Coatue Management, a first-generation “Tiger Cub” hedge fund specializing in technology crossover investing, has been active in public appearances recently.

Philippe Laffont was interviewed by David Rubenstein, co-founder of the Carlyle Group. Coatue also hosted and publicized its annual East Meets West conference, where the Laffont brothers shared their insights on the technology industry and trends in both public and private markets.

Here are my takeaways to get a pulse check on where we are in the market cycle from the legends.

I am building a job matching service to get you more interviews by putting you in front of decision-makers. Details below:

The AI Hype

AI is real. Coatue is known for its philosophy of seeking high valuations for tech stocks as a sign that a real trend is forming, which contrasts with traditional value investors of buying statistically low-valuation stocks. Low-valuation stocks often correlate with low-quality businesses because the market typically assigns appropriate multiples based on the economics (return on invested capital). This is especially true for tech stocks, where low-valuation stocks tend to be in secular decline or under threat, with no signs of recovery.

The danger of falling in love with low-valuation stock is particularly dangerous because the rate of decline for tech companies is more rapid than in other sectors—think of how quickly pagers, yellow pages, CD players, and floppy drives phased out when new paradigms emerged.

Philippe Laffont is very positive about AI as an industry trend and its investment opportunities. He drew an analogy to his investment in Apple: despite widespread hype, investing in Apple proved profitable. The trick, though challenging in practice, involves paying a reasonable price for exponential growth in earnings if these businesses indeed will become the winners riding the beginning of an S-curve.

Year-to-date, two-thirds of the S&P 500 return was driven by AI, with one-third attributable to Nvidia alone, and another third to "clear AI stocks." Stocks with an AI component have increased tenfold more than those without. It’s clear the market valuation tends to move first before the fundamentals, which makes sense given investors are betting on the future.

When asked whether to invest in AI through mega-cap incumbents or small caps, Philippe pointed out that historically, the big tech players tend to get bigger with only a new winning player (such as Meta and TikTok) emerging each year.

At EMW 2024, Philippe discussed the rise of $2-3 trillion market cap companies. The S&P 500 has a market cap of approximately $50 trillion, and the global market cap is around $110 trillion. The increasing number of trillion-dollar market cap companies supports Philippe’s observation that "the winner tends to win, and the big tends to get bigger." The consensus is that these BigCos will continue to dominate for now.

Philippe provided a fascinating analogy of AI and the human brain: GPUs are like neurons, copper wires connect all the neurons, data centers are like houses, and electricity is the food for the neurons. He estimates that $10 trillion has been spent on CPU infrastructure, and replacing it will require a $10-20 trillion investment in GPU infrastructure. Phillippe believes we are at the start of a super-cycle, as illustrated by Coatue's famous slide with the "waves."

Most business and financing activities currently revolve around AI core infrastructure, which he likens to the "left side of the brain" referring to large language models. As we move forward, we will see "Edge AI," akin to the right side of the brain, where processes are very fast but may not always provide the most precise answers. Eventually, AI applications will emerge as the models improve, which is driving the tepid sentiment toward the software industry lately. However, Laffont believes the software sector is merely "delayed." After companies acquire GPUs and set up data centers, the hyperscalers will refocus on AI applications. Finally, he discussed integrating AI into robots or machines. So far, the AI infrastructure layer is winning, with $6 trillion in market cap created.

Challenges and Opportunities in AI

Philippe has expressed concerns that regulation might cripple smaller companies. The FTC intended to protect small companies by preventing them from being acquired, but this often makes their prospects worse. This regulatory environment leads to fewer ways for small companies to succeed and fewer IPOs, which is detrimental to investors. As a result, there is a growing disparity in returns between mega caps and non-profitable smaller companies. Mega companies, due to their critical mass in their respective end markets and network effects, are dominating.

I think betting on incumbents winning is a safer strategy than trying to find winners among hundreds of new players. One problem with trying to find winners among new entrants is that when a new secular trend emerges, many start-ups want to play the trends, resulting in a highly fragmented industry. And the new paradigms can often accrue value to the incumbents such as Microsoft and Nvidia, where the outcome is more paradoxically more predictable.

Another way to profit is by investing in peripheral industries. Laffont uses the analogy of "peeling the onion" to illustrate this point, something that has also been discussed by Lee Ainslie, the founder of Maverick Capital.

For example, the AI theme involves data centers, utilities, and power consumption, the latter of which is a well-known bottleneck for AI computing. Power companies like NRG and Vistra have seen significant gains.

Coatue's view is that the current AI boom is not a valuation bubble like the dot-com era, which is when Coatue was founded. The big companies are investing heavily in capital expenditures, but they have return targets to justify these investments.

Private market trends

Philippe shared several reasons why there aren't more dominant European tech companies. One key factor is the ease of raising venture capital (VC) money in the U.S., often securing term sheets in weeks. For example, Snowflake Software was started by three French people, but they chose to establish the company in the US. Additionally, Europe is not a single market like the US; it consists of many countries with different regulations and localization requirements, complicating business operations.

Thomas Laffont, Phillippe’s brother, and head of private investing at Coatue, shared trends in private technology investing at EMW 2024. The VC funding environment is normalizing, while AI funding is accelerating. Although AI deals comprise only 3% of total VC deals, they represent 15% of the total invested capital, with higher valuations and round sizes.

Most of the capital is directed towards the model/infrastructure layer. However, there is a perverse incentive here because the largest funders, who are semiconductor designers and hyperscale cloud providers, benefit as they sell products to the model builders. In contrast, AI semiconductor companies receive little funding primarily because there are so few startups in this space, and starting a semiconductor company is extremely challenging.

The public market has changed: the dominance of ETFs and passive products means the market favors larger companies. Startup founders need to adapt when considering exits. The last two years have seen historically low numbers of IPOs. There aren't enough active investors who are willing to invest in a company at IPO.

This has led to Coatue’s view that a startup needs to reach $1 billion in revenue to go public. By becoming larger, a company can tap into a broader investor base, including retail investors. Additionally, boards may become fixated on issues such as the terms of the last VC round and the preferred stock structure, which can influence their path to liquidity.

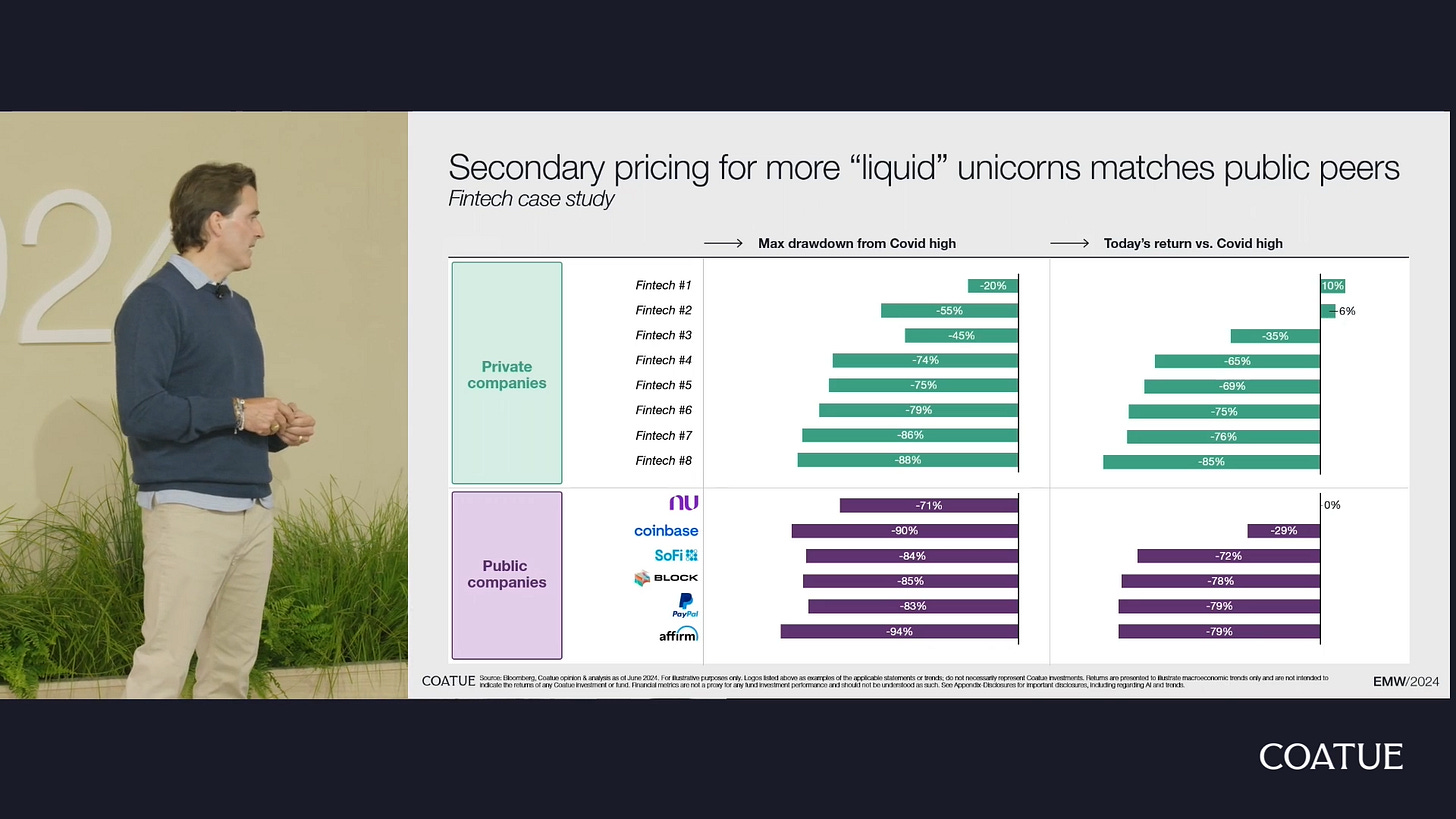

Coatue observes that private market secondary valuation mirrors the public market comparables, where companies with both growth and profitability are favored by public investors, which is challenging for early-stage companies to achieve.

In the current interest rate environment, investors have numerous alternatives, such as investing in treasuries for a risk-free return of ~5%, or in large publicly traded companies at reasonable valuations of 20-30 times price-to-fully-taxed GAAP earnings for entities that grow earnings in the mid-teens (I will take that.)

Thomas highlighted a new exit option is to be acquired by private equity firms, which have ample dry powder (approximately $1 trillion in available capital) and these PE acquirers tend to support growth rather than engage in cost-cutting measures.

Another option is strategic M&A with another company. Thomas shared two cases: Cohesity merging with Veritas for data synergies, and Metropolis, a software company with the vision of powering checkout-free parking, raising $1.5 billion to acquire the largest U.S. parking company to demonstrate its value-add at scale.

Conclusion

Coatue Management’s recent insights highlight the promise of AI and the advantage of investing in established tech giants. Despite regulatory and market challenges, focusing on incumbents and peripheral industries offers strong opportunities. Adaptation to new exit strategies, like strategic M&A and private equity acquisitions, is key to success for today’s start-up founders.

Thanks for reading, I will talk to you next time.

If you want to advertise on my newsletter, contact me 👇

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you.

Link to the EMW video and slide: https://www.coatue.com/blog/company-update/coatues-2024-emw-conference

Link to Phillippe’s interview with David Rubinstein: