Can Multi-Managers Continue to Win?

The Lie Detector Says ... That's a Lie

Multi-manager hedge funds (referred to interchangeably as "pod shops"1) have captured significant attention over the past few years for generating stellar returns despite market turbulence driven by a war, a pandemic, and political instability worldwide. Can they sustain their success? Let's hear what the experts have to say.

WATCH this article:

The rise of the pod shops

In the intricate world of hedge funds, a select group of entities has risen to prominence: the multi-manager hedge fund platforms, also known as "pod shops."

These platforms employ specialist traders, sophisticated risk management, and an uncompromising approach to personnel management.

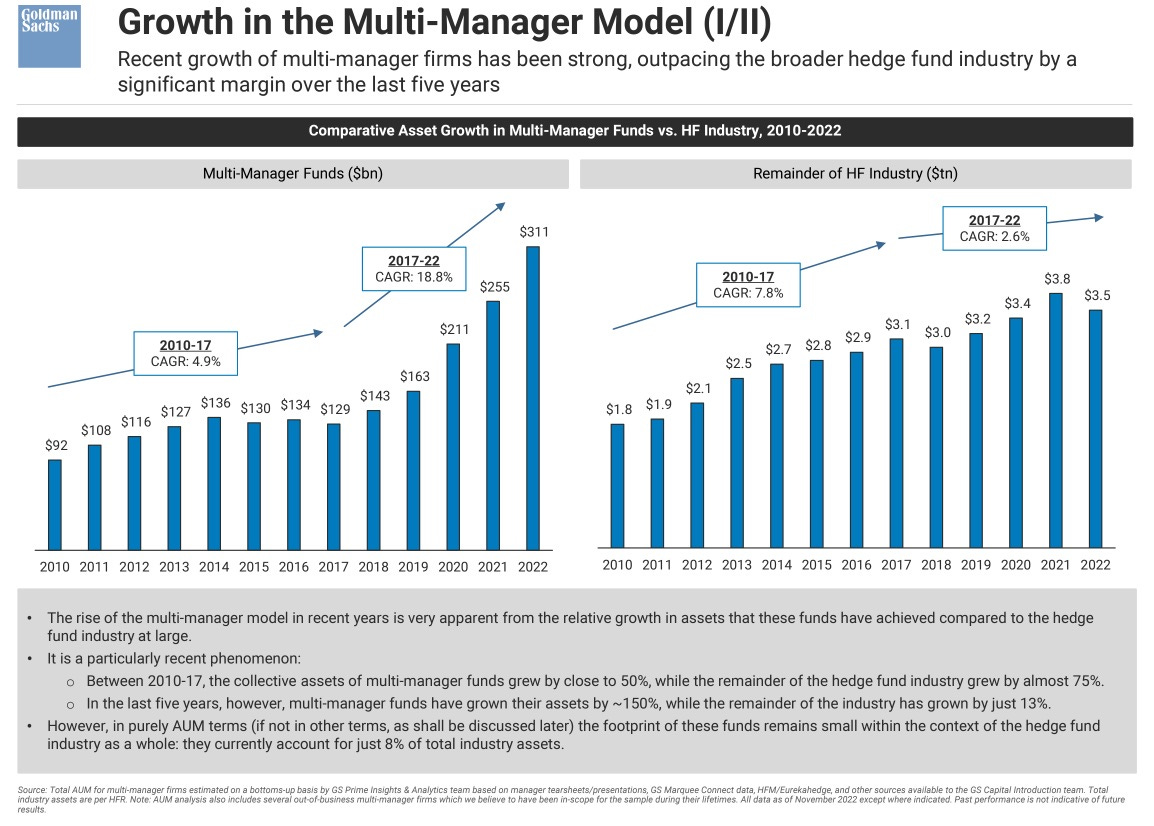

While their number remains limited, with only 40 such multi-manager platforms worldwide, their impact is undeniable. They have solidified their position as the fastest-growing and most profitable segment within the global hedge fund domain.

The ascent of pod shops finds its roots in a confluence of factors, notably the implementation of the Volcker Rule, a regulatory provision that eliminated banks' proprietary trading activities.

Central to the allure of pod shops is their promise of risk-adjusted returns with minimal volatility.

This unique approach, known as market-neutral, enables pod shops to generate returns insulated from the fluctuations of the broader market.

Regardless of whether the market soars or plunges, these entities possess a remarkable ability to maintain a steady stream of returns for their investors.

The rising regulatory hurdles and soaring start-up costs have further propelled the ascendancy of pod shops.

Star analysts at established funds are more discouraged from striking out on their own, and instead, they take their talent to a pod shop where they can continue to focus on generating returns while the pod shop platform takes care of operations, marketing, and compliance.

What’s under the hood at pod shops?

In the innovative pod model, the pod manager embodies a role similar to a single stock within a diversified portfolio. This approach extends risk management beyond individual investment strategies to encompass the multi-manager platform's oversight of its manager portfolio.

Venturing into underperformance territory results in a significant reduction of allocated resources or triggers the ominously termed "quantitative eject seat," an industry jargon for being fired.

On the other hand, those who excel enjoy increased asset allocation and compensation ranging from 15% to 22% of the alpha they generate.

This model, praised for its meritocratic essence, is undoubtedly rewarding, yet the flip side remains its unrelenting and unforgiving stress quotient.

Good times are coming to an end

As performance trends normalize for pod shops, industry luminary Ken Griffin acknowledges that being at the pinnacle of popularity often coincides with market peaks. Such cyclical shifts are characteristic of markets, where strategies rise and wane in popularity.

At this juncture, pod shops are facing headwinds: Elevated fees and lock-up requisites are driving potential investors away. The "pass-through" expenses model, a departure from the traditional 2/20 fee structure2, transfers costs from managers to investors, compounding investors’ financial burden.

Despite the elevated fees, investors have increased their allocation to pod shops in the recent year due to their value add. However, as returns stabilize, investors are moving on to the next thing.

Although multi-managers comprise 8% of the total hedge fund AUM, their hold on US equities has grown to 27% (from 14% since 2014), facilitated by leveraged positions that amplify returns.

The specter of higher interest rates amplifies borrowing costs for these leverage-reliant entities, altering return dynamics against a backdrop of heightened risk-free returns.3

Further complexity arises from reliance on financing partners, as banks reconsider exposure proportional to pod shop growth, potentially stymying expansion.

Finally, regulatory scrutiny compounds challenges, as the SEC examines the systemic risks posed by leveraged hedge funds, invoking the specter of the LTCM debacle and its cascading effects on financial stability.

Rising Operating Cost

The multi-manager model distinguishes itself with its lower operating leverage. Despite representing 8% of total hedge fund assets under management, multi-manager setups account for a significant 25% of the industry's total headcount.

Their investment in technology, systems, and alternative data underscores their focus on information-based advantage over time arbitrage and psychological strategies.

There are only that many consistently value-creating portfolio managers. This dynamic conforms to the power law concept, where a small pool of consistently alpha-generating stars garners the lion's share of investor interest.

Recognizing this reality, industry giants like Citadel, Millennium, and Balyasny have closed their doors to new allocations to maintain their competitive edge.

Incumbency has proven to be a barrier to entry. Even notable debuts like ExodusPoint4 have grappled with lackluster performance compared to the industry's top players due to the aforementioned power law dynamic.

The scarcity of true alpha-generating talent has triggered a zero-sum talent war among pod shops, prompting sign-on packages of unprecedented magnitude, making professional athletes' deals seem modest.

Sign-on packages of $10mm-$15mm are not unheard of, along with tens of millions in guaranteed payments that include upfront compensation to cover forgone bonuses from prior role at another pod shop and two-year guarantees that are paid regardless of whether they remain with the firm.

This fierce competition for portfolio managers has left traditional investment banks recognizing their financial inability to compete for top talent, while non-platform hedge funds lament escalating hiring costs due to the talent bidding war.

Although this lavish treatment primarily extends to portfolio managers and experienced juniors, the rising prominence of in-house training programs, such as Point72's renowned academy, signifies an effort to nurture internal talent.

Additionally, some pod shops have also added fund-of-fund structures, inviting external fund managers to oversee portions of their capital.

However, size looms as an emerging challenge for pod shops, as expanding their offerings necessitates the recruitment of additional portfolio managers to manage new capital sleeves allocated by investors. As these managers crowd into the same trades, uncovering alpha becomes progressively intricate.

Conclusion

For aspiring young investors, several positives come with the pod shop model:

The inherent rapid hiring and firing means that job openings are more abundant under this model.

Not to mention, if Ken Griffin concedes that this is a cyclical peak, job openings are probably at their peak (ie. maximum quantity) too.

Youngsters just want jobs, and pod shops are a rare corner of the investment market industry that offers a direct path from undergraduate to professional investing, without the need to grind in investment banking or equity research.

As someone who has a firm belief in how to invest, I will only caution you to know what you are signing up for. There is no right or wrong way to invest, only that it needs to work for you.

Source: https://www.ft.com/content/86eb1c4f-ef5f-4bf9-93b1-74a484dd4a20

If you want to advertise in my newsletter, contact me 👇

Resources for your public equity job search:

Research process and financial modeling (10% off using my code in link)

Check out my other published articles and resources:

📇 Connect with me: Instagram | Twitter | YouTube | LinkedIn

If you enjoyed this article, please subscribe and share it with your friends/colleagues. Sharing is what helps us grow! Thank you.

They are called “pod shops” because each portfolio manager runs their autonomous portfolio, or a “pod”, within the multi-manager platform, while subjecting to contractually agreed-to risk limits

“2/20” fee model means a hedge fund charges 2% fee on the total assets under management and 20% fee on the profit it generates each year. This fee model has come under pressure for many years now because most hedge funds don’t create consistent value to justify it

To counter that, short rebates are more attractive in a higher interest rate environment

ExodusPoint is founded by Michael Gelband who is ex-Millennium Management