Business Hall of Fame

Founders and C-suite

Technology Founders

Sam Altman

Sam Altman is an American billionaire entrepreneur and investor, serving as the CEO of OpenAI. He is recognized as one of the leading figures of the AI boom.

Drop out: Stanford University

Altman was born in Chicago, IL in 1985.

At 19, Altman co-founded Loopt, a location-based social networking mobile app, securing venture financing from NEA, Sequoia Capital, and Y Combinator. In March 2012, Loopt was acquired by the Green Dot Corporation for $43.4 million. The following month, Altman co-founded Hydrazine Capital with his brother, Jack Altman.

Altman joined Y Combinator as a partner in 2011. In February 2014, he was appointed president by co-founder Paul Graham. In September 2016, Altman assumed an expanded role as president of YC Group, overseeing Y Combinator and other units. In March 2019, YC announced Altman's transition from president to chairman of the board, allowing him to focus more on OpenAI.

OpenAI was initially funded by Altman, Greg Brockman, Elon Musk, Jessica Livingston, Peter Thiel, and several large tech companies. At its launch in 2015, OpenAI raised $1 billion. By the summer of 2019, Altman had facilitated an additional $1 billion investment from Microsoft.

For eight days in 2014, Altman served as Reddit's CEO after CEO Yishan Wong resigned. Altman invested in multiple rounds of funding for Reddit and became its third-largest shareholder, with approximately 9% ownership, before its IPO in 2024.

On Friday, November 17, 2023, OpenAI's board removed Altman as CEO and Greg Brockman from the board, both co-founders. In response, Brockman resigned as President of OpenAI. On November 20, Microsoft CEO Satya Nadella announced Altman's appointment to lead a new advanced AI research team. Two days later, 700 of 770 OpenAI employees published an open letter threatening to leave for Microsoft unless all board members stepped down and reinstated Altman. Late that night, OpenAI announced an "agreement in principle" for Altman to return as CEO and Brockman as president. The current board was to resign, except for Quora CEO D'Angelo, to represent the views of the previous board.

Dario Amodei

Dario Amodei is an Italian-American artificial intelligence researcher and entrepreneur. He is the co-founder and CEO of Anthropic, the company behind the large language model series Claude AI.

Dario was born in 1983 and grew up in San Francisco. Amodei began his undergraduate studies at Caltech, where he worked with Tom Tombrello as one of his Physics 11 students. He later transferred to Stanford University, where he earned his undergraduate degree in physics in 2006. He also holds a PhD in physics from Princeton University, graduating in 2011, where he studied the electrophysiology of neural circuits. He was a postdoctoral scholar at the Stanford University School of Medicine.

From November 2014 until October 2015, Amodei worked at Baidu after a brief stint at Google.

In 2016, Amodei joined OpenAI, where he worked for five years and led the development of GPT-2 and GPT-3, the precursors to the large language model powering ChatGPT today.

In an interview, Amodei implied he left OpenAI to start his own company due to differing ideas from OpenAI CEO Sam Altman. In 2021, Amodei and his sister Daniela founded Anthropic along with other former senior members of OpenAI.

Anthropic’s main product is Claude, a ChatGPT-like AI text generator. The company uses a unique training method called “constitutional AI” that aims to build AI systems that are not only powerful and intelligent but also aligned with human values.

In September 2023, Amazon announced an investment of up to $4 billion, followed by a $2 billion commitment from Google the following month.

Brian Armstrong

Brian Armstrong is a billionaire entrepreneur and co-founder of Coinbase, a leading cryptocurrency platform. Born in 1983 near San Jose, CA, Armstrong earned dual bachelor’s degrees in economics and computer science at Rice University in 2005, followed by a master’s in computer science in 2006.

While at Rice, he launched a tutor-matching business. After graduation, he spent a year in Buenos Aires with an education company, gaining exposure to global finance. Armstrong later worked at IBM and Deloitte before discovering Bitcoin’s white paper in 2010, which sparked his interest in cryptocurrency.

In 2011, Armstrong joined Airbnb as a software engineer, working on payment systems across 190 countries. This role revealed the challenges of sending money to South America.

Determined to find a solution, he began coding on nights and weekends to enable cryptocurrency transactions.

In 2012, Armstrong entered the Y Combinator startup accelerator, securing $150,000 to launch Coinbase. After over 50 meetings, he partnered with Fred Ehrsam, a former Goldman Sachs trader he met on Reddit. Together, they co-founded Coinbase to facilitate trading Bitcoin and other digital currencies. Armstrong became the company’s first CEO. Coinbase’s initial wallet was named "Toshi," a nod to Satoshi Nakamoto and one of Armstrong’s cats.

By 2018, a funding round valued Coinbase at $8.1 billion. In December 2020, the company filed for a direct listing and went public in April 2021, achieving an $85 billion market cap and cementing Armstrong’s billionaire status.

Coinbase gained cultural recognition with its 2022 Super Bowl ad: a $13 million, 60-second spot featuring a bouncing QR code offering $15 in free Bitcoin and a chance to win $1 million. The minimalist design went viral, crashing Coinbase’s website with 20 million hits in a minute and boosting its app to No. 2 in downloads.

Tope Awotona

Tope Awotona is a Nigerian-born entrepreneur. He is the founder of Calendly.

Born in Lagos, Nigeria, Tope's early life was shaped by both tragedy and inspiration. At just 12 years old, his father, an entrepreneur himself, was tragically killed in a carjacking. This devastating loss led Tope, his mother, and his three brothers to leave Lagos and settle in Atlanta, GA. His father's entrepreneurial spirit stayed with him, sparking a deep desire in Tope to carry on his legacy.

Tope initially majored in computer science at the University of Georgia but later pivoted to business, earning his Bachelor of Business Administration. After graduation, he worked at various corporate jobs, including IBM, before joining a startup, Perceptive Software, as an account executive. It was here that Tope was exposed to the inner workings of the software business.

But it was a personal frustration that led to his big idea. Tired of the inefficiency of scheduling meetings, Tope took a bold risk: he poured his entire life savings of $200,000 into creating Calendly. With his bank account and 401(k) drained, Tope hustled to raise venture capital, facing countless rejections along the way. Yet, he remained “resourceful, scrappy, and maniacally focused,” determined to prove his doubters wrong.

In 2013, from Atlanta Tech Village, Calendly launched, starting as a bootstrapped operation. Tope’s relentless drive turned Calendly into a major success. By 2021, the company had secured a $350 million investment and reached a $3 billion valuation. Today, Calendly has become the leading scheduling automation platform, with 86% of Fortune 500 companies using it, including 14 of the top 15 Fortune 500 financial firms.

With over 10 million users, Tope Awotona has cemented his place as one of the wealthiest immigrants in America—a true testament to perseverance and vision.

Marc Benioff

Marc Benioff is the billionaire co-founder and CEO of Salesforce. He is a second cousin to David Benioff, who created the television series Game of Thrones.

Beinoiff was born in San Francisco in 1964.

UG: University of Southern California, Business Administration.

After college, Benioff joined Oracle Corporation in a customer service role. He worked for Oracle for 13 years in sales, marketing, and product development roles. At 23, he was named Oracle’s Rookie of the Year. Three years later, he became the youngest VP in Oracle’s history.

In 1999, Benioff founded Salesforce as a software-as-a-service (SaaS) company in a San Francisco apartment. Salesforce gained notability during this period for its "the end of software" tagline and marketing campaign, which included hiring actors to hold up signs with its slogan outside a Siebel Systems conference, used as a guerrilla marketing tactic against the dominant CD-ROM CRM competitor Siebel at the time.

Two of Salesforce's earliest investors were Larry Ellison, the co-founder and first CEO of Oracle, and Halsey Minor, the founder of CNET.

Benioff extended Salesforce's offerings in the early 2000s with the idea of a platform that allowed developers to create applications.

Also in 2003, Salesforce held its first annual Dreamforce conference in San Francisco. In June 2004, the company had its initial public offering on the New York Stock Exchange under the stock symbol CRM.

In 2009, Salesforce passed $1 billion in annual revenue. In December 2020, it was announced that Salesforce would acquire Slack for $27.7 billion, its largest acquisition to date.

In August 2022, Salesforce reported second-quarter earnings of $7.72 billion, surpassing SAP to become the world's largest enterprise software vendor.

Michael Bloomberg

Michael Bloomberg is an American billionaire businessman and politician. He is the co-founder of Bloomberg L.P. and served as the mayor of New York City from 2002 to 2013 over three terms. He was also a candidate for the 2020 Democratic nomination for the President of the United States. As of January 2024, Bloomberg has a net worth of almost $100 billion.

Bloomberg was born in Boston in 1942. He graduated in 1964 with a Bachelor of Science degree in electrical engineering from Johns Hopkins University. In 1966, he received his MBA from Harvard Business School.

In 1966, Bloomberg was hired by Salomon Brothers for a job earning $9,000 a year. He was promoted to the equities desk and became a general partner in 1972. He headed equity trading and, later, systems development. In 1981, Phibro Corporation bought Salomon Brothers, and the new management fired Bloomberg, paying him $10 million for his partnership equity.

After Salomon, Bloomberg used the money received from Phibro to set up a data services company named IMS. Having designed in-house computerized financial systems for Salomon, he believed Wall Street would pay a premium for high-quality, instantaneous business information on computer terminals in a variety of usable formats. The company sold customized computer terminals that delivered real-time market data, financial calculations, and other analytics to Wall Street firms. IMS released its first terminal, called the Market Master terminal, in December 1982.

In 1986, IMS renamed itself Bloomberg L.P. Over the years, the company launched new products including Bloomberg News, Bloomberg Radio, Bloomberg Message, and Bloomberg Tradebook.

In 2022, Bloomberg L.P. generated more than $12 billion in revenue. Bloomberg remains an 88% owner of Bloomberg L.P.

Kim Beomseok

Kim Beomseok (김범석), known as Bom Kim, is the billionaire founder and CEO of Coupang, South Korea’s largest e-commerce company and one of Asia’s fastest-growing tech giants. In 2018, when SoftBank Vision Fund invested $2 billion in Coupang, valuing the company at $9 billion, Kim became South Korea’s newest and second-youngest billionaire at the age of 40.

Born in Seoul, South Korea, in 1978 and raised in the United States, Kim moved to the U.S. at the age of 7. He graduated from Harvard University with a BA and initially pursued a career in journalism, briefly attending Harvard Business School for an MBA. However, he soon recognized a massive opportunity in e-commerce and decided to drop out to focus on building a startup in South Korea.

In 2010, he founded Coupang with the mission to revolutionize South Korean retail through speed, convenience, and a customer-first approach. Over the next decade, Kim transformed Coupang into a one-stop-shop for millions of South Koreans, who now rely on it for everything from groceries to electronics. Coupang pioneered "Rocket Delivery," promising delivery within hours—now a cornerstone of the company's appeal. The company’s logistical innovations and advanced fulfillment centers set a new standard, helping Coupang stay competitive even as global giants like Amazon and Alibaba expanded into the region.

In 2021, Coupang’s IPO on the New York Stock Exchange became one of the largest by an Asian company, valuing it at over $60 billion and solidifying Kim’s status as a tech pioneer.

Today, he continues to push boundaries, expanding Coupang into new sectors like streaming and food delivery, aiming to make the company indispensable to daily life in South Korea.

Morris Chang

Morris Chang is the founder, former chairman and CEO of Taiwan Semiconductor Manufacturing Company (TSMC). He has a net worth of $2.5 billion. He is known as the founder of the semiconductor industry in Taiwan. Chang was born in Ningbo, China, in 1931. During his childhood, his family moved around in China due to the Sino-Japanese War and the Chinese Civil War.

UG/Masters: MIT, Mechanical Engineering

Ph.D.: Stanford

In 1949, Chang moved to study. He failed his doctoral qualification exams two times consecutively and left MIT without obtaining his Ph.D.

In 1955, Chang was hired by Sylvania Semiconductor. Three years later, he moved to Texas Instruments (TI), a rapidly rising company in its field at the time. He rose to the position of manager in the engineering section of TI after three years. TI sponsored him to obtain his Ph.D. in electrical engineering from Stanford, which he received in 1964. He continued to work at TI until 1983, where he had risen to become group VP responsible for TI's worldwide semiconductor business.

In 1983, Chang joined General Instrument Corporation where he eventually became president and chief operating officer. After leaving General Instrument, Chang was recruited by the Premier of the Republic of China to become chairman and president of the Industrial Technology Research Institute in Taiwan. In this role, he was responsible for promoting industrial and technological development in Taiwan.

In 1987, Chang founded TSMC, marking the beginning of a period where firms increasingly saw value in outsourcing manufacturing to Asia. TSMC quickly became one of the world's most profitable chip makers. In 2018, Chang announced his retirement.

Brian Chesky

Brian Chesky is the billionaire founder of Airbnb.

Chesky was born in Niskayuna, NY in 1981.

UG: Rhode Island School of Design (RISD)

At RISD, Chesky met Joe Gebbia, with whom he would eventually co-found Airbnb.

After graduation, Chesky moved to Los Angeles to work as an industrial designer.

In 2007, Chesky moved to SF where he shared an apartment with Gebbia. In October 2007, all hotel rooms in SF were booked because of an industry conference. The pair could not afford rent for the month and decided to rent out their apartment for money. They purchased three air mattresses and marketed this idea as "Airbed and Breakfast", with three guests staying the first night. A few months later, Chesky, Gebbia, and their engineer friend, Nathan Blecharczyk, started Airbedandbreakfast.com. Chesky served as CEO.

To receive funding, the trio created special-edition cereals called "Obama O's" and "Cap'n McCains", based on presidential candidates Barack Obama and John McCain.

Impressed by the cereal boxes, Paul Graham, the founder of Y Combinator, invited the founders to the January 2009 winter training session, training them and providing $20,000 in funding in exchange for a 6% interest in the company.

Due to travel restrictions during COVID, Airbnb's revenue plummeted 80%. The company burned through its cash reserves and opted to raise $2 billion in debt and equity financing to stay afloat. Its valuation, previously $31 billion, slipped to $18 billion. Airbnb laid off 1,900 employees, approximately 25% of its full-time staff. Employees said they felt betrayed, but Chesky was also praised for his handling of the situation. Workers were given generous severance packages, and Chesky offered to help find them jobs elsewhere.

Then, travelers burned out from lockdown turned to Airbnb because they preferred domestic locations and private homes over traditional hotels. Bookings recovered as much as 127% between April and May that year.

In December 2020, Airbnb went public with an IPO. On its first day of trading, the company was valued at $86 billion, more than Marriott, Hilton, and Intercontinental combined.

Michael Dell

Michael Dell (b. 1965, Houston, TX) is an American billionaire businessman and the founder, chairman, and CEO of Dell Inc.

While a freshman pre-med student at the University of Texas at Austin, Dell began building and selling upgrade kits for personal computers. He soon applied for a vendor license to bid on State of Texas contracts—winning bids by avoiding the overhead of a traditional retail storefront. Dell dropped out of UT Austin at age 19 to pursue the business full-time.

In January 1984, believing in the cost advantages of selling PCs directly to consumers, he registered his business as PC’s Limited. Operating out of a condominium, the company generated between $50,000 and $80,000 in sales of PC upgrades and components. In May 1984, he incorporated the business as Dell Computer Corporation and relocated to a business center in North Austin. The startup had a capitalization of just $1,000 and a manufacturing staff that Dell described as “three guys with screwdrivers sitting at six-foot tables.” During these early years, he was mentored by Morton Meyerson, a former executive at EDS and Perot Systems.

In 1992, at age 27, Dell became the youngest CEO of a Fortune 500 company. In 1996, the company began selling computers online and launched its first line of servers. By March 1997, dell.com was generating roughly $1 million in daily sales.

In the first quarter of 2001, Dell became the world’s largest PC maker, surpassing Compaq with a global market share of 12.8%.

On March 4, 2004, Dell stepped down as CEO but remained chairman of the board.

In 2013, he led a $25 billion buyout to take Dell Inc. private, partnering with Silver Lake Partners, Microsoft, and a consortium of lenders. The deal faced significant resistance—most notably from Carl Icahn—but ultimately closed, giving Dell a 75% stake in the company.

On October 12, 2015, Dell announced his intent to acquire EMC Corporation, a major enterprise software and storage company. The $67 billion deal—finalized on September 7, 2016—remains the largest tech acquisition in history.

Jack Dorsey

Jack Dorsey (b. 1976 St. Louis, Missouri) is the co-founder and former CEO of Twitter, and the founder and current CEO of Block, Inc. (formerly Square). Renowned for shaping two major digital sectors—social media and financial technology—Dorsey has been a central figure in building transformative platforms used globally.

He began his collegiate studies at the University of Missouri–Rolla in 1995 before transferring to New York University in 1997, where he conceived the concept that evolved into Twitter. In 2006, he partnered with Biz Stone, Noah Glass, and Evan Williams to develop a short-form status communication tool, launching Twitter the following year. Dorsey served as Twitter’s first CEO, guiding it through early fundraising and platform development. He returned to lead the company from 2015 to 2021, during which Twitter expanded its content policies, introduced algorithmic feeds, and increased its role in political and civic discourse worldwide.

In 2009, Dorsey co-founded Square, later renamed Block, Inc., to create mobile payment solutions for small businesses. Square launched its first product in 2010 and went public in 2015, with Dorsey as CEO. He oversaw the firm’s expansion into broader financial services, including peer-to-peer payments via Cash App and acquiring TIDAL and Afterpay. In 2020, Square received FDIC approval to establish a bank, launching Square Financial Services in 2021. The company rebranded as Block in 2021 to reflect its growing interest in blockchain technologies.

Dorsey also served on the board of Bluesky, a decentralized social media project spun out of Twitter, from 2022 until 2024. He departed the initiative citing philosophical disagreements, later endorsing more open and less centrally-moderated platforms.

Dorsey continues to lead Block, Inc. and remains an influential voice in the technology and cryptocurrency communities.

Marcos Galperin

Marcos Galperin is an Argentine billionaire entrepreneur and the co-founder and CEO of Mercado Libre, the largest e-commerce platform in Latin America. As of today, he is the wealthiest person in Argentina.

Born in 1971 in Buenos Aires, Galperin graduated from The Wharton School of the University of Pennsylvania, where he befriended José Estenssoro, the son of YPF’s then-president. After graduation, Galperin returned to Argentina in 1994 and joined YPF.

In 1997, he returned to the United States to attend Stanford Graduate School of Business, earning his MBA in 1999. While still at Stanford, Galperin co-founded Mercado Libre.

Finance professor Jack McDonald introduced Galperin to John Muse, co-founder of Hicks, Muse, Tate & Furst. After a brief discussion and a ride to Muse’s private plane, Muse expressed interest and invested in the idea. Mercado Libre received early investments from JPMorgan Partners, Flatiron Partners, Hicks, Muse, Tate & Furst, Goldman Sachs, GE Capital, and Banco Santander Central Hispano.

In September 2001, eBay acquired a 19.5% stake in the company, exchanging it for their Brazilian subsidiary Ibazar.com.br. This deal established Mercado Libre as eBay’s exclusive partner in the region. Although eBay sold its stake in 2016, the companies continue to collaborate, including the launch of eBay’s first branded store on Mercado Libre in Chile in March 2017.

In August 2007, Mercado Libre made history as the first Latin American technology company to list on NASDAQ. Today, the company operates in numerous countries, including Brazil, Mexico, Colombia, Chile, and Venezuela, among others.

Mercado Libre is a leading platform across Latin America. By 2016, it had amassed 174.2 million users, becoming the region’s most popular e-commerce site by visitor count.

Bill Gates

Bill Gates is the co-founder of Microsoft, growing it into the world’s largest software firm. He spearheaded the mainstream adoption of PCs in the 1970s/80s with MS-DOS and Microsoft Windows. He is one of the ten richest people in the world.

Born in 1955 in Seattle, Gates showed an early aptitude for software programming. He enrolled at Harvard in 1973 but dropped out two years later to work on a start-up with his childhood friend Paul Allen.

In 1975, Gates and Allen, inspired by the Altair 8800 featured in Popular Electronics, contacted Micro Instrumentation and Telemetry Systems (MITS) about developing a BASIC interpreter for the platform.

Despite not having an Altair, they successfully developed an emulator and BASIC interpreter for MITS, leading to a deal to distribute it as Altair BASIC. Gates took a leave from Harvard to work at MITS, and together with Allen, they formed "Micro-Soft" in Albuquerque. The first employee was Ric Weiland, their high school friend. They officially registered the name "Microsoft" in 1976.

Microsoft became independent of MITS in 1976 and moved to Washington in 1979. In the company’s first five years, Gates personally reviewed and often rewrote every line of code, eventually transitioning to a managerial and executive role as Microsoft grew.

In 1980, Gates and Allen sealed a pivotal deal to supply operating system software 86-DOS for IBM’s personal computer, the IBM PC. Though not earning much initially, IBM’s adoption of their system catalyzed the rise of Microsoft.

Gates steered Microsoft's ascendance through the '80s/'90s. Under his leadership, Microsoft came to dominate the PC software industry, launching products like Microsoft Windows and Microsoft Office.

In 2000, Gates stepped down as CEO, giving control to Steve Ballmer, his Harvard classmate. Gates gradually distanced himself from operations in the mid-2000s to focus on philanthropy.

Gates exited as chairman in 2014, marking the end of 39 years of formally leading the company he created.

Gates has been arrested twice for driving without a license, speeding, and not stopping at a stop sign.

Ali Ghodsi

Ali Ghodsi, born in Tehran, Iran, in 1978, is the co-founder and CEO of Databricks, a global leader in data, analytics, and artificial intelligence. He earned a Master's in Computer Engineering and an MBA from Mid-Sweden University in 2002, followed by a PhD in Computer Science from KTH Royal Institute of Technology in 2006.

After completing his PhD, Ghodsi moved to the U.S. as a visiting scholar at the University of California, Berkeley, where he joined AMPLab. In 2009, he and six other researchers developed Spark, a breakthrough tool for processing large data sets. Spark’s speed and efficiency led to the creation of Databricks in 2013. They sought $200,000 in funding from Ben Horowitz of Andreessen Horowitz, who instead invested $11 million, encouraging the team to think bigger.

Initially unsure about becoming a full-time tech executive, Ghodsi worked part-time at Databricks while considering academia. In 2016, he succeeded Ion Stoica as CEO at Horowitz’s request. Under Ghodsi, Databricks introduced new features to Spark for paying customers, expanded the sales team, and restructured the executive team. His decision to share board presentations with employees promoted greater alignment and transparency.

In 2016, Horowitz introduced Ghodsi to Microsoft CEO Satya Nadella, leading to a partnership to integrate Databricks with Azure in 2017, generating $100M in committed revenue. Ghodsi later expanded Databricks’ offerings by integrating Spark with structured data, further increasing its value to customers. Despite challenges in the tech market, Ghodsi drove strong growth.

In 2023, Ghodsi acquired MosaicML for $1.3 billion, enhancing Databricks’ AI capabilities. He also secured a $2 billion deal to acquire Tabular, tripling competitor Snowflake’s offer.

As of 2024, Ghodsi continues to lead Databricks’ growth, with plans to potentially take the company public by 2025, though he has opted to pursue additional private funding instead.

Reid Hoffman

Reid Hoffman is an American billionaire entrepreneur and venture capitalist, best known as the co-founder of LinkedIn and a partner at Greylock Partners. Born in 1967 in Palo Alto, California, Hoffman grew up in an academic family and earned a Bachelor's degree in Symbolic Systems from Stanford University. He later received a Master of Philosophy (M.Phil.) in Philosophy from the University of Oxford as a Marshall Scholar.

Hoffman began his Silicon Valley career in the 1990s, working at Apple and Fujitsu before founding SocialNet.com in 1997, an early platform for online dating and professional networking.

After SocialNet failed to gain traction, he joined PayPal in 2000 as Chief Operating Officer (COO), working alongside future tech leaders like Elon Musk and Peter Thiel. Hoffman played a pivotal role in PayPal’s $1.5 billion sale to eBay in 2002, becoming part of the famed "PayPal Mafia."

In 2002, Hoffman co-founded LinkedIn with the mission of connecting professionals globally to advance their careers. Launched in 2003, LinkedIn quickly became a critical tool for job seekers, recruiters, and businesses. Hoffman served as LinkedIn’s CEO until 2007. Under his leadership, the company went public in 2011 and was later acquired by Microsoft in 2016 for $26.2 billion, one of the largest tech acquisitions in history.

Beyond LinkedIn, Hoffman is an influential venture capitalist at Greylock Partners, where he has invested in several successful startups, including Airbnb, Aurora Innovation, and Figma.

In March 2022, Hoffman co-founded Inflection AI with his long-time friend and Greylock colleague, Mustafa Suleyman, co-founder of DeepMind.

In April 2017, Hoffman launched the Masters of Scale podcast, which features interviews with prominent entrepreneurs and leaders, such as Brian Chesky, Reed Hastings, Dara Khosrowshahi, Arianna Huffington, Mellody Hobson, and President Barack Obama. The podcast has won multiple Webby and Signal awards.

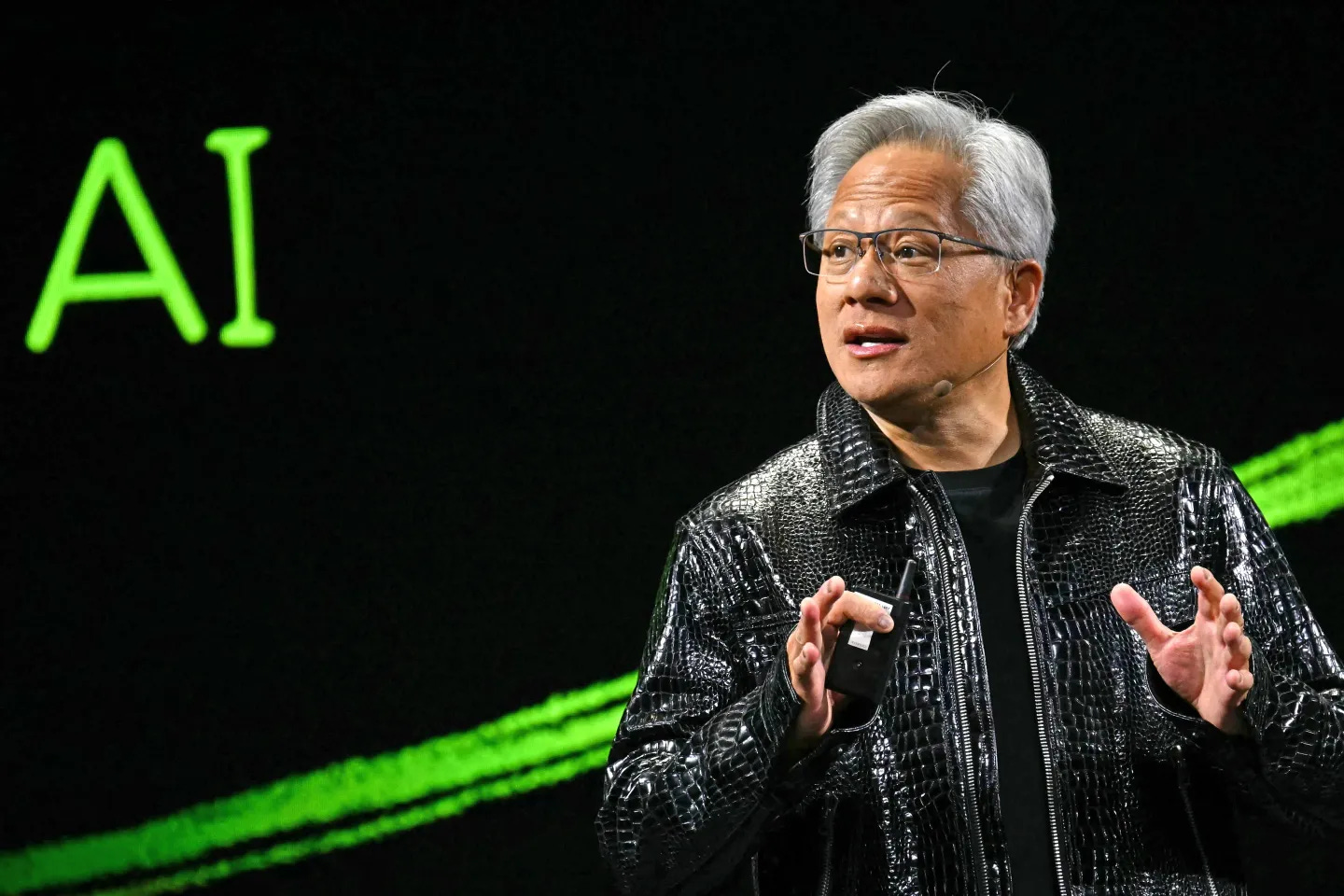

Jensen Huang

Jensen Huang (黃仁勳) is the billionaire founder and CEO of Nvidia Corporation. Jensen was born in 1963 in Tainan, Taiwan, and emigrated to the U.S. at the age of 4, where his family first settled in Kentucky and later in Oregon.

UG: Oregon State University, Electrical Engineering

Masters: Stanford University, Electrical Engineering

After graduation, Jensen worked as a microprocessor designer at Advanced Micro Devices (AMD), while simultaneously pursuing a master's degree in the evenings. Jensen later joined LSI Logic.

Around Thanksgiving in 1992, two of Jensen's friends at Sun Microsystems, Chris Malachowsky and Curtis Priem, met with Jensen at a local Denny's to pitch him the idea of starting a company designing dedicated graphics cards to cater to the growing demand for 3D graphics in gaming PCs.

The three of them decided to pursue this idea. Initially, the company had no name, and the co-founders named all their files "NV," as in "next version." However, they needed a name to incorporate the company. After reviewing all dictionary words with the two letters "NV," they settled on "invidia," the Latin word for envy.

When Jensen informed Wilf Corrigan, the CEO of LSI Logic, about his resignation, Wilf told Jensen that he would hold Jensen's desk because "he would come back." Wilf also made an introduction for Jensen to Don Valentine, the founder of Sequoia Capital and the “Father of Venture Capital”, with whom Wilf had worked at Fairchild Semiconductor.

During a pitch in front of Valentine, Jensen stumbled and presented only a partially written business plan. However, Don stopped Jensen and said, "Well, that wasn't very good, but Wilf says to give you money. Against my best judgment, based on what you just told me, I am going to give you money. But if you lose my money, I will kill you."

Nvidia was founded in 1993. The company went public in January 1999, and its stock reached a market capitalization of more than $3 trillion in June 2024. NVIDIA's high-end chips are critical hardware for AI model development.

Travis Kalanick

Travis Kalanick is a billionaire co-founder and former CEO of Uber. Born in 1976 in Los Angeles, Kalanick dropped out of UCLA to pursue his entrepreneurial ambitions.

In 1998, he joined Scour Inc., a P2P file-sharing company, where he managed sales and marketing. The company sought funding from Ronald Burkle and Michael Ovitz, which led to contentious negotiations and Ovitz gaining majority control. This experience shaped Kalanick's negative view of investor-founder relations. In 2000, Scour faced a copyright infringement lawsuit and subsequently filed for Chapter 11 bankruptcy.

In 2001, Kalanick co-founded Red Swoosh, another P2P file-sharing company aimed at challenging the MPAA and RIAA. After struggling for funding in the wake of the dot-com bubble, the company used payroll tax withholdings for operations, leading to disputes with co-founder Michael Todd. Despite warnings about potential tax fraud, they secured funding to repay the IRS, avoiding prosecution. However, this tension ultimately resulted in Todd's departure. In 2005, with Mark Cuban’s investment, Red Swoosh was sold to Akamai for $19 million, netting Kalanick $2 million.

In 2009, Kalanick co-founded Uber with Garrett Camp. The company quickly gained traction, despite facing regulatory challenges that Kalanick often ignored, famously rebranding from UberCab to Uber. He structured deals to maintain control and limit investor influence.

Kalanick's management style faced criticism for promoting long hours without pay and for engaging in industrial espionage. Scandals related to sexual harassment and discrimination emerged in early 2017.

In June 2017, under pressure from investors, Kalanick resigned as CEO but continued to exert influence post-resignation, leading to further tensions within the company. By December 2019, he announced his exit from Uber’s board, having sold 90% of his shares, valued at $2.6 billion.

Kalanick later launched a venture fund. With the backing of Saudi Arabia’s sovereign wealth fund, he acquired CloudKitchens, positioning himself as a significant player in the food industry.

Alex Karp

Alex Karp (b. 1967, New York City, NY) is the co-founder and CEO of Palantir Technologies, a software firm specializing in data analytics for government and commercial clients. As of 2025, the company has a market capitalization exceeding $270 billion, positioning it as a key player in national security and defense technology.

Karp earned a BA in Philosophy from Haverford College in 1989, a JD from Stanford University in 1992, and a PhD in neoclassical social theory from Goethe University Frankfurt in 2002. He began his career as a research associate at the Sigmund Freud Institute in Frankfurt before transitioning to finance, founding the London-based money management firm Caedmon Group to manage investments for high-net-worth individuals.

In 2004, Karp co-founded Palantir Technologies alongside Peter Thiel and others, taking on the role of CEO. The company has since become a dominant force in the data analytics space, working closely with government agencies on intelligence, defense, and law enforcement projects.

Karp has been a vocal advocate for strong U.S. military and defense policies, asserting that technology firms have an obligation to support national security. He has also publicly criticized short sellers, stating that he loves "burning the short sellers." He has compared them to cocaine addicts, claiming that they "just love pulling down great American companies."

He has expressed strong views on the role of Western values in global technology leadership.

Karp's strategic direction has helped Palantir secure critical contracts, including work with the U.S. Department of Defense and Immigration and Customs Enforcement (ICE). He has defended Palantir's government partnerships, emphasizing the company's commitment to national security despite political controversy. Additionally, he has advocated for increased government involvement in technology regulation and Western dominance in artificial intelligence research.

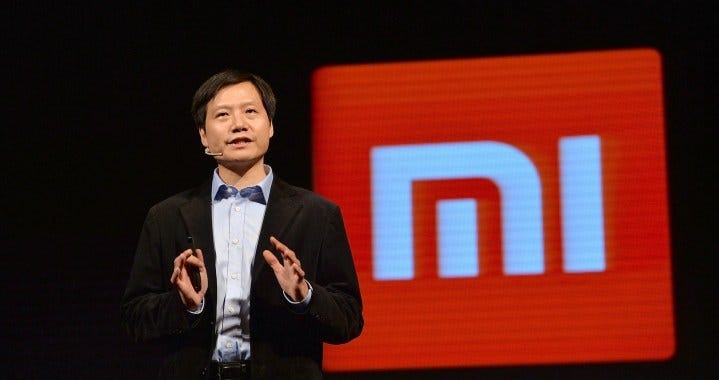

Lei Jun

Lei Jun 雷军 (born 1969, Xiantao, Hubei Province, PRC) is a Chinese billionaire entrepreneur and computer engineer best known as founder, chairman, and CEO of Xiaomi. He also chairs Kingsoft and Shunwei Capital.

Fascinated by electronics from an early age, Lei built his village’s first electric lamp as a child. He graduated from Wuhan University in 1991 with a degree in computer engineering.

Lei joined Kingsoft in 1992 as an engineer and became CEO in 1998, steering the company to a Hong Kong IPO in 2007. He stepped down that year but returned as chairman in 2011.

Alongside his work at Kingsoft, Lei founded Joyo.com in 2000, selling it to Amazon in 2004 for $75 million, and made an early $1 million bet on the video-based social network, YY, which returned 129x after its 2012 IPO.

In 2010, Lei co-founded Xiaomi with Lin Bin and others. Known for its aggressive growth, Xiaomi expanded rapidly across smartphones and smart devices. In 2018, Lei led Xiaomi’s IPO, making it the first company listed under Hong Kong’s new weighted voting rights system. In 2019, Xiaomi became the youngest company ever on the Fortune Global 500.

Lei has driven Xiaomi’s push into premium smartphones (Xiaomi 10 series in 2020) and into electric vehicles.

In 2021, Lei announced Xiaomi’s $10 billion EV strategy, personally leading the initiative. In March 2024, Xiaomi unveiled its first EV, the Xiaomi SU7, drawing 100,000+ pre-orders in its debut.

Forrest Li Xiaodong

Forrest Li Xiaodong 李小东 (b. 1977/78, Tianjin, China) is a Singaporean billionaire entrepreneur and the founder, chairman, and CEO of Sea Limited, a leading internet company in Southeast Asia with key subsidiaries including Garena, Shopee, and SeaMoney.

Li earned a bachelor's degree in engineering from Shanghai Jiaotong University and an MBA from Stanford.

In 2009, Li founded Garena in Singapore as a digital entertainment company focused on game publishing, operating initially from a single shophouse. In 2010, Garena secured the publishing rights for Riot Games’ League of Legends in Southeast Asia, marking a significant milestone in its early growth.

By 2014, Garena was valued at $1 billion and recognized as the largest internet company in Singapore. In 2015, the Ontario Teachers' Pension Plan invested in Garena, increasing its valuation to over $2.5 billion.

That same year, Li expanded the business by launching Shopee, an e-commerce platform that rapidly grew to become the largest online shopping service provider in Southeast Asia and Taiwan. The company further diversified with the introduction of SeaMoney, offering digital financial services such as mobile wallets, payment processing, and lending across multiple Southeast Asian markets.

Following a $550 million funding round in May 2017, the company rebranded from Garena to Sea Limited to better reflect its expanded scope, while maintaining Garena as its digital entertainment segment. Sea Limited went public on the NYSE in 2017, becoming the first major Southeast Asian tech firm to list in the U.S.

In March 2023, Sea launched Maribank, a digital bank in Singapore after obtaining a full digital banking license from the Monetary Authority of Singapore. The company also holds digital banking licenses in Malaysia, Indonesia, and the Philippines.

Garena’s gaming division developed Free Fire in 2017, which became the most downloaded game on the Google Play Store in 2019 and reached over 100 million daily active users by early 2024. Despite profit challenges in 2022, Sea stabilized its digital entertainment business in 2023.

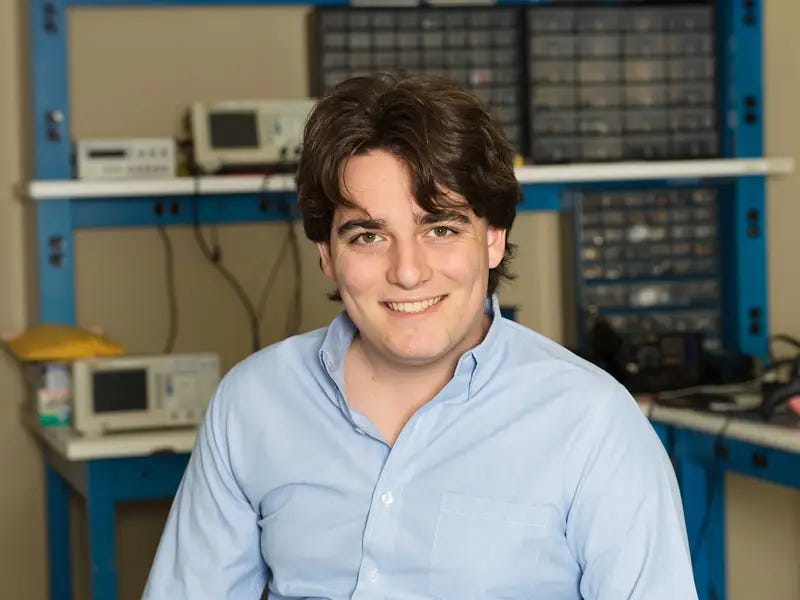

Palmer Luckey

Palmer Luckey is an American billionaire entrepreneur, inventor, and founder of Oculus VR and Anduril Industries. He designed the Oculus Rift, a virtual reality (VR) headset credited with reviving the VR industry.

Born in Long Beach, CA, in 1992, Luckey had a passion for technology from an early age. As a teenager, he began experimenting with electronics, particularly virtual reality, and developed early VR headset prototypes using low-cost components.

In 2012, at 19, Luckey launched a Kickstarter campaign for the Oculus Rift, raising over $2.4 million and attracting attention from tech enthusiasts and major gaming companies. In 2014, Facebook (now Meta) acquired Oculus VR for about $2 billion, making Luckey a key figure in the future of VR. His time at Facebook ended in 2017 under debated circumstances.

Undeterred, Luckey co-founded Anduril Industries with former Palantir executives and the early Oculus VR hardware lead. The defense technology company, named after Andúril, the sword of Aragorn from The Lord of the Rings, focuses on cutting-edge national security solutions. Under Luckey's leadership, Anduril grew into a multi-billion-dollar enterprise, providing advanced defense systems incorporating artificial intelligence and autonomous technologies to the U.S. military and its allies.

In 2020, Anduril secured a $967M contract with the U.S. Air Force, followed by a $1B contract in 2022 with SOCOM. By May 2022, Anduril was negotiating a $100M program with the Australian military to develop autonomous undersea vehicles for the Royal Australian Navy.

Jack Ma

Jack Ma is the Chinese billionaire founder of Alibaba Group.

UG: Hangzhou Normal University (he failed the college entrance exam twice in two years, but was accepted to hit the enrollment target for English majors)

Ma was born in Hangzhou, China, in 1964. After graduation, he applied for 31 entry-level jobs but was rejected from all of them.

In 1994, Ma founded his first company, an online Chinese translation agency, upon learning about the Internet.

In 1995, during a trip to the U.S. with colleagues, Ma noticed a lack of Chinese beer information online. He and his friend quickly created a website, which attracted inquiries from Chinese investors within hours, revealing the internet's potential.

In April 1995, Ma and his partner He Yibing opened the first office for their second company, China Pages, which generated around 5 million RMB in profit within three years. With the assistance of friends in the United States, Ma began creating websites for Chinese companies.

From 1998 to 1999, Ma led a government-affiliated IT company. In 1999, he left to found Alibaba with 18 friends in his apartment, starting with 500,000 yuan. Over four months, Alibaba secured $25 million in foreign venture seed capital from Goldman Sachs and SoftBank.

The program aimed to enhance the Chinese e-commerce market and develop an online platform for local enterprises, particularly SMEs, while addressing challenges related to China's entry into the WTO in 2001.

Alibaba turned profitable after three years. Despite an offer from eBay to buy Taobao, Ma declined and secured a $1 billion investment from Yahoo co-founder Jerry Yang to expand Alibaba's operations.

Since 1999, Ma has been the executive chairman of Alibaba Group, overseeing its nine major subsidiaries, including Alibaba.com, Taobao Marketplace, Tmall, and Alipay, establishing it as a leading high-technology holding company in China.

In September 2014, reports surfaced of Alibaba's plan to raise over $25 billion in an initial public offering (IPO) on the New York Stock Exchange.

Pony Ma

Pony Ma (马化腾) is a Chinese billionaire entrepreneur. He is the co-founder, chairman, and CEO of Tencent, one of the largest and most valuable tech companies globally.

Education

* Shenzhen University UG, BS in CS and Applied Engineering, 1993

Early Career and Founding of Tencent

* Early 1990s: Began his career as an engineer for telecom companies.

* 1998: Co-founded Tencent with four classmates.

* February 1999: Tencent's first product, OICQ, a Chinese version of ICQ, launched in 1999 and quickly gained over a million registered users, becoming one of China's largest messaging services.

Early Challenges and Financing

* 2000: Because OICQ was free to use, Ma sought VC investments, securing $2.2 million for a 40% stake in Tencent. As the pager market shrank, he allowed OICQ users to send messages to mobile handsets. This shift led to telecom deals that generated 80% of the company's revenue through shared message fees.

AOL Arbitration and Business Expansion

* 1998-2000: AOL, which acquired ICQ, filed an arbitration against Tencent over OICQ's domain names, claiming trademark violations. Tencent lost and had to give up the domain names.

* December 2000: Pony Ma renamed OICQ to QQ, with the "Q" symbolizing "cute".

* 2003: Tencent launched its own portal (QQ.com) and entered the online gaming market.

* 2004: Tencent became the largest Chinese instant messaging service, with 74% market share. Tencent raised $200 million in its Hong Kong IPO. Launched an online gaming platform

WeChat and Diversification

* 2010: Inspired by Microsoft’s strategy, Pony Ma created two teams of engineers to develop new products. One team developed WeChat.

* January 2011: WeChat was launched.

* By 2015, WeChat became the largest instant messaging platform in the world, with 48% of Internet users in the Asia-Pacific region using it.

* WeChat has become China's "app for everything" and a super-app because of its wide range of functions: it offers text and voice messaging, video calls, mobile payments, photo and video sharing, location sharing, and more.

Andrew Ng

Andrew Ng is a British-American computer scientist and entrepreneur specializing in machine learning and AI. He co-founded Google Brain and served as Chief Scientist at Baidu, where he expanded the AI Group to thousands.

Born in the UK in 1976, Ng earned a triple major in computer science, statistics, and economics from Carnegie Mellon University in 1997. He completed a master’s in Electrical Engineering and Computer Science at MIT in 1998, where he developed an early web-search engine for research papers, a precursor to CiteSeerX, focusing on machine learning. Ng earned his Ph.D. in Computer Science from UC Berkeley in 2002.

That same year, Ng joined Stanford University as an assistant professor, becoming an associate professor in 2009. Ng was the former director of the Stanford AI Lab (SAIL). His machine learning course, CS229, is one of Stanford's most popular, with over 1,000 students enrolling in some years.

In 2008, Ng's group at Stanford was among the first in the U.S. to advocate for using GPUs in deep learning. Despite initial controversy, GPUs have become essential in the field.

From 2011 to 2012, Ng worked at Google, where he founded and led the Google Brain Deep Learning Project. In 2012, he co-founded Coursera with Stanford professor Daphne Koller and served as CEO. The platform launched with over 100,000 students in his CS229A course and now has millions of enrollees.

In 2014, Ng joined Baidu as chief scientist, where he led research in big data and AI. He established teams for facial recognition and the Melody healthcare chatbot and developed the DuerOS AI platform. These innovations helped position Baidu ahead of Google in AI development. Ng resigned from Baidu in March 2017.

Shortly thereafter, Ng launched Deeplearning.AI, offering online deep learning courses, including the AI for Good Specialization. He also founded Landing AI, which provides AI-powered SaaS products.

In January 2018, Ng launched the AI Fund, raising $175 million to invest in new startups.

Melanie Perkins

Melanie Perkins is an Australian billionaire technology entrepreneur, who is the CEO and co-founder of Canva. Perkins was born in Perth, Western Australia in 1987.

At the University of Western Australia, Perkins tutored students in graphic design, noticing their struggles with complex programs like Adobe Photoshop, often taking a whole semester to grasp basic features. Seeing a business opportunity, she dropped out at 19 to start Fusion Books with Cliff Obrecht. Fusion Books simplified yearbook design with drag-and-drop tools and templates.

Originally aiming for broader design software, Perkins pivoted due to competition and resource constraints. Inspired by her mother's experience coordinating yearbooks, Perkins saw it as an ideal niche to test her idea for Canva.

Fusion Books started in Perkins's mother's living room in Duncraig, with Obrecht cold-calling schools for clients. Their parents helped with printing. Within five years, it became Australia's largest yearbook company, expanding to France and New Zealand. Based in Perth, Perkins faced rejection from over 100 local investors.

In 2011, they pitched Canva to investor Bill Tai during a start-up competition in Perth. Despite no funding, they networked at Tai's gatherings, including some in Silicon Valley, where they met Lars Rasmussen. He advised them to wait for a strong tech team. Rasmussen introduced them to Cameron Adams, who initially declined but later joined as Canva's third founder and chief product officer.

Perkins leads one of the rare profitable 'unicorn' startups as its CEO. She's part of the 2 percent of female CEOs in venture-backed firms. In an article, she shared her entrepreneurial journey to inspire those who feel like outsiders to pursue their dreams. At Canva, Perkins introduced hiring policies that remove bias, resulting in 41 percent female representation, surpassing the industry average of 28 percent.

Austin Russel

Austin Russell (b. 1995, Newport Beach, CA) is the founder and CEO of Luminar Technologies, a leader in lidar technology for autonomous vehicles.

At 15, Russell applied for his first patent and was mentored by laser entrepreneur Jason Eichenholz, who later became Luminar's co-founder and CTO. Russell credits self-learning via Wikipedia and YouTube for expanding his skills.

Russell left Stanford University after receiving the Thiel Fellowship in 2012, which provided $100,000 to support his entrepreneurial vision. He founded Luminar that same year.

In 2017, Luminar emerged from stealth mode with Series A funding, establishing a lidar manufacturing facility in Orlando, Florida. The company quickly formed key partnerships with industry leaders, including the Toyota Research Institute, Volvo, and Audi AID. By 2019, Luminar had raised over $250 million, built a robust patent portfolio, and unveiled advanced lidar models optimized for autonomous vehicle systems.

In 2020, Luminar went public via a SPAC merger, achieving a $3.4 billion market cap and making Russell a billionaire. He retained 83% voting power and became chairman. Strategic partnerships with Daimler AG, Mobileye, and Volvo's Zenseact subsidiary followed, establishing Luminar as a leader in self-driving systems like the Sentinel platform.

By 2021, Luminar expanded into aviation, partnering with Airbus UpNext to explore lidar applications for autonomous flight. The company further solidified its capabilities through acquisitions of OptoGration and Freedom Photonics, strengthening its expertise in ASICs, photodiodes, and lasers.

In 2022, Luminar announced major collaborations with Mercedes-Benz and Nissan, integrating lidar systems into next-generation vehicles to enable advanced driver-assistance and autonomous functionalities. By early 2023, Luminar enhanced its lidar and mapping capabilities through acquisitions of Civil Maps and Seagate's lidar division.

Today, Luminar partners with global leaders such as Nvidia, Pony.ai, and SAIC Motor, solidifying its position at the forefront of autonomous transportation.

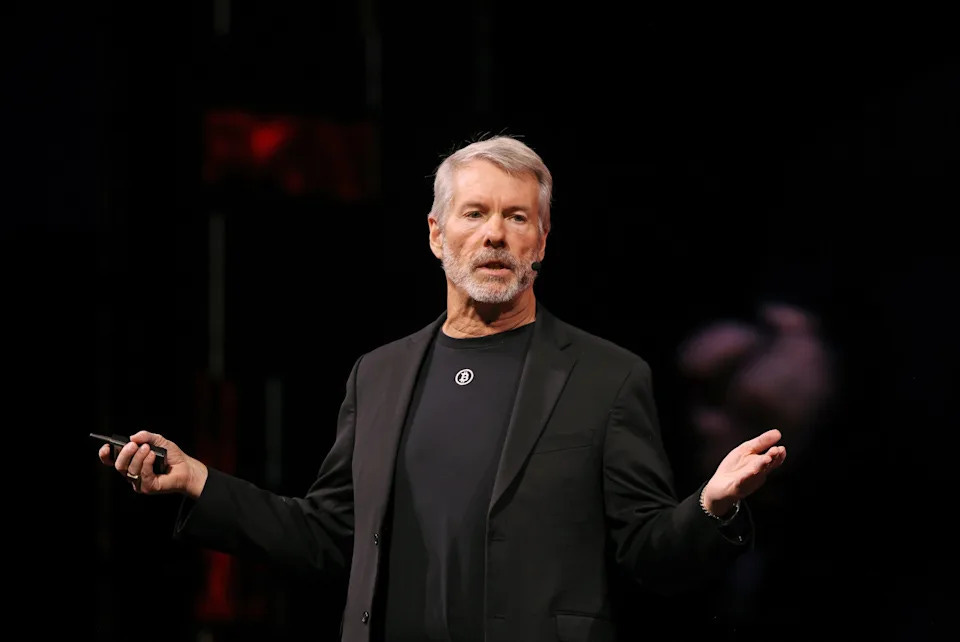

Michael Saylor

Michael Saylor (b. 1965, Lincoln, NE) is an American entrepreneur and the co-founder of MicroStrategy, a software company. A vocal Bitcoin advocate, Saylor has overseen MicroStrategy’s purchase of over 100,000 bitcoins, spending billions of dollars on the asset.

In 1983, Saylor enrolled at MIT on an Air Force ROTC scholarship, earning dual degrees in engineering and the history of science. After a medical condition ended his pilot aspiration, he joined The Federal Group in 1987 as a consultant specializing in computer simulation modeling.

In 1988, he became an internal consultant at DuPont, where his market models successfully forecasted the 1990 recession in key industries.

Saylor co-founded MicroStrategy with Sanju Bansal, using funds from a DuPont consulting contract. Initially focused on data mining software, the company shifted to business intelligence.

In 1992, MicroStrategy secured a $10 million contract with McDonald's to analyze promotion efficiency, inspiring Saylor to create business intelligence software that enabled companies to gain insights from their data.

Saylor took MicroStrategy public in June 1998. By 2000, his net worth had reached $7 billion. However, that year the company restated financial results, triggering a 62% stock price drop and SEC fraud charges. The company settled, agreeing to hire an independent director for compliance.

In 2014, following investor criticism, Saylor adopted a $1 salary with stock options, which he exercised for $400 million in early 2024.

A passionate Bitcoin advocate, Saylor believes Bitcoin will replace gold as a non-governmental store of value and views it as a key asset for capital preservation, likening it to prime real estate.

In 2020, MicroStrategy began using cash reserves to buy Bitcoin, acquiring 21,454 bitcoins for $250 million, and later taking on debt to increase holdings to over $1 billion. By September 2024, MicroStrategy held 252,220 bitcoins, valued at $9.9 billion. Despite skepticism, Saylor remains committed to Bitcoin as a transformative asset, with MicroStrategy continuing to expand its holdings.

Aravind Srinivas

Aravind Srinivas is the co-founder and CEO of Perplexity AI, a conversational search engine harnessing large language models (LLMs) to deliver precise, informative answers. Born in Chennai, India, Srinivas earned dual degrees (B.Tech and M.Tech) in Electrical Engineering in 2017 from IIT Madras, where he developed a passion for AI. Despite his official focus on electrical engineering, he pursued cross-disciplinary studies, seizing opportunities in machine learning and programming, including a transformative Python class that laid the foundation for his future breakthroughs.

While at IIT Madras, Aravind made waves in AI research. He collaborated with leading professors and published nine influential papers across top-tier conferences, including ICLR, AAAI, and NeurIPS, quickly establishing himself as a rising talent in machine learning.

Between 2018 and 2021, he gained hands-on experience with AI through research internships at pioneering institutions. At OpenAI, he tackled complex reinforcement learning problems, and at DeepMind in London, he contributed to large-scale contrastive learning projects. His internship at Google saw him advance cutting-edge vision models and self-attention-based architectures.

After completing his Ph.D. in Computer Science at UC Berkeley in 2021, Aravind returned to OpenAI as a research scientist, where he contributed to high-impact projects like DALL-E 2, a text-to-image generator that redefined AI’s creative potential. In August 2022, Aravind embarked on a new venture, co-founding Perplexity AI with Denis Yarats and Andy Konwinski.

Under his leadership, Perplexity AI has attracted substantial attention, raising over $100 million from notable investors, including Jeff Bezos, Nat Friedman, Elad Gil, and Susan Wojcicki.

Perplexity’s freemium model offers users a choice: the free version, powered by a standalone LLM, and Perplexity Pro, with access to advanced models like GPT-4, Claude 3.5, Mistral Large, Llama 3, and Perplexity’s experimental model.

Evan Spiegel

Evan Spiegel is the billionaire co-founder and CEO of Snap Inc., the parent company of Snapchat, a social media platform known for its disappearing messages and augmented reality features.

Born on June 4, 1990, in Los Angeles, Spiegel grew up in a wealthy family and attended Stanford University. In college, Spiegel, along with his co-founder Bobby Murphy and Reggie Brown, conceived the idea for Snapchat as a product design class project in 2011. Originally called "Picaboo," the app was designed to allow users to send photos that would vanish after being viewed.

In 2012, the company rebranded as Snapchat and quickly gained traction among young users, revolutionizing how people communicate by emphasizing ephemeral content. Spiegel dropped out of Stanford just a few credits shy of graduation to focus full-time on building Snapchat. Contrary to some reports, he did not complete his degree in 2018.

Spiegel helped Snap Inc. grow into a publicly traded company, which went public in March 2017 in one of the largest tech IPOs in recent years. Despite early skepticism about the company’s long-term viability, he successfully steered it through competition with giants like Facebook, which attempted to replicate many of Snapchat's features. Under his direction, Snap continued to innovate with products like Snapchat Stories, Lenses, and Spectacles, maintaining its relevance in a highly competitive social media landscape.

Spiegel has maintained a unique approach to leadership, focusing on user privacy and product differentiation. His decision to refuse a $3 billion acquisition offer from Facebook in 2013 is often highlighted as a pivotal moment that cemented his reputation as a visionary entrepreneur.

Today, he is one of the youngest billionaires in the world.

Kevin Systrom

Kevin Systrom is the billionaire co-founder of Instagram.

Born in Holliston, MA in 1983, Systrom had early exposure to computer programming in school. The video game Doom 2 further kindled his fascination, leading him to create his own levels.

UG: Stanford University, Bachelor's in Management Science and Engineering, 2006

During college, Systrom turned down an offer from Mark Zuckerberg and instead opted for a winter term in Florence to study photography. He was one of the 12 students selected for the Mayfield Fellows Program at Stanford, which led to an internship at Odeo, the company that would later evolve into Twitter.

After graduating in 2006, Systrom worked at Google as a product manager. During a vacation in Mexico, Systrom's girlfriend was reluctant to share photos due to the limitations of an iPhone 4 camera. That incident inspired him to create a prototype, Burbn, which would evolve into Instagram. The prototype introduced filters to enhance photo quality, including the iconic X-Pro II filter that remains a staple of Instagram's offerings today.

After an initial pitch to Baseline Ventures and Andreessen Horowitz, Systrom left his job at Google to pursue the dream of turning Burbn into a business. Just two weeks after taking this leap, he secured $500,000 in seed funding from these two VC firms.

Collaborating with fellow Stanford graduate Mike Krieger, Systrom expanded Burbn's features before realizing that simplicity was the key to user engagement, leading them to refocus on photo sharing. This pivot resulted in the creation of Instagram, which witnessed rapid growth, soaring from 1 million users a month after launch to an astounding 10 million users within a year.

In 2010, Systrom officially co-founded Instagram with Krieger. The pinnacle of their journey came in April 2012 when Instagram was acquired by Meta (formerly Facebook) for a staggering $1 billion in cash and stock, netting Systrom $400 million based on his ownership stake.

Initially committed to maintaining Instagram's independence, Zuckerberg's promises eventually faltered, prompting Systrom to resign as the head of Instagram in September 2018.

Vlad Tenev

Vlad Tenev (b. 1986, Bulgaria) is a Bulgarian-American billionaire entrepreneur and the co-founder and CEO of Robinhood, a financial technology company that has redefined commission-free trading. Tenev assumed the role of sole CEO in November 2020, after previously sharing the position with co-founder Baiju Bhatt.

Tenev earned a mathematics degree from Stanford University and pursued a PhD in mathematics at UCLA before leaving academia to focus on entrepreneurship. His early ventures with Bhatt included Celeris, a high-frequency trading software company, and Chronos Research, which specialized in low-latency trading technology.

In 2013, Tenev and Bhatt co-founded Robinhood with the mission of democratizing access to financial markets by eliminating trading commissions and minimum account balances. The company launched its mobile app in 2015, targeting millennial investors with a user-friendly design and innovative business model. By 2018, Robinhood reached a $6 billion valuation, propelling Tenev and Bhatt to billionaire status.

Robinhood has been lauded as a pioneer in zero-commission trading, fundamentally transforming retail investing. However, it has also faced criticism for its reliance on payment for order flow (PFOF), a practice that has led to regulatory scrutiny and allegations of conflicts of interest. In December 2019, the Financial Industry Regulatory Authority fined Robinhood $1.25 million for routing orders to market makers based on payments rather than execution quality. In 2020, the company paid $65 million to settle allegations by the U.S. Securities and Exchange Commission regarding inadequate disclosures and inferior trade executions.

Despite these challenges, Robinhood’s innovative approach has attracted millions of users, with an average customer age of 32 as of 2022. In July 2021, the company went public through an initial public offering, achieving a valuation of $32 billion.

Tony Xu

Tony Xu is a Chinese-American billionaire and the co-founder and CEO of DoorDash. Born in Nanjing, China, in 1983 (or 1984), he immigrated to Champaign, Illinois, at age four. His early years were shaped by his parents’ sacrifices—his mother, Julie Cao, transitioned from being a doctor in China to running clinics in Illinois and California, while his father pursued a Ph.D. in aerospace engineering.

Xu started working young, washing dishes alongside his mother at a restaurant. Inspired by Who’s the Boss?, he changed his name to Tony Xu and went on to earn a BS in industrial engineering from UC Berkeley and an MBA from Stanford.

While at Stanford, Xu and classmates Andy Fang, Stanley Tang, and Evan Moore launched PaloAltoDelivery.com in 2013 after hearing a bakery owner’s struggles with deliveries. This small venture evolved into DoorDash, backed by $120,000 in seed funding from Y Combinator. In its early days, Xu and his team made deliveries themselves.

Drawing on his mother’s restaurant experience, Xu built DoorDash into the largest U.S. food delivery platform by 2019, surpassing Uber Eats and GrubHub with a 27.6% market share. The company went public in 2020, making Xu a billionaire at age 36. He retains control with 69% of voting shares.

DoorDash has since expanded into international markets, including Canada, Australia, Japan, Germany, and New Zealand. It has also diversified its services with grocery and alcohol delivery, and innovations like DoubleDash, enabling orders from multiple merchants.

During the COVID-19 pandemic, DoorDash pivoted to meet new challenges, offering gloves and sanitizer to drivers, implementing contactless delivery, and helping shuttered restaurants reopen through ghost kitchens. By April 2020, DoorDash became the fastest-growing food delivery service in the U.S.

Alexandr Wang

Alexandr Wang (b. 1997, Los Alamos, NM) is the founder and CEO of Scale AI, a data annotation platform that provides training data for machine learning models. Under his leadership, Scale AI has become a key player in artificial intelligence infrastructure, serving clients across technology, automotive, and defense industries.

In 2021, at age 24, Wang became the youngest self-made billionaire when Scale AI reached a $7.3 billion valuation.

Wang briefly attended the Massachusetts Institute of Technology before leaving in 2016 to co-found Scale AI. The company initially focused on supplying human labor for tasks that algorithms could not complete, quickly identifying a demand for high-quality data labeling in the autonomous vehicle sector. Early investors included Accel, Founders Fund, and Index Ventures, with Scale achieving unicorn status in 2019 after a $100 million investment from Peter Thiel’s Founders Fund.

In 2018, co-founder Guo left Scale due to "differences in product vision and roadmap."

Scale AI has since expanded beyond autonomous vehicles to support AI model development for companies such as OpenAI, Uber, and Toyota, as well as the U.S. Department of Defense. The company has secured defense contracts and partnered with the Pentagon to assess the safety and reliability of large language models for military applications.

By 2024, Scale AI's valuation had climbed to $14 billion following investments from Amazon and Meta. The company nearly quadrupled its sales to $400 million in the first half of 2024, reflecting increased demand for AI training data.

Despite its rapid growth, Scale AI has faced scrutiny over labor conditions on its Remotask platform, which hires approximately 240,000 data labelers in Africa and Southeast Asia at low rates.

Mark Zuckerberg

Mark Zuckerberg is a technology entrepreneur and the billionaire founder of Meta Platforms (formerly Facebook, Inc.). He is one of the ten richest people in the world, with a net worth of approximately $120 billion (as of November 2023).

Born on May 14, 1984, in White Plains, New York, Zuckerberg showcased an early passion for technology during his Harvard University days. Notably, he developed projects like the music streaming platform Synapse and the precursor to Facebook, Facemash, foreshadowing his pivotal role in the tech industry.

In 2004, alongside Andrew McCollum, Eduardo Saverin, Chris Hughes, and Dustin Moskovitz, Zuckerberg officially launched Facebook. Initially limited to Harvard, the platform rapidly expanded, a testament to Zuckerberg's visionary approach and understanding of the evolving digital landscape.

Zuckerberg decided to drop out of Harvard in his sophomore year and moved to Palo Alto to pursue his venture with his co-founders. As the platform's leader, Zuckerberg introduced transformative features like the News Feed. Strategic acquisitions, including Instagram (2012) and WhatsApp (2014), further solidified Facebook's global influence.

Despite its success, Facebook faced challenges under Zuckerberg's leadership. Issues like user privacy and misinformation prompted congressional scrutiny in 2018. Zuckerberg's testimony demonstrated a commitment to addressing concerns while defending Facebook's societal impact.

Legal challenges, including lawsuits from co-founders like Eduardo Saverin, punctuated Facebook's journey. These legal battles showcased the complexities of managing a rapidly growing tech giant and navigating relationships within the founding team.

In a significant shift in October 2021, Zuckerberg announced the rebranding of Facebook to Meta, signaling a strategic focus on the metaverse—a virtual shared space that combines aspects of social media, augmented reality, and virtual reality. This move represents Zuckerberg's vision for the future of the internet and his continued efforts to shape the direction of technology on a global scale.

Technology Executives

Steven Ballmer

Steven Ballmer, an American billionaire businessman, served as the CEO of Microsoft from 2000 to 2014 and ranked as the seventh-richest person globally as of June 2024.

Ballmer was born in 1956 in Detroit, MI. He was the first in his family to graduate from college, attending Harvard University, where he lived near Bill Gates. He outscored Gates in the Putnam Competition and graduated magna cum laude with a BA in applied mathematics and economics in 1977.

Ballmer worked as an assistant product manager at Procter & Gamble for two years, sharing an office with Jeff Immelt, later CEO of GE. After an attempt to become a Hollywood screenwriter, he started an MBA at Stanford GSB but dropped out in 1980 to join Microsoft.

Ballmer joined Microsoft as its 30th employee and the first business manager hired by Gates. Initially offered $50,000 and 5–10% of the company, he owned 8% at Microsoft's 1981 incorporation. In 2003, Ballmer reduced his stake to 4% after selling his shares for $955 million.

In his first 20 years at Microsoft, Ballmer led divisions such as operations, operating systems development, and sales and support. Promoted to President in July 1998, he became second in command after Bill Gates.

In 2000, Ballmer was officially named CEO of Microsoft. He managed company finances and daily operations, while Gates retained control of the "technological vision" as chief software architect and chairman of the board. At the time, Microsoft was embroiled in antitrust lawsuits.

While Gates was inclined to continue fighting the federal suit, Ballmer sought to settle these legal challenges.

Ballmer implemented strict business justifications for new products and hired B. Kevin Turner from Walmart as COO to streamline operations and the salesforce.

Under Ballmer's tenure as CEO, Microsoft's share price stagnated. He faced criticism for not capitalizing on emerging consumer technologies, leading Microsoft to play catch-up.

In 2014, Satya Nadella succeeded Ballmer as CEO. Ballmer is known for his energetic and exuberant personality, often shouting so vigorously that he required surgery on his vocal cords.

Safra Catz

Safra Catz is an Israeli-American billionaire technology executive who serves as the CEO of Oracle Corporation.

Catz was born in Holon, Israel, in 1961. Her family relocated to Brookline, MA, when Catz was six years old.

UG: Wharton, 1983

Law: J.D., UPenn Law School, 1976

Catz began her career at Donaldson, Lufkin & Jenrette (DLJ) in 1986, where she eventually served as a Senior Vice President from 1994 to 1997 and as Managing Director from 1997 to March 1999.

Catz joined Oracle Corporation in April 1999 as Senior Vice President. She played a pivotal role in orchestrating Oracle's 2005 acquisition of software rival PeopleSoft (started by Dave Duffield, co-founder of Workday) in a $10.3 billion takeover. She served as the CFO of Oracle from November 2005 to September 2008 and again from 2011 to 2014.

Catz forged a strong partnership with Oracle founder and then CEO Larry Ellison, who personally recommended her inclusion on the Oracle board.

In 2010, Catz and Mark Hurd were appointed co-presidents. Following Hurd's passing in December 2019, Oracle announced that Catz would assume the sole role of CEO.

Throughout her tenure, Catz pursued an aggressive acquisition strategy, completing more than 100 acquisitions. Notable acquisitions include NetSuite for $9.3 billion, BEA Systems for $8.5 billion and Sun Microsystems for $7.4 billion.

Marissa Mayer

Marissa Mayer is an American executive who served as the CEO of Yahoo! from 2012 to 2017. She was a long-time executive and employee number 20 at Google.

Mayer was born in Wausau, Wisconsin, in 1975. She graduated with honors from Stanford University, earning a BS in symbolic systems in 1997 and an MS in computer science in 1999.

She received 14 job offers, including positions at McKinsey. Mayer joined Google in 1999 as employee number 20, starting by writing code and leading small teams. Her attention to detail led to promotions, eventually becoming the director of consumer web products.

Mayer oversaw the layout of Google's minimalist search homepage and was part of the team responsible for Google AdWords, which generated 96% of the company's revenue in Q1 2011. In 2002, she founded the Associate Product Manager (APM) program to mentor new talent, with notable graduates including Bret Taylor (ex-CTO of Facebook) and Justin Rosenstein (co-founder of Asana). In 2005, Mayer became VP of Search Products and User Experience.

She held this role until the end of 2010, when CEO Eric Schmidt asked her to lead Local, Maps, and Location Services.

On July 16, 2012, Mayer became president and CEO of Yahoo!, which had been struggling compared to Google. She launched PB&J, an online program to streamline processes by addressing employee complaints that received at least 50 votes. Mayer faced criticism for her management decisions, but by September 2013, Yahoo!'s stock price had doubled. However, the stock price growth was largely due to Yahoo!'s stake in Alibaba, acquired before her tenure.

In December 2015, two investment funds called for Mayer to be replaced as Yahoo's CEO. By January 2016, Yahoo's core business was valued at less than zero. In February 2016, Mayer confirmed that Yahoo was considering selling its core business.

Mayer announced her resignation on June 13, 2017. After leaving Yahoo, she co-founded Lumi Labs, focusing on AI and consumer media.

Bill McDermott

Bill McDermott (b. 1961, Amityville, NY) is a business executive and the CEO of ServiceNow.

A grandson of Naismith Memorial Basketball Hall of Fame player Bobby McDermott, he demonstrated entrepreneurial drive early on, purchasing the Amityville Country Delicatessen at age 16 for $7,000. The business helped finance his undergraduate education.

McDermott earned a bachelor's degree in business management from Dowling College and later completed an MBA from Northwestern University’s Kellogg School of Management. He began his career at Xerox, where he spent 17 years in various sales and management roles. In 2000, he became president of Gartner, followed by a role as executive vice president of worldwide sales and operations at Siebel Systems from 2001 to 2002.

In 2002, McDermott joined SAP America as CEO and was appointed to SAP’s Executive Board in 2008. He became co-CEO of SAP SE in 2010 and, in 2014, its first sole American CEO.

Under his leadership, SAP’s market capitalization grew from $39 billion to $144 billion by 2018. He oversaw major acquisitions, starting with Sybase in 2010, and led SAP’s expansion into cloud computing. In 2016, he was the highest-paid executive among German DAX-listed companies, earning €11.6 million in direct remuneration. He stepped down from SAP in October 2019.

Later that month, ServiceNow appointed McDermott as CEO, succeeding John Donahoe. Since then, he has led the company’s expansion in enterprise software and cloud computing, strengthening its position in digital workflow automation.

McDermott wears sunglasses due to an accident in July 2015 that resulted in the loss of his left eye. While at his brother's house, he fell down the stairs while holding a glass of water, and a shard of glass went through his left eye. He underwent multiple surgeries, but doctors couldn't save his eye, and it was ultimately removed. McDermott has stated that the accident gave him strength, resolve, and passion.

Charles Phillips

Charles Phillips is a technology business executive and a former Wall Street equity research analyst. He was the co-president of Oracle Corporation and the CEO of Infor, an enterprise software company serving industry verticals.

Phillips was born in Little Rock, Arkansas, where his father was stationed in the Air Force. He earned a BS in Computer Science from the United States Air Force Academy. He accepted a commission in the U.S. Marines after not meeting the eyesight standard to be a pilot. He rose to the rank of captain and was stationed in North Carolina, where he worked on computer systems. Phillips earned his MBA from Hampton University in 1986 and a JD from New York Law School in 1993.

After his MBA, Phillips worked for BNY Mellon, SoundView Technology Group, and Kidder Peabody through 1994. In 1994, Phillips joined Morgan Stanley as an equity research analyst covering the enterprise software industry. He stayed at Morgan Stanley through 2003, where he was promoted to Managing Director. He was an Institutional Investor #1 ranked software analyst for ten consecutive years.

In 2003, Phillips accepted an invitation from Larry Ellison, CEO of Oracle, to join as co-president and director. Phillips led Oracle’s field organization and played a key role in over 70 acquisitions, including PeopleSoft, BEA System, Hyperion Solutions, and Siebel Systems.

In 2010, Phillips became the subject of a series of billboards (swipe left) in New York City, San Francisco, and Atlanta that included images of him with a mistress and the URL of a website that detailed their affair. The mistress claimed that she bought the billboards and created the website after discovering Phillips was married. Phillips admitted to the 8.5-year affair with the mistress in a statement released by Oracle’s public relations team.

In the same year, Phillips resigned from Oracle and became the CEO of Infor, the world’s largest privately owned software company.

Ruth Porat

Ruth Porat is a British–American business executive serving as the CFO of Alphabet and Google.

Porat was born in Sale, Cheshire, England. Her family relocated first to Cambridge, MA, and then to Palo Alto, CA.

UG: Economics and International Relations, Stanford

Masters: Industrial Relations, LSE

MBA: Wharton

Porat commenced her career at Morgan Stanley in 1987, departing in 1993 to follow Morgan Stanley president Robert Greenhill to Smith Barney. She returned to Morgan Stanley in 1996, serving as Vice Chairman of Investment Banking from 2003 to 2009 and as the global head of the Financial Institutions Group from 2006 to 2009. She was the CFO of Morgan Stanley from 2010 to 2015.

While at Morgan Stanley, Porat was credited with creating the European debt financing that saved Amazon from collapse during the dot-com meltdown. Her financial partner during the dot-com bubble was Mary Meeker, the famed technology research analyst who is now a venture capitalist.

During the financial crisis, Porat led the Morgan Stanley team advising the U.S. Treasury Department regarding Fannie Mae and Freddie Mac, and the New York Fed with respect to AIG.

In 2013, it was reported that President Obama would nominate Porat as the next Deputy Secretary of the Treasury. However, it was later reported that Porat had withdrawn her name.

On March 24, 2015, it was announced that Porat would join Google as its new CFO. Her hiring deal amounted to $70 million. She reorganized the company and imposed financial discipline, boosting Google’s share price. Porat also oversees Business Operations, Real Estate, and Workplace Services.

In July 2023, Alphabet announced that Porat would be promoted to a newly created role of President and Chief Investment Officer, allowing her to oversee the company's "Other Bets" portfolio comprising risky hardware and services ventures.

Porat is well known for her incredible work ethic. According to The New York Times, when Porat was giving birth to her first son in 1992, she was making calls to clients from inside the delivery room. Porat is also a two-time breast cancer survivor.

Sheryl Sandberg

Sheryl Sandberg is a billionaire American technology executive.

Sandberg served as the chief operating officer (COO) of Meta Platforms. She is also the founder of LeanIn.Org.