking at Bear Stearns. In his spare time outside of working hundred-hour weeks, Sundheim won four monthly best investing idea awards under the alias “Sunny329” on Joel Greenblatt’s Value Investors Club website. One of which was a thesis to short the stock of Orthodontic Centers of America (“OCA”) alleging fraud that forced the company to respond to the claim publicly. OCA eventually filed for bankruptcy.

Sundheim’s OCA pitch became widely known on Wall Street and helped him land an analyst job at a “Tiger Cub” hedge fund Viking Global Investors.

At Viking, Sundheim was a financial services analyst. He started managing his own portfolio in 2005 and became the sole Chief Investment Officer in 2014. As the CIO of Viking Global, Sundheim made $275 million in 2014 and $280 million in 2015.

In 2018, after a 15-year run at Viking, Sundheim founded D1, which stands for “day one,” a concept started by Jeff Bezos. With more than $500 million of Sundheim’s own money, D1 started trading with more than $5 billion under management.

Sundheim is a “Tiger Grandcub,” a Tiger Cub employee who founded his own firm. He is respected and liked by colleagues and friends.

In January 2021, D1 lost $4 billion due to the GameStop short squeeze, but recouped 90% of its loss in three months.

Jeffrey Vinik

Jeffrey Vinik (b. 1959, Deal, NJ) is an American investor and former hedge fund manager best known for running the Fidelity Magellan Fund.

He graduated Phi Beta Kappa from Duke University in 1981 with a B.S. in civil engineering and earned his MBA from Harvard Business School in 1985.

Vinik began his career as a securities analyst at Value Line and later worked as an equities block trader at First Boston. He joined Fidelity Investments in 1986, where he managed several funds, including the Fidelity Select Energy Services Fund (1986–1989), the Fidelity Contrafund (1989–1990), and the Fidelity Growth and Income Fund (1990–1992).

In 1992, Vinik was tapped to manage the $50 billion Magellan Fund, then the world’s largest mutual fund. A protégé of Peter Lynch, he averaged 17% annual returns during his four-year tenure but stepped down in 1996 amid criticism over short-term performance and personal stock trades.

Later that year, he launched Vinik Asset Management (VAM), generating a 93.8% return in his first 11 months and approximately 50% annually for the next three years. In 2000, he returned $4.2 billion to outside investors and continued managing his own capital. VAM ultimately closed in 2013 after distributing approximately $9 billion in assets.

In 2010, Vinik purchased the NHL’s Tampa Bay Lightning and a minority stake in the Boston Red Sox. He also served on the board of Liverpool FC from 2010 to 2013 and led a $3 billion redevelopment project in downtown Tampa through Strategic Property Partners.

He stepped away from team ownership in October 2024.

Trading

Pierre Andurand

Pierre Andurand (b. February 1977, Aix-en-Provence, France) is the founder and Chief Investment Officer of Andurand Capital, an energy and commodities-focused hedge fund with approximately $2 billion in assets under management.

He holds an MSc in Applied Mathematics from the Institut National des Sciences Appliquées in Toulouse, an MSc in International Finance from HEC Paris, and additional master’s degrees in Computer Science from Columbia University, Mathematical and Theoretical Physics from the University of Oxford, and Astrophysics from Queen Mary University of London.

Andurand began his trading career at Goldman Sachs in Singapore, specializing in oil markets. He went on to hold senior trading roles at Bank of America and Vitol, where he was promoted to partner in London in 2004. His trading performance at Vitol earned him a reported $20 million bonus in one year, solidifying his reputation in global oil markets.

In 2007, he co-founded BlueGold Capital, serving as Chief Investment Officer. The fund launched in 2008 and posted a 210% return in its first year, reaching $2.4 billion in assets. BlueGold closed in 2012, returning nearly all investor capital promptly after the founders parted ways.

In 2013, he founded Andurand Capital, building a reputation for decisive positioning in volatile energy markets. The firm posted standout performance during the 2020 oil crash and recovery, with returns of 154% in 2020 and 87% in 2021. Despite a -54.7% decline in 2023 and a volatile 2024, the fund remained active through sharp market swings. As of mid-2025, its flagship strategy had declined by roughly 60% year-to-date amid renewed turbulence in commodities.

In 2021, he expanded into sustainability with the launch of the Andurand Climate and Energy Transition Fund.

Outside of finance, he is the majority shareholder of the international kickboxing league Glory, founded after the collapse of K-1.

John Arnold

John Arnold is a billionaire hedge fund manager who was once the youngest billionaire in the U.S. in 2007. He ran a Houston-based hedge fund, Centaurus Advisors, specializing in trading energy products. Arnold was born in 1974 in Dallas, Texas.

UG: Vanderbilt University, bachelor degrees in mathematics and economics

After graduation in 1995, Arnold joined Enron as an oil analyst and swiftly rose to the position of assistant trader.

In 1996, Arnold took over the trading of natural gas derivatives at the Natural Gas Desk.

Leveraging the new Internet-based trading network, EnronOnline, Arnold made $750 million for Enron in 2001 and was given an $8 million bonus, the largest in Enron's history, earning him the nickname "king of natural gas."

A year later, Arnold founded Centaurus, a hedge fund, with his bonus. He gained renown within the industry for his astute insights and strategic maneuvers, notably during the collapse of Amaranth Advisors, where Centaurus emerged as a major player on the other side of their positions, returning as much as 150% in 2005.

Arnold announced his retirement from running the hedge fund in 2012. He is widely quoted for his viewpoints on the energy industry.

Dmitry Balyasny

Dmitry Balyasny is the founder and Chief Investment Officer of Balyasny Asset Management (BAM). He was born in Kiev, Ukraine, and immigrated to the United States at the age of seven. He pursued a finance degree at Loyola University Chicago.

After facing multiple rejections from hedge funds, Balyasny secured a job at Schonfeld Securities in 1994. In an eat-what-you-kill environment, where traders received capital and lunch but no base salary, Balyasny initially struggled to make profits but soon found his footing.

Through the 1990s, Balyasny built a strong capital base and an internal team, which eventually became the foundation for BAM. In 1999, he co-founded BAM with Scott Schroeder and Taylor O’Malley, launching officially in 2001, initially focusing on long/short equity strategies and expanding into global macro and other approaches.

BAM remarkably weathered market crises, including the dotcom crash and the 2008 financial crisis, posting consistent gains. Over the first 16 years of its existence, BAM generated 12% annualized returns.

However, in 2018, the firm faced challenges, posting large losses. AUM dropped by half from $12 billion to $6 billion. Balyasny himself sent out an email to all employees with the subject line “Adapt or Die.” This email wound up in the hands of Ken Griffin, founder and CEO of Citadel LLC. Griffin used the email in an internal town hall meeting for employees, telling them this was an example of what happens when a firm has a poor culture. BAM laid off 20% of its workforce that year.