A few weeks ago during coffee, my mentor asked me what I learned from the last two years of building Richard Toad into a business. I thought to share my lessons because many of you asked me as well.

In this part 1, I will share about the new skills I learned that are different from being a public investor.

Let’s dive in.

All details matter

You need to do everything when building a product and starting a business, even when you don’t know how to. I learned JavaScript and HTML using ChatGPT to build a sortable table for my job board. I learned Adobe Premiere and OBS to produce YouTube videos. I learned Canva for Instagram posts and YouTube thumbnail creation.

Some days, my Stripe will stop working. Some days, my clients tell me my links are broken on my link aggregator. Problems don’t resolve themselves; every day is like fighting fire. If I don’t do them, no progress is made.

Thankfully, in my prior corporate jobs including sell-side equity research, I loved rolling up my sleeves and diving into the details. Unlike stock investing, you can’t get away by focusing only on 2-3 things that matter. In operating a business, everything matters.

However. similar to the volatility of stocks, nonlinearity is an inherent feature of entrepreneurship, which leads to my next point.

Embrace nonlinearity

Unlike the predictable bi-weekly paycheck of a 9-5 job, progress and money come nonlinearly in the entrepreneurial realm.

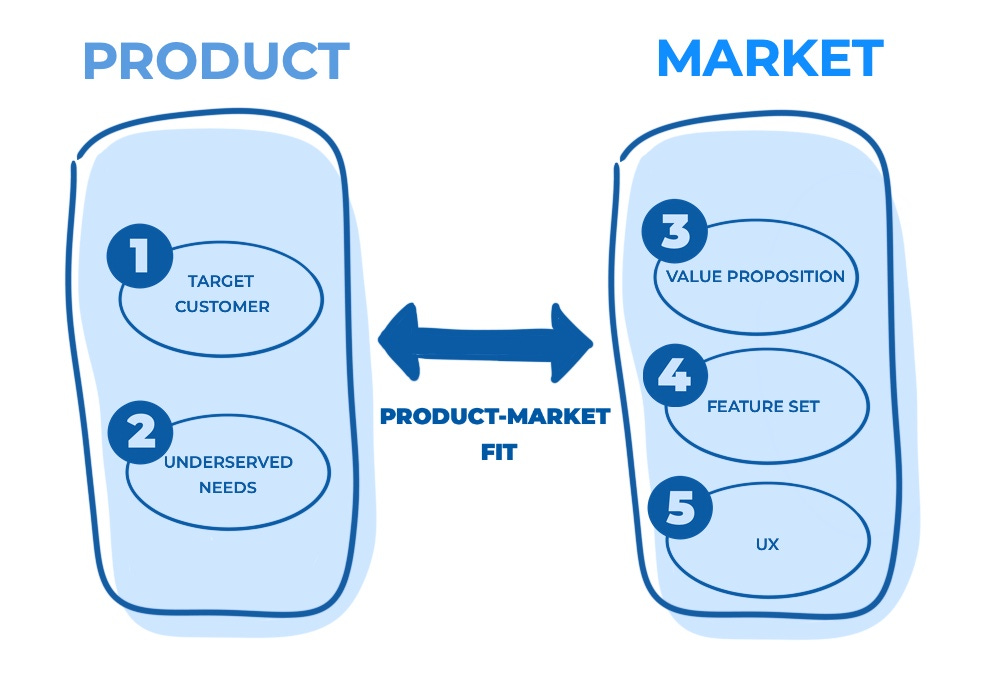

Without content-audience fit, your social media won’t grow. Without product-market fit, your business will make no sales. There are many fancy terms for these observations: tipping point, critical mass, escape velocity, etc.

When I first started, I was naïve. At the time, my social media had gotten traction, but I assumed that would translate into immediate financial success when I opened for business. However, launching 1-on-1 coaching calls revealed the harsh reality: despite the audience size, converting followers into paying customers proved challenging. I learned one of the early lessons of not conflating distribution channels with revenue conversions.

Despite the initial setbacks, there's a silver lining: as I navigate the business building, it gradually becomes easier, not just because it does, but because I adapted, listened, and tried things. Internet-based businesses inherently possess critical mass and exponential growth mechanisms. But getting to the tipping point is far from being taken for granted.

The journey will continue to be fraught with challenges, with more cold start problems as I explore new revenue streams. Yet, it's precisely these hurdles that define the entrepreneurial path, shaping one's resilience and determination. And part of that journey involves learning how to sell, which leads to my next point.

Selling

I learned how to sell. At first, I made the mistake of merely describing my offerings, but clients only care about how they will benefit. We are naturally selfish. So it was an amateur mistake to be 'selfish' by describing how great my products are when a simple reframe of how much value my products can add motivates clients to take out their credit cards.

I have also realized the importance of incorporating calls to action. Encouraging my audience to take action after engaging with my content has yielded positive business and financial outcomes.

Thankfully, there is synergy between being a social media creator and an entrepreneur, in that I already have a fulfilling career as a self-marketer.

While this may seem cringeworthy to some, it's crucial to strive for visibility in the social media world where there is no barrier to entry.

Even in corporate settings, visibility and self-promotion play vital roles in achieving success. You know what they say: It’s not about what you do and know, it’s about what others think you do and know that matters.

And when you sell, you run into all sorts of characters as customers, which leads to my next point.

Appreciation for human behaviors

Social media's emergence as a business concept remains in its infancy, resulting in skepticism and the proliferation of online get-rich-quick schemes. Despite its transformative potential, the internet inevitably brings forth dark sides. For every creator who genuinely wants to solve a problem, there is a sketchy seller of courses that promise quick money only for you to realize the only revenue they generate is from the course sale.

The success stories of individuals like Mr. Beast, Casey Neistat, and Ali Abdaal serve as evidence that social media-based businesses are real (in their cases, YouTube).

I get my fair share of haters and jealous people. They come in endless permutations, but I suspect some are coming from the angle of thinking social media revenue generation is effortless, so they are jealous, without realizing social media has zero barriers to entry, so it’s wildly competitive, takes effort and discipline to keep going when facing obstacles. Not to mention content-audience fit should not be taken for granted. I went through a rebrand and content theme pivot to reaccelerate my Instagram growth.

I also deal with many who try to discredit me. Some like to associate credibility with years of work experience in the profession. While this matters if I am teaching portfolio management or idea generation (in fact, I give idea generation content away for free), this perception is completely erroneous. I have known many PMs who aren’t great teachers, and yet many non-PM investors I have befriended are some of the greatest mentors to me (one of whom was instrumental in encouraging me to pursue entrepreneurship). So I will continue to let my content do the talking.

A sizeable portion of my audience is in college who would rather spend money on beers than self-transformation. I, along with a few other creators I am on a DM basis with, deal with plenty of freeloaders, which also come in endless permutations. Thankfully, recent discussions with many big-shot creators made me accept that freeloaders will always be around, and I should not obsess over them. In their exact words: “Freeloaders are never going to be paying customers. Accept that and focus on acquiring customers who do value your work.”

And that leads to my point about asking for help.

Ask for help

Failing to ask for help has been my big mistake, stemming from laziness in going outside and a holdover from my research background.

Each entrepreneur's journey is unique, and learning from others' experiences can expedite progress or help avoid big mistakes. Fortunately, because of my job search, I have been networking in person more and encountered individuals who generously shared their insights, leading to breakthroughs in my business endeavors. This underscores the importance of peer support in the often solitary path of entrepreneurship.

However, remember, that while external advice is valuable, you know your business the best. Consultation and data gathering are essential, but ultimately, trusting your instincts is key. Despite others' genuine efforts to help, they may lack insight into the intricacies of your market and product. You should make the final decision.

Just do it

Your vision for the business often will diverge significantly from its eventual form. Overplanning is futile and pivot is inevitable; experiment, gather early feedback from customers, and adjust product design based on customer responses.

For example, I know many things, but no one will value my disparate knowledge as a product. So, I started publishing things I think can help you. Over time, I hear more recurring questions and see analytics on which articles do well. That’s how I decided to go paid on investment fund deep dives. I didn’t know whether that would attract paid subscribers, but I knew that it’s part of my knowledge I don’t like to give away for free because I think it’s very valuable and differentiated. And a year later, hundreds of you agree, so I'm continuing.

While some prominent entrepreneurs have successfully evangelized a new problem and preached their products as the solution you need to solve it, for most of us, it's better to identify an existing problem.

Avoid perfectionism and get your MVP out there. Focus more on execution and less on strategy and business model. They are important, but a business model is meaningless if you don’t have a product and customers, which means there is no moat to talk about.

Processes and time leverage

Being organized and establishing processes are crucial for business success and for reclaiming time.

The media loves to portray instant wealth stories of someone who works a few hours a week and makes $500,000 a year. It’s not a lie, but it neglects to report the upfront effort and perseverance required to achieve such a lifestyle.

Initially, you may need to do things that don’t scale to pave the way for scalable revenue streams. For instance, career coaches typically start with selling one-on-one coaching first to understand recurring customer problems before transitioning to scalable recorded courses.

I have had enough experience in corporate settings to design and automate processes, which benefit greatly my daily execution of repeatable tasks.

Learn skills on your current job

Don’t discredit what you do on the job today. Maybe you have product development skills as an engineer. Or you have finance skills learned from inside a company or from Wall Street. Or you have sales skills as well as a salesperson. Or you have strategic insights because you are a product manager or a management consultant.

Be curious about what others at your company do because, as a founder (regardless of solo or having a co-founder), you will need to be wearing multiple hats, and you never know what skills you learn are invaluable.

Focus on key drivers

In both investing and operating a business, focusing on what matters is the only way to maximize return on time.

When considering investing in a stock, experienced investors will tell you to hone in on the 2-3 key drivers of the business. While at first, entrepreneurs must throw everything against the wall to see what sticks (aka what generates revenue), the principle of focusing on what matters holds for entrepreneurs as well over time.

Having achieved product market fit a few times now, I am focusing on reduction, not addition, by prioritizing activities that maintain existing revenue and drive future growth.

Those of you who are my YouTube channel followers must have noticed that I have not published a video for a while. At this point, I am treating YouTube as a marketing channel. While the creative process behind video production is fun, it’s not repeatable by definition (because it’s creative) and consumes too much time that can be better spent on revenue-generating products that can move the needle.

Why do investors screen for stocks? It’s for the same reason of reducing the opportunity set in hopes of identifying stocks that can be actionable.

Entrepreneurs need to focus on fewer things. I came across a Jensen Huang talk where he advised the audience to focus on solving a small problem well rather than trying to solve a big problem but failing. I can relate to that comment very strongly today. By prioritizing what truly moves the needle, whether in investing in stocks or operating a business, individuals can maximize their chances of long-term success, which leads to the point of understanding business drivers.

Strategic Finance

Investors are skilled in conducting financial statement analysis and dissecting business drivers. My experience in analyzing companies has helped in strategize for my own business.

From the very start, I knew that Richard Toad would not ever have as many followers as a general finance social media account, given the niche targeting. Thankfully, having met many creators who went full-time with smaller follower counts, I realize revenue size does not have to depend on a massive following.

Instead, I focused on value creation and capture per follower. This should have been obvious to me if I realized why CPM is higher for technology and finance YouTubers compared to other verticals - those audience segments have higher spending power. Just like how the street was so fixated on Netflix’s quarterly subscriber count without realizing how it had transitioned to an ARPS (average revenue per subscriber) story.

This insight might not have come as swiftly had it not been for prior experience in assessing drivers for businesses in many industries. The investor skill set will continue to be useful as I eventually venture into the phase of establishing moats.

However, as Frank Slootman, the former CEO of Snowflake Inc., stated “no strategy is better than its execution.”

At this point, the focus is to build more products with product-market fit, not on finalizing revenue models (which remain fluid) and establishing competitive advantages, which leads to my next point on building for the long term.

Long-term owner mindset

Long-term value investing has resonated with my investment philosophy from the very beginning. And that translates well as a founder, and even as a member of the corporate world in the past.

While the notion that price is what you pay and what you get is well known today, its application certainly goes beyond the public equity market.

As an investor, I steadfastly underemphasize short-term price fluctuations in favor of focusing on the intrinsic value of investments. Similarly, as a founder, my attention is directed towards constantly enhancing the value proposition of my offerings, my value-add to the community, and the value of my brand, rather than engaging in price-centric strategies or generating near-term cash flow.

While success can be achieved through sheer determination and operational excellence in price-based competition in commodity industries, I will always prefer to engage in value-based competition.

Conventional wisdom for aspiring entrepreneurs is to start as a side hustle while maintaining a full-time job. The rationale is clear: with a steady income stream from a corporate job, you will be less likely to succumb to the pressures of generating short-term cash flow generation for lifestyle purposes and instead focus on value creation and brand-building.

Because I did not adhere to that conventional wisdom, there were definitely instances when I was close to succumbing to the temptation (such as low-quality ad deals) of near-term cash flow that didn’t align with my brand’s ethos. Thankfully, I ultimately walked away after careful consideration.

Observing the proliferation of get-rich-quick schemes and short-term profit-maximizing tactics prevalent on the internet, I understand the audience’s skepticism of online businesses, but paradoxically I think it makes it easier to differentiate online by focusing on demonstrating tangible value.

Similarly, quality businesses with consistently high returns on capital have always prioritized long-term decision-making, eschewing short-term gains for sustainable value creation. Certainly, having skin in the game helps a lot, as seen in examples like Elon Musk, Jeff Bezos, and Jensen Huang, who are owner-operators of some of the most valuable businesses in the world.

Ultimately, the ability to capture value is contingent upon the creation of it. Thus, as the owner-operator, my focus remains unwaveringly fixed on creating value in more ways, secure in the knowledge that value capture should follow over time.

Investing (in the business)

Many wealthy individuals have made the point that it’s impossible to build a very valuable business without learning how to delegate and automate. However, understanding the concept of leverage was initially a significant adjustment for me as a business operator.

A single analogy of understanding return on invested capital has helped me adapt to that lesson. Good capital allocation can result in sustainable above-average value creation in the presence of competitive advantages.

As a process-oriented person, I am already good at establishing repeatable processes to save time. And last year, I was more willing to spend capital to buy back time, so that I could have time to build more products. So I hired a contractor to perform administrative tasks, and it has been a wonderful experience to get time back to focus on higher-value activities. Over time, I envision expanding the scope of work with my contractor as I delegate more tasks.

Similarly, seeing the time I can reclaim, I have been more willing to invest in software to shorten tasks such as YouTube video production and client onboarding.

Risk-taking and the value of acting

Entrepreneurship and equity investing share a common thread of risk-taking. Both endeavors involve navigating uncertainty and imperfect information.

Investors are no strangers to being wrong in a probabilistic profession. The most successful investors often exhibit humility, having been humbled by the market's unpredictable nature, and employ scenario-based planning strategies, which are highly transferable to entrepreneurship.

Entrepreneurial success hinges on the ability to embrace uncertainty and adapt to unforeseen challenges. Launching a Minimum Viable Product (MVP) serves as a pivotal moment where outcomes remain unknown until market feedback is received. Similarly, investors understand that value creation occurs only when acting on their views via buying and selling of stocks.

In both cases, you don’t know whether you are right or wrong until after the fact, but you need to act. Rather than fixating on theoretical frameworks, success in both domains is contingent upon acting and a willingness to adjust based on feedback.

Maybe that’s why Nike’s “Just Do It” is such a powerful slogan. For investors, the wrong approach (which I have guiltily done so plenty) is to read hundreds of investment books, hedge fund letters, and other case studies without analyzing stocks. For entrepreneurs, no amount of books on entrepreneurship, leadership, or sales can replace doing it, learning from mistakes, and adapting.

Comment below if you see other similarities between equity investing and entrepreneurship that I might have missed.

Thanks for reading. I will talk to you next time.

If you want to advertise in my newsletter, contact me 👇

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you.

Great one Richard. I can relate each point you made by reflecting on my own journey.

Great share, Richard! Grasping the concept of non-linearity was an eye-opening moment in my entrepreneurial journey.